【复合CTA交易系统New】(多因子+多品种+多策略自适应公用版)

穿越牛熊2000天实盘,稳定盈利的复合CTA策略模组

各位交易者大家好,历时数年的实盘检验,很高兴与大家分享这款复合CTA交易系统模组。本款策略保持多因子多品种多周期多策略组合的思想,包含趋势、波段、震荡、另类等数十子策略。持仓周期数天至数周,策略容量极大,适合大资金长期运作。策略盈利点为跟随活跃品种与活跃市场带来的波动。策略回撤期为长期市场低迷与无序震荡。本款策略亮点之处为本策略经历800天+的实盘检验(文末有实盘地址),穿越牛熊风雨无阻,下面将详细为大家介绍本款策略。

Hello~Welcome come to my channel!

欢迎各位交易者来到我的频道,我是作手君,一名Quant Developer,全栈开发CTA & HFT & Arbitrage等交易策略。 感谢FMZ平台,我会在我的量化频道多多分享量化开发相关内容,同各位交易者共同维护量化社区的繁荣。

更多信息,移步我的频道哦~在这等你来撩【作手君量化小屋】

一,CTA交易策略

CTA策略全称是Commodity Trading Advisor Strategy,即“商品交易顾问策略”,也被称作管理期货策略。是由专业的管理人以追求绝对收益为目标,运用客户委托的资金投资于期货市场、期权市场,并收取相应投资顾问费用的一种基金形式。1949年,美国证券经纪人Richard Donchuan设立了第一个公开发售的期货基金,标志着CTA基金的诞生,后于20世纪70年代开始兴起,到了21世纪,采用CTA策略的基金管理规模开始呈现爆发式增长。全球代表的CTA基金包括:元盛资产、Aspect Capital、Transtrend B.V等。

就投资方法而言,CTA基金有两大类。一类是主观CTA,即由基金管理人基于基本面、调研或操盘经验,主观来判断走势,决定买卖时点;另一类是量化CTA,是通过分析建立数量化的交易策略模型,由模型产生的买卖信号进行投资决策。从具体策略来看,CTA可以划分为趋势、反转、波段套利策略。趋势策略是指跟踪交易标的不同周期的趋势,进行做多或做空操作;反转策略是指利用标的价格的反转性波动进行反向交易;套利策略包括跨期套利、跨品种套利、期现套利与资金费套利等。发展到今日,量化CTA策略又大概分为两类,一类是以规则型策略为主的传统CTA,一类是以机器学习深度学习为主的预测类CTA。传统CTA多采用线性模型,可解释性较强普适性较高,但收益较低,需要使用者有较多的经验进行优化。预测类CTA需要更系统化的数理储备与因子储备,对非线性预测模型的使用与组合方式都要有不少的要去。各类CTA策略与方法论都各有优劣,需要投资者自主进行选择与搭配。

二,基于多因子+多品种+多策略的复合CTA交易系统

本款策略基于低频、顺势、薄利、复利的交易思想,践行多因子、多品种、多策略、多维度的组合方式,已经达到了较为安全稳定的状态。部分子策略如下所示:

● 趋势策略:动量效应因多种行为金融学效应在金融市场普遍存在,运用独立研发的多维度趋势因子库,从多个市场信息维度与时间维度进行全天候监控+多重保护出场方案(因子信号聚合出场、动态自适应保护、极端衰竭出场)。

● 回归策略:回归效应同样在金融市场广泛存在,运用独立研发的多维度震荡因子库,捕捉各级别超买超卖状态,进行回归交易,用于对冲趋势信号。

● 波段策略:基于市场趋势运动存在一波三折的效应,以多维趋势为基础进行波段交易,在趋势中捕捉反弱势反被套信号以加减仓,用于平滑趋势曲线。

● 另类策略:其余类型策略,包括统计类策略,异象策略等。

同时本策略还十分注重风险控制与资金管理。永远铭记一句话:“做CTA交易永远要将风险控制摆在第一位,要时刻如履薄冰。”交易者需自行设置风险承受程度。风险控制系统包括但不限于风险敞口管理、单信号波动性仓位控制、止损/退出原则、组合风险管理、市场反馈及策略资金曲线自适应调整机制等。需要注意的是,CTA策略不是暴力策略,属于跟随市场型的β策略,在市场存在波动时跟随盈利,在市场无序波动时做好防守减少回撤。CTA策略更应做到鲁棒性强生命力长而不是收益爆炸,类似于动物世界中鳄鱼与猎豹的关系。

