Use Cryptocurrency Platform Aggregated Market Interface to Construct Multi-Symbol Strategy

0

0

875

875

Use Cryptocurrency Platform Aggregated Market Interface to Construct Multi-Symbol Strategy

In the “Live” section of FMZ Quant Trading Platform, multi-symbol strategies are often seen, which can detect the market conditions of dozens of symbols or even an entire platform at the same time. How is it done? And how should it be designed? This article takes you to discuss how to use the platform aggregated market interface to build a multi-symbol strategy.

Take Binance and Huobi as example; if you check out their API documentation, you will find there are aggregated interfaces:

Market Interface

Binance contract: https://fapi.binance.com/fapi/v1/ticker/bookTicker Interface returned data:

[ { "symbol": "BTCUSDT", // trading pair "bidPrice": "4.00000000", //optimum bid price "bidQty": "431.00000000", //bid quantity "askPrice": "4.00000200", //optimum ask price "askQty": "9.00000000", //ask quantity "time": 1589437530011 // matching engine time } ... ]Huobi spot: https://api.huobi.pro/market/tickers Interface returned data:

[ { "open":0.044297, // open price "close":0.042178, // close price "low":0.040110, // the lowest price "high":0.045255, // the highest price "amount":12880.8510, "count":12838, "vol":563.0388715740, "symbol":"ethbtc", "bid":0.007545, "bidSize":0.008, "ask":0.008088, "askSize":0.009 }, ... ]However, the result is actually not like that, and the actual structure returned by Huobi interface is:

{ "status": "ok", "ts": 1616032188422, "data": [{ "symbol": "hbcbtc", "open": 0.00024813, "high": 0.00024927, "low": 0.00022871, "close": 0.00023495, "amount": 2124.32, "vol": 0.517656218, "count": 1715, "bid": 0.00023427, "bidSize": 2.3, "ask": 0.00023665, "askSize": 2.93 }, ...] }Attention should be paid when processing the data returned by the interface.

Construct Strategy Program Structure

How to encapsulate the two interfaces in the strategy, and how to process the data? Let’s take a look.

First, write a constructor, to construct control objects

// parameter e is used to import the exchange object; parameter subscribeList is the trading pair list to be processed, such as ["BTCUSDT", "ETHUSDT", "EOSUSDT", "LTCUSDT", "ETCUSDT", "XRPUSDT"]

function createManager(e, subscribeList) {

var self = {}

self.supportList = ["Futures_Binance", "Huobi"] // the supported platform's

// object attribute

self.e = e

self.name = e.GetName()

self.type = self.name.includes("Futures_") ? "Futures" : "Spot"

self.label = e.GetLabel()

self.quoteCurrency = ""

self.subscribeList = subscribeList // subscribeList : [strSymbol1, strSymbol2, ...]

self.tickers = [] // all market data obtained by the interfaces; define the data format as: {bid1: 123, ask1: 123, symbol: "xxx"}}

self.subscribeTickers = [] // the market data needed; define the data format as: {bid1: 123, ask1: 123, symbol: "xxx"}}

self.accData = null // used to record the account asset data

// initialization function

self.init = function() {

// judge whether a platform is supported

if (!_.contains(self.supportList, self.name)) {

throw "not support"

}

}

// judge the data precision

self.judgePrecision = function (p) {

var arr = p.toString().split(".")

if (arr.length != 2) {

if (arr.length == 1) {

return 0

}

throw "judgePrecision error, p:" + String(p)

}

return arr[1].length

}

// update assets

self.updateAcc = function(callBackFuncGetAcc) {

var ret = callBackFuncGetAcc(self)

if (!ret) {

return false

}

self.accData = ret

return true

}

// update market data

self.updateTicker = function(url, callBackFuncGetArr, callBackFuncGetTicker) {

var tickers = []

var subscribeTickers = []

var ret = self.httpQuery(url)

if (!ret) {

return false

}

try {

_.each(callBackFuncGetArr(ret), function(ele) {

var ticker = callBackFuncGetTicker(ele)

tickers.push(ticker)

for (var i = 0 ; i < self.subscribeList.length ; i++) {

if (self.subscribeList[i] == ele.symbol) {

subscribeTickers.push(ticker)

}

}

})

} catch(err) {

Log("error:", err)

return false

}

self.tickers = tickers

self.subscribeTickers = subscribeTickers

return true

}

self.httpQuery = function(url) {

var ret = null

try {

var retHttpQuery = HttpQuery(url)

ret = JSON.parse(retHttpQuery)

} catch (err) {

// Log("error:", err)

ret = null

}

return ret

}

self.returnTickersTbl = function() {

var tickersTbl = {

type : "table",

title : "tickers",

cols : ["symbol", "ask1", "bid1"],

rows : []

}

_.each(self.subscribeTickers, function(ticker) {

tickersTbl.rows.push([ticker.symbol, ticker.ask1, ticker.bid1])

})

return tickersTbl

}

// initialization

self.init()

return self

}

Use FMZ API function HttpQuery to send a request to access the platform interface. When using HttpQuery, you need to use the exception processing try...catch to handle exceptions such as interface return failure.

