概述

本策略利用有限体积要素方法,结合自适应波动性计量,对价格变化进行多空判断,属于趋势跟踪类策略。策略适用于各个时间周期,能够自动调整参数,适应不同波动性水平。

原理

策略先计算最近N根K线的高低平均价、收盘价平均价,以及前一根K线的高低收盘价平均价。然后计算当前K线和前一K线的对数收益率 Intra 和 Inter。同时计算 Intra 和 Inter 的波动性 Vintra 和 Vinter。

根据波动性水平和可调参数,计算自适应截断系数 CutOff。当价格变化超过 CutOff 时,给出多空信号。具体来说,计算当前K线收盘价与高低平均价的差值 MF,当 MF 大于 CutOff 时为多头信号,当 MF 小于负的 CutOff 时为空头信号。

最后根据信号计算资金流向, outputs 信号 pos,并画出有限体积要素曲线 FVE。

优势

- 自适应参数,适用于不同周期和波动性水平,无需人为调整。

- 准确捕捉价格趋势变化。

- 有限体积要素曲线清晰反映多空力量对比。

- 资金流理论基础稳固,信号比较可靠。

风险

- 市场剧烈震荡时,可能出现较多错误信号。可以适当调整 N 参数。

- 无法处理价格跳空。可以考虑补充其他指标进行组合。

- 资金流理论与技术分析信号可能存在背离。可以考虑多种信号综合判断。

优化方向

- 可以测试不同 N 参数对结果的影响。一般 N 取较大值,能够过滤掉过多噪声。

- 可以测试 Cintra 和 Cinter 的不同取值,找到最佳参数组合。也可以考虑动态调整这两个参数。

- 可以考虑与其他指标如 MACD 等组合,提高策略稳定性。

- 可以建立止损机制,以控制单笔损失。

总结

本策略整体来说较为可靠,原理优良,可以作为趋势跟踪策略的组成部分,与其他策略适当组合后效果会更好。关键是找到最佳参数,并建立良好的风控措施。如果后期能够继续优化,会成为非常强大的趋势跟踪策略。

