概述

双向RSI均线回复策略是一种趋势跟踪策略,它使用两个不同时间周期的RSI指标来识别超买和超卖状况。该策略旨在通过在超卖后做多、在超买后做空来获利。该策略使用平滑异同移动平均线、RSI指标和开仓颜色过滤器来识别交易机会。

策略逻辑

该策略使用两个具有不同周期的RSI指标——一个在5分钟图表上,一个在1小时图表上。对于RSI指标,超卖水平被认定在30以下,超买水平在70以上。

它会追踪RSI值,寻找RSI持续一定周期处于超卖区或者超买区的情况,表明出现了扩张的超卖或超买状态。

此外,它使用平滑异同移动平均线,在进入交易前检查一定周期的红色或绿色K线来确认趋势方向。开仓颜色过滤器有助于避免假信号。

当RSI和平滑异同移动平均线条件都满足时,该策略会在超卖后做多,在超买后做空,押注价格重新回归均线。

每天结束时平仓,以避免过夜持仓。

优势分析

- 使用多时间框架识别超买超卖状况

- 平滑异同移动平均线过滤噪音,识别趋势方向

- 开仓颜色过滤器避免假信号

- 根据两个指标匹配明确的开仓平仓规则

- 每日前平仓控制风险

风险分析

- 如果强势趋势继续,RSI超买超卖信号后可能出现震荡

- 市场间隙可能触发止损

- 平滑异同移动平均线滞后可能延迟开仓从而错过行情

- 每日结束前平仓放弃过夜持仓可能获得的收益

优化方向

- 添加交易量或波动率等额外过滤器以确认信号

- 优化RSI周期和超买超卖水平参数

- 考虑根据波动率进行动态仓位控制

- 测试止盈止损退出,而非每日结束前平仓

- 在不同品种测试效果并调整参数

总结

双向RSI均线回复策略采用规则化方法交易动量。通过组合两个时间框架、超买超卖指标、K线形态分析和开仓过滤器,其目标是识别高概率均线回归机会。严格的风险管理和审慎的仓位控制有助于在获利的同时控制回撤。进一步优化和稳健性测试将有助于成功地在各类市场部署该策略。