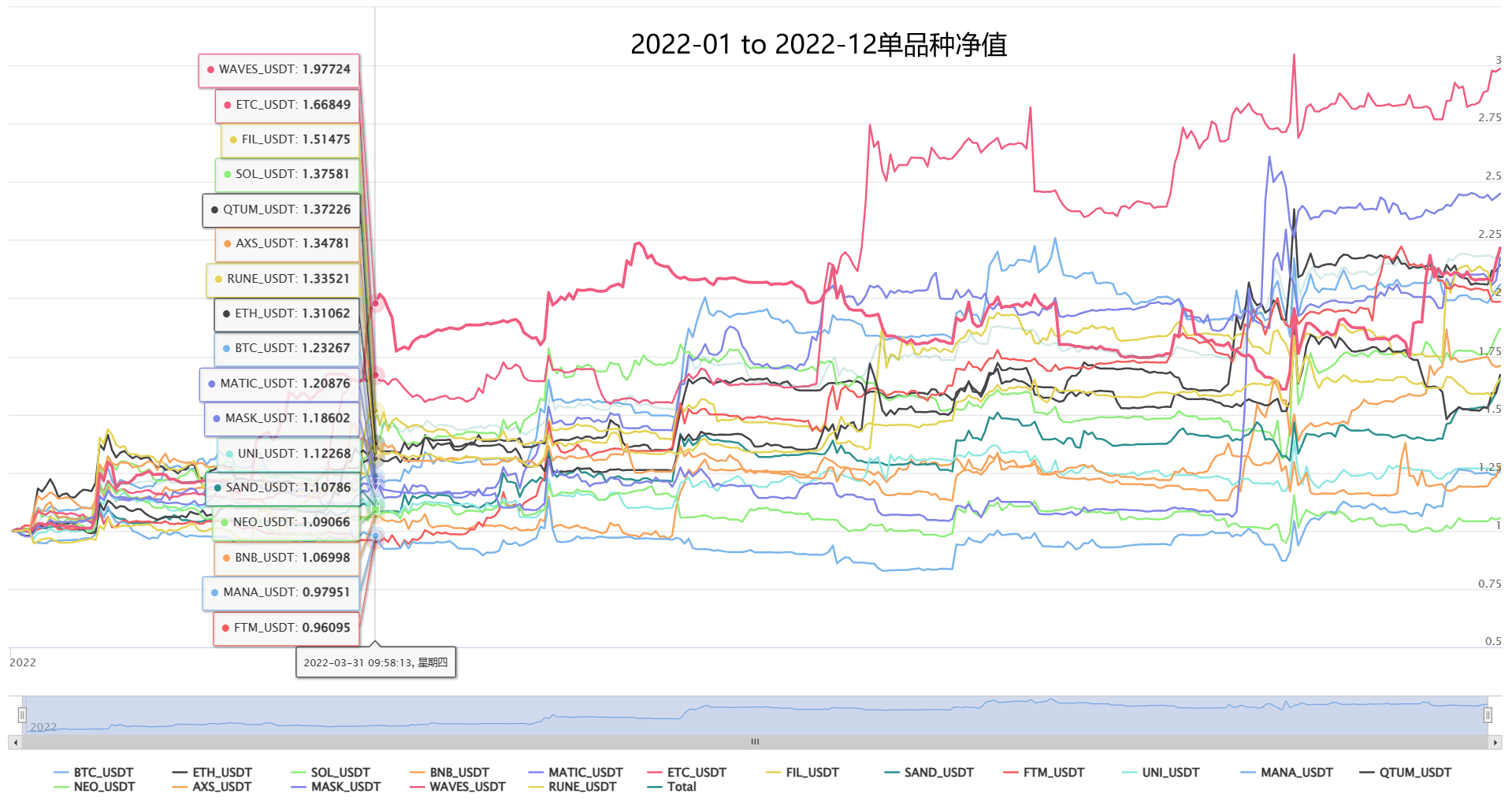

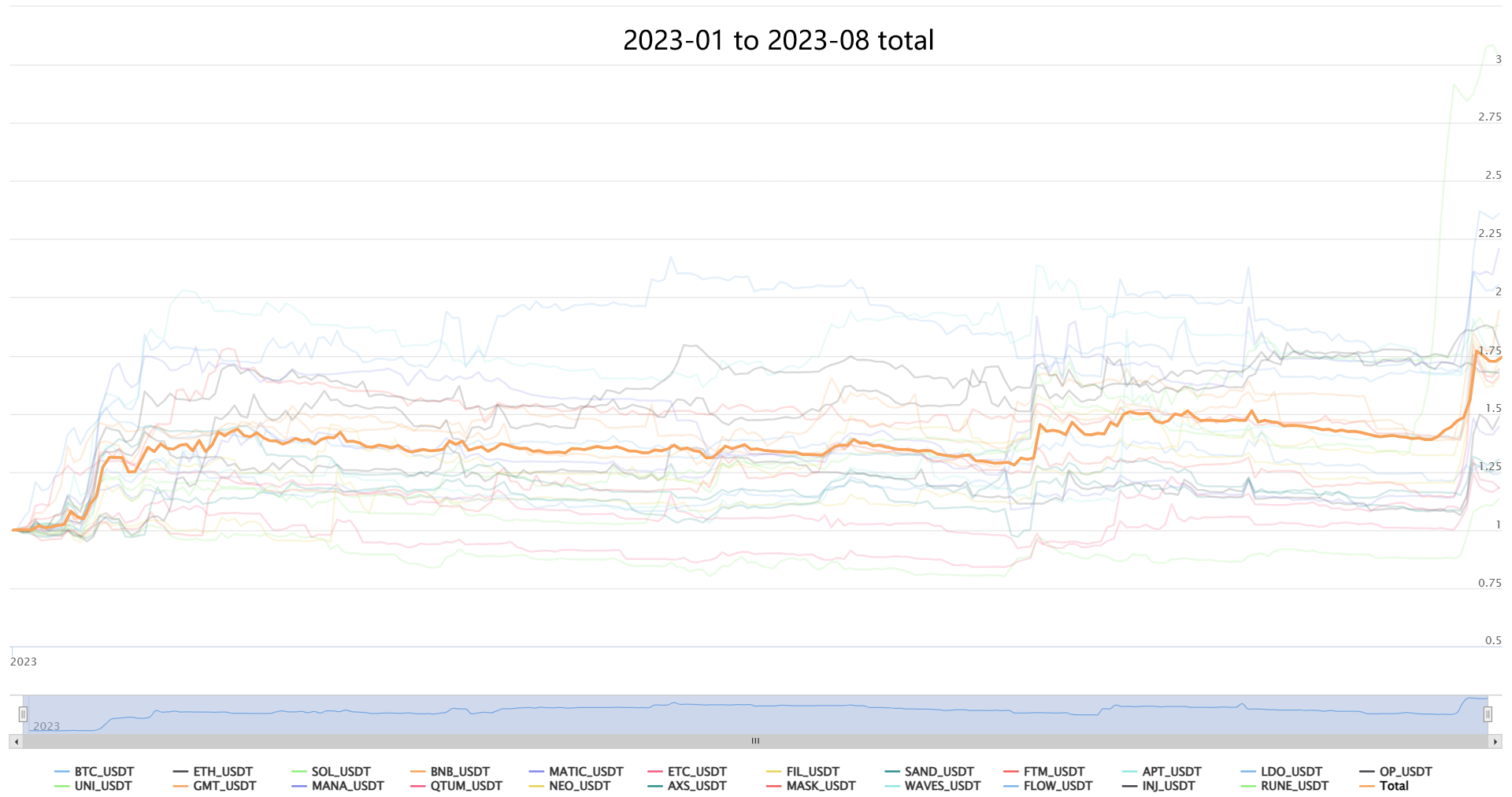

