Cryptocurrency Spot Multi-Symbol Dual Moving Average Strategy (Teaching)

0

0

785

785

Cryptocurrency Spot Multi-Symbol Dual Moving Average Strategy (Teaching)

At the request of our users in the Forums that they hope to have a multi-symbol dual moving average strategy as a design reference, a multi-symbol dual moving average strategy will be implemented in today’s sharing. Remarks will be written in the strategy code to facilitate your understanding and learning of the strategy, which will enable more new students of programmatic and quantitative trading get started with the strategy quickly.

Strategy Thinking

The logic of the dual moving average strategy is very simple, that is, two moving averages. A moving average with a small period (fast line) and a moving average with a large period (slow line). When the two lines have a golden cross (the fast line up crosses the slow line from bottom ), buy long, and when the two lines have a dead cross (the fast line down crosses the slow line from top ), sell short. For moving average, We use EMA.

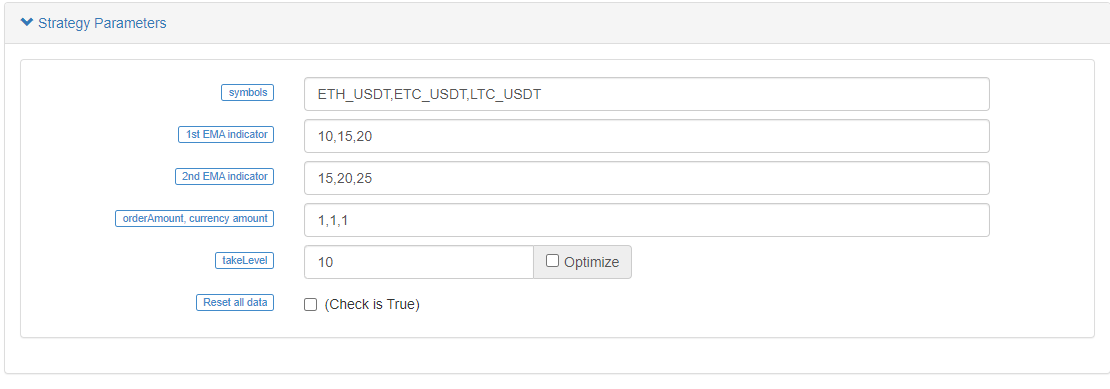

It is just that the strategy needs to be designed for multiple symbols, so the parameters of different symbols may be different (different symbols use different moving average parameters), so it is necessary to design parameters in a “parameter array”.

Parameters are designed in form of string, with each parameter split by comma. These strings are parsed when the strategy starts running, which will be matched with the execution logic for each symbol (trading pair). Strategy polling detects the market quotes, of all symbols, the trigger of trading conditions, and chart print. After all symbols are polled once, the data is aggregated and table information is displayed on the status bar.

The strategy is super simply designed and very suitable for beginners; it is only of 200+ lines in total.

Strategy Code

// function effect: to cancel all pending orders of the current trading pair

function cancelAll(e) {

while (true) {

var orders = _C(e.GetOrders)

if (orders.length == 0) {

break

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// function effect: to calculate the real-time profit and loss

function getProfit(account, initAccount, lastPrices) {

// account indicates the current account information; initAccount is the initial account information; lastPrices is the the latest prices of all current symbols

var sum = 0

_.each(account, function(val, key) {

// traverse the current total assets, and calculate asset currency (except USDT) difference and amount difference

if (key != "USDT" && typeof(initAccount[key]) == "number" && lastPrices[key + "_USDT"]) {

sum += (account[key] - initAccount[key]) * lastPrices[key + "_USDT"]

}

})

// return the asset profit and loss calculated by the current price

return account["USDT"] - initAccount["USDT"] + sum

}

// function effect: to generate chart configuration

function createChartConfig(symbol, ema1Period, ema2Period) {

// symbol indicates trading pair; ema1Period indicates the first EMA period; ema2Period indicates the second EMA period

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line date series

name: symbol,

id: symbol,

data: []

