概述

本策略通过监控RSI指标在不同区间的突破,实现低买高卖的目的。当RSI位于低位区间时买入,当RSI位于高位区间时卖出,从而在超买超卖现象出现时进行反向操作。

策略原理

设置RSI的长度为14周期

设置买入信号的RSI区间:

- 区间1: RSI <= 27

- 区间2: RSI <= 18

设置卖出信号的RSI区间:

- 区间1: RSI >= 68

- 区间2: RSI >= 80

当RSI进入买入区间时,做多入场:

- 如果RSI进入区间1(27以下),做多1手

- 如果RSI进入区间2(18以下),额外做多1手

当RSI进入卖出区间时,做空入场:

- 如果RSI进入区间1(68以上),做空1手

- 如果RSI进入区间2(80以上),额外做空1手

每次开仓固定止盈2500点,止损5000点

RSI离开信号区间后,平掉相关仓位

优势分析

双区间设定使策略能更清楚判断超买超卖现象,避免错过反转机会

采用固定止盈止损点数设置,不会过于追涨杀跌

RSI是一种比较成熟的超买超卖判断指标,相比其他指标更有优势

本策略参数设置合理时,能够有效捕捉趋势反转点,获取超额收益

风险分析

RSI指标可能出现失效的市场,从而导致系统持续做空亏损

固定止盈止损点数设置可能与市场波动幅度不匹配,无法获利或过早止损

区间设置不合理可能导致错过交易机会或频繁交易亏损

本策略较依赖参数优化,需要注意测试周期及滑点控制

优化方向

可以测试不同长度周期的RSI指标效果

可以优化买卖区间的数值,使其更符合不同品种的特点

可以研究动态止盈止损方式,使止盈更有效,止损更合理

可以考虑结合其他指标进行组合交易,提高系统稳定性

可以探索机器学习方式自动优化区间参数,使策略更具鲁棒性

总结

本策略基于RSI指标的超买超卖判断原理设计。通过设置双买卖区间发挥RSI指标的效用,在保持一定的稳定性的同时,能够有效捕捉市场的超买超卖现象进行反向操作。但本策略也存在一定的参数依赖性,需要针对不同品种进行优化测试。如果参数设定得当,本策略可以获取不错的超额收益。总体来说,本策略是一个利用成熟指标的简单有效的交易策略,值得进一步研究优化,也为量化交易策略提供了思路。

