概述

该策略名为“基于Heikin Ashi ROC百分位数的交易策略”,其目的是提供一个基于Heikin Ashi ROC及其百分位数的易于使用的交易框架。

策略原理

该策略通过计算Heikin Ashi收盘价的ROC及其不同时间段内的最高值和最低值,来生成用于交易的上下轨。具体来说,它计算过去rocLength周期的Heikin Ashi收盘价的ROC。然后计算过去50周期ROC的最高值 rocHigh和最低值 rocLow。之后根据 rocHigh 计算出上轨upperKillLine,根据rocLow计算出下轨lowerKillLine。这两个轨线表示roc的特定百分位数。当ROC上穿下轨时做多;当ROC下穿上轨时平多仓。反之,当ROC下穿上轨时做空;当ROC上穿下轨时平空仓。

优势分析

该策略最大的优势在于利用ROC指标的强大趋势跟踪能力,配合Heikin Ashi平滑价格信息的特性,能够有效识别趋势的变化。相比单纯的移动平均线等指标,ROC对价格变化的响应更加敏锐,使策略可以及时入场。此外,使用百分位数生成的上下轨,可以有效过滤震荡,避免假突破造成不必要的交易。总体上,该策略结合趋势跟踪和震荡过滤两大功能,可以在大趋势下获取较好的风险回报比。

风险分析

该策略的主要风险在于参数设置不当可能导致交易频繁或者不够敏感。rocLength和计算百分位数的周期需要谨慎设置,否则可能导致上下轨过于疲软或僵硬,从而错过交易机会或引发不必要的损失。此外,百分位数的设定也需要根据不同市场反复测试调整,找到最佳参数组合。在趋势反转时,该策略由于依赖趋势指标也会面临一定亏损。应适当缩短持仓时间,或设置止损来控制风险。

优化方向

该策略可以从以下几个方面进行优化:1)结合其他指标过滤入场信号,如RSI等;2)利用机器学习方法动态优化参数;3)设置止损止盈自动原粗退出机制;4)进行组合,与其他非趋势策略进行组合,以平衡策略风险。

总结

综上所述,该策略利用ROC指标的强大趋势跟踪能力,配合Heikin Ashi特性进行趋势判断和趋势跟踪,并通过ROC百分位数形成的上下轨进行止损筛选,从而实 现了较好的趋势跟踪效果。其优势在于及时识别趋势变化并跟踪大趋势,同时通过上下轨过滤震荡。但参数设置不当可能影响策略表现,且面临趋势反转的风险。通过进一步优化参数选择和设置止损、止盈,该策略可以获得更稳定的效果。