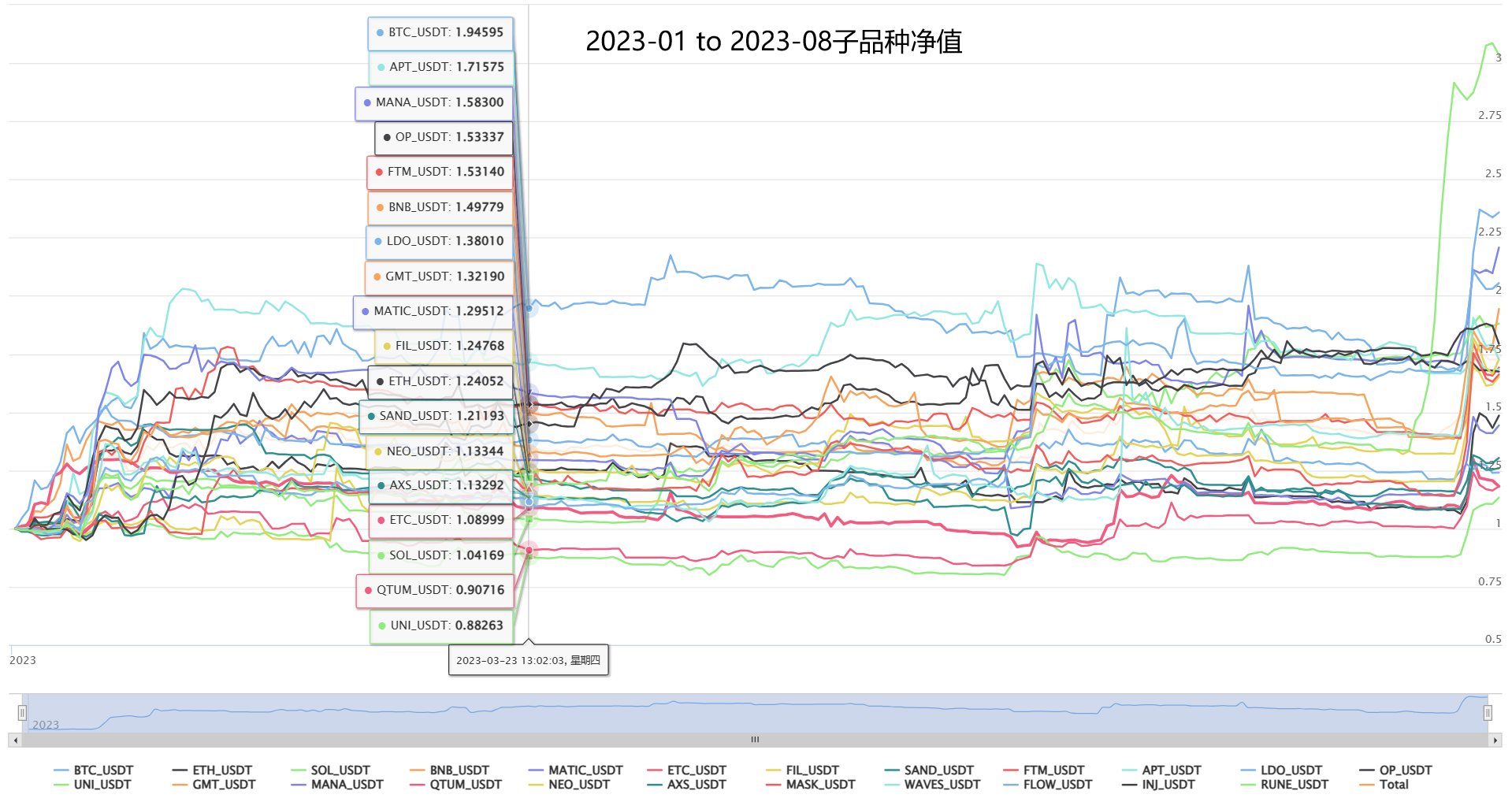

三,策略绩效与各行情下盈亏特性展示

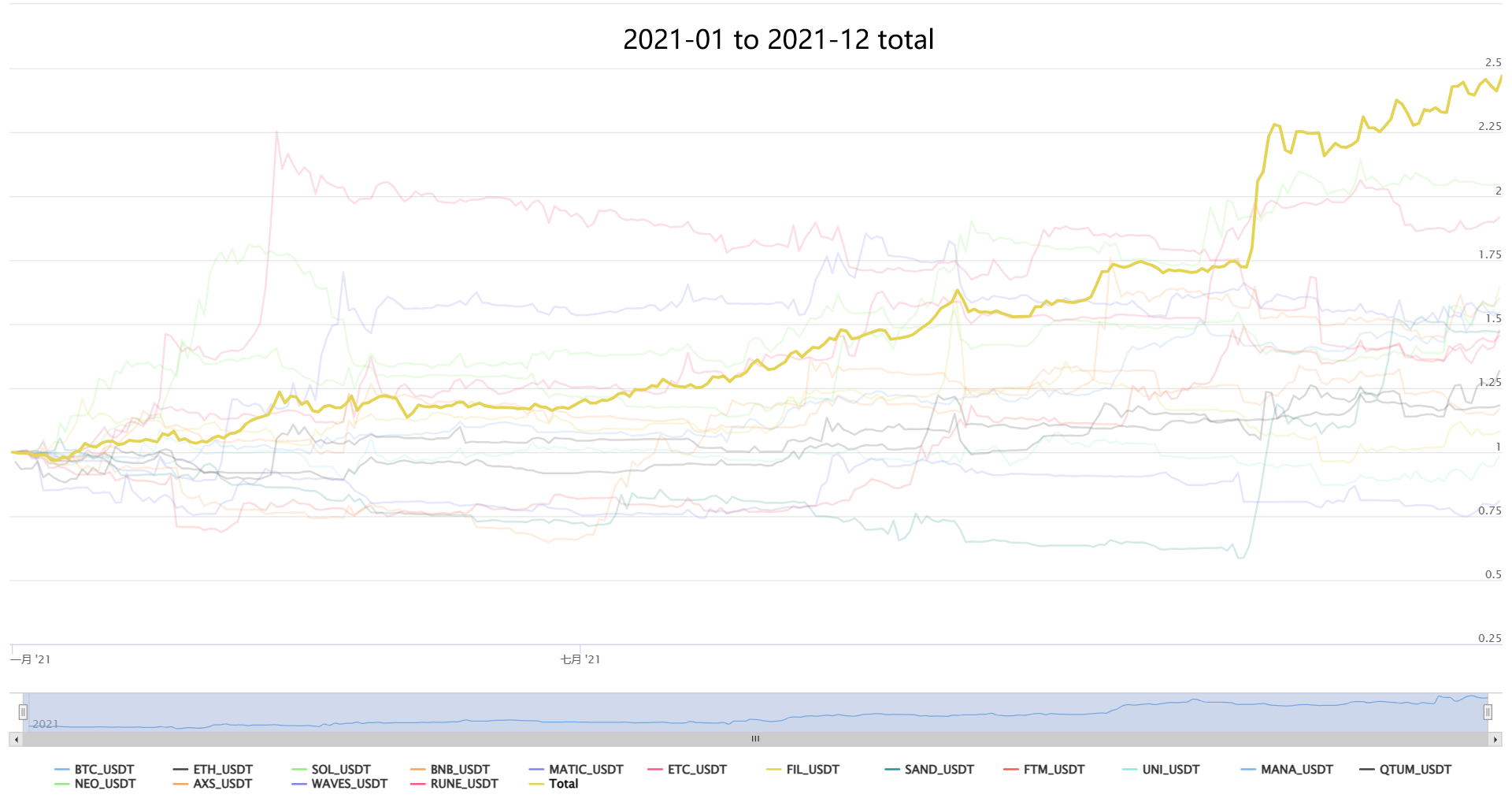

■ 本款策略适用于币本位与U本位合约。U本位合约中可配置多品种,不过盈亏是按U计算的。有些用户长期看好数字币本身,也可以持有币做相应币本位合约,盈亏按币计算,这样可以达到币本位增强效果,获取超额市场大盘的α收益。