}, {

type: 'line', // EMA data series

name: symbol + ',EMA1:' + ema1Period,

data: [],

}, {

type: 'line', // EMA data series

name: symbol + ',EMA2:' + ema2Period,

data: []

}

]

}

return chart

}

function main() {

// reset all data

if (isReset) {

_G(null) // vacuum all persistently recorded data

LogReset(1) // vacuum all logs

LogProfitReset() // vacuum all profit logs

LogVacuum() // release the resource occupied by the bot database

Log("reset all data", "#FF0000") // print information

}

// parse parameters

var arrSymbols = symbols.split(",") // use comma to split the trading symbol strings

var arrEma1Periods = ema1Periods.split(",") // split the string of the first EMA parameter

var arrEma2Periods = ema2Periods.split(",") // split the string of the second EMA parameter

var arrAmounts = orderAmounts.split(",") // split the order amount of each symbol

var account = {} // the variable used to record the current asset information

var initAccount = {} // the variable used to record the initial asset information

var currTradeMsg = {} // the variable used to record whether the current BAR is executed

var lastPrices = {} // the variable used to record the latest price of the monitored symbol

var lastBarTime = {} // the variable used to record the time of the latest BAR, to judge the BAR update during plotting

var arrChartConfig = [] // the variable used to record the chart configuration information, to plot

if (_G("currTradeMsg")) { // for example, when restart, recover currTradeMsg data

currTradeMsg = _G("currTradeMsg")

Log("recover GetRecords", currTradeMsg)

}

// initialize account

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol)

var arrCurrencyName = symbol.split("_")

var baseCurrency = arrCurrencyName[0]

var quoteCurrency = arrCurrencyName[1]

if (quoteCurrency != "USDT") {

throw "only support quoteCurrency: USDT"

}

if (!account[baseCurrency] || !account[quoteCurrency]) {

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

}

// initialize the related data of chart

lastBarTime[symbol] = 0

arrChartConfig.push(createChartConfig(symbol, arrEma1Periods[index], arrEma2Periods[index]))

})

if (_G("initAccount")) {

initAccount = _G("initAccount")

Log("recover initial account information", initAccount)

} else {

// use the current asset information to initialize initAccount (variable)

_.each(account, function(val, key) {

initAccount[key] = val

})

}

Log("account:", account, "initAccount:", initAccount) // print asset information

// initialize the chart objects

var chart = Chart(arrChartConfig)

// reset chart

chart.reset()

// strategy logic of the main loop

while (true) {

// traverse all symbols, and execute the dual moving average logic one by one

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol) // switch the trading pair to the trading pair recorded by by symbol string

var arrCurrencyName = symbol.split("_") // split trading pairs by "_"

var baseCurrency = arrCurrencyName[0] // string of base currency

var quoteCurrency = arrCurrencyName[1] // string of quote currency

// according to index, obtain the EMA paramater of the current trading pair

var ema1Period = parseFloat(arrEma1Periods[index])

var ema2Period = parseFloat(arrEma2Periods[index])

var amount = parseFloat(arrAmounts[index])

// obtain the K-line data of the current trading pair

var r = exchange.GetRecords()

if (!r || r.length < Math.max(ema1Period, ema2Period)) { // when the length of K-line is not long enough, return directly

Sleep(1000)

return

}

var currBarTime = r[r.length - 1].Time // record the current BAR timestamp

lastPrices[symbol] = r[r.length - 1].Close // record the current latest price

var ema1 = TA.EMA(r, ema1Period) // calculate EMA indicator

var ema2 = TA.EMA(r, ema2Period) // calculate EMA indicator

if (ema1.length < 3 || ema2.length < 3) { // when the length of EMA indicator array is too short, return derectly

Sleep(1000)

return

}

var ema1Last2 = ema1[ema1.length - 2] // EMA on the second last BAR

var ema1Last3 = ema1[ema1.length - 3] // EMA on the third last BAR

var ema2Last2 = ema2[ema2.length - 2]

var ema2Last3 = ema2[ema2.length - 3]