策略源码

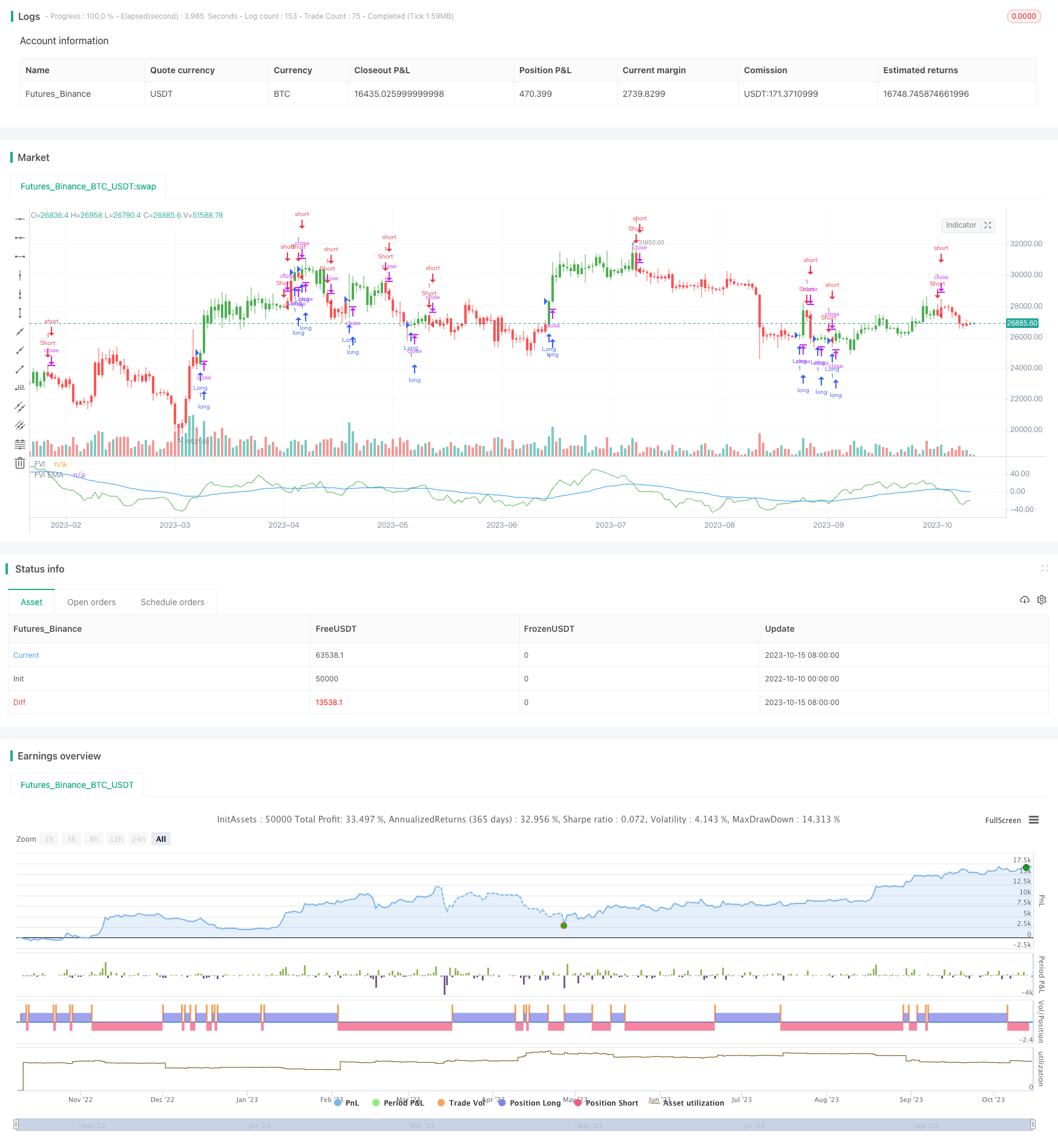

/*backtest

start: 2022-10-10 00:00:00

end: 2023-10-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 18/08/2017

// This is another version of FVE indicator that we have posted earlier

// in this forum.

// This version has an important enhancement to the previous one that`s

// especially useful with intraday minute charts.

// Due to the volatility had not been taken into account to avoid the extra

// complication in the formula, the previous formula has some drawbacks:

// The main drawback is that the constant cutoff coefficient will overestimate

// price changes in minute charts and underestimate corresponding changes in

// weekly or monthly charts.

// And now the indicator uses adaptive cutoff coefficient which will adjust to

// all time frames automatically.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Volatility Finite Volume Elements", shorttitle="FVI")

Samples = input(22, minval=1)

Perma = input(40, minval=1)

Cintra = input(0.1, step=0.1)

Cinter = input(0.1, step=0.1)

reverse = input(false, title="Trade reverse")

xhl2 = hl2

xhlc3 = hlc3

xClose = close

xIntra = log(high) - log(low)

xInter = log(xhlc3) - log(xhlc3[1])

xStDevIntra = stdev(sma(xIntra, Samples) , Samples)

xStDevInter = stdev(sma(xInter, Samples) , Samples)

xVolume = volume

TP = xhlc3

TP1 = xhlc3[1]

Intra = xIntra

Vintra = xStDevIntra

Inter = xInter

Vinter = xStDevInter

CutOff = Cintra * Vintra + Cinter * Vinter

MF = xClose - xhl2 + TP - TP1

FveFactor = iff(MF > CutOff * xClose, 1,

iff(MF < -1 * CutOff * xClose, -1, 0))

xVolumePlusMinus = xVolume * FveFactor

Fvesum = sum(xVolumePlusMinus, Samples)

VolSum = sum(xVolume, Samples)

xFVE = (Fvesum / VolSum) * 100

xEMAFVE = ema(xFVE, Perma)

pos = iff(xFVE > xEMAFVE, 1,

iff(xFVE < xEMAFVE, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xFVE, color=green, title="FVI")

plot(xEMAFVE, color=blue, title="FVI EMA")