概述

该策略基于拉里·威廉姆斯的9日突破理念,通过监测9日移动平均线的方向判断趋势,在突破点进行入场,跟随趋势运行。

策略原理

- 使用9日指数移动平均线EMA作为判断趋势的指标

- 当价格从EMA下方突破上方时,判断为看涨,进行买入

- 当价格从EMA上方突破下方时,判断为看跌,进行卖出

- 买入信号:开盘价低于9日EMA,收盘价高于9日EMA

- 卖出信号:开盘价高于9日EMA,收盘价低于9日EMA

具体来说:

- 计算9日EMA

- 判断当日K线是否满足买入条件,即开盘价低于9日EMA,收盘价高于9日EMA

- 如果满足,则在收盘价位置入场做多,止损价设为之前高点

- 判断当日K线是否满足卖出条件,即开盘价高于9日EMA,收盘价低于9日EMA

- 如果满足,则在之前做多入场点出场卖出,止盈价设为之前低点

以上构成了完整的买入和卖出逻辑。

优势分析

这是一个较为简单的趋势跟踪策略,具有以下优势:

- 以EMA判断趋势方向,可以有效滤除价格小幅波动的噪音

- 在EMA突破点入场,可以及时捕捉趋势转折

- 采用之前高点作为止损,之前低点作为止盈,可以锁定趋势获利

- 交易规则清晰简单,容易理解实现,适合新手学习

- 资金使用效率高,不需要全程持仓,只在趋势突破点短期持仓

风险及优化

该策略也存在一些风险与不足,可以从以下方面进一步优化:

- EMA周期设定为9日,对不同品种和市场情况可能不够灵活,可以引入自适应EMA周期

- 仅用9日EMA判断趋势可能过于简单,可以引入多重时间周期EMA或其他指标进行组合判断

- 未考虑交易成本和滑点,实盘中这两者会对盈亏产生较大影响

- 没有设置止损止盈比例,无法控制单笔交易风险收益比

- 入场信号可能出现多次震荡,产生多个不必要的小单,可以设置过滤条件

综上,该策略可以从动态参数优化、多因子判断、交易成本管理、风险收益控制等方面进行改进,使策略更稳健适应不同市场状态。

总结

威廉姆斯9日突破策略是一个较为经典的短期趋势策略,核心思想简单清晰,以EMA判断趋势方向,在突破点入场,跟随趋势运行并适时止盈止损。该策略易于理解实现,资金使用效率高,但也存在一些不足之处。我们可以通过多角度优化,使策略参数更加动态灵活,判断规则更严谨全面,风险收益控制更完善,从而适应更广泛的市场情况,提高策略稳定性和盈利能力。

策略源码

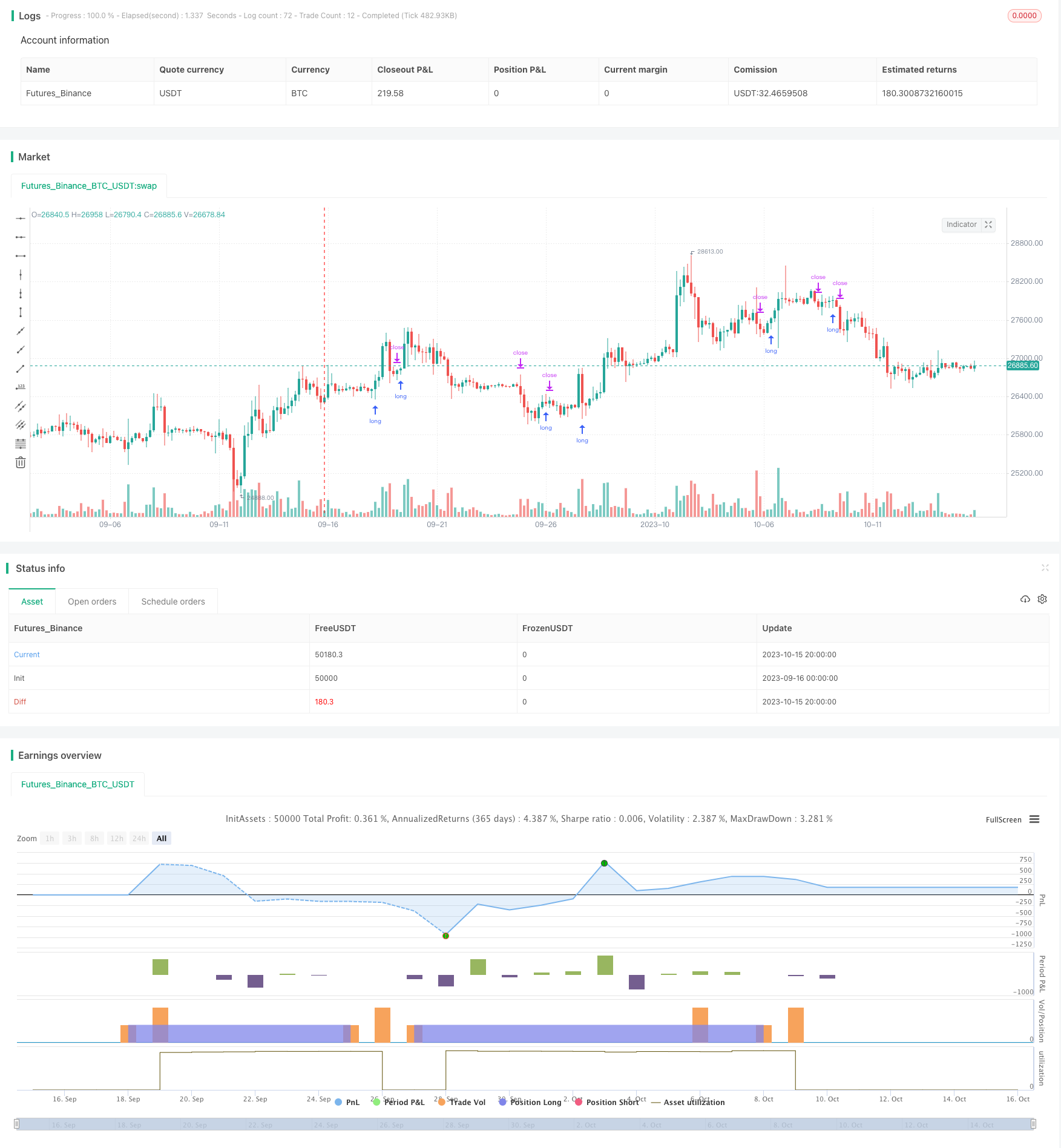

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("larry willians teste2", overlay=true)

//Window of time

start = timestamp(2019, 00, 00, 00, 00) // backtest start window

finish = timestamp(2019, 12, 31, 23, 59) // backtest finish window

window() => true // create function "within window of time"

ema9=ema(close,9) // Ema de 9 periodos

//Condições de compra

c1= (open< ema9 and close > ema9) //abrir abaixo da ema9 e fechar acima da ema9

if(window())

if(c1)

strategy.entry("Compra", true, stop = high) // Coloca ordem stopgain no topo anterior

else

strategy.cancel("Compra") // Cancela a ordem se o proximo candle não "pegar"

//codições de venda

v1= (open> ema9 and close < ema9) // abrir acima da ema9 e fechar abaixo ema9

if(window())

if (v1)

strategy.exit("Venda", from_entry = "Compra", stop = low) // Saida da entrada com stop no fundo anterior

else

strategy.cancel("Venda") //Cancela a ordem se o proximo candle não "pegar"