策略源码

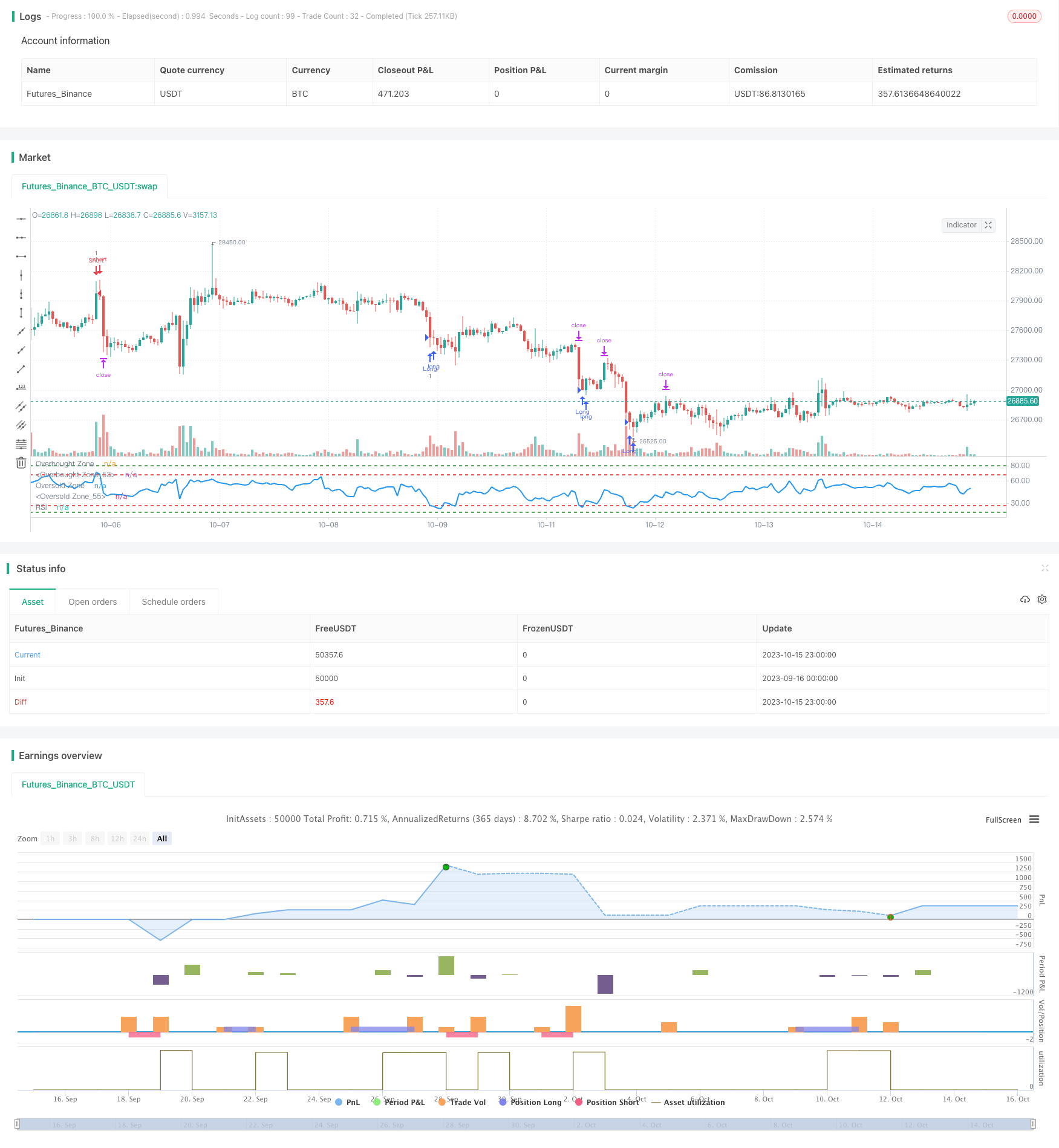

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Rawadabdo

// Ramy's Algorithm

//@version=5

strategy("BTC/USD - RSI", overlay=false, initial_capital = 5000)

// User input

length = input(title = "Length", defval=14, tooltip="RSI period")

first_buy_level = input(title = "Buy Level 1", defval=27, tooltip="Level where 1st buy triggers")

second_buy_level = input(title = "Buy Level 2", defval=18, tooltip="Level where 2nd buy triggers")

first_sell_level = input(title = "Sell Level 1", defval=68, tooltip="Level where 1st sell triggers")

second_sell_level = input(title = "Sell Level 2", defval=80, tooltip="Level where 2nd sell triggers")

takeProfit= input(title="target Pips", defval=2500, tooltip="Fixed pip stop loss distance")

stopLoss = input(title="Stop Pips", defval=5000, tooltip="Fixed pip stop loss distance")

lot = input(title = "Lot Size", defval = 1, tooltip="Trading Lot size")

// Get RSI

vrsi = ta.rsi(close, length)

// Entry Conditions

long1 = (vrsi <= first_buy_level and vrsi>second_buy_level)

long2 = (vrsi <= second_buy_level)

short1= (vrsi >= first_sell_level and vrsi<second_sell_level)

short2= (vrsi >= second_sell_level)

// Entry Orders

// Buy Orders

if (long1 and strategy.position_size == 0)

strategy.entry("Long", strategy.long, qty=lot, comment="Buy")

if (long2 and strategy.position_size == 0)

strategy.entry("Long", strategy.long, qty=lot, comment="Buy")

// Short Orders

if (short1 and strategy.position_size == 0)

strategy.entry("Short", strategy.short,qty=lot, comment="Sell")

if (short2 and strategy.position_size == 0)

strategy.entry("Short", strategy.short,qty=lot, comment="Sell")

// Exit our trade if our stop loss or take profit is hit

strategy.exit(id="Long Exit", from_entry="Long",qty = lot, profit=takeProfit, loss=stopLoss)

strategy.exit(id="Short Exit", from_entry="Short", qty = lot, profit=takeProfit, loss=stopLoss)

// plot data to the chart

hline(first_sell_level, "Overbought Zone", color=color.red, linestyle=hline.style_dashed, linewidth = 2)

hline(second_sell_level, "Overbought Zone", color=color.green, linestyle=hline.style_dashed, linewidth = 2)

hline(first_buy_level, "Oversold Zone", color=color.red, linestyle=hline.style_dashed, linewidth = 2)

hline(second_buy_level, "Oversold Zone", color=color.green, linestyle=hline.style_dashed, linewidth = 2)

plot (vrsi, title = "RSI", color = color.blue, linewidth=2)