// write the chart data

var klineIndex = index + 2 * index

// traverse k-line data

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == lastBarTime[symbol]) { // plot; update the current BAR and its indicator

// update

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

chart.add(klineIndex + 1, [r[i].Time, ema1[i]], -1)

chart.add(klineIndex + 2, [r[i].Time, ema2[i]], -1)

} else if (r[i].Time > lastBarTime[symbol]) { // plot; add BAR and its indicator

// add

lastBarTime[symbol] = r[i].Time // update the timestamp

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

chart.add(klineIndex + 1, [r[i].Time, ema1[i]])

chart.add(klineIndex + 2, [r[i].Time, ema2[i]])

}

}

if (ema1Last3 < ema2Last3 && ema1Last2 > ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// golden cross

var depth = exchange.GetDepth() // obtain the depth data of the current order book

var price = depth.Asks[Math.min(takeLevel, depth.Asks.length)].Price // select the 10th level price; taker

if (depth && price * amount <= account[quoteCurrency]) { // obtain that the depth data is normal, and the assets are enough to place an order

exchange.Buy(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2) // maker; buy

cancelAll(exchange) // cancel all pending orders

var acc = _C(exchange.GetAccount) // obtain the account asset information

if (acc.Stocks != account[baseCurrency]) { // detect the account assets changed

account[baseCurrency] = acc.Stocks // update assets

account[quoteCurrency] = acc.Balance // update assets

currTradeMsg[symbol] = currBarTime // record the current BAR has been executed

_G("currTradeMsg", currTradeMsg) // persistently record

var profit = getProfit(account, initAccount, lastPrices) // calculate profit

if (profit) {

LogProfit(profit, account, initAccount) // print profit

}

}

}

} else if (ema1Last3 > ema2Last3 && ema1Last2 < ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// death cross

var depth = exchange.GetDepth()

var price = depth.Bids[Math.min(takeLevel, depth.Bids.length)].Price

if (depth && amount <= account[baseCurrency]) {

exchange.Sell(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2)

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

if (acc.Stocks != account[baseCurrency]) {

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

currTradeMsg[symbol] = currBarTime

_G("currTradeMsg", currTradeMsg)

var profit = getProfit(account, initAccount, lastPrices)

if (profit) {

LogProfit(profit, account, initAccount)

}

}

}

}

Sleep(1000)

})

// variables in the table of status bar

var tbl = {

type : "table",

title : "account information",

cols : [],

rows : []

}

// write the data in the table structure of status bar

tbl.cols.push("--")

tbl.rows.push(["initial"])

tbl.rows.push(["current"])

_.each(account, function(val, key) {

if (typeof(initAccount[key]) == "number") {

tbl.cols.push(key)

tbl.rows[0].push(initAccount[key]) // initial

tbl.rows[1].push(val) // current

}

})

// display the status bar table

LogStatus(_D(), "\n", "profit:", getProfit(account, initAccount, lastPrices), "\n", "`" + JSON.stringify(tbl) + "`")