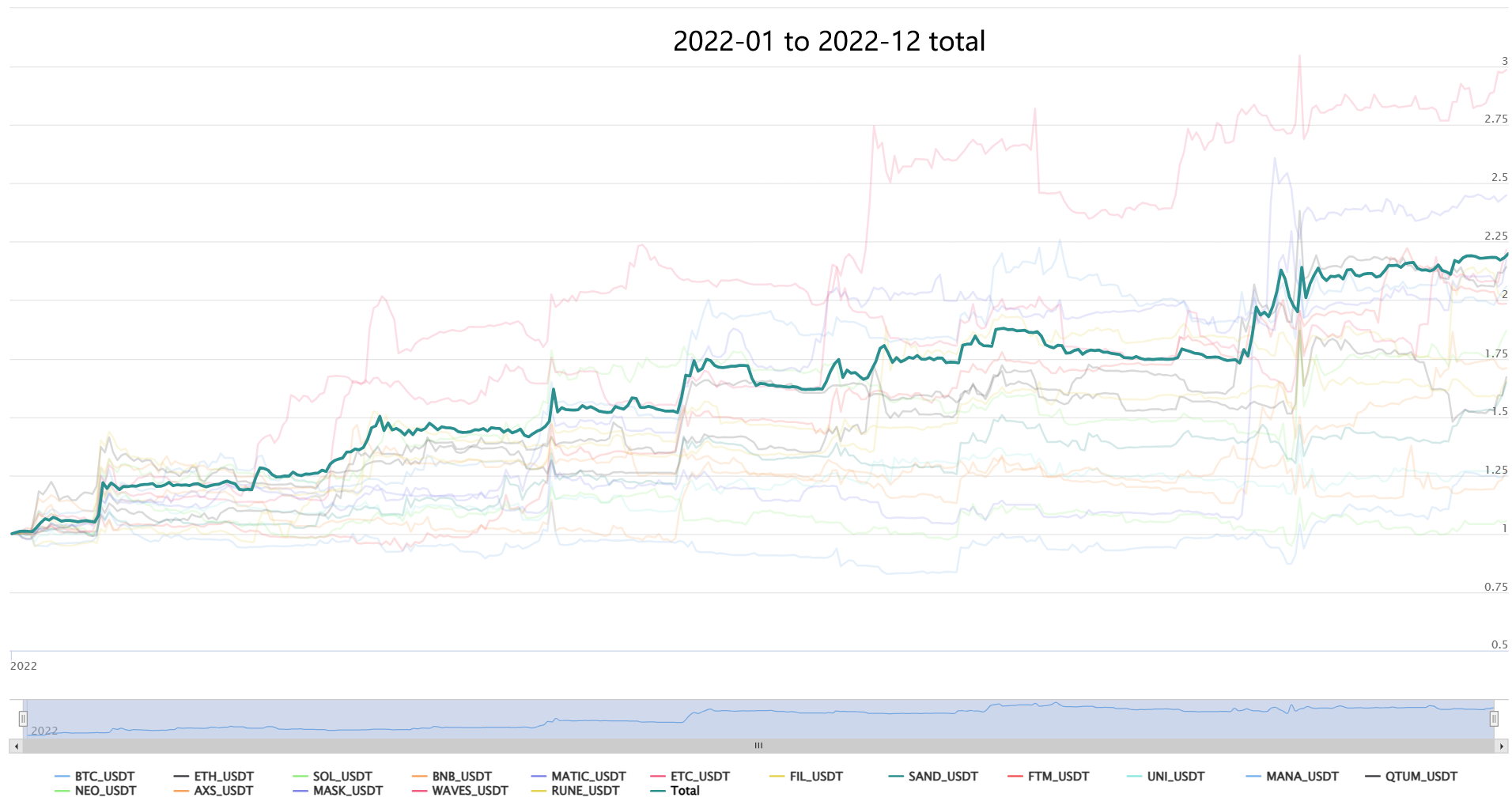

■ 回测结果分为OKX quarter币本位合约与Binance swap U本位合约各自展示,OKX的币本位合约数据较长,可以观察18年至今数个牛熊的表现,Binance U本位合约数据多从2020年开始,可以观察本轮牛熊策略表现。回测采用Taker 0.06%手续费测试。

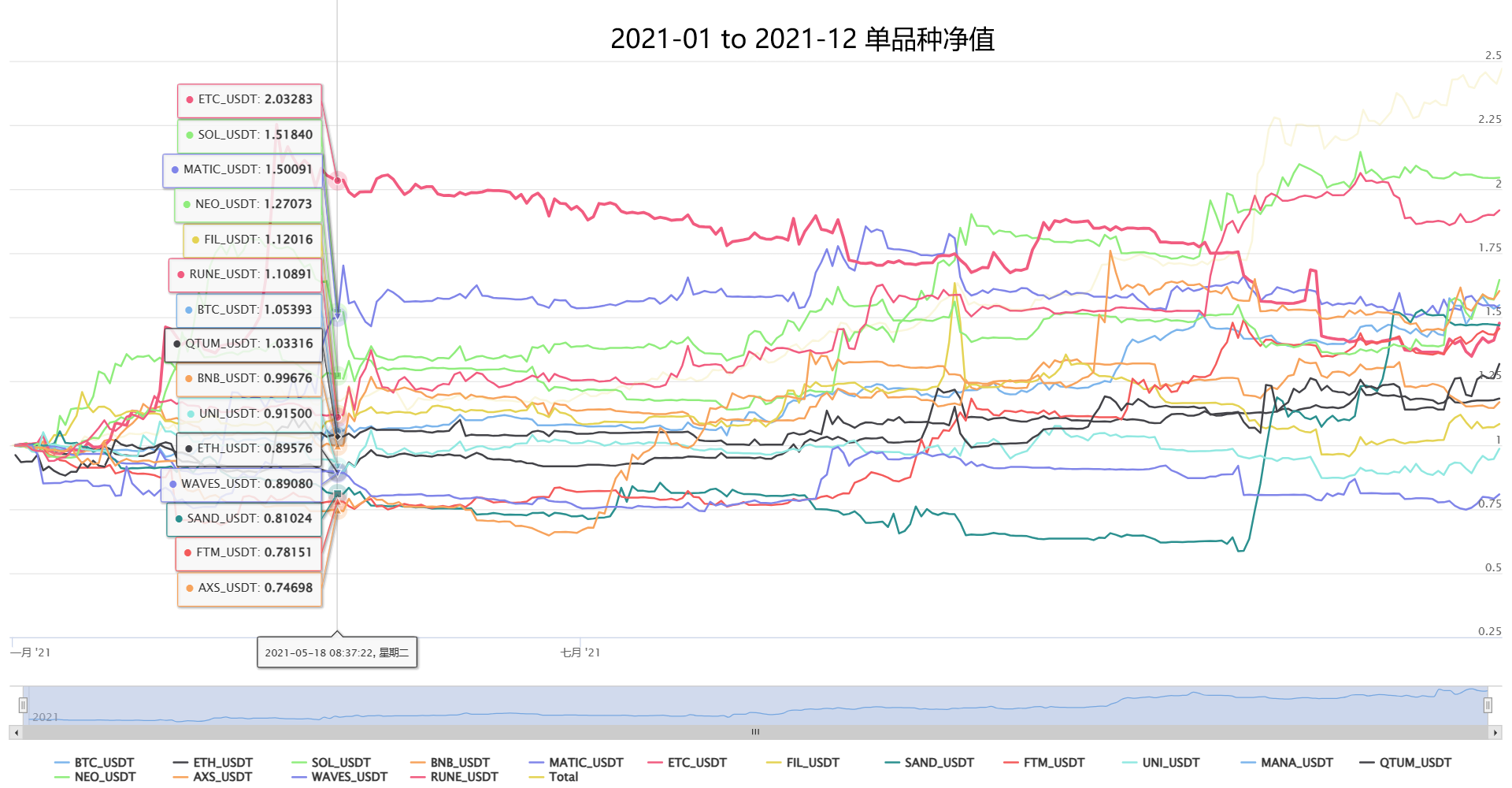

■ 本策略坚信普适性与鲁棒性是CTA类策略第一要义(想要暴力需研究其余小众策略),所有测试与实盘均采用同样参数,不同品种也采用相同参数。为验证策略强壮性,还将本策略应用于内盘商品期货的十数个品种进行测试,同样也获得了不错的收益,在下面会逐一展示。