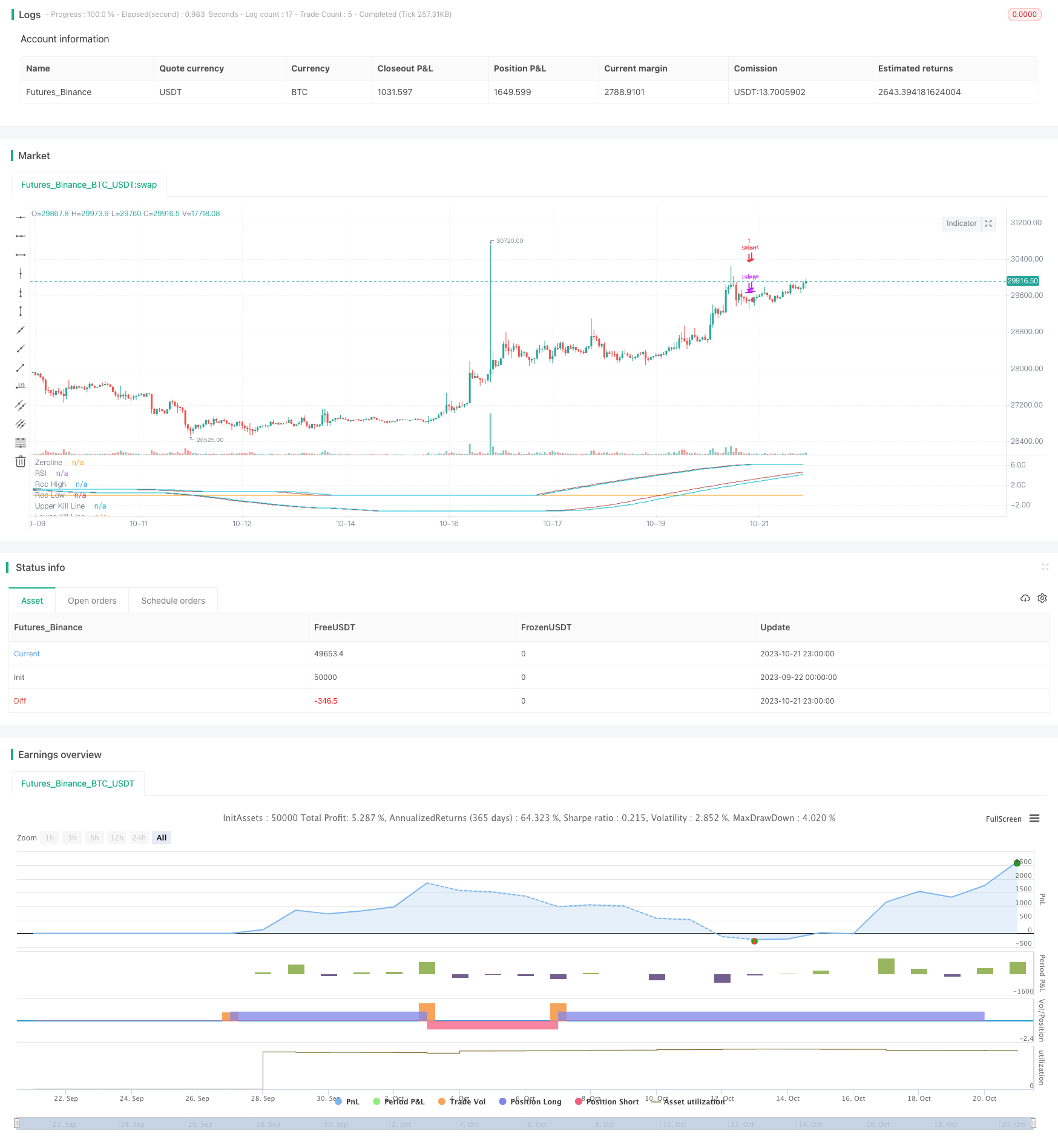

/*backtest

start: 2023-09-22 00:00:00

end: 2023-10-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © jensenvilhelm

//@version=5

strategy("Heikin Ashi ROC Percentile Strategy", shorttitle="ROC ON" , overlay=false)

// User Inputs

zerohLine = input(0, title="Midline") // Zero line, baseline for ROC (customer can modify this to adjust midline)

rocLength = input(100, title="roc Length") // Lookback period for SMA and ROC (customer can modify this to adjust lookback period)

stopLossLevel = input(2, title="Stop Loss (%)") // Level at which the strategy stops the loss (customer can modify this to adjust stop loss level)

startDate = timestamp("2015 03 03") // Start date for the strategy (customer can modify this to adjust start date)

// Heikin Ashi values

var float haClose = na // Define Heikin Ashi close price

var float haOpen = na // Define Heikin Ashi open price

haClose := ohlc4 // Calculate Heikin Ashi close price as average of OHLC4 (no customer modification needed here)

haOpen := na(haOpen[1]) ? (open + close) / 2 : (haOpen[1] + haClose[1]) / 2 // Calculate Heikin Ashi open price (no customer modification needed here)

// ROC Calculation

roc = ta.roc(ta.sma(haClose, rocLength), rocLength) // Calculate Rate of Change (ROC) (customer can modify rocLength in the inputs)

rocHigh = ta.highest(roc, 50) // Get the highest ROC of the last 50 periods (customer can modify this to adjust lookback period)

rocLow = ta.lowest(roc, 50) // Get the lowest ROC of the last 50 periods (customer can modify this to adjust lookback period)

upperKillLine = ta.percentile_linear_interpolation(rocHigh, 10, 75) // Calculate upper kill line (customer can modify parameters to adjust this line)

lowerKillLine = ta.percentile_linear_interpolation(rocLow, 10, 25) // Calculate lower kill line (customer can modify parameters to adjust this line)

// Trade conditions

enterLong = ta.crossover(roc, lowerKillLine) // Define when to enter long positions (customer can modify conditions to adjust entry points)

exitLong = ta.crossunder(roc, upperKillLine) // Define when to exit long positions (customer can modify conditions to adjust exit points)

enterShort = ta.crossunder(roc, upperKillLine) // Define when to enter short positions (customer can modify conditions to adjust entry points)

exitShort = ta.crossover(roc, lowerKillLine ) // Define when to exit short positions (customer can modify conditions to adjust exit points)

// Strategy execution

if(time >= startDate) // Start strategy from specified start date

if (enterLong)

strategy.entry("Long", strategy.long) // Execute long trades

if (exitLong)

strategy.close("Long") // Close long trades

if (enterShort)

strategy.entry("Short", strategy.short) // Execute short trades

if (exitShort)

strategy.close("Short") // Close short trades

// Plotting

plot(zerohLine,title="Zeroline") // Plot zero line

plot(roc, "RSI", color=color.rgb(248, 248, 248)) // Plot ROC

plot(rocHigh, "Roc High", color = color.rgb(175, 78, 76)) // Plot highest ROC

plot(rocLow, "Roc Low", color = color.rgb(175, 78, 76)) // Plot lowest ROC

plot(upperKillLine, "Upper Kill Line", color = color.aqua) // Plot upper kill line

plot(lowerKillLine, "Lower Kill Line", color = color.aqua) // Plot lower kill line