概述

本策略结合双移动均线和相对强弱指标RSI,寻找价格在强势趋势中的短期反转机会进行交易。在趋势方向明确时,利用RSI识别超买超卖情况,等待价格反转进入场内。该策略适用于趋势较明显的市场,能够在不逆势的前提下捕捉部分反转 movement。

策略原理

计算30日简单移动均线SMA和200日指数移动均线EMA,判断大趋势方向

- SMA>EMA,为上升趋势

- SMA

计算30日RSI,判断超买超卖

- RSI<=53为超卖

- RSI>=60为超买

进入规则:

- 上升趋势中(SMA>EMA)且RSI<=53时做多

- 下降趋势中(SMA=60时做空

出场规则:

- 多单止损或止盈

- 空单止损或止盈

策略优势分析

追踪大趋势,避免逆势操作

RSI参数设置较为保守,可以减少虚假信号

结合双移动均线过滤,entry timing比较准确

风险可控,回撤不大

风险分析

需要较明显趋势市场,震荡行情效果不佳

RSI参数设置保守,可能错过部分机会

止损位置需要合理设置,避免过于激进退出

策略优化方向

优化RSI参数,适当降低参数寻找更多entry机会

测试不同的移动均线组合

设置趋势过滤,只在趋势足够明显时操作

优化止损策略,严格控制单笔止损

总结

本策略整体风险可控,适合中长线持仓交易者。策略根据大趋势方向交易,采用保守RSI参数以及严格的移动均线过滤,可以有效避免假突破,从而提高胜率。同时也存在一定潜在改进空间,如果参数调整得当,可以获得更多机会。需要注意风险控制,保持长线的交易心态。

策略源码

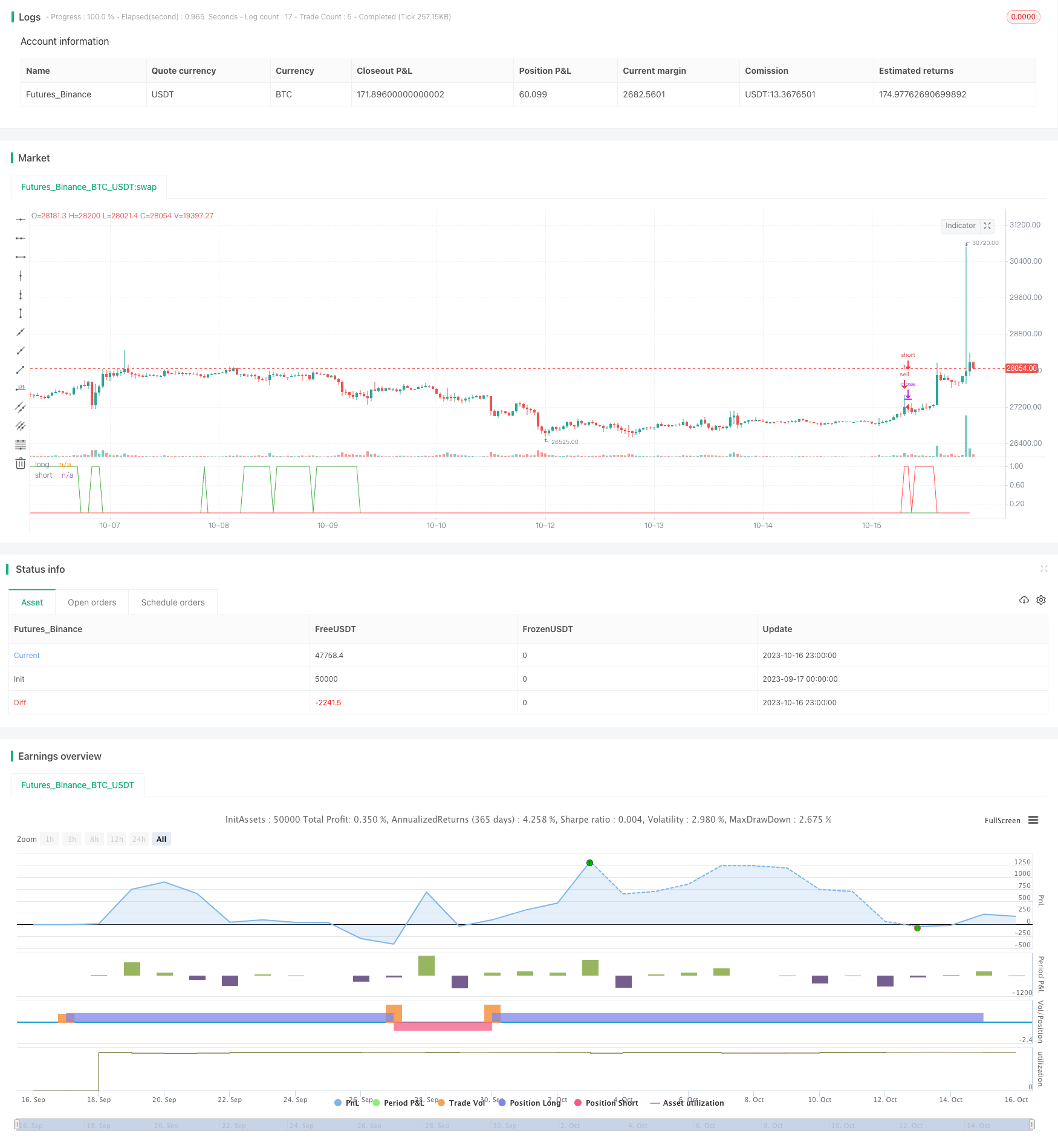

/*backtest

start: 2023-09-17 00:00:00

end: 2023-10-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Based on Larry Connors RSI-2 Strategy - Lower RSI

strategy(title="_CM_RSI_2_Strat_Low", shorttitle="_CM_RSI_2_Strategy_Lower", overlay=false)

src = close,

//RSI CODE

up = rma(max(change(src), 0), 30)

down = rma(-min(change(src), 0), 30)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

//Criteria for Moving Avg rules

ma50= vwma(close,30)

ma200= vwma(close,200)

//Rule for RSI Color

col = ma50 > ma200 and rsi <=53?lime: ma50 < ma200 and rsi >= 60?red : silver

long = ma50 > ma200 and rsi <= 53

short = ma50 < ma200 and rsi >= 60

//plot(rsi, title="RSI", style=line, linewidth=1,color=col)

//plot(100, title="Upper Line 100",style=line, linewidth=3, color=aqua)

//plot(0, title="Lower Line 0",style=line, linewidth=3, color=aqua)

//band1 = plot(60, title="Upper Line 60",style=line, linewidth=1, color=aqua)

//band0 = plot(44, title="Lower Line 40",style=line, linewidth=1, color=aqua)

//fill(band1, band0, color=silver, transp=90)

strategy.entry ("buy", strategy.long, when=long)

strategy.entry ("sell", strategy.short, when=short)

plot(long,"long",color=green,linewidth=1)

plot(short,"short",color=red,linewidth=1)