■ 策略正常风险模式下,最大回撤约为20%内,根据市场波动情况,预期年化40%-150%,使用者可以根据自身风险偏好同比扩大和缩小风险敞口,风险与收益是统一的。

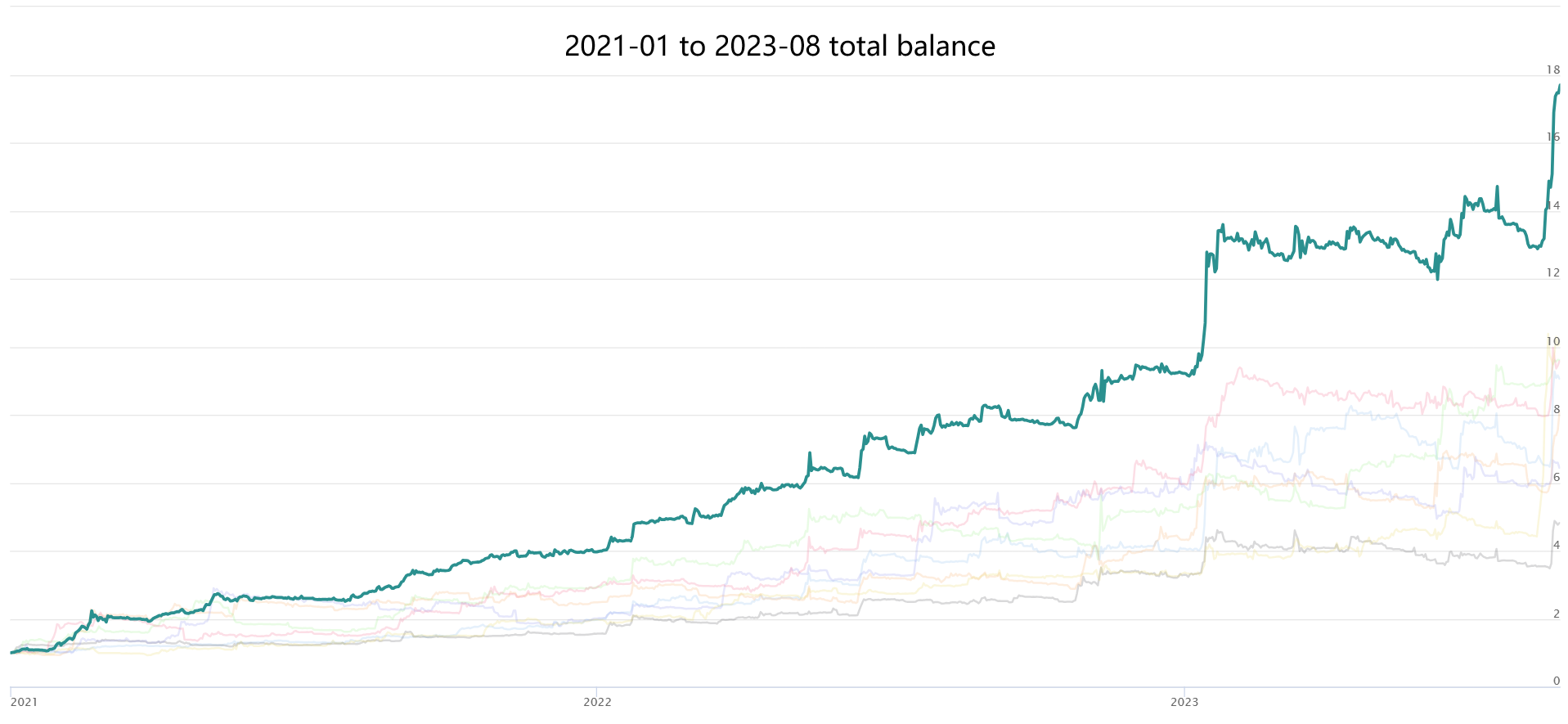

■ 回测好并不能说明什么,本款策略从2021年开始便在FMZ平台实盘,虽中途有多次修改和调整,但超过1000天的实盘积累还是为策略增加了不少信任,这期间的问题和经验也会不断注入进新的迭代之中。

