DEX交易所量化实践(4)-- WOOFi / EdgeX 策略接入测试

0

0

807

807

在过去的几篇文章中,我们围绕主流 DEX 的接入做了探讨,而本篇将聚焦于实际使用方面,进行实际策略部署测试。FMZ平台近期又新增支持了WOOFi和EdgeX去中心化交易所,本篇我们就一起在这两个交易所上实践运行一些简单的教学策略。

WOOFi

在WOOFi上连接钱包,然后在API KEY页面,可以查看到API秘钥信息,复制粘贴出来配置到FMZ上即可。

使用FMZ最新的托管者,已经支持WOOFi DEX和EdgeX DEX,下载、部署完成后。在页面: https://www.fmz.com/m/platforms/add 配置交易所对象,配置WOOFi的AccountId、AccessKey、SecretKey。

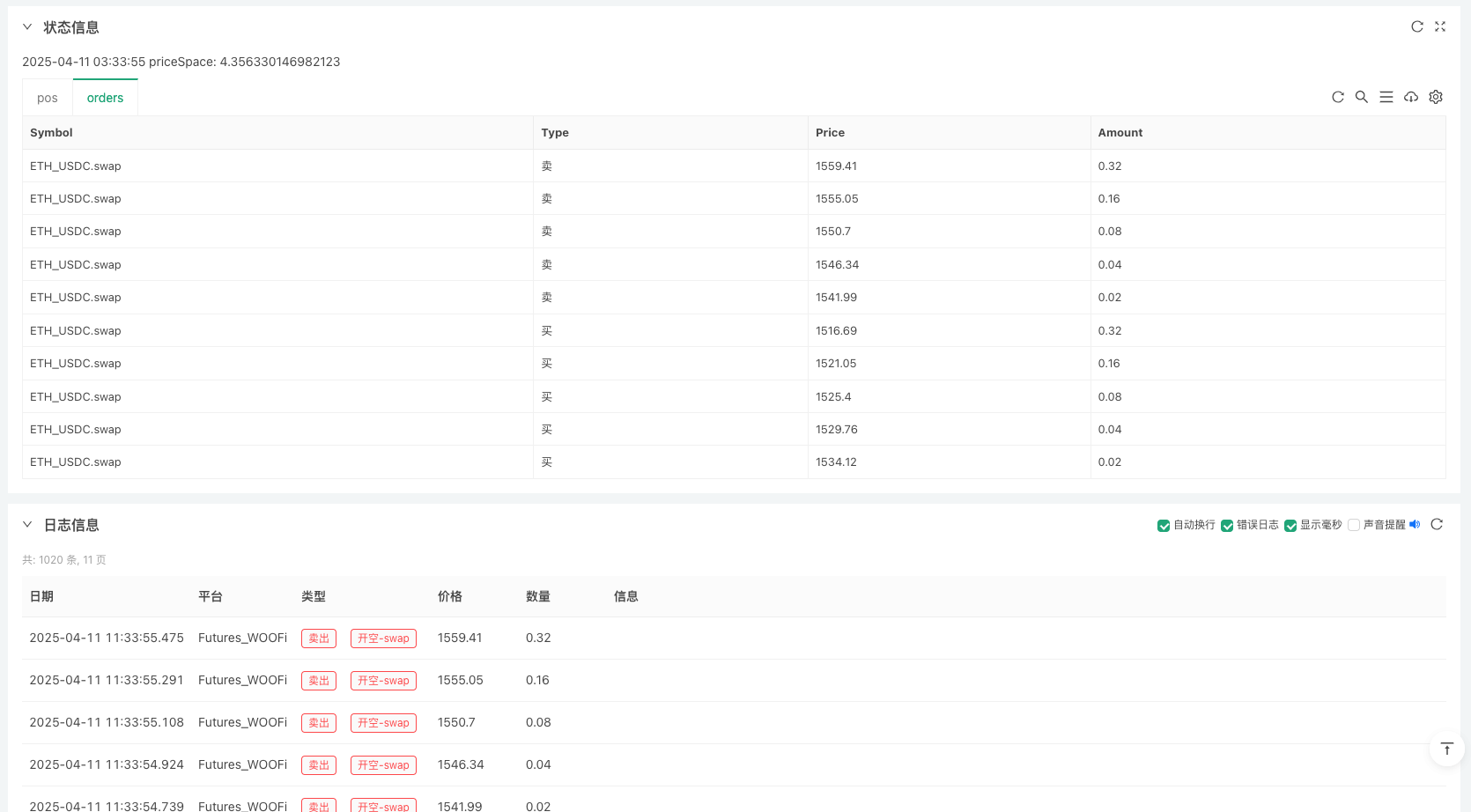

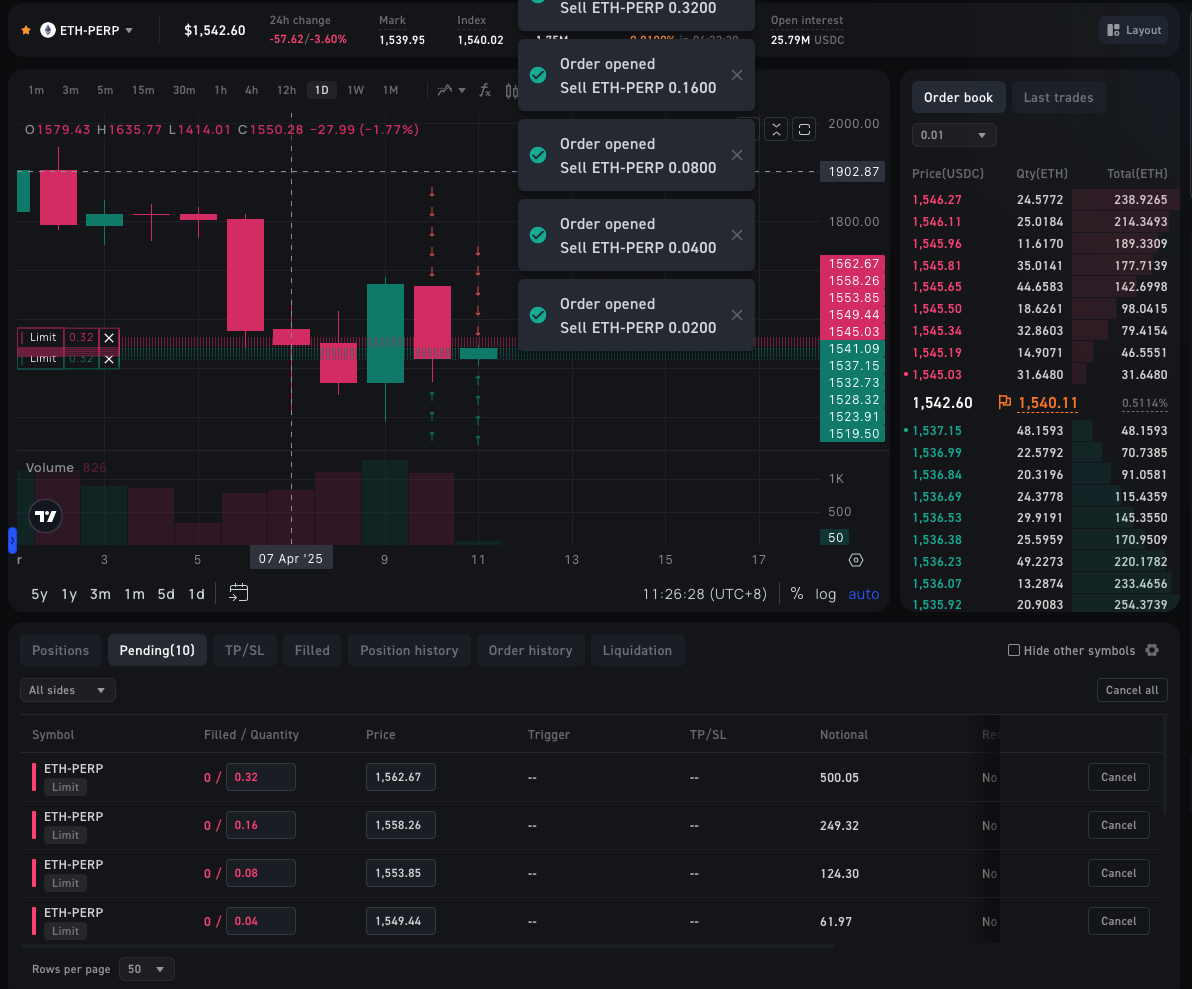

在本次测试中,我们使用了一个基础做市策略原型,结合市场波动率指标(ATR)动态计算挂单间距,并实现了对持仓的智能识别和平仓优先的下单逻辑。策略每轮刷新订单簿,重新获取深度与持仓信息,并按设定的价格间隔和下单数量进行挂单。整个流程涵盖了:

- 市场行情的实时拉取与指标分析;

- 多空方向的挂单逻辑控制;

- 平仓与开仓的判断与分流;

- 仓位与账户状态的可视化输出。

通过该策略,我们可以观察在 WOOFi 的实际成交效率、订单延迟、撮合体验,为后续设计更复杂的策略打下了基础。

我们使用WOOFi的测试环境、测试网:Arbitrum Sepolia。

exchange.SetBase(”https://testnet-api.orderly.org”)

在WOOFi测试网上有水龙头,可以很方便的获取测试用USDC。

策略代码:

function createOrders(e, symbol, side, ordersNum, beginPrice, firstAmount, spacing, pos) {

if (side == "buy" || side == "closesell") {

if (spacing > 0) {

throw "spacing error"

}

} else if (side == "sell" || side == "closebuy") {

if (spacing < 0) {

throw "spacing error"

}

} else {

throw "side error"

}

var holdAmount = 0

if (pos) {

holdAmount = pos.Amount

}

var amount = firstAmount

for (var i = 0 ; i < ordersNum ; i++) {

var id = null

amount = amount * 2

var price = beginPrice + i * spacing

if (price <= 0 || amount <= 0) {

Log("continue loop:", price, amount, "#FF0000")

continue

}

if (holdAmount - amount >= 0) {

id = e.CreateOrder(symbol, side == "buy" ? "closesell" : "closebuy", price, holdAmount)

holdAmount = 0

} else {

id = e.CreateOrder(symbol, side, price, amount)

}

Sleep(100)

}

}

function cancelAll(e, symbol) {

while (true) {

var orders = _C(e.GetOrders, symbol)

var sideOrders = []

for (var o of orders) {

sideOrders.push(o)

}

if (sideOrders.length == 0) {

break

}

for (var o of sideOrders) {

e.CancelOrder(o.Id, o)

}

Sleep(500)

}

}

function main() {

LogReset(1)

LogProfitReset()

exchange.SetBase("https://testnet-api.orderly.org")

// 参数

var symbol = "ETH_USDC.swap"

var ordersNum = 5

var orderAmount = 0.01

var priceSpace = 0

// 初始化

exchange.SetPrecision(2, 3)

var msg = []

var buyOrdersNum = ordersNum

var sellOrdersNum = ordersNum

while (true) {

cancelAll(exchange, symbol)

var r = _C(exchange.GetRecords, symbol, 60 * 5)

var art = TA.ATR(r, 20)

priceSpace = art[art.length - 1]

var pos = _C(exchange.GetPositions, symbol)

// depth

var depth = _C(exchange.GetDepth, symbol)

if (depth.Bids.length == 0 || depth.Asks.length == 0) {

msg.push("invalid depth")

} else {

var bid1Price = depth.Bids[0].Price

var ask1Price = depth.Asks[0].Price

var longPos = null

var shortPos = null

for (var p of pos) {

if (p.Type == PD_LONG) {

longPos = p

} else if (p.Type == PD_SHORT) {

shortPos = p

}

}

// long

createOrders(exchange, symbol, "buy", buyOrdersNum, bid1Price, orderAmount, -priceSpace, shortPos)

// short

createOrders(exchange, symbol, "sell", sellOrdersNum, ask1Price, orderAmount, priceSpace, longPos)

}

var acc = _C(exchange.GetAccount)

var orders = _C(exchange.GetOrders, symbol)

LogProfit(acc.Equity, "&")

var posTbl = {"type": "table", "title": "pos", "cols": ["Symbol", "Type", "Price", "Amount"], "rows": []}

for (var p of pos) {

posTbl["rows"].push([p.Symbol, p.Type == PD_LONG ? "多" : "空", p.Price, p.Amount])

