来自YouTube大神的「神奇的双EMA均线策略」

28

28

7482

7482

来自YouTube大神的「神奇的双EMA均线策略」

本期我们来探讨一个来源于YouTube的「神奇的双EMA均线策略」,这个策略被称为“股票和加密货币市场杀手”。小编我观看视频了解到这个策略是一个trading view的pine语言策略,用到了2个trading view指标。看到视频中的回测效果非常好,FMZ也支持Trading View的Pine语言,所以就忍不住想要自己回测、测试分析。那么就开始整活!这就动手把视频中的策略复刻下来。

策略使用的指标

1、EMA指标

为了简便设计,我们就不使用视频上列举的Moving Average Exponential。我们使用trading view的内置ta.ema代替(其实都一样)。

2、VuManChu Swing Free指标

这个是一个Trading View上的指标,我们需要去Trading View上把源码扒下来。

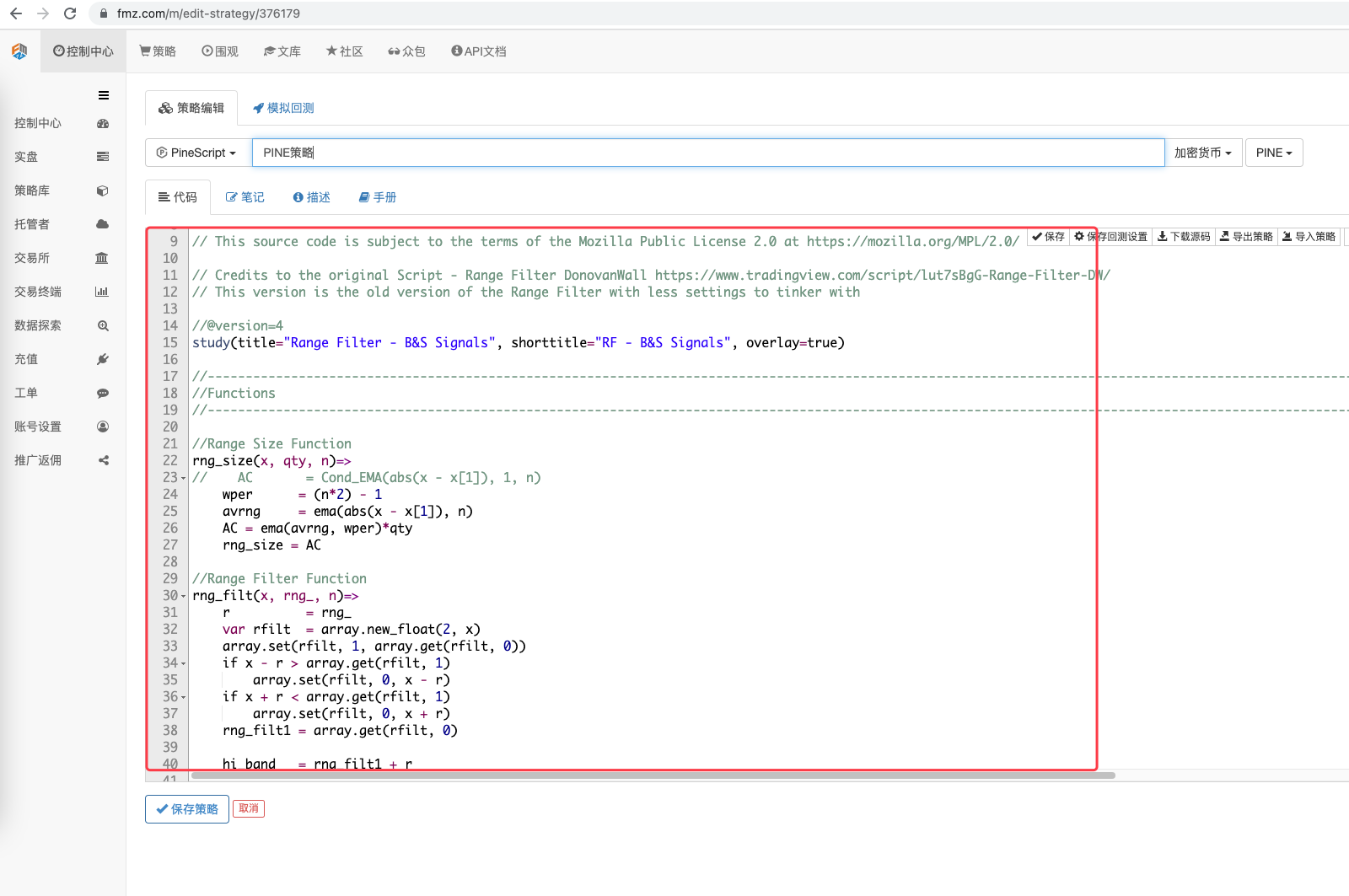

VuManChu Swing Free代码:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Credits to the original Script - Range Filter DonovanWall https://www.tradingview.com/script/lut7sBgG-Range-Filter-DW/

// This version is the old version of the Range Filter with less settings to tinker with

//@version=4

study(title="Range Filter - B&S Signals", shorttitle="RF - B&S Signals", overlay=true)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Functions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Size Function

rng_size(x, qty, n)=>

// AC = Cond_EMA(abs(x - x[1]), 1, n)

wper = (n*2) - 1

avrng = ema(abs(x - x[1]), n)

AC = ema(avrng, wper)*qty

rng_size = AC

//Range Filter Function

rng_filt(x, rng_, n)=>

r = rng_

var rfilt = array.new_float(2, x)

array.set(rfilt, 1, array.get(rfilt, 0))

if x - r > array.get(rfilt, 1)

array.set(rfilt, 0, x - r)

if x + r < array.get(rfilt, 1)

array.set(rfilt, 0, x + r)

rng_filt1 = array.get(rfilt, 0)

hi_band = rng_filt1 + r

lo_band = rng_filt1 - r

rng_filt = rng_filt1

[hi_band, lo_band, rng_filt]

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Inputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Source

rng_src = input(defval=close, type=input.source, title="Swing Source")

//Range Period

rng_per = input(defval=20, minval=1, title="Swing Period")

//Range Size Inputs

rng_qty = input(defval=3.5, minval=0.0000001, title="Swing Multiplier")

//Bar Colors

use_barcolor = input(defval=false, type=input.bool, title="Bar Colors On/Off")

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Definitions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Filter Values

[h_band, l_band, filt] = rng_filt(rng_src, rng_size(rng_src, rng_qty, rng_per), rng_per)

//Direction Conditions

var fdir = 0.0

fdir := filt > filt[1] ? 1 : filt < filt[1] ? -1 : fdir

upward = fdir==1 ? 1 : 0

downward = fdir==-1 ? 1 : 0

//Trading Condition

longCond = rng_src > filt and rng_src > rng_src[1] and upward > 0 or rng_src > filt and rng_src < rng_src[1] and upward > 0

shortCond = rng_src < filt and rng_src < rng_src[1] and downward > 0 or rng_src < filt and rng_src > rng_src[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

//Colors

filt_color = upward ? #05ff9b : downward ? #ff0583 : #cccccc

bar_color = upward and (rng_src > filt) ? (rng_src > rng_src[1] ? #05ff9b : #00b36b) :

downward and (rng_src < filt) ? (rng_src < rng_src[1] ? #ff0583 : #b8005d) : #cccccc

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Outputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Filter Plot

filt_plot = plot(filt, color=filt_color, transp=67, linewidth=3, title="Filter")

//Band Plots

h_band_plot = plot(h_band, color=color.new(#05ff9b, 100), title="High Band")

l_band_plot = plot(l_band, color=color.new(#ff0583, 100), title="Low Band")

//Band Fills

fill(h_band_plot, filt_plot, color=color.new(#00b36b, 92), title="High Band Fill")

fill(l_band_plot, filt_plot, color=color.new(#b8005d, 92), title="Low Band Fill")

//Bar Color

barcolor(use_barcolor ? bar_color : na)