Some students here may ask: “The data structures returned by the platform interfaces are quite different, so how to deal with it? It must not be possible to use the same processing method.”

Indeed, not only the data structures returned by the platform interface are different, but also the names of the returned data fields are also different. The same meaning may be named differently. For example, the interfaces we listed above. The same expression means buy1 price, which is called: bidPrice in Binance, but bid in Huobi.

We use the callback function here and separate these parts that need specialized processing independently.

So after the above object is initialized, it becomes like this in the specific use:

(The following code omits the constructor createManager)

contracts monitored by Binance Futures: ["BTCUSDT", "ETHUSDT", "EOSUSDT", "LTCUSDT", "ETCUSDT", "XRPUSDT"]

spot trading pairs monitored by Huobi Spot: ["btcusdt", "ethusdt", "eosusdt", "etcusdt", "ltcusdt", "xrpusdt"]

function main() {

var manager1 = createManager(exchanges[0], ["BTCUSDT", "ETHUSDT", "EOSUSDT", "LTCUSDT", "ETCUSDT", "XRPUSDT"])

var manager2 = createManager(exchanges[1], ["btcusdt", "ethusdt", "eosusdt", "etcusdt", "ltcusdt", "xrpusdt"])

while (true) {

// update market data

var ticker1GetSucc = manager1.updateTicker("https://fapi.binance.com/fapi/v1/ticker/bookTicker",

function(data) {return data},

function (ele) {return {bid1: ele.bidPrice, ask1: ele.askPrice, symbol: ele.symbol}})

var ticker2GetSucc = manager2.updateTicker("https://api.huobi.pro/market/tickers",

function(data) {return data.data},

function(ele) {return {bid1: ele.bid, ask1: ele.ask, symbol: ele.symbol}})

if (!ticker1GetSucc || !ticker2GetSucc) {

Sleep(1000)

continue

}

var tbl1 = {

type : "table",

title : "futures market data",

cols : ["futures contract", "futures buy1", "futures sell1"],

rows : []

}

_.each(manager1.subscribeTickers, function(ticker) {

tbl1.rows.push([ticker.symbol, ticker.bid1, ticker.ask1])

})

var tbl2 = {

type : "table",

title : "spot market data",

cols : ["spot contract", "spot buy1", "spot sell1"],

rows : []

}

_.each(manager2.subscribeTickers, function(ticker) {

tbl2.rows.push([ticker.symbol, ticker.bid1, ticker.ask1])

})

LogStatus(_D(), "\n`" + JSON.stringify(tbl1) + "`", "\n`" + JSON.stringify(tbl2) + "`")

Sleep(10000)

