概述

穿越大师-反转突破策略是一个基于移动平均线的简单但实用的交易策略。它利用快速移动平均线和慢速移动平均线的交叉作为买入和卖出的信号。当快速移动平均线从下方上穿慢速移动平均线时产生买入信号;当快速移动平均线从上方下穿慢速移动平均线时产生卖出信号。该策略适用于中等波动的市场 environment。

策略原理

该策略使用两个移动平均线: 一个短期的快速移动平均线和一个长期的慢速移动平均线。快速移动平均线参数为12日,慢速移动平均线参数为26日。策略先计算ENDPOINT的2日简单移动平均作为价格数据,然后计算出快速移动平均线和慢速移动平均线。如果快速移动平均线上穿慢速移动平均线,产生买入信号;如果快速移动平均线下穿慢速移动平均线,产生卖出信号。

具体来说,策略通过比较快速移动平均线和慢速移动平均线的数值大小来判断市场走势。当快速移动平均线数值大于慢速移动平均线时,认为市场处于上升趋势(Bullish);当快速移动平均线数值小于慢速移动平均线时,认为市场处于下降趋势(Bearish)。策略结合价格动量指标,在判断市场反转的时候进行买入和卖出。

买入信号的触发逻辑是:当市场由下降趋势变为上升趋势,即快速移动平均线上穿慢速移动平均线,并且价格高于快速移动平均线时产生买入信号。

卖出信号的触发逻辑是:当市场由上升趋势转为下降趋势,即快速移动平均线下穿慢速移动平均线,并且价格低于快速移动平均线时产生卖出信号。

通过这样的设计,策略在市场反转的时候能起到及时抓住反转机会的效果。

优势分析

该策略具有以下优势:

策略逻辑简单清晰,容易理解和实现。

移动平均线技术成熟可靠,应用广泛。

采用双移动平均线设计,可以有效过滤市场噪音,识别市场趋势。

结合价格动量指标,可以提高买卖时机的准确性。

参数优化空间大,可以根据市场调整参数,获得更好的效果。

可加设止损逻辑,控制风险。

交易频率适中,避免过度交易。

可结合其他指标进行优化,如布林带、RSI等。

回测数据充足,可验证策略效果。

风险分析

该策略也存在以下风险:

双移动平均线策略容易产生错误信号,可能错过市场趋势或产生不必要的交易。

移动平均线存在滞后性,可能错过快速反转的机会。

参数设置不当可能导致交易频率过高或过低。

该策略较适合中长线交易,短线交易效果可能不佳。

该策略无法应对市场突发事件的影响。

存在一定的时间段亏损的风险。

不同品种参数设置需要调整。

大盘震荡行情中效果可能会打折扣。

可通过以下方式降低风险:

优化参数,调整至适合当前市场环境。

结合其他指标过滤信号。

加设止损机制控制损失。

适当调整仓位管理。

根据不同品种分别测试优化参数。

优化方向

该策略可从以下方面进行优化:

优化移动平均线的周期参数,使其更符合当前市场情况。

测试不同类型的移动平均线,如指数移动平均线、加权移动平均线等。

增加成交量指标来验证趋势。

结合其他技术指标,如MACD、RSI等进行组合。

增加止损策略,如移动止损、时间止损等。

优化仓位管理策略,如固定份额、动态比例等。

分时段、分品种测试参数优化。

增加机器学习算法,利用AI技术进行参数自动优化和信号检验。

利用深度学习技术识别更复杂的图形形态。

探索无参数策略设计思路。

通过持续优化,可以提高策略的适应能力,在不同市场环境中获得稳定的效果。

总结

综上所述,该穿越大师-反转突破策略整体思路清晰、易于实现,具有一定的实用价值。该策略把握住移动平均线指标的趋势判断优势,同时结合价格动量指标提高信号质量。在参数优化和风险控制方面还有提升空间。总体而言,该策略为我们提供了一个基于简单指标实现突破交易策略的思路,可作为量化交易策略学习的好案例。通过不断优化和丰富,有望培育出适应市场的有效策略。