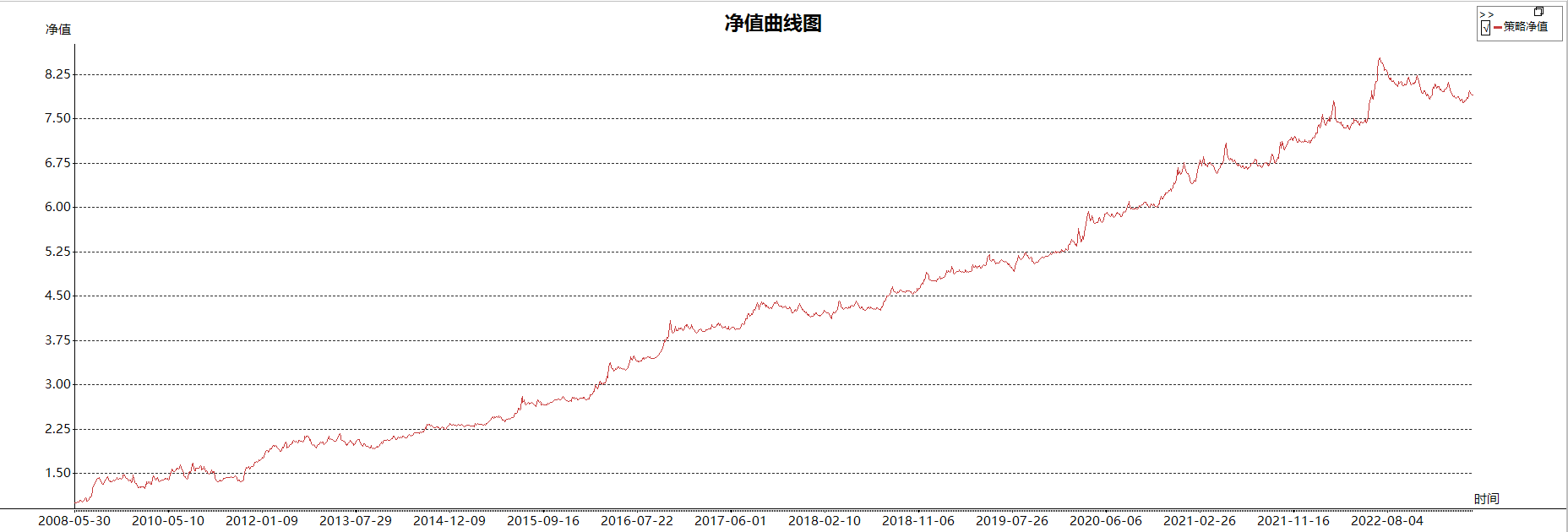

U本位测试:2020-03-01 to 2023-03-30

商品期货压力测试,为保证策略的强鲁棒性,使用内盘商品期货进行压力测试,不进行专门优化使用相同的参数!测试品种为各个板块全品种混合,平均分配资金,包括白银,沪铝,沪铜,黄金,沥青,燃油,热卷,沪镍,螺纹钢,橡胶,不锈钢,苯乙烯,玉米,铁矿石,焦炭,焦煤,鸡蛋,塑料,生猪,豆粕,棕榈油,聚苯西,苹果,棉花,红枣,玻璃,纯碱,硅铁,锰硅,白糖,PTA,动力煤,500中证,300沪深,10年国债,2年国债,原油。可以看到,策略在数十年的表现依然稳健,中长周期来看稳定盈利,体验出本策略组超强的适应性。

四,合作方式:

本策略从2021年起历时2000多天实盘,穿越牛熊,具有一定的可信度与可检验性,实盘地址: 【复合CTA交易系统New】(多因子+多品种+多策略自适应公用版)-普通风险敞口

(注:为避免自画曲线,同步展示币COIN第三方实盘平台绩效,展示账户为币安普通费率账户。)

量化不是永动机,也不是万能的,但它一定是未来交易的方向,值得每个交易者学习和使用!欢迎各位交易者前来指出不足,共同讨论,一起学习进步,在波澜壮阔的行情里乘风破浪,砥砺前行。

● 更多合作方案:本款策略容量极大,更适合大资金中长期运作,欢迎各位大佬一起合作,对于任何有需求的个人与机构都保持开放共赢的合作态度,期待您的商讨,按您需求、风险偏好等定制化合作。

另外一款0多空敞口风险,长期稳健的中性对冲统计套利策略,在不暴露市场β性风险下,赚钱超额阿尔法的稳健策略: 【中性对冲统计套利New】(Pure-Alpha 梦幻版)

如果您风险偏好较高,喜欢短期盈亏,有短期交易的需求,可以查看另一款稳定的高频策略,月化3%-50%,无爆仓风险: 【高频对冲做市网格New】(HFT Market-Making矿机版)

✱ 联系方式 (欢迎交流讨论,共同学习进步)

WECHAT:haiyanyydss TEL:https://t.me/JadeRabbitcm

✱ Fully automatic CTA & HFT & Arbitrage trading system @2018 - 2025