}

}

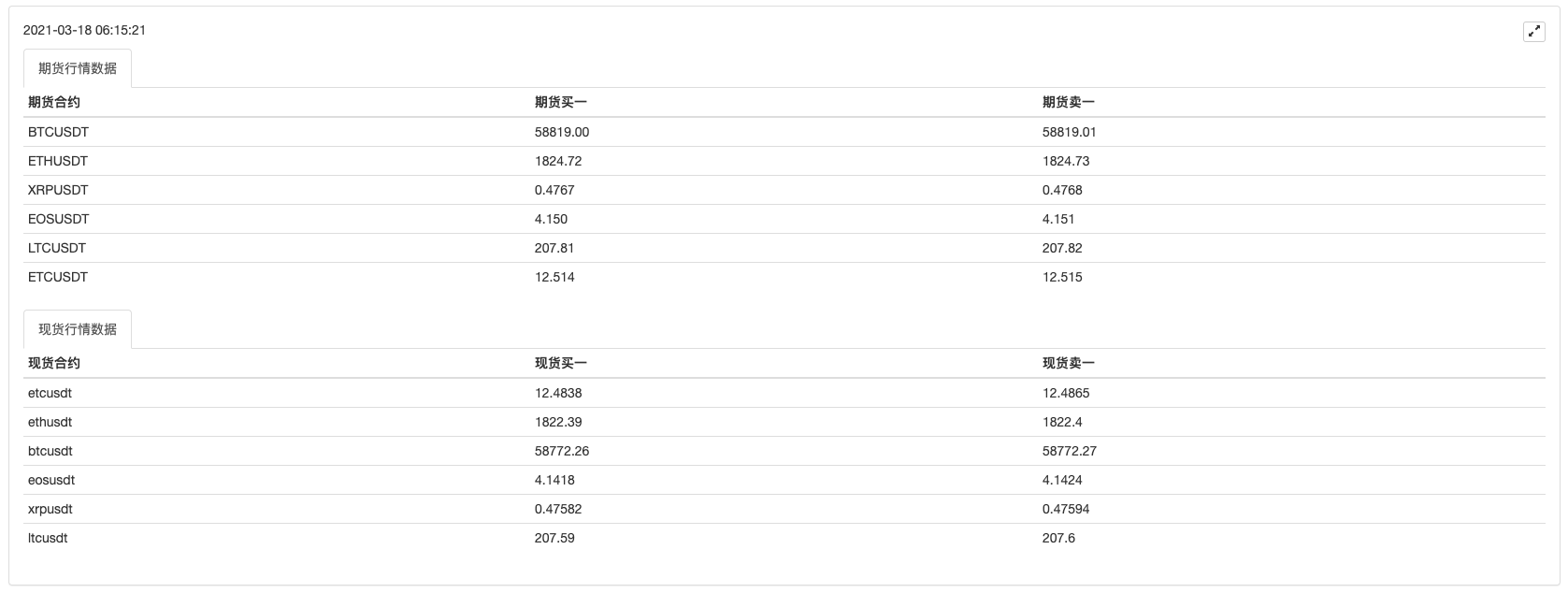

Operation test:

Add Binance Futures as the first exchange object, and add Huobi Spot as the second exchange object.

As you can see, here the callback function is invoked to do specialized processing on operations in different platforms, like how to obtain the data returned by interface.

var ticker1GetSucc = manager1.updateTicker("https://fapi.binance.com/fapi/v1/ticker/bookTicker",

function(data) {return data},

function (ele) {return {bid1: ele.bidPrice, ask1: ele.askPrice, symbol: ele.symbol}})

var ticker2GetSucc = manager2.updateTicker("https://api.huobi.pro/market/tickers",

function(data) {return data.data},

function(ele) {return {bid1: ele.bid, ask1: ele.ask, symbol: ele.symbol}})

After designing the method of obtaining the market data, we can create a method of obtaining the market data. For it is a multi-symbol strategy, the account asset data is also multiple. Fortunately, a platform account asset interface generally returns full asset data.

Add the method of obtaining assets in the constructor createManager:

// update assets

self.updateAcc = function(callBackFuncGetAcc) {

var ret = callBackFuncGetAcc(self)

if (!ret) {

return false

}

self.accData = ret

return true

}

Similarly, for the formats returned by different platform interfaces and the field names are different, here we need to use the callback function to do specialized processing.

Take Huobi Spot and Binance Futures as examples, and the callback function can be written like this:

// the callback function of obtaining the account assets

var callBackFuncGetHuobiAcc = function(self) {

var account = self.e.GetAccount()

var ret = []

if (!account) {

return false

}

// construct the array structure of assets

var list = account.Info.data.list

_.each(self.subscribeList, function(symbol) {

var coinName = symbol.split("usdt")[0]

var acc = {symbol: symbol}

for (var i = 0 ; i < list.length ; i++) {

if (coinName == list[i].currency) {

if (list[i].type == "trade") {

acc.Stocks = parseFloat(list[i].balance)

} else if (list[i].type == "frozen") {

acc.FrozenStocks = parseFloat(list[i].balance)

}

} else if (list[i].currency == "usdt") {

if (list[i].type == "trade") {

acc.Balance = parseFloat(list[i].balance)

} else if (list[i].type == "frozen") {

acc.FrozenBalance = parseFloat(list[i].balance)

}

}

}

ret.push(acc)

})

return ret

}

var callBackFuncGetFutures_BinanceAcc = function(self) {

self.e.SetCurrency("BTC_USDT") // set to USDT-margined contract trading pair

self.e.SetContractType("swap") // all are perpetual contracts

var account = self.e.GetAccount()

var ret = []

if (!account) {

return false

}

var balance = account.Balance

var frozenBalance = account.FrozenBalance

// construct asset data structure

_.each(self.subscribeList, function(symbol) {

var acc = {symbol: symbol}

acc.Balance = balance

acc.FrozenBalance = frozenBalance

ret.push(acc)

})

return ret

}

Operate the Strategy Structure with the Function of Obtaining Market Data and Assets

