概述

多空力量策略是由Alexander Elder博士开发的,它通过Elder-ray指标来衡量市场的买入和卖出压力。Elder-ray指标通常与三屏交易系统一起使用,但也可以单独使用。

Alexander Elder博士使用13日指数移动平均线(EMA)来表示市场价值的共识。多头力量反映买方将价格推高于价值共识的能力。空头力量反映卖方将价格压低于平均价值共识的能力。

多头力量通过高点减去13日EMA计算。空头力量通过低点减去13日EMA计算。

策略原理

该策略通过计算多空力量指标来判断市场的多空态势。

- 计算13日EMA作为市场价值共识

- 计算多头力量:当日最高价减去13日EMA

- 计算空头力量:当日最低价减去13日EMA

- 比较多头力量和空头力量与阈值的关系,判断做多做空信号

- 可以选择反向交易

当多头力量大于阈值时为做多信号,当空头力量大于阈值时为做空信号。且可以选择反向交易。

优势分析

- 使用多空力量指标判断市场多空态势,简单易懂

- 可配置参数灵活,阈值和周期可调

- 可选择反向交易,适应不同市场环境

- 采用指数移动平均线,对突发事件敏感度较低

风险分析

- 多空力量指标容易产生错误信号,需结合趋势和其他指标过滤

- 固定周期无法适应市场变化,可采用自适应周期优化

- 不存在止损,容易追随市场产生过大亏损

- 仅判断多空,缺乏入市时机选择

可设置止损,优化移动平均线周期,结合趋势指标等进行优化。

优化方向

- 优化移动平均线周期参数,使用自适应周期EMA

- 加入趋势指标过滤,避免逆势交易

- 增加止损策略,控制单笔亏损

- 结合其他指标选择更佳入市时机

- 运用机器学习技术优化参数设置

总结

多空力量策略通过Elder-ray指标判断市场多空态势,简单直观,参数可配置。但容易产生错误信号,需进一步优化加入趋势判断和止损。该策略思路值得学习借鉴,但直接应用需谨慎。

策略源码

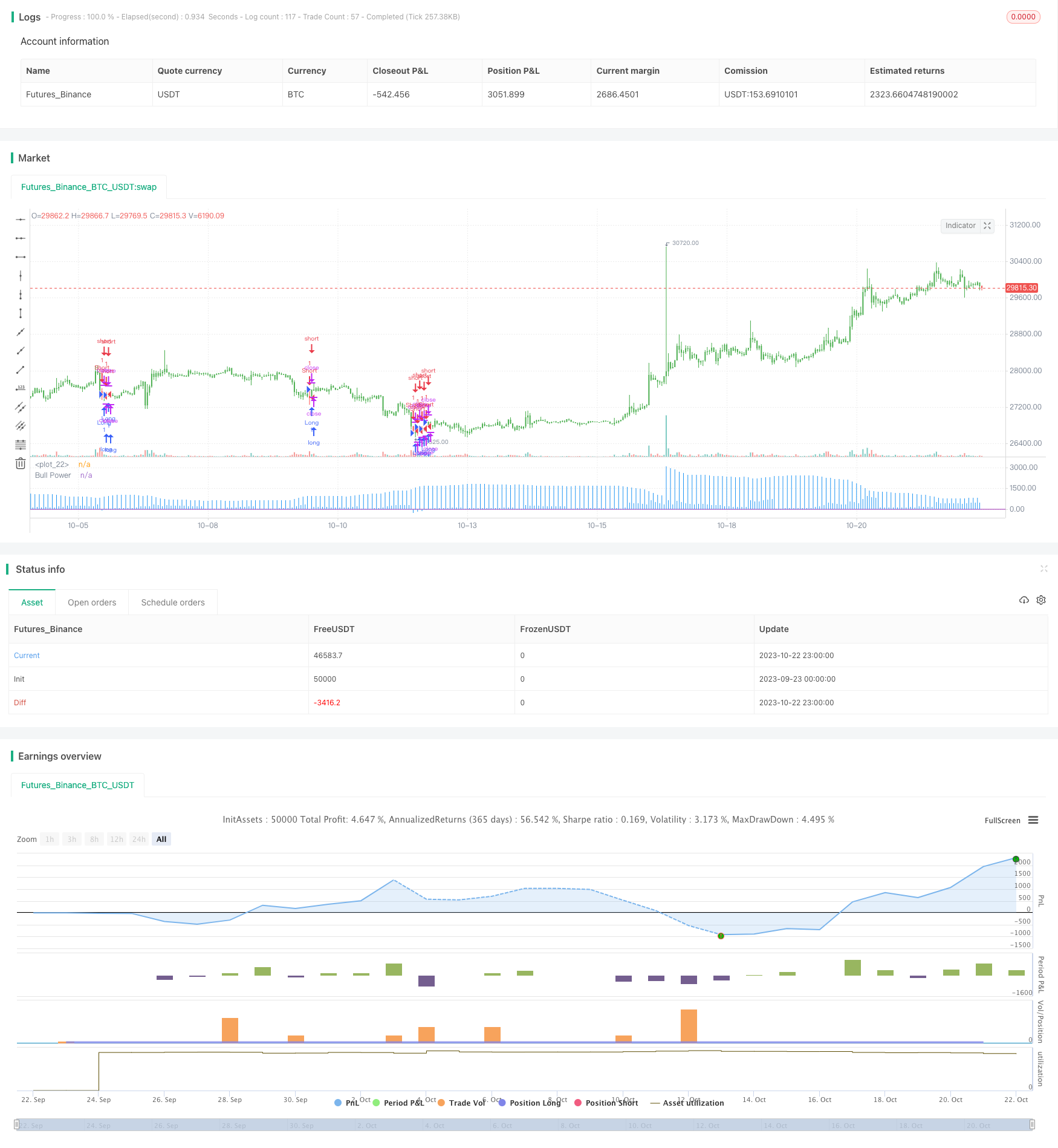

/*backtest

start: 2023-09-23 00:00:00

end: 2023-10-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version = 2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 08/12/2016

// Developed by Dr Alexander Elder, the Elder-ray indicator measures buying

// and selling pressure in the market. The Elder-ray is often used as part

// of the Triple Screen trading system but may also be used on its own.

// Dr Elder uses a 13-day exponential moving average (EMA) to indicate the

// market consensus of value. Bull Power measures the ability of buyers to

// drive prices above the consensus of value. Bear Power reflects the ability

// of sellers to drive prices below the average consensus of value.

// Bull Power is calculated by subtracting the 13-day EMA from the day's High.

// Bear power subtracts the 13-day EMA from the day's Low.

//

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Elder Ray (Bull Power) Strategy Backtest")

Length = input(13, minval=1)

Trigger = input(0)

reverse = input(false, title="Trade reverse")

hline(0, color=purple, linestyle=line)

xPrice = close

xMA = ema(xPrice,Length)

DayHigh = iff(dayofmonth != dayofmonth[1], high, max(high, nz(DayHigh[1])))

nRes = DayHigh - xMA

pos = iff(nRes > Trigger, 1,

iff(nRes < Trigger, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(nRes, color=blue, title="Bull Power", style = histogram)