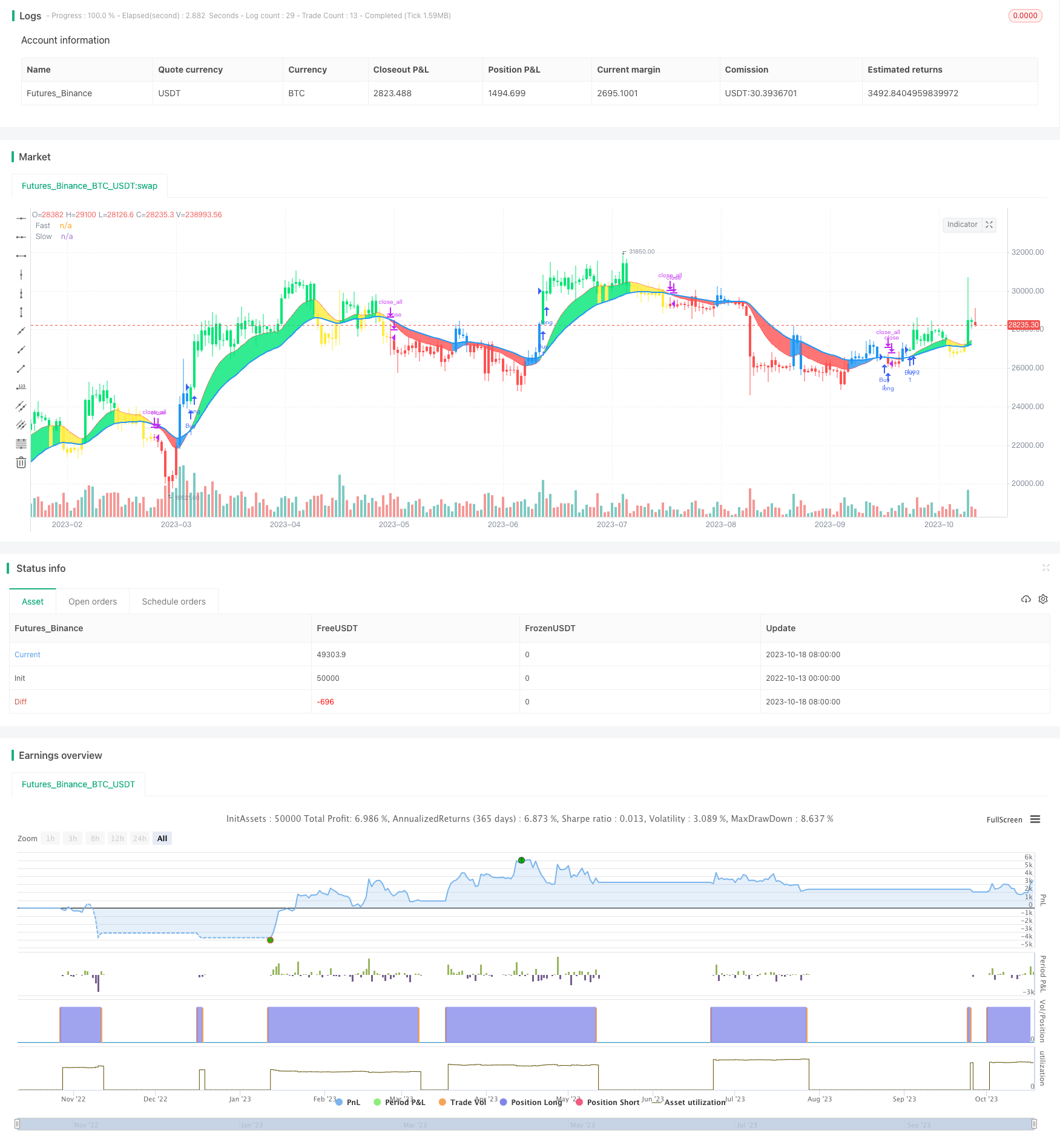

/*backtest

start: 2022-10-13 00:00:00

end: 2023-10-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("CDC Action Zone V.2 strategy", overlay=true)

// Credit Script base from CDC Action Zone V.2 by piriya33

// CDC ActionZone V2 29 Sep 2016

// CDC ActionZone is based on a simple 2MA and is most suitable for use with medium volatility market

// 11 Nov 2016 : Ported to Trading View with minor UI enhancement

src = input(title="Data Array",defval=ohlc4)

prd1=input(title="Short MA period",defval=12)

prd2=input(title="Long MA period",defval=26)

AP = ema(src,2)

Fast = ema(AP,prd1)

Slow = ema(AP,prd2)

// === INPUT BACKTEST RANGE ===

FromYear = input(defval = 2019, title = "From Year", minval = 2009)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2009)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

Bullish = Fast>Slow

Bearish = Fast<Slow

Green = Bullish and AP>Fast

Red = Bearish and AP<Fast

Yellow = Bullish and AP<Fast

Blue = Bearish and AP>Fast

//Long Signal

Buy = Green and Green[1]==0

Sell = Red and Red[1]==0

//Short Signal

Short = Red and Red[1]==0

Cover = Red[1] and Red==0

//Plot

l1=plot(Fast,"Fast", linewidth=1,color=red)

l2=plot(Slow,"Slow", linewidth=2,color=blue)

bcolor = Green ? lime : Red ? red : Yellow ? yellow : Blue ? blue : white

barcolor(color=bcolor)

fill(l1,l2,bcolor)

strategy.entry("Buy",true,when=window() and Buy)

strategy.close_all(when=window() and Sell)