概述

反转均线包络策略是一种综合利用反转交易和均线包络两大技术指标的量化交易策略。它整合了反转策略捕捉市场反转机会和均线包络判断趋势方向的优势,实现稳定盈利。

策略原理

该策略由两部分组成:

第一部分为123反转策略。它的交易信号来自随机指标KDJ。具体逻辑是:如果收盘价连续两个交易日低于前一日收盘价,且9日随机慢线低于50,产生买入信号;如果收盘价连续两个交易日高于前一日收盘价,且9日随机快线高于50,产生卖出信号。

第二部分为均线包络策略。它利用均线和均线上下两个包络线判定趋势。具体逻辑是:如果收盘价高于上轨,产生买入信号;如果收盘价低于下轨,产生卖出信号。

该策略综合利用上述两种交易信号,当123反转和均线包络同时发出买入信号时,策略才会开仓做多;当两者同时发出卖出信号时,策略才会开仓做空。这样可以过滤掉部分无效信号,降低交易频率的同时提高盈利概率。

优势分析

结合反转和趋势,提高获利概率

123反转策略擅长捕捉关键支撑阻力附近的反转机会。均线包络策略可准确判断趋势方向。两者结合使用,可以在高概率位置捕捉反转。

双重过滤降低交易频率

只有当两种指标同时发出信号时,策略才会开仓。这避免了单一指标产生的过多无效信号的干扰,从而降低了交易频率,有助于减少交易成本。

parametrizable parameters为策略提供了灵活性

策略中的指标参数都是可调整的,用户可以根据市场情况和个人偏好,选择合适的参数组合,使策略更具适应性。

单边交易简化了操作

该策略只进行多头或空头单边交易,不进行反向开仓。这简化了策略操作逻辑,降低了durations风险。

风险分析

反转交易难以捕捉趋势行情

该策略主要依靠反转交易获利。当出现长期单边趋势行情时,策略可能产生连续亏损。

参数优化困难

策略包含多个可调整的参数,这给参数优化带来一定难度。不当的参数组合可能影响策略表现。

高换仓频率增加交易风险

策略设计频繁换仓,虽可锁定小利润,但过于频繁的交易也会增加交易成本和意外风险。

无法限制最大回撤

策略没有设置止损点,无法有效控制最大回撤。如果遇到重大黑天鹅事件,策略可能面临巨大亏损。

优化方向

增加止损策略

可以设置移动止损或跟踪止损来限制最大回撤。当市场出现反常变化时,及时止损可以保护资金。

优化参数组合

通过回测和模拟交易优化参数,确定最佳参数组合,提高策略稳定性。也可以设计动态参数优化机制,使策略更具适应性。

结合其它指标过滤信号

增加例如MACD,布林带等指标,对交易信号进行验证,可以进一步提高信号质量,减少无效交易。

降低交易频率

适当放宽反转条件和调整均线参数,降低换仓频率,有助于减少交易成本和意外风险。

总结

反转均线包络策略综合运用反转交易和趋势跟踪的优势,在控制风险的前提下,实现稳定的超额收益。该策略可以进一步优化,使其参数组合更科学合理,从而获得更出色的交易表现。它提供了一种结合多种交易信号的有效策略思路,适用于趋势行情和盘整市场,值得量化交易者学习和运用。

