概述

移动平均线交叉策略是一种趋势跟踪策略,通过计算不同周期的移动平均线,判断行情趋势方向,以发出买入和卖出信号。该策略使用3日和50日移动平均线交叉进行判断,当短期移动平均线上穿长期移动平均线时看涨买入,短期移动平均线下穿长期移动平均线时看跌卖出。

策略原理

该策略通过计算3日和50日的简单移动平均线,当3日SMA上穿50日SMA时,表示短期趋势转为看涨,发出买入信号;当3日SMA下穿50日SMA时,表示短期趋势转为看跌,发出卖出信号。为了减少无谓的交易,该策略还加入了一个中期的40日SMA,如果3日SMA下穿40日SMA,也会发出卖出信号,快速止损。

该策略的关键在于使用不同周期的移动平均线划分市场波动的不同阶段,3日SMA表征的是最短期趋势,50日SMA表征中期趋势,它们的交叉表征短期和中期走势的转换,可以捕捉到价格在不同时间尺度上的变化。通过这种多时间轴的组合分析,可以比较准确地判断行情的转折点。

优势分析

动量交叉清晰,信号比较明确。不同周期SMA的交叉可以有效判断短期和中期走势的变化,避免被市场的小幅震荡干扰。

通过快速止损sma3下穿sma40,可以减少损失,控制风险。

策略思路简单清晰,容易实现。指标和信号规则直接可操作。

可以灵活调整SMA的参数,适应不同的行情和交易品种。

风险分析

在横盘和无明确趋势的市场中,SMA交叉信号频繁,可能导致过于频繁交易而增加交易成本和滑点损失。

SMA具有滞后性,交叉信号发出时,价格已经产生一定变化,容易让策略错过最佳买入卖出点位。

固定的SMA参数不适应所有行情,需要配合参数优化使用。

单一指标易受失效,可考虑加入其它技术指标或基本面指标进行组合验证。

优化方向

优化SMA周期参数,寻找最佳参数组合

加入 stochastic,MACD等指标验证信号,避免假信号

根据市场变化调整开仓手数和止损幅度

考虑加入基本面指标,如财报、消息面等进行组合

结合量能指标,在高量突破时开仓

总结

移动平均线交叉策略通过不同周期SMA的交叉判断市场短期和中期趋势的变化,采取趋势跟踪,属于较为简单直接的趋势策略。该策略优势是思路清晰,易于操作,可以通过参数优化和指标组合验证提高策略效果。但SMA本身具有滞后性,无法精确捕捉转折点。建议与其他先行指标组合使用,在大趋势下进行趋势跟踪获利。

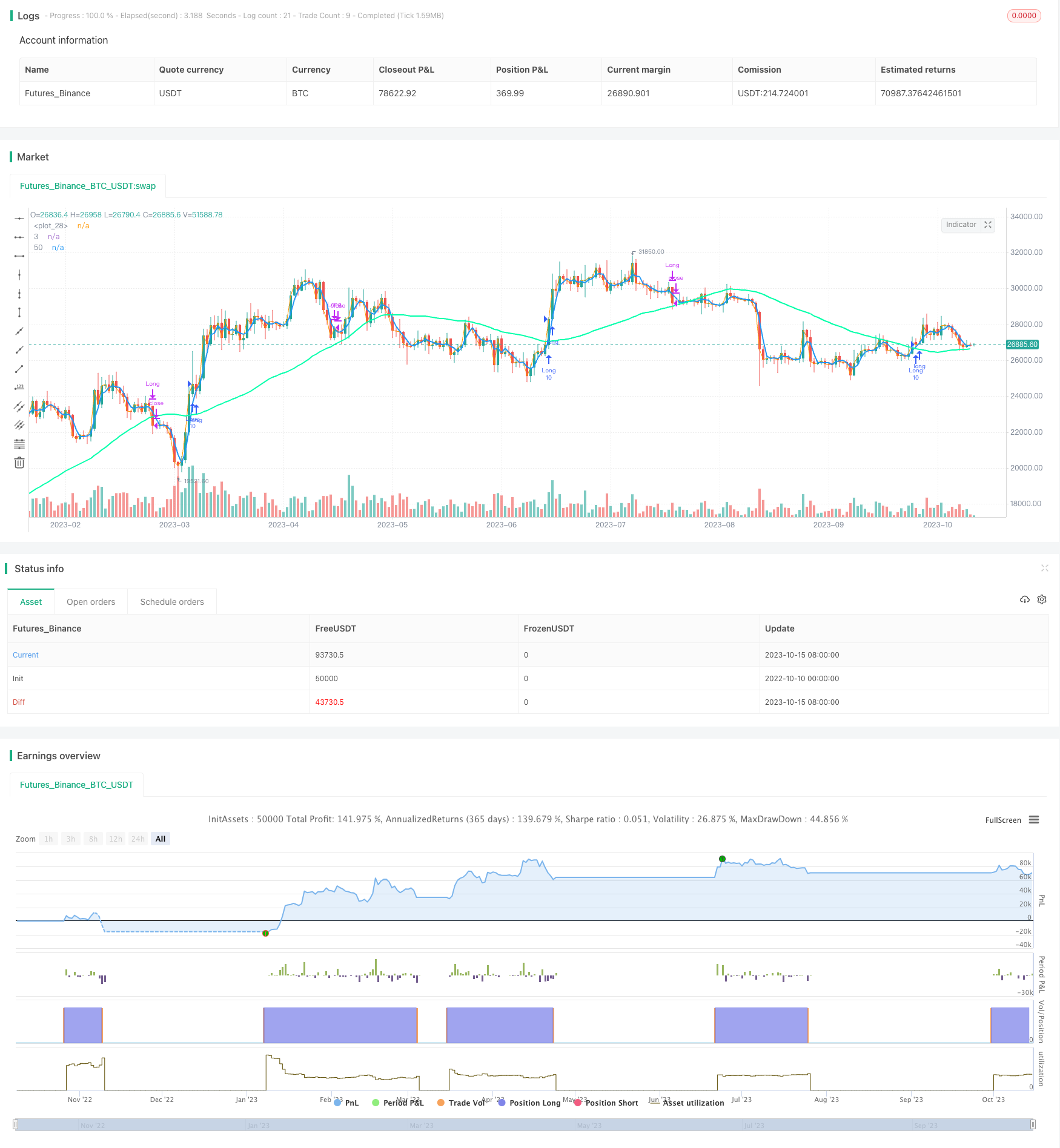

/*backtest

start: 2022-10-10 00:00:00

end: 2023-10-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Geduldtrader

//@version=4

strategy("MA Crossover", overlay = true)

start = timestamp(2009,2,1,0,0)

sma50 = sma(close, 50)

sma40 = sma(close, 40)

sma3 = sma(close, 3)

plot(sma50,title='50', color=#00ffaa, linewidth=2)

plot(sma3,title='3', color=#2196F3, linewidth=2)

long = crossover(sma3,sma50)

neut = crossunder(close,sma50)

short = crossunder(sma3,sma40)

if time >= start

strategy.entry("Long", strategy.long, 10.0, when=long)

strategy.close("Long", when = short)

strategy.close("Long", when = neut)

plot(close)