概述

该策略是一种基于移动均线的趋势跟踪策略。它利用快速移动均线和慢速移动均线的金叉和死叉来判断趋势方向,实现低风险的趋势跟踪交易。

策略原理

该策略使用了长度为9的快速移动均线和长度为21的慢速移动均线。当快速移动均线上穿慢速移动均线时,表示市场进入上升趋势,这时做多;当快速移动均线下穿慢速移动均线时,表示市场进入下降趋势,这时平仓做多头仓位。

具体来说,策略通过计算快速移动均线和慢速移动均线的值,并比较两者的大小关系来判断趋势方向。在多头方向时,如果快速移动均线上穿慢速移动均线,就会触发做多信号,进入长仓。在空头方向时,如果快速移动均线下穿慢速移动均线,就会触发平仓信号,平掉之前的多头仓位。

这样,通过快慢均线的金叉死叉来捕捉市场趋势的转换,实现低风险的趋势跟踪交易。

策略优势

- 使用移动均线判断趋势,可以过滤市场噪音,识别趋势方向

- 快速移动均线能更快捕捉趋势转换,慢速移动均线过滤假信号

- 采用金叉买入、死叉卖出的交易信号,避免追高杀跌

- 策略交易逻辑简单清晰,容易理解实现

策略风险

- 移动均线存在滞后,可能错过趋势转换的最佳时间点

- 固定平均线长度无法适应市场各种周期

- 双均线策略容易产生频繁交易信号,存在过拟合风险

- 仅使用均线判断易受突发事件影响,存在亏损风险

可以通过调整均线参数、引入其他指标作为过滤、设置止损止盈来管理风险。

策略优化方向

- 尝试不同的参数设置,如均线长度组合、金叉死叉判断标准等

- 增加量能指标等过滤器,避免假突破

- 增加趋势指标判断,区分趋势和震荡市场

- 结合波动率指标优化止损止盈设定

- 引入机器学习算法动态优化参数

总结

该策略作为一种简单的趋势跟踪策略,核心思想是通过快速和慢速均线组合判定趋势方向。优点是简单易懂,交易规则清晰,能够有效跟踪趋势;缺点是存在滞后且容易产生假信号。我们可以通过调整参数以及加入其他技术指标来优化该策略,使其更好地适应市场环境。总的来说,双均线策略作为一种基础策略,为量化交易提供了一个简单可靠的思路。通 过不断优化和改进,可以使这一策略的实际交易效果更佳。

策略源码

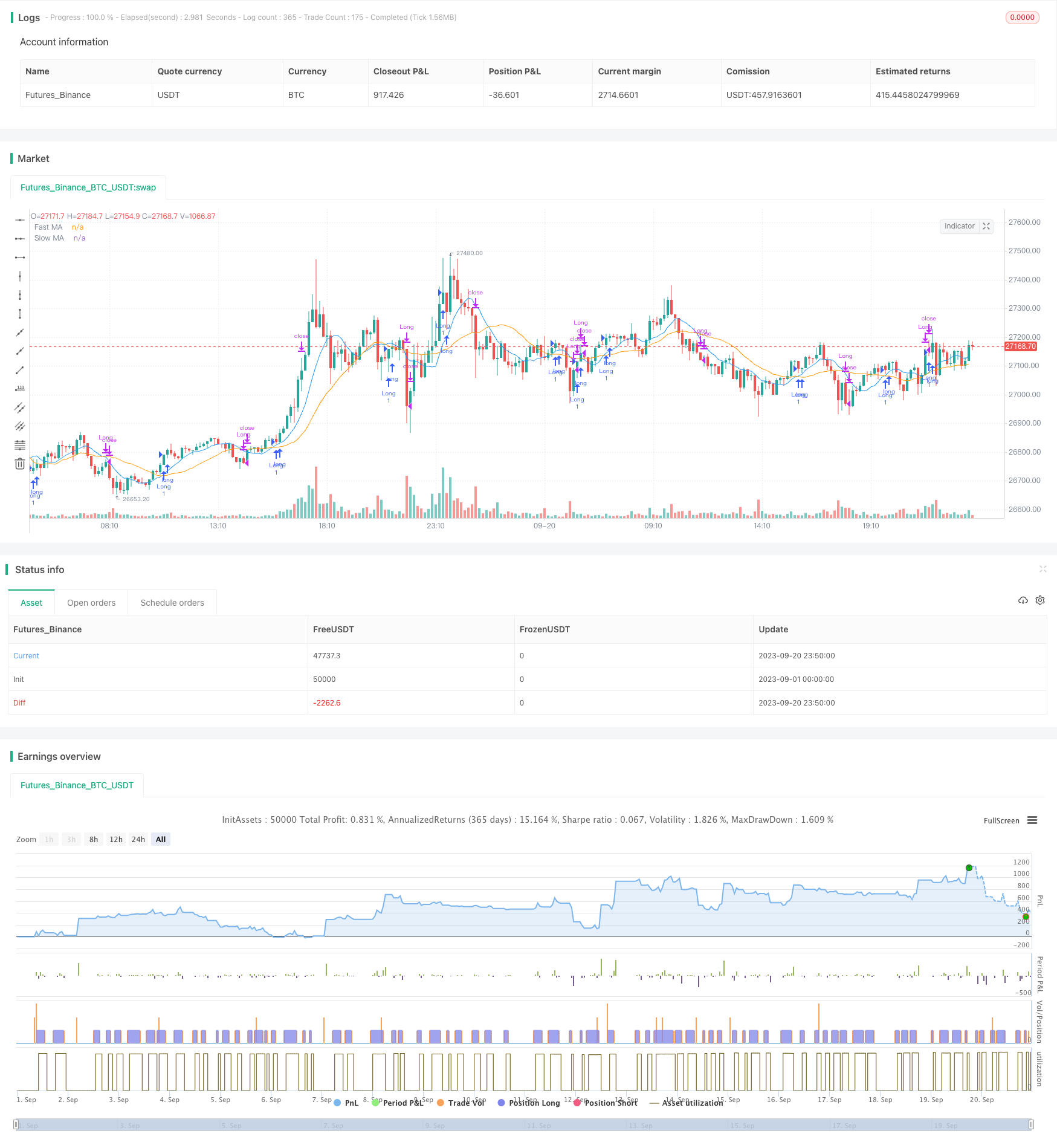

/*backtest

start: 2023-09-01 00:00:00

end: 2023-09-20 23:59:59

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Profitable Crypto Strategy", shorttitle="Profit Strategy", overlay=true)

// Define strategy parameters

fastLength = input.int(9, title="Fast MA Length", minval=1)

slowLength = input.int(21, title="Slow MA Length", minval=1)

stopLossPercent = input.float(1.0, title="Stop Loss %", step=0.1)

takeProfitPercent = input.float(1.0, title="Take Profit %", step=0.1)

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Entry condition: Buy when fast MA crosses above slow MA

longCondition = ta.crossover(fastMA, slowMA)

// Exit condition: Sell when fast MA crosses below slow MA

shortCondition = ta.crossunder(fastMA, slowMA)

// Plot moving averages on the chart

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.orange, title="Slow MA")

// Strategy entry and exit logic

var stopLossPrice = 0.0

var takeProfitPrice = 0.0

if (longCondition)

stopLossPrice := close * (1.0 - stopLossPercent / 100)

takeProfitPrice := close * (1.0 + takeProfitPercent / 100)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long")

// Set stop loss and take profit for open positions

strategy.exit("Stop Loss/Profit", stop=stopLossPrice, limit=takeProfitPrice)