概述

该策略基于RSI指标和蜡烛实体的EMA实现快速突破操作。它利用RSI的快速形态和大型蜡烛实体来识别反转信号。

策略原理

计算RSI指标,周期7,用RMA实现加速形态。

计算蜡烛实体大小的EMA,周期30,作为实体大小基准。

如果RSI上穿限值线(默认30),并且当前K线实体大于平均实体大小的1/4,做多。

如果RSI下穿限值线(默认70),并且当前K线实体大于平均实体大小的1/4,做空。

如果已经持仓,RSI重新回穿限值线时平仓。

可以设置RSI长度、限值、参考价格等参数。

可以设置实体大小EMA周期、开仓 chroot倍数等参数。

可以设置RSI金叉/死叉的根数。

优势分析

利用RSI指标的反转属性,能及时捕捉反转信号。

RMA实现RSI的加速形态,使反转更加敏感。

结合大型K线实体过滤,避免被小范围震荡套利。

回测数据充足,可靠性较高。

可自定义参数,适应不同市场环境。

交易逻辑清晰简单。

风险分析

RSI指标存在回测偏差,实盘效果待验证。

大型K线实体无法完全过滤充分震荡市场。

默认参数可能不适合所有品种,需要优化。

胜率可能不高,需要承受连续止损的心理压力。

突破失败的风险,需要及时止损。

优化方向

优化RSI参数,适应不同周期及品种。

优化K线实体EMA周期,平滑实体大小。

优化开仓的实体倍数,控制入场频率。

增加移动止损,保证胜率。

增加趋势过滤,避免逆势交易。

优化资金管理策略,控制单笔风险。

总结

该策略整体来说是一个非常简单直接的反转策略。它同时利用RSI指标的反转属性和大型K线实体的破坏力,在市场突破时快速入场。虽然回测效果不错,但实盘效果还有待验证,使用时需要注意优化参数并控制风险。整体来说,该策略具有非常高的价值,是可以在实盘中应用并持续优化的非常好的策略之一。

策略源码

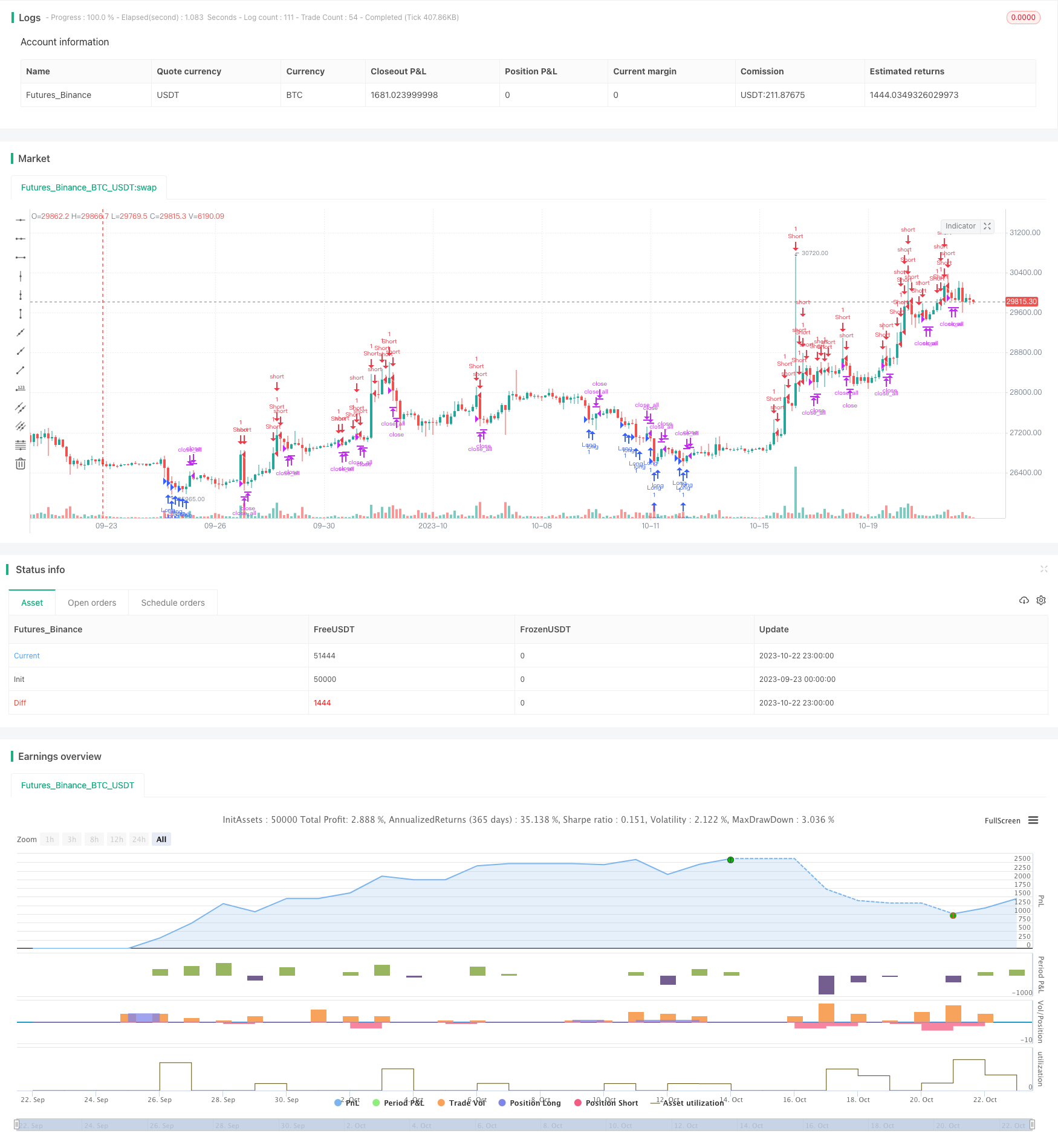

/*backtest

start: 2023-09-23 00:00:00

end: 2023-10-23 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "Noro's Fast RSI Strategy v1.2", shorttitle = "Fast RSI str 1.2", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 5)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

rsiperiod = input(7, defval = 7, minval = 2, maxval = 50, title = "RSI Period")

limit = input(30, defval = 30, minval = 1, maxval = 100, title = "RSI limit")

rsisrc = input(close, defval = close, title = "RSI Price")

rb = input(1, defval = 1, minval = 1, maxval = 5, title = "RSI Bars")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(rsisrc), 0), rsiperiod)

fastdown = rma(-min(change(rsisrc), 0), rsiperiod)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

uplimit = 100 - limit

dnlimit = limit

//RSI Bars

ur = fastrsi > uplimit

dr = fastrsi < dnlimit

uprsi = rb == 1 and ur ? 1 : rb == 2 and ur and ur[1] ? 1 : rb == 3 and ur and ur[1] and ur[2] ? 1 : rb == 4 and ur and ur[1] and ur[2] and ur[3] ? 1 : rb == 5 and ur and ur[1] and ur[2] and ur[3] and ur[4] ? 1 : 0

dnrsi = rb == 1 and dr ? 1 : rb == 2 and dr and dr[1] ? 1 : rb == 3 and dr and dr[1] and dr[2] ? 1 : rb == 4 and dr and dr[1] and dr[2] and dr[3] ? 1 : rb == 5 and dr and dr[1] and dr[2] and dr[3] and dr[4] ? 1 : 0

//Body

body = abs(close - open)

emabody = ema(body, 30)

//Signals

bar = close > open ? 1 : close < open ? -1 : 0

up = bar == -1 and (strategy.position_size == 0 or close < strategy.position_avg_price) and dnrsi and body > emabody / 4

dn = bar == 1 and (strategy.position_size == 0 or close > strategy.position_avg_price) and uprsi and body > emabody / 4

exit = ((strategy.position_size > 0 and fastrsi > dnlimit and bar == 1) or (strategy.position_size < 0 and fastrsi < uplimit and bar == -1)) and body > emabody / 2

//Trading

if up

strategy.entry("Long", strategy.long, needlong == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))

if dn

strategy.entry("Short", strategy.short, needshort == false ? 0 : na, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00)))

if time > timestamp(toyear, tomonth, today, 00, 00) or exit

strategy.close_all()