}

var ordersTbl = {"type": "table", "title": "orders", "cols": ["Symbol", "Type", "Price", "Amount"], "rows": []}

for (var o of orders) {

ordersTbl["rows"].push([o.Symbol, o.Type == ORDER_TYPE_BUY ? "买" : "卖", o.Price, o.Amount])

}

LogStatus(_D(), "priceSpace:", priceSpace, "\n`" + JSON.stringify([posTbl, ordersTbl]) + "`")

Sleep(1000 * 60)

LogReset(1000)

}

}

WOOFi上的策略实践

EdgeX

在FMZ上配置EdgeX的API信息与WOOFi基本一致,不过不同的交易所对于需要的API信息并不同,在EdgeX上只需要配置AccountId和SecretKey。这些同样在使用钱包连接EdgeX的前端后,在账户API管理页面查看。

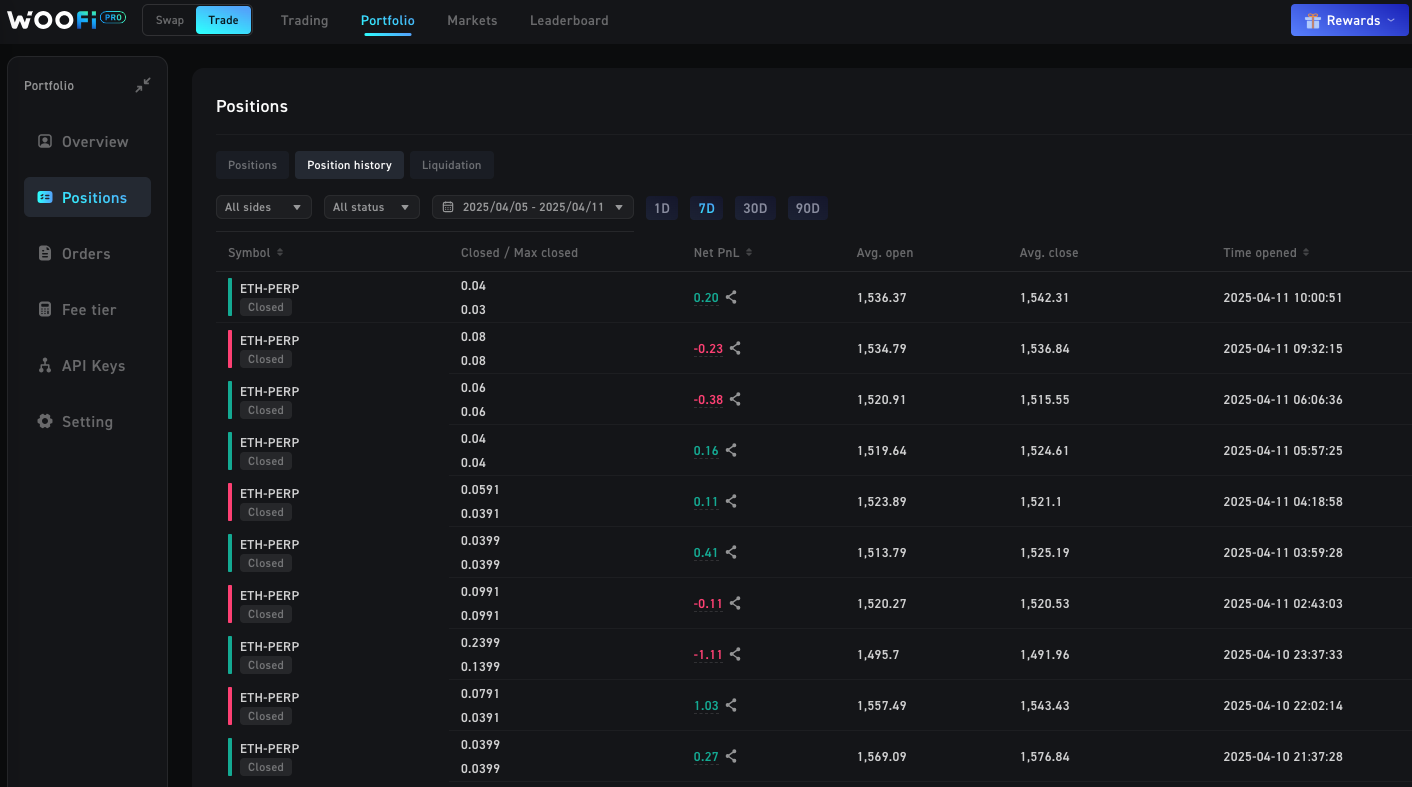

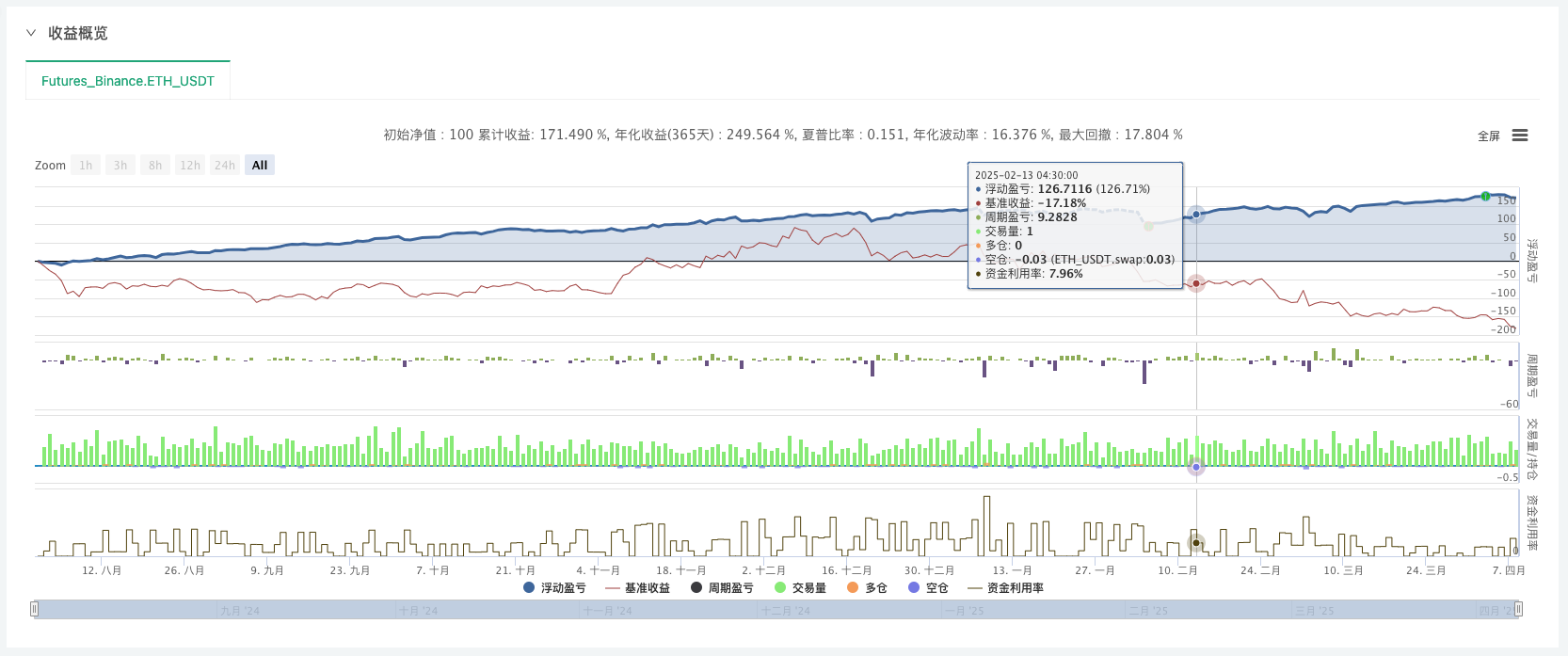

对于在EdgeX上我们要实践的策略是一个基于多层布林带的反向开仓+中轨平仓的量化交易逻辑,实现短线波动套利。

策略十分简单,核心思路为:

- 利用了多重布林标准差,能量化出市场波动强度。

- 有开仓加仓逻辑,突破越强,仓位越大。

- 有明确的平仓逻辑,回到中轨即撤离。

- 成交量与标准差倍数成正比:更强的突破下更大仓位。

可能您都不会相信,在FMZ上编写一个完整的策略竟然只有50行代码。目前AI大模型的发展给策略设计大大降低了门槛,我们测试的策略思路可以很轻松的让AI产出,编写质量也足够用,唯一的是需要人工修正,但是已经大大降低了普通人使用量化交易技术的门槛。

策略代码:

function main() {

var symbol = "ETH_USDT.swap"

var arrUp = []

var arrDown = []

let c = KLineChart({

overlay: true

})

while (true) {

var bolls = []

var r = _C(exchange.GetRecords, symbol)

for (var i = 0; i < 3; i++) {

var boll = TA.BOLL(r, 20, i + 1)

bolls.push(boll)

var up = boll[0][boll[0].length - 1]

var mid = boll[1][boll[1].length - 1]

var down = boll[2][boll[2].length - 1]

var close = r[r.length - 1].Close

if (close > up && i >= arrUp.length) {

exchange.CreateOrder(symbol, "sell", -1, 0.01 * (i + 1))

arrUp.push({"symbol": symbol, "amount": 0.01 * (i + 1)})

} else if (close < down && i >= arrDown.length) {

exchange.CreateOrder(symbol, "buy", -1, 0.01 * (i + 1))

arrDown.push({"symbol": symbol, "amount": 0.01 * (i + 1)})

} else if ((arrUp.length > 0 && close < mid) || (arrDown.length > 0 && close > mid)) {

var pos = exchange.GetPositions(symbol)

for (var p of pos) {

if (p.Type == PD_LONG) {

exchange.CreateOrder(symbol, "closebuy", -1, p.Amount)

} else if (p.Type == PD_SHORT) {

exchange.CreateOrder(symbol, "closesell", -1, p.Amount)

}

}

arrUp = []

arrDown = []

}

}

r.forEach(function(bar, index) {

c.begin(bar)

for (var i in bolls) {

var b = bolls[i]

c.plot(b[0][index], 'up_' + (i + 1))

c.plot(b[1][index], 'mid_' + (i + 1))

c.plot(b[2][index], 'down_' + (i + 1))

}

c.close()

})

LogStatus(_D(), "\n", arrUp, "\n", arrDown)

Sleep(500)

}

}

我们先长期回测一下看看:

部署上EdgeX测试

END

以上策略仅教学研究为主,请谨慎实盘。感谢您的阅读。

- 视觉增强利器!在FMZ上用砖图与平均K线读懂市场趋势

- Building A Multi-Account Walkthrough System That Supports MyLanguage and Pine Strategy Language Based on FMZ

- 基于FMZ构建一个支持My语言和Pine策略语言的多账户跟单系统

- Design of Real Ticker Driven Simulation Trading System Based on FMZ Quant Trading Platform

- 基于FMZ量化平台的真实行情驱动仿真交易系统设计

- Using AI to Learn Strategy Design Reversely: A New Way to Improve Quantitative Trading Skills

- 用AI反向学习策略设计:提升量化交易技能的新思路

- The Go-Anywhere Quantitative Journey Starts from FMZ

- 说走就走的量化旅程,从 FMZ 开始

- Quantitative Practice of DEX Exchanges (4) - Strategy Access Test of WOOFi / EdgeX

- Practice of Web3 Tron Encapsulated and Access to SunSwap DEX Based on FMZ Platform

- 基于FMZ平台Web3 Tron封装接入SunSwap DEX的实践

- FMZ Platform Web3 Ethereum Practice - Pending Order Exchange Based on Smart Contract

- FMZ 平台 Web3 以太坊实践 —— 基于智能合约的挂单兑换

- How to Implement Pending Orders in Decentralized Exchanges — Taking Curve as An Example

- 去中心化交易所如何实现挂单——以Curve为例

- FMZ Quant Web3 Expansion: Tron Support Added, Expand On-chain Tradings

- A Brief Analysis of Arbitrage Strategy: How to Capture Low-risk Opportunities with Short Time Lags

- 套利策略浅析:如何捕捉短时滞后的低风险机会

- FMZ量化Web3拓展:新增Tron支持,扩展链上交易能力