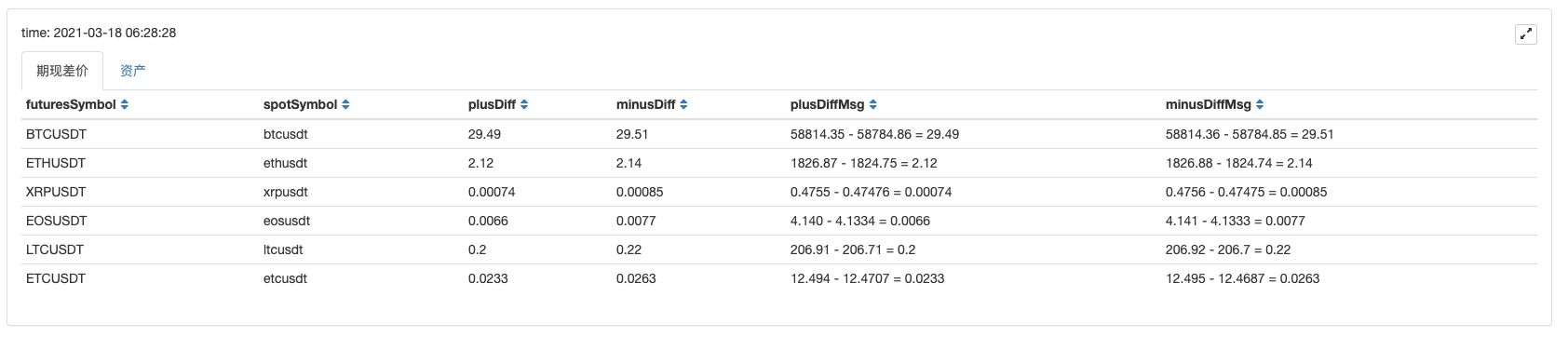

Market:

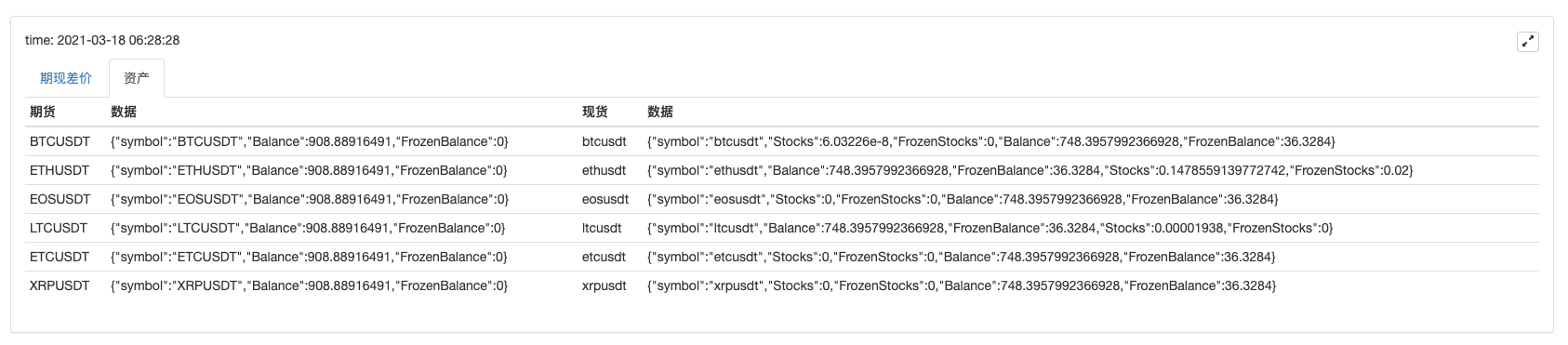

Assets:

It can be seen that after obtaining the market data, you can process the data to calculate the price spread of each symbol, and monitor the futures-spot price spread of multiple trading pairs. And then you can design a multi-symbol futures hedging strategy.

According to this way of designing, other platforms can also be expanded like this, and the students who are interested can try it out.

- FMZ PINE Script Doc

- Notes & Explanation of Futures Reverse Doubling Algorithm Strategy

- Solutions to Obtaining Docker Http Request Message

- Extending Custom Template by Visual (Blockly ) Strategy Editing

- Profit Harvester Strategy Analysis (2)

- Profit Harvester Strategy Analysis (1)

- Python的usdt永续合约交易改成能busd永续交易需要改哪个函数,那个函数影响这个的,求大佬教学一下

- Add Stoploss to control risks — What's the Price

- Discussion on High-Frequency Strategy Design —— Magically Modified Profit Harvester

- Binance Perpetual Funding Rate Arbitrage (100% of Annualized Rate in Bull Market)

- my语言这里怎么写才能有信号就打印输出一次

- Dynamic Delta Hedging of Deribit Options

- Use SQLite to Construct FMZ Quant Database

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (8)

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (7)

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (6)

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (3)

- Novice, Check it Out —— Take You to Cryptocurrency Quantitative Trading (2)

- 我的发明者的时间不对

- 提供思路找大神代写策略呀!