//Plot Buy and Sell Labels

plotshape(longCondition, title = "Buy Signal", text ="BUY", textcolor = color.white, style=shape.labelup, size = size.normal, location=location.belowbar, color = color.new(color.green, 0))

plotshape(shortCondition, title = "Sell Signal", text ="SELL", textcolor = color.white, style=shape.labeldown, size = size.normal, location=location.abovebar, color = color.new(color.red, 0))

//Alerts

alertcondition(longCondition, title="Buy Alert", message = "BUY")

alertcondition(shortCondition, title="Sell Alert", message = "SELL")

策略逻辑

EMA指标:策略使用两根EMA均线,一根快线(小周期参数),一根慢线(大周期参数)。双EMA均线的作用主要是帮助我们判断市场趋势方向。

多头排列 快线在慢线上方。

空头排列 快线在慢线下方。

VuManChu Swing Free指标:VuManChu Swing Free指标用来发出信号,再结合其它条件判断是否进行下单交易。从VuManChu Swing Free指标源码可以看出:longCondition变量就代表买入信号,shortCondition变量就代表卖出信号。后续编写下单条件就使用这两个变量。

现在我们来讲下策略具体的交易信号触发条件:

1、进入多头的规则: 阳K线的收盘价要处在EMA快线的上方,两根EMA均线要呈现多头排列(快线在慢线上方),VuManChu Swing Free指标要出现买入信号(longCondition为真)。三个条件成立,这根K线就是做多入场的关键K线,这根K线的收盘价就是入场位置。

2、进入空头的规则(和多头相反): 阴K线的收盘价要处在EMA快线的下方,两根EMA均线要呈现空头排列(快线在慢线下方),VuManChu Swing Free指标要出现卖出信号(shortCondition为真)。三个条件成立,这根K线的收盘价就是做空入场位置。

交易逻辑是不是很简单,由于出处的视频中没有具体说明止盈止损,小编这里就自由发挥一下使用一种比较中庸的止盈止损方式,使用固定点数止损,跟踪止盈。

代码设计

VuManChu Swing Free指标的代码,我们直接原封不动地放进我们的策略代码中。

然后紧跟着我们编写一段Pine语言代码,实现交易功能:

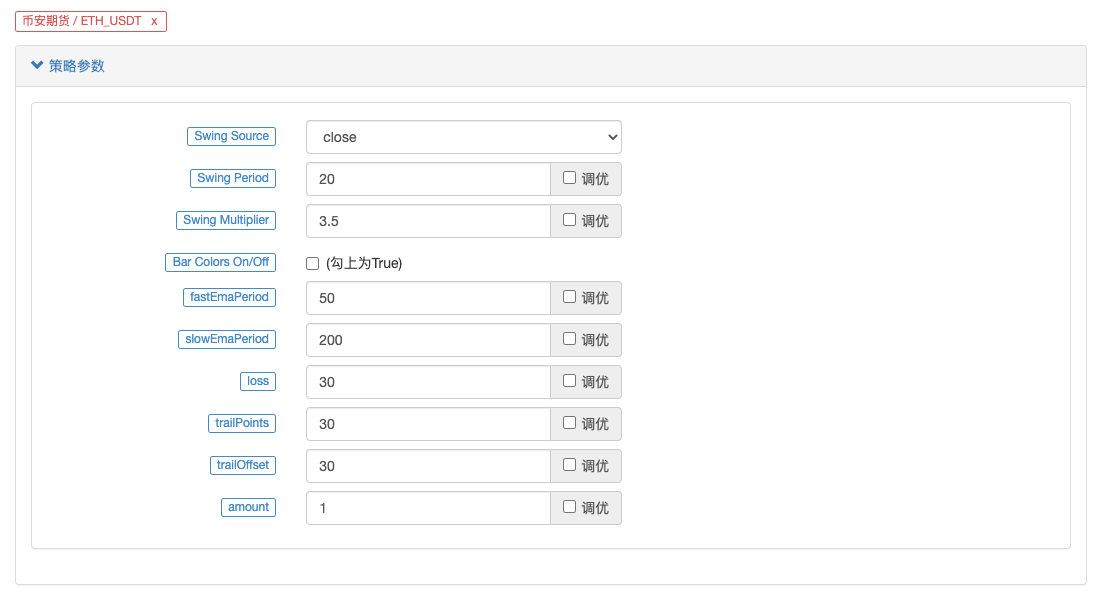

// extend

fastEmaPeriod = input(50, "fastEmaPeriod") // 快线周期

slowEmaPeriod = input(200, "slowEmaPeriod") // 慢线周期

loss = input(30, "loss") // 止损点数

trailPoints = input(30, "trailPoints") // 移动止盈触发点数

trailOffset = input(30, "trailOffset") // 移动止盈偏移量(点数)

amount = input(1, "amount") // 下单量

emaFast = ta.ema(close, fastEmaPeriod) // 计算快线EMA

emaSlow = ta.ema(close, slowEmaPeriod) // 计算慢线EMA

buyCondition = longCondition and emaFast > emaSlow and close > open and close > emaFast // 做多入场条件

sellCondition = shortCondition and emaFast < emaSlow and close < open and close < emaFast // 做空入场条件

if buyCondition and strategy.position_size == 0

strategy.entry("long", strategy.long, amount)

strategy.exit("exit_long", "long", amount, loss=loss, trail_points=trailPoints, trail_offset=trailOffset)

if sellCondition and strategy.position_size == 0

strategy.entry("short", strategy.short, amount)

strategy.exit("exit_short", "short", amount, loss=loss, trail_points=trailPoints, trail_offset=trailOffset)

A.可以看到,当buyCondition为真时即:

1、longCondition变量为真(VuManChu Swing Free指标发出信号做多)。 2、emaFast > emaSlow (EMA多头排列)。 3、close > open (表示当前BAR为阳线),close > emaFast (表示收盘价在EMA快线上方)。

做多的三个条件成立。

B.当sellCondition为真时,则做空的三个条件成立(这里不再赘述)。

然后就在if条件判断信号触发的情况下,使用strategy.entry函数入场开仓,同时设置strategy.exit函数止损、跟踪止盈。

完整的代码

/*backtest

start: 2022-01-01 00:00:00

end: 2022-10-08 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

args: [["ZPrecision",0,358374]]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// Credits to the original Script - Range Filter DonovanWall https://www.tradingview.com/script/lut7sBgG-Range-Filter-DW/

// This version is the old version of the Range Filter with less settings to tinker with

//@version=4

study(title="Range Filter - B&S Signals", shorttitle="RF - B&S Signals", overlay=true)

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Functions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Size Function

rng_size(x, qty, n)=>

// AC = Cond_EMA(abs(x - x[1]), 1, n)

wper = (n*2) - 1

avrng = ema(abs(x - x[1]), n)

AC = ema(avrng, wper)*qty

rng_size = AC

//Range Filter Function

rng_filt(x, rng_, n)=>

r = rng_

var rfilt = array.new_float(2, x)

array.set(rfilt, 1, array.get(rfilt, 0))

if x - r > array.get(rfilt, 1)

array.set(rfilt, 0, x - r)

if x + r < array.get(rfilt, 1)

array.set(rfilt, 0, x + r)

rng_filt1 = array.get(rfilt, 0)

hi_band = rng_filt1 + r

lo_band = rng_filt1 - r

rng_filt = rng_filt1

[hi_band, lo_band, rng_filt]

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Inputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Source

rng_src = input(defval=close, type=input.source, title="Swing Source")

//Range Period

rng_per = input(defval=20, minval=1, title="Swing Period")

//Range Size Inputs

rng_qty = input(defval=3.5, minval=0.0000001, title="Swing Multiplier")

//Bar Colors

use_barcolor = input(defval=false, type=input.bool, title="Bar Colors On/Off")

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Definitions

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Range Filter Values

[h_band, l_band, filt] = rng_filt(rng_src, rng_size(rng_src, rng_qty, rng_per), rng_per)

//Direction Conditions

var fdir = 0.0

fdir := filt > filt[1] ? 1 : filt < filt[1] ? -1 : fdir

upward = fdir==1 ? 1 : 0

downward = fdir==-1 ? 1 : 0

//Trading Condition

longCond = rng_src > filt and rng_src > rng_src[1] and upward > 0 or rng_src > filt and rng_src < rng_src[1] and upward > 0

shortCond = rng_src < filt and rng_src < rng_src[1] and downward > 0 or rng_src < filt and rng_src > rng_src[1] and downward > 0

CondIni = 0

CondIni := longCond ? 1 : shortCond ? -1 : CondIni[1]

longCondition = longCond and CondIni[1] == -1

shortCondition = shortCond and CondIni[1] == 1

//Colors

filt_color = upward ? #05ff9b : downward ? #ff0583 : #cccccc

bar_color = upward and (rng_src > filt) ? (rng_src > rng_src[1] ? #05ff9b : #00b36b) :

downward and (rng_src < filt) ? (rng_src < rng_src[1] ? #ff0583 : #b8005d) : #cccccc

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Outputs

//-----------------------------------------------------------------------------------------------------------------------------------------------------------------

//Filter Plot

filt_plot = plot(filt, color=filt_color, transp=67, linewidth=3, title="Filter")

//Band Plots

h_band_plot = plot(h_band, color=color.new(#05ff9b, 100), title="High Band")

l_band_plot = plot(l_band, color=color.new(#ff0583, 100), title="Low Band")

//Band Fills

fill(h_band_plot, filt_plot, color=color.new(#00b36b, 92), title="High Band Fill")

fill(l_band_plot, filt_plot, color=color.new(#b8005d, 92), title="Low Band Fill")

//Bar Color

barcolor(use_barcolor ? bar_color : na)

//Plot Buy and Sell Labels

plotshape(longCondition, title = "Buy Signal", text ="BUY", textcolor = color.white, style=shape.labelup, size = size.normal, location=location.belowbar, color = color.new(color.green, 0))

plotshape(shortCondition, title = "Sell Signal", text ="SELL", textcolor = color.white, style=shape.labeldown, size = size.normal, location=location.abovebar, color = color.new(color.red, 0))

//Alerts

alertcondition(longCondition, title="Buy Alert", message = "BUY")

alertcondition(shortCondition, title="Sell Alert", message = "SELL")

// extend

fastEmaPeriod = input(50, "fastEmaPeriod")

slowEmaPeriod = input(200, "slowEmaPeriod")

loss = input(30, "loss")

trailPoints = input(30, "trailPoints")

trailOffset = input(30, "trailOffset")

amount = input(1, "amount")

emaFast = ta.ema(close, fastEmaPeriod)

emaSlow = ta.ema(close, slowEmaPeriod)

buyCondition = longCondition and emaFast > emaSlow and close > open and close > emaFast

sellCondition = shortCondition and emaFast < emaSlow and close < open and close < emaFast

if buyCondition and strategy.position_size == 0

strategy.entry("long", strategy.long, amount)

strategy.exit("exit_long", "long", amount, loss=loss, trail_points=trailPoints, trail_offset=trailOffset)

if sellCondition and strategy.position_size == 0

strategy.entry("short", strategy.short, amount)

strategy.exit("exit_short", "short", amount, loss=loss, trail_points=trailPoints, trail_offset=trailOffset)