策略源码

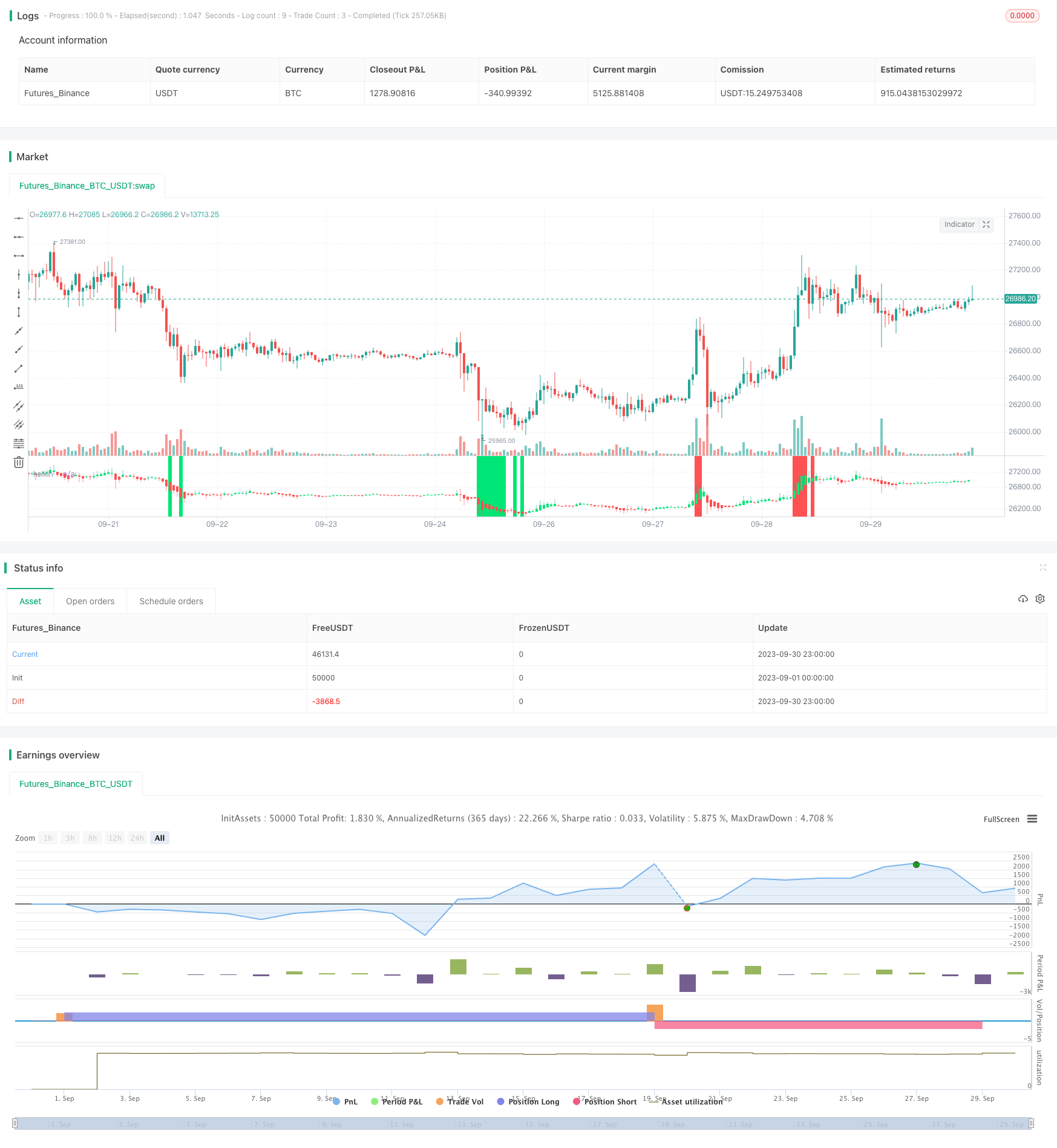

/*backtest

start: 2023-09-01 00:00:00

end: 2023-09-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Gidra

//2018

//@version=2

strategy(title = "Gidra's Vchain Strategy v0.1", shorttitle = "Gidra's Vchain Strategy v0.1", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 100)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Lot, %")

rsiperiod = input(14, defval = 14, minval = 2, maxval = 100, title = "RSI period")

rsilimit = input(30, defval = 30, minval = 1, maxval = 50, title = "RSI limit")

rsibars = input(3, defval = 3, minval = 1, maxval = 20, title = "RSI signals")

useocf = input(true, defval = true, title = "Use Open Color Filter")

openbars = input(2, defval = 2, minval = 1, maxval = 20, title = "Open Color, Bars")

showrsi = input(true, defval = true, title = "Show indicator RSI")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From Day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To Day")

//Heikin Ashi Open/Close Price

o=open

c=close

h=high

l=low

haclose = (o+h+l+c)/4

haopen = na(haopen[1]) ? (o + c)/2 : (haopen[1] + haclose[1]) / 2

hahigh = max (h, max(haopen,haclose))

halow = min (l, min(haopen,haclose))

col=haopen>haclose ? red : lime

plotcandle(haopen, hahigh, halow, haclose, title="heikin", color=col)

//RSI

uprsi = rma(max(change(close), 0), rsiperiod)

dnrsi = rma(-min(change(close), 0), rsiperiod)

rsi = dnrsi == 0 ? 100 : uprsi == 0 ? 0 : 100 - (100 / (1 + uprsi / dnrsi))

uplimit = 100 - rsilimit

dnlimit = rsilimit

rsidn = rsi < dnlimit ? 1 : 0

rsiup = rsi > uplimit ? 1 : 0

//RSI condition

rsidnok = highest(rsidn, rsibars) == 1? 1 : 0

rsiupok = highest(rsiup, rsibars) == 1? 1 : 0

//Color Filter

bar = haclose > haopen ? 1 : haclose < haopen ? -1 : 0

gbar = bar == 1 ? 1 : 0

rbar = bar == -1 ? 1 : 0

openrbarok = sma(gbar, openbars) == 1 or useocf == false

opengbarok = sma(rbar, openbars) == 1 or useocf == false

//Signals

up = openrbarok and rsidnok

dn = opengbarok and rsiupok

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 : lot[1]

//Indicator RSI

colbg = showrsi == false ? na : rsi > uplimit ? red : rsi < dnlimit ? lime : na

bgcolor(colbg, transp = 20)

//Trading

if up

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if dn

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59)// or exit

strategy.close_all()