为回馈FMZ平台与社区,进行策略&代码&思路&模板的分享

简介: 封包好的函数指标,可直接调用 逐根K线分析 通过比较K线自身收盘位置与最近两根K线关系衡量市场多空强弱。

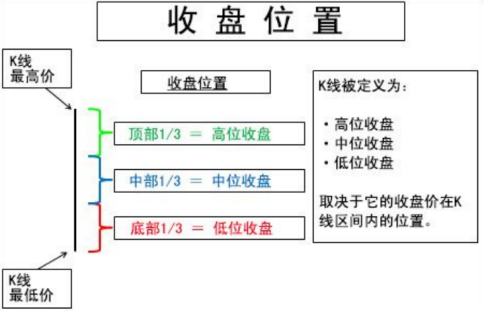

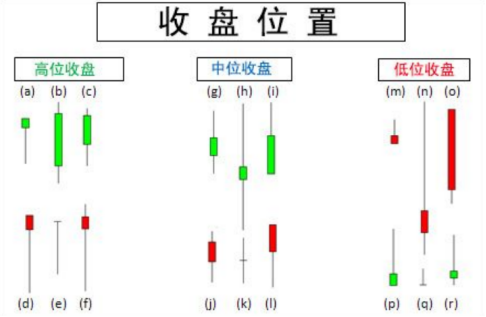

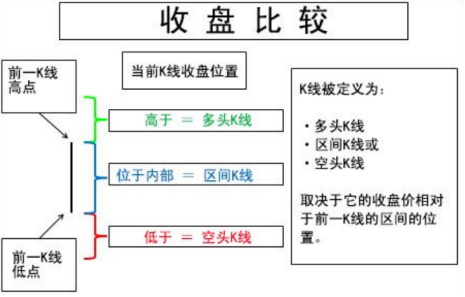

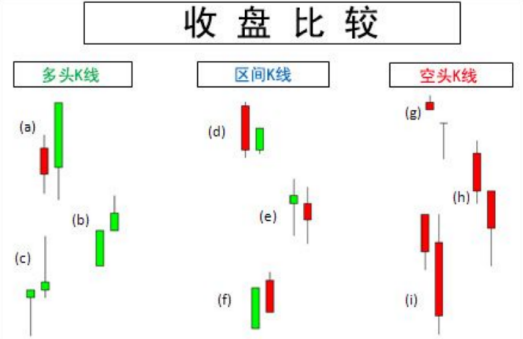

大多数情况下我们观察价格运动只会注意收盘价或者本根K线的形态,如何以一种更好的方式阅读K线和理解多空的强弱是更深入研究的方向,本研究提出一种解决思路,将K线自身类型与本根K线和上跟K线位置比较进行多空力量编码,如图所示,本研究将K线定义为18种类型。其分类方式主要有两个,一是收盘位置(帮助确定单根K线观点),二是收盘比较(帮助确定联系的K线观点)。收盘位置可以帮助确定单根K线的观点,我们根据一条K线的收盘价在其最高价到最低价的区间内所处的位置,把它定义为高位收盘K线、中位收盘K线和低位收盘K线。每种位置收盘的K线又分为强势K线(收盘价>开盘价)与弱势K线(收盘价<开盘价),因此单根K线的类别总共有6种,分别为:高位收盘的强势K线;高位收盘的弱势K线;中位收盘的强势K线;中位收盘的弱势K线;低位收盘的强势K线;低位收盘的弱势K线。

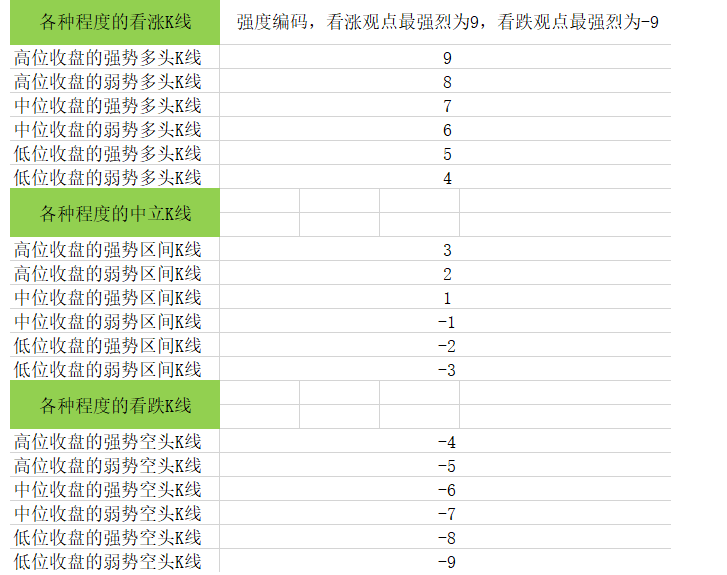

综上所述,将6种K线收盘关系与3种K线收盘比较相结合,总共产生18种K线强弱关系,将多头最强的K线编码为9将最弱的K线编码为-9,其余依次按强弱关系递进编码,结果如图

综上所述,将6种K线收盘关系与3种K线收盘比较相结合,总共产生18种K线强弱关系,将多头最强的K线编码为9将最弱的K线编码为-9,其余依次按强弱关系递进编码,结果如图

欢迎合作交流,共同学习进步~ v:haiyanyydss

策略源码

$.getClosezhubang = function(rds){

var arrclose = [];

var arropen = [];

var arrhigh = [];

var arrlow = [];

var arrzhubang = [];

for(var i in rds){

arrclose[i] = rds[i].Close;

arropen[i] = rds[i].Open;

arrhigh[i] = rds[i].High;

arrlow[i] = rds[i].Low;

if(i>1){

if(arrclose[i] >= arrhigh[i-1]){

if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.09;

}else if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*1.08;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.07;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*1.06;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.05;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*1.04;

}

}

else if(arrclose[i] < arrhigh[i-1] && arrclose[i] > arrlow[i-1]){

if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.03;

}else if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*1.02;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*1.01;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.99;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*0.98;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.97;

}

}

else if(arrclose[i] <= arrlow[i-1]){

if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*0.96;

}else if(arrclose[i] >= (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.95;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*0.94;

}else if(arrclose[i] > (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < (arrhigh[i]-(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.93;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] >= arropen[i]){

arrzhubang[i] = arrclose[i]*0.92;

}else if(arrclose[i] <= (arrlow[i]+(arrhigh[i]-arrlow[i])/3) && arrclose[i] < arropen[i]){

arrzhubang[i] = arrclose[i]*0.91;

}

}

}else{

arrzhubang[i] = arrclose[i];

}

}

return arrzhubang;

}

全部留言

wuhuoyan

这个怎么用呢?

2023-08-06 13:53:17