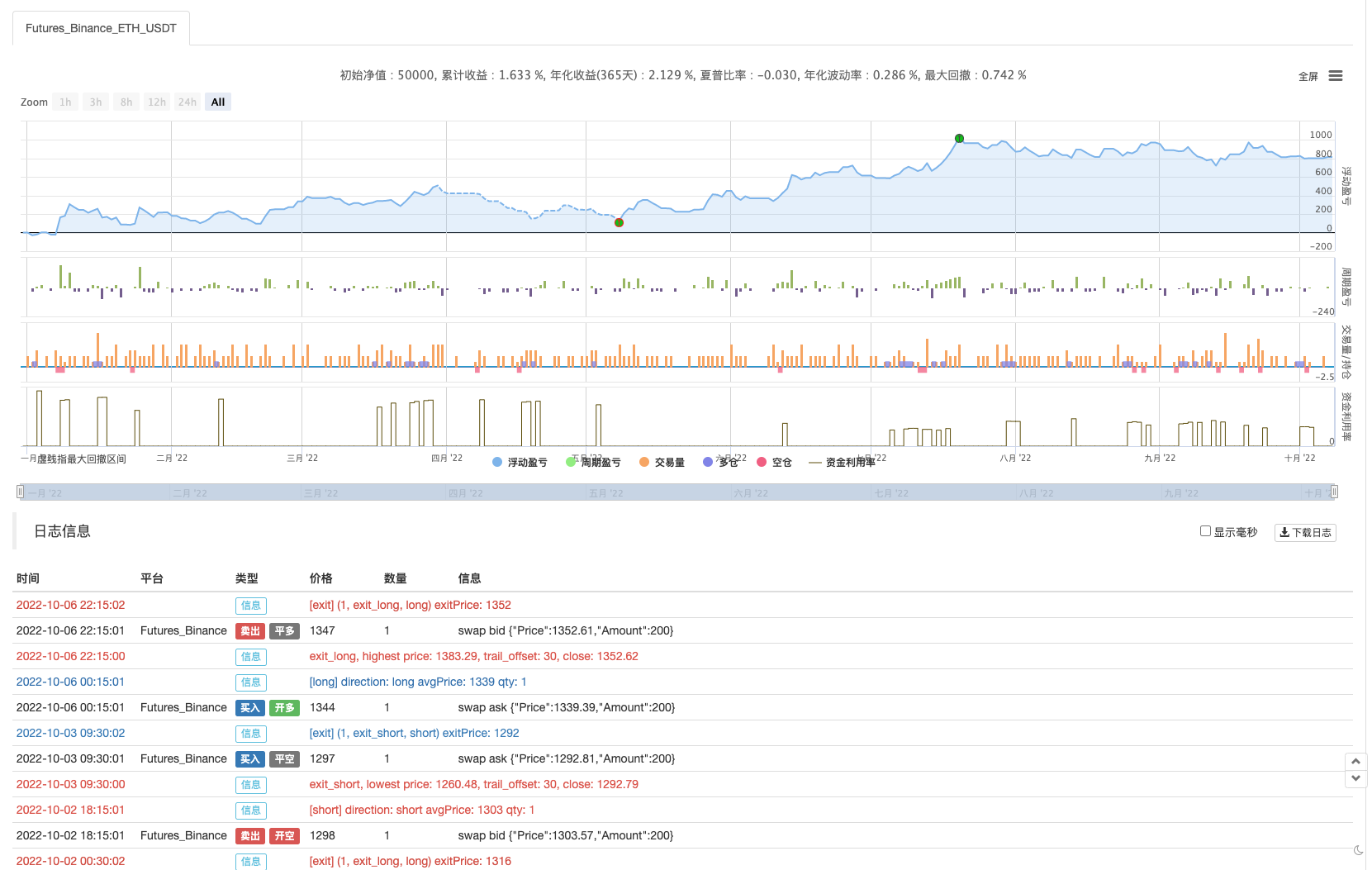

回测测试

回测测试时间范围选取从2022年1月到2022年10月,K线周期为15分钟,使用收盘价模型回测。市场选择Binance的ETH_USDT永续合约。参数设置按照出处视频中所说快线50周期,慢线200周期,其它参数默认不变。止损、跟踪止盈点数我主观一点,就设置30个点位。