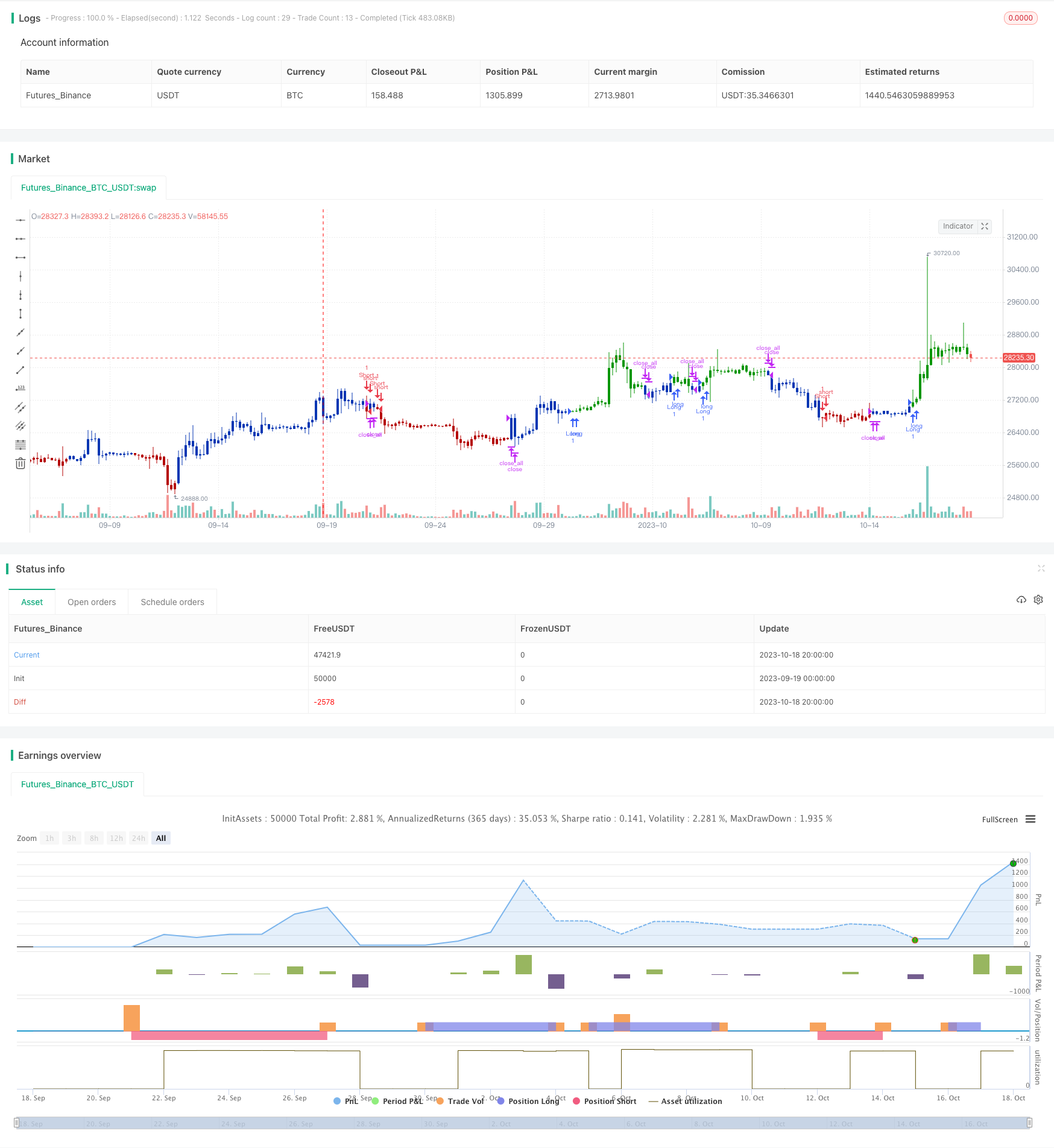

/*backtest

start: 2023-09-19 00:00:00

end: 2023-10-19 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 22/03/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Moving Average Envelopes are percentage-based envelopes set above and

// below a moving average. The moving average, which forms the base for

// this indicator, can be a simple or exponential moving average. Each

// envelope is then set the same percentage above or below the moving average.

// This creates parallel bands that follow price action. With a moving average

// as the base, Moving Average Envelopes can be used as a trend following indicator.

// However, this indicator is not limited to just trend following. The envelopes

// can also be used to identify overbought and oversold levels when the trend is

// relatively flat.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

MAE(Length,PercentShift) =>

pos = 0.0

xSMA = sma(close, Length)

xHighBand = xSMA + (xSMA * PercentShift / 100)

xLowBand = xSMA - (xSMA * PercentShift / 100)

pos := iff(close > xHighBand, 1,

iff(close <xLowBand, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Moving Average Envelopes", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- MA Envelope ----")

LengthMA = input(18, minval=1)

PercentShift = input(0.2, minval = 0.01, step = 0.01)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posMAE = MAE(LengthMA,PercentShift)

pos = iff(posReversal123 == 1 and posMAE == 1 , 1,

iff(posReversal123 == -1 and posMAE == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )