概述

动量突破策略主要利用 stochastic oscillator 指标判断市场趋势方向,结合 ADX 指标判断趋势强弱,形成交易信号。该策略主要适用于中长线趋势交易。

策略原理

该策略主要基于两个技术指标:

Stochastic oscillator 指标:用于判断市场趋势方向。Stochastic oscillator 的值为 0 到 100,当周期为 14,值在 45 到 55 区间意味着没有明确趋势,Stochastic 在 55 以上为看涨信号,在 45 以下为看跌信号。

ADX 指标:用于判断趋势强弱。ADX 在 20 以下表示趋势较弱。

策略首先根据 Stochastic oscillator 的值判断市场目前是否存在明确的上涨或下跌趋势。当 Stochastic 在 55 以上时,认为存在看涨趋势;当 Stochastic 在 45 以下时,认为存在看跌趋势。

然后策略会检测 ADX 是否在 20 以上,如果 ADX 在 20 以上,说明趋势较强,可以进行趋势交易。如果 ADX 在 20 以下,说明趋势不够明显,此时策略不会产生交易信号。

综合 Stochastic oscillator 和 ADX 的判断,当同时满足以下两个条件时,策略会产生买入/卖出信号:

- Stochastic 在 55 以上,表明存在看涨趋势

- ADX 在 20 以上,表明看涨趋势较强

当同时满足以下两个条件时,策略会产生卖出信号:

- Stochastic 在 45 以下,表明存在看跌趋势

- ADX 在 20 以上,表明看跌趋势较强

通过这样的判断规则,该策略形成以趋势为导向的中长线交易策略。

策略优势

该策略具有以下优势:

捕捉中长线趋势:结合 Stochastic 和 ADX,能够有效判断市场中长线趋势方向和强度,把握主要趋势。

回撤控制:只在趋势明显时交易,可以有效控制无谓的反转交易带来的回撤。

参数优化空间:Stochastic 周期和 ADX 周期都可以进行优化,可以针对不同市场调整参数。

简单直观:该策略整体逻辑简单清晰,由两个常用技术指标组成,直观易懂。

universality:The strategy can be applied to different markets with parameter tuning.

策略风险

该策略也存在一些风险:

错过突破点:Stochastic 和 ADX 都属于趋势跟随型指标,可能会错过潜在的趋势转折点,錯过早期的突破交易机会。

趋势反转风险:在趋势末期,Stochastic 和 ADX 可能会错误判断趋势仍在继续,而错过及时退出的机会,导致亏损放大。

参数优化难度:Stochastic 和 ADX 参数需要针对不同市场进行优化,存在一定难度。

whipsaws:在无明确趋势的市场中,该策略可能会产生多次无效交易信号。

Divergence:When the price trend conflicts with the Stochastic oscillator trend, divergence emerges, which may lead to losing trades.

可以通过以下方法降低风险:

结合其它指标判断局部趋势,发现潜在突破点。

增加趋势反转信号,在趋势明显反转时及时退出。

通过机器学习等方法自动优化参数。

Increase the ADX threshold to filter out weak trend signals in ranging markets.

Apply additional indicators to confirm the Stochastic signals and avoid divergence trades.

策略优化方向

该策略可以从以下几个方面进行优化:

优化 Stochastic 参数:调整 K 周期、D 周期等参数,优化买卖点定位。

优化 ADX 参数:调整 ADX 周期,确定最佳判定趋势强弱的参数。

增加趋势反转信号:在 Stochastic 超买超卖区域加大仓位,设置止损。

结合其它指标:与 RSI、MACD 等指标结合,确定买卖时机。

机器学习:利用机器学习获取最优参数组合。

增加止损策略:设定移动止损或转向止损策略,控制单笔亏损。

Trailong stop loss: Add trailing stop loss to lock in profits as the trend extends.

Money management: Optimize the risk management by adjusting position sizing based on ADX strength.

总结

综上所述,该动量突破策略整体以趋势为导向,利用 Stochastic 判断趋势方向,ADX 判断趋势强度,形成中长线交易策略。策略优势是捕捉趋势,控制回撤,简单直观,缺点是可能错过早期突破点,存在趋势反转风险。我们可以通过调整参数、增加信号、止损等方法来优化该策略,在控制风险的同时获取较好的收益回报。

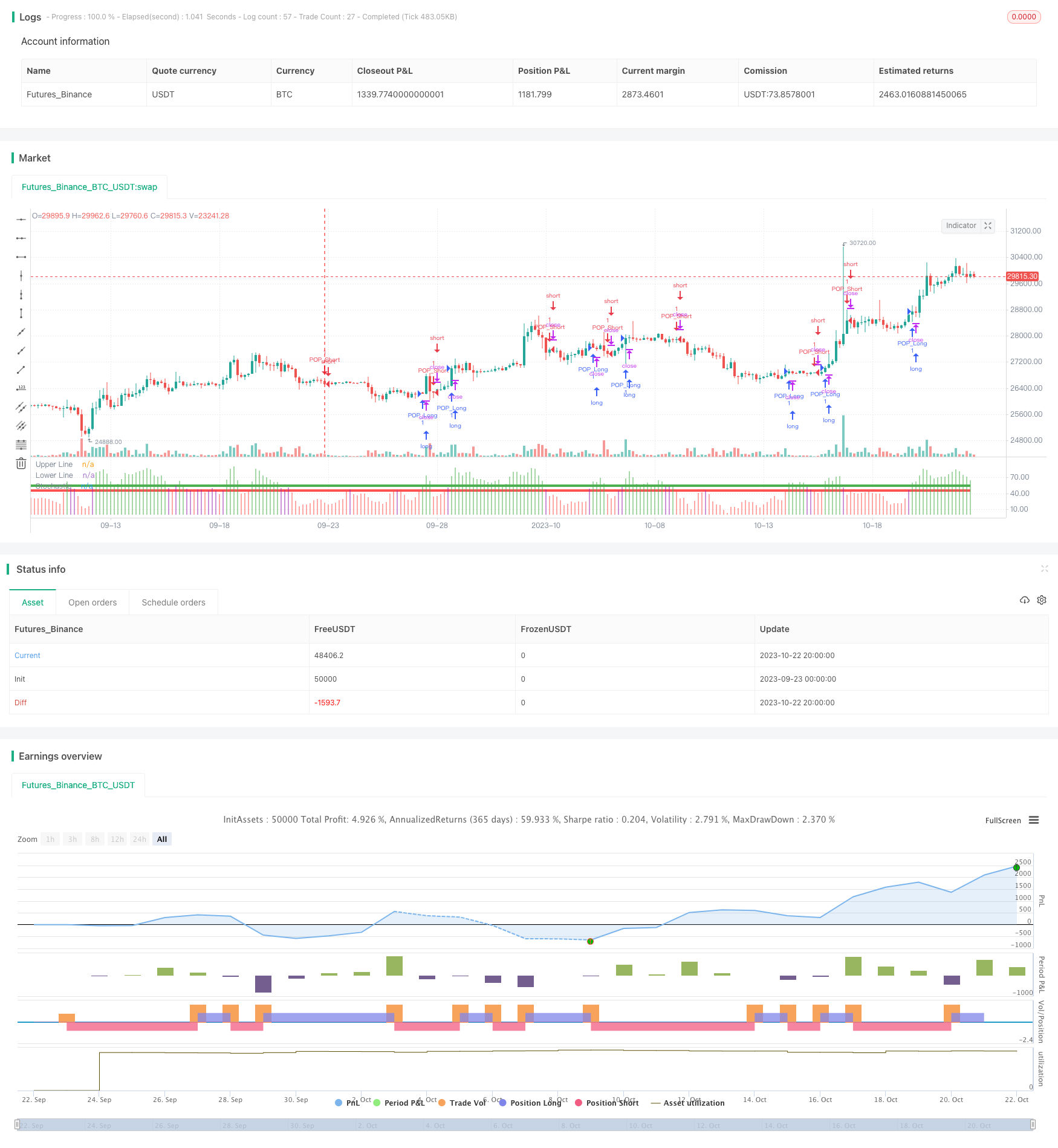

/*backtest

start: 2023-09-23 00:00:00

end: 2023-10-23 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Created by Bitcoinduke

//Original Creator is Jake Bernstein

// Link: https://school.stockcharts.com/doku.php?id=trading_strategies:stochastic_pop_drop

// Tested: XBTUSD 3h | BTCPERP FTX 3h

//@version=4

// strategy(shorttitle="Stochastic Pop and Drop", title="Pop and Drop", overlay=false,

// calc_on_every_tick=false, pyramiding=0, default_qty_type=strategy.cash,

// default_qty_value=1000, currency=currency.USD, initial_capital=1000,

// commission_type=strategy.commission.percent, commission_value=0.075)

upper_threshold_buy = input(55, minval=50, title="Buy Entry/Exit Line")

lower_threshold_sell = input(45, maxval=50, title="Sell Entry/Exit Line")

oscillator_length = input(14, minval=1, title="Stochastic Length - Default 14")

sma_length = input(2, minval=1, title="SMA Length - 3-day (3 by default) simple moving average of stoch")

stoch_oscillator = sma(stoch(close, high, low, oscillator_length), sma_length)

//Upper and Lower Entry Lines

upper_line = upper_threshold_buy

lower_line = lower_threshold_sell

stoch_color = stoch_oscillator >= upper_line ? green : stoch_oscillator <= lower_line ? red : purple

//Charts

plot(stoch_oscillator, title="Stochastic", style=histogram, linewidth=4, color=stoch_color)

upper_threshold = plot(upper_line, title="Upper Line", style=line, linewidth=4, color=green)

lower_threshold = plot(lower_line, title="Lower Line", style=line, linewidth=4, color=red)

// Strategy Logic

LongSignal = stoch_oscillator >= upper_line and not (stoch_oscillator > lower_line and stoch_oscillator < upper_line) ? true : false

ShortSignal = stoch_oscillator <= lower_line and not (stoch_oscillator > lower_line and stoch_oscillator < upper_line) ? true : false

strategy.entry("POP_Short", strategy.short, when=ShortSignal)

strategy.entry("POP_Long", strategy.long, when=LongSignal)

// === Backtesting Dates === thanks to Trost

testPeriodSwitch = input(true, "Custom Backtesting Dates")

testStartYear = input(2019, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testStartHour = input(0, "Backtest Start Hour")

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, testStartHour, 0)

testStopYear = input(2020, "Backtest Stop Year")

testStopMonth = input(1, "Backtest Stop Month")

testStopDay = input(5, "Backtest Stop Day")

testStopHour = input(0, "Backtest Stop Hour")

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, testStopHour, 0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

testPeriod_1 = testPeriod()

isPeriod = testPeriodSwitch == true ? testPeriod_1 : true

// === /END