回测结果马马虎虎,多次回测看来止盈止损这些参数对回测结果有些影响。感觉这个方面还需要再优化设计。不过策略信号触发交易后胜率还是可以的。

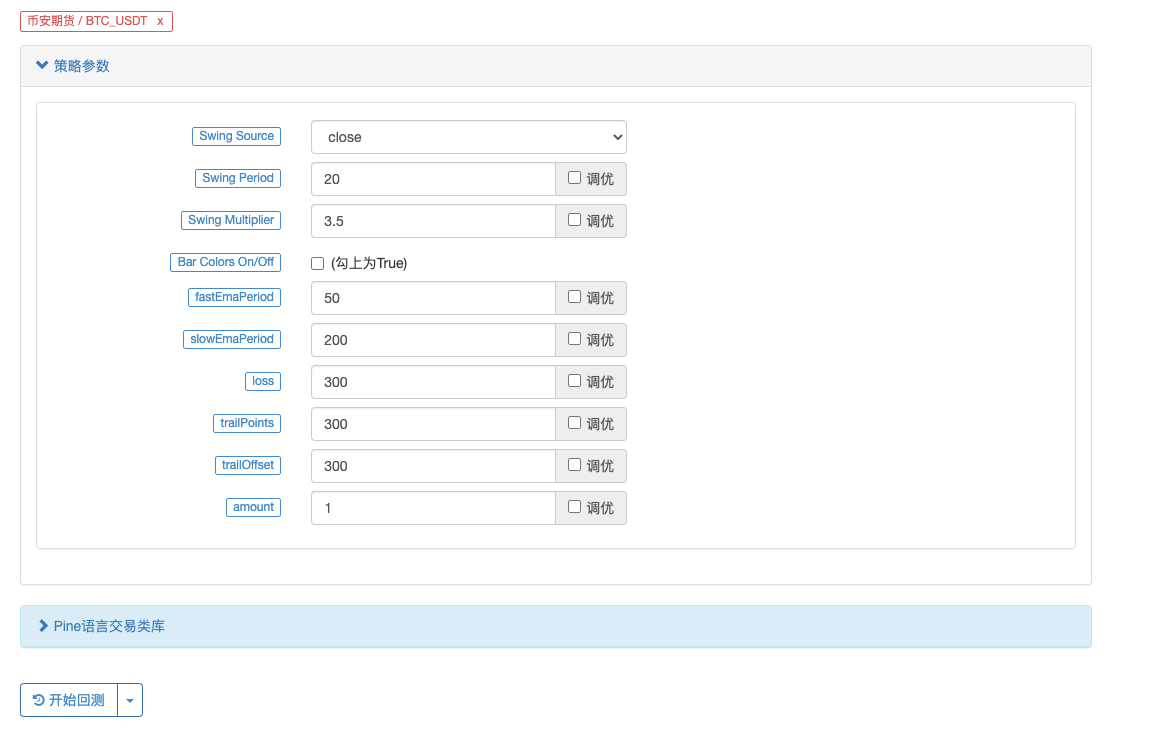

我们换一个BTC_USDT永续合约试试看:

结果在BTC上回测也很炸裂:

策略地址:https://www.fmz.com/strategy/385745

看来这个交易方法对于趋势的拿捏还是比较靠谱的,可以根据这个思路继续优化设计。本期文章我们不仅了解了一个双均线策略的思路,也了解了如何把油管(youtube)上大神的策略拿来加工、学习。OK,以上策略代码仅仅是小编我抛砖引玉,回测结果也并不代表具体实盘效果,对于策略代码、设计仅供参考。感谢您的支持,我们下期再见!

- LeeksReaper Strategy Analysis (2)

- The "Magic Double EMA Strategy" from the YouTube Veterans

- JavaScript language implementation of Fisher indicators and drawing on FMZ

- Example of dYdX strategy design

- Design of Order Synchronization Management System Based on FMZ Quant (1)

- LeeksReaper Strategy Analysis(1)

- Deribit Options Delta Dynamic Hedging Strategy

- Recent Status and Recommended Operation of Funding Rate Strategy

- Review of Digital Currency Market in 2021 and the Simplest 10 times Strategy Missed

- Digital Currency Factor Model

- 使用Pine语言编写一个半自动的交易工具

- 数字货币因子模型

- 交易中做自己的救世主

- Hedging strategy of cryptocurrency manual futures and spots

- Cryptocurrency spot hedging strategy design(1)

- A perpetual balance strategy suitable for bear market bottoming

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (8)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (7)

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (6)

- Overview and architecture of the main interface of FMZ Quant Trading Platform