}

}

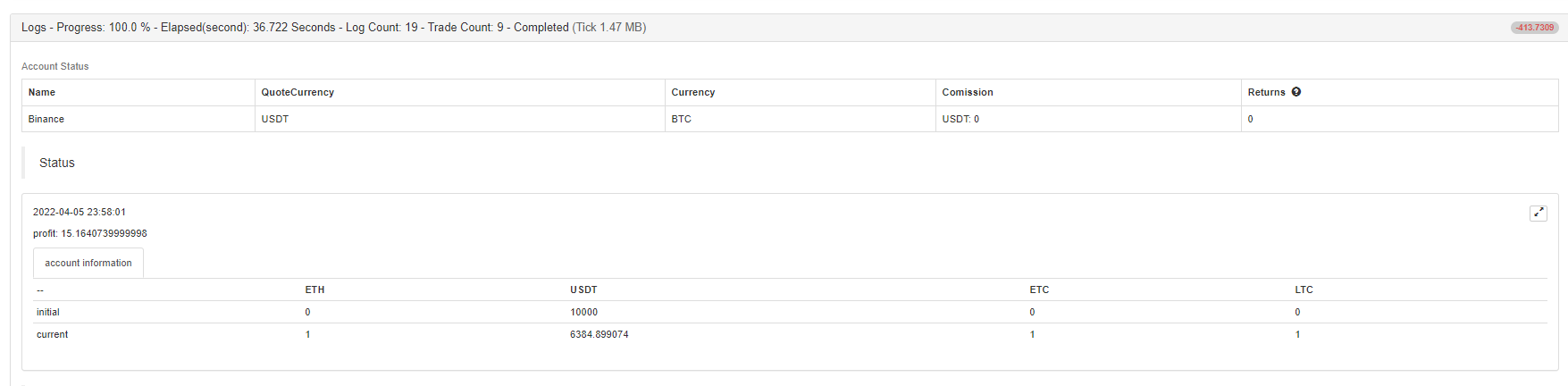

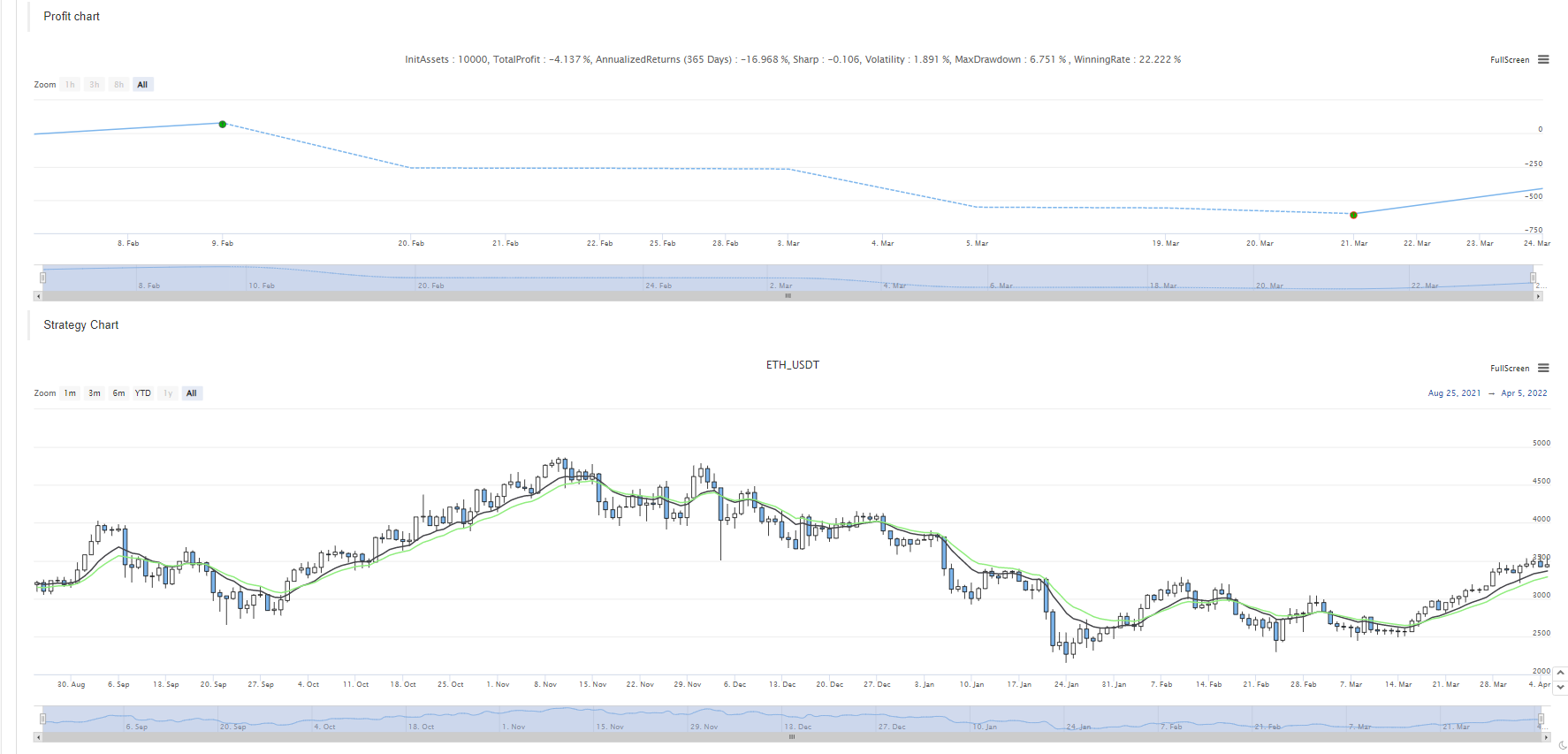

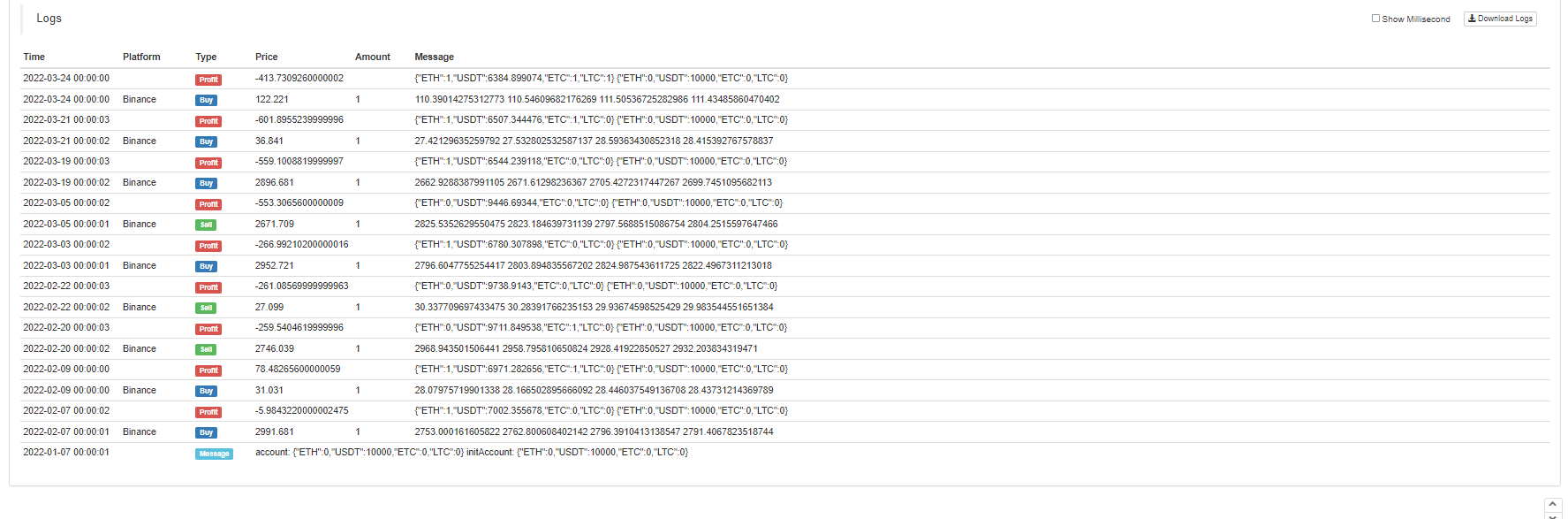

Strategy Backtest

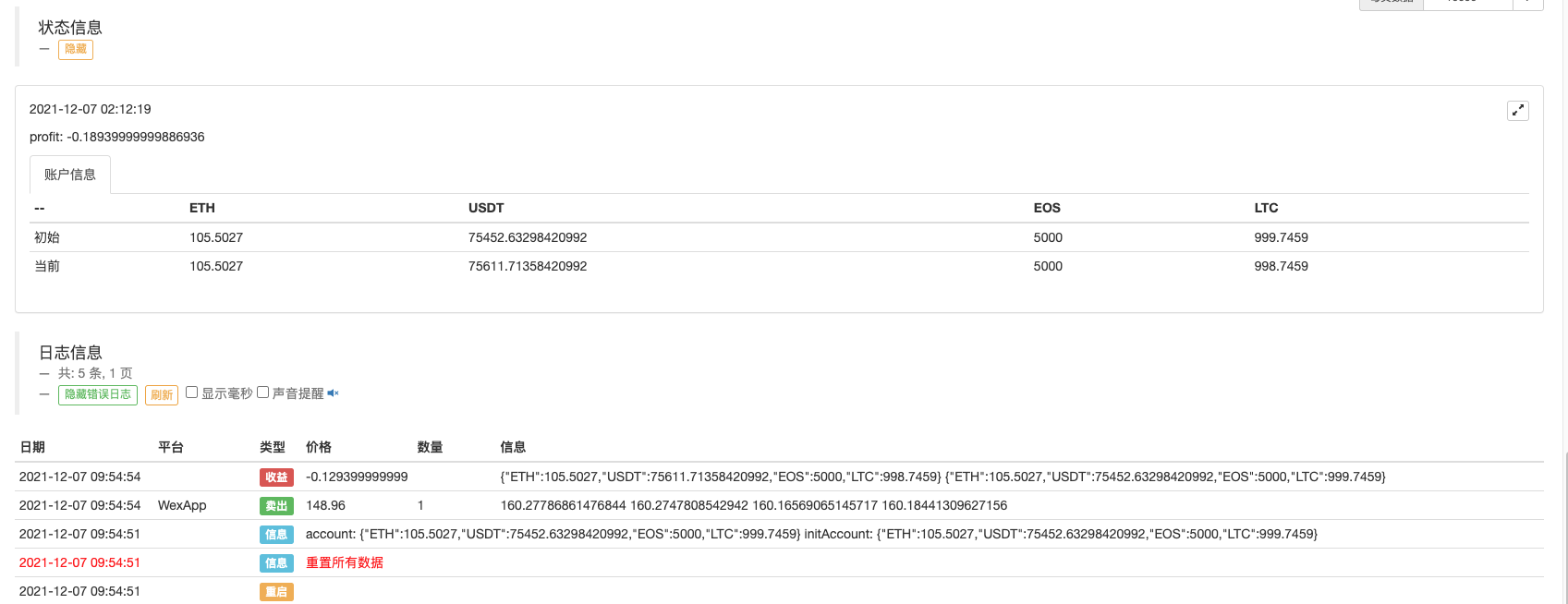

You can see ETH, LTC and ETC all had trades according to the triggers of the golden cross and death cross of moving averages.

You can also pend on simulated bot to test.

Strategy source code: https://www.fmz.com/strategy/333783

The strategy is only used for backtest and strategy design learning, so use it in a bot with caution.

- 基于FMZ做成跟单平台

- Cryptocurrency Contract Simple Order-Supervising Bot

- 在用getdepth时想获取对应时间戳

- 忽略,已解决

- 面值问题

- dYdX Strategy Design Example

- Initial Exploration of Applying Python Crawler on FMZ — Crawling Binance Announcement Content

- Hedge Strategy Design Research & Example of Pending Spot and Futures Orders

- Recent Situation and Recommended Operation of Funding Rate Strategy

- Dual Moving Average Breakpoint Strategy of Cryptocurrency Futures (Teaching)

- Realization of Fisher Indicator in JavaScript & Plotting on FMZ

- 托管者

- 2021 Cryptocurrency TAQ Review & Simplest Missed Strategy of 10-Time Increase

- Cryptocurrency Futures Multi-Symbol ART Strategy (Teaching)

- Upgrade! Cryptocurrency Futures Martingale Strategy

- Getrecords函数无法获取以秒为单位的K线图

- FMZ Based Order Synchronous Management System Design (2)

- Getticker返回的Volume数据不对

- FMZ Based Order Synchronous Management System Design (1)

- Design a Multiple-Chart Plotting Library