概述

本策略通过计算海因阿修蜡烛的移动均线交叉来产生交易信号,并结合MACD作为过滤条件,实现了一个较为稳定的交易系统。

策略原理

- 计算海因阿修蜡烛的开盘价和收盘价

- 计算快速移动均线(EMA)和慢速移动均线(SMA)

- 当快速移动均线上穿慢速移动均线时,产生买入信号

- 当快速移动均线下穿慢速移动均线时,产生卖出信号

- 如果启用MACD过滤,只有当MACD柱上穿0轴时才产生买入信号,MACD柱下穿0轴时才产生卖出信号

优势分析

- 海因阿修蜡烛能有效滤除市场噪音,使得移动均线交叉信号更可靠

- 结合不同周期的均线,可以采用多重确认,避免假突破

- MACD过滤有助于进一步避免假信号,提高信号质量

- 采用海因阿修蜡烛计算均线,可以降低 Scientistå1⁄4 è ́±è ̄ã2022å1 ́11æ10æ¥10:33

本V3版本的海因阿修蜡烛策略,通过计算海因阿修蜡烛的移动均线交叉来产生交易信号,并结合MACD作为过滤条件,相比V1和V2版本有了很大的改进。

总体来说,该策略具有以下优势:

海因阿修蜡烛能有效滤除市场噪音,使得移动均线交叉信号更清晰可靠。

采用快慢均线组合,可以避免被单一均线的假突破欺骗。

加入MACD过滤机制,可以进一步避免假信号,提高入场的准确率。

采用不同周期的均线,实现多时间框架的确认,这也提高了信号的可靠性。

使用海因阿修蜡烛计算均线,可以减少由普通K线带来的回撤。

该策略参数设置合理,操作频率适中,无需高频交易也可以获得稳定收益。

但是该策略也存在一些风险需要注意:

在震荡行情中,可能会出现多次调整仓位的反复交易。

MACD作为过滤指标也可能出现失效的情况,导致假信号的产生。

均线系统对参数设置比较敏感,需要谨慎测试最佳参数组合。

长期持有仓位时,需要关注突发事件带来的重大行情变化。

仍需人工判断大级别趋势,避免逆势交易带来的损失。

总的来说,该策略作为一个较成熟的均线策略,在参数调整合理的前提下,可以获得稳定的投资收益。但交易者仍需关注风险,适时调整仓位,并结合趋势判断来运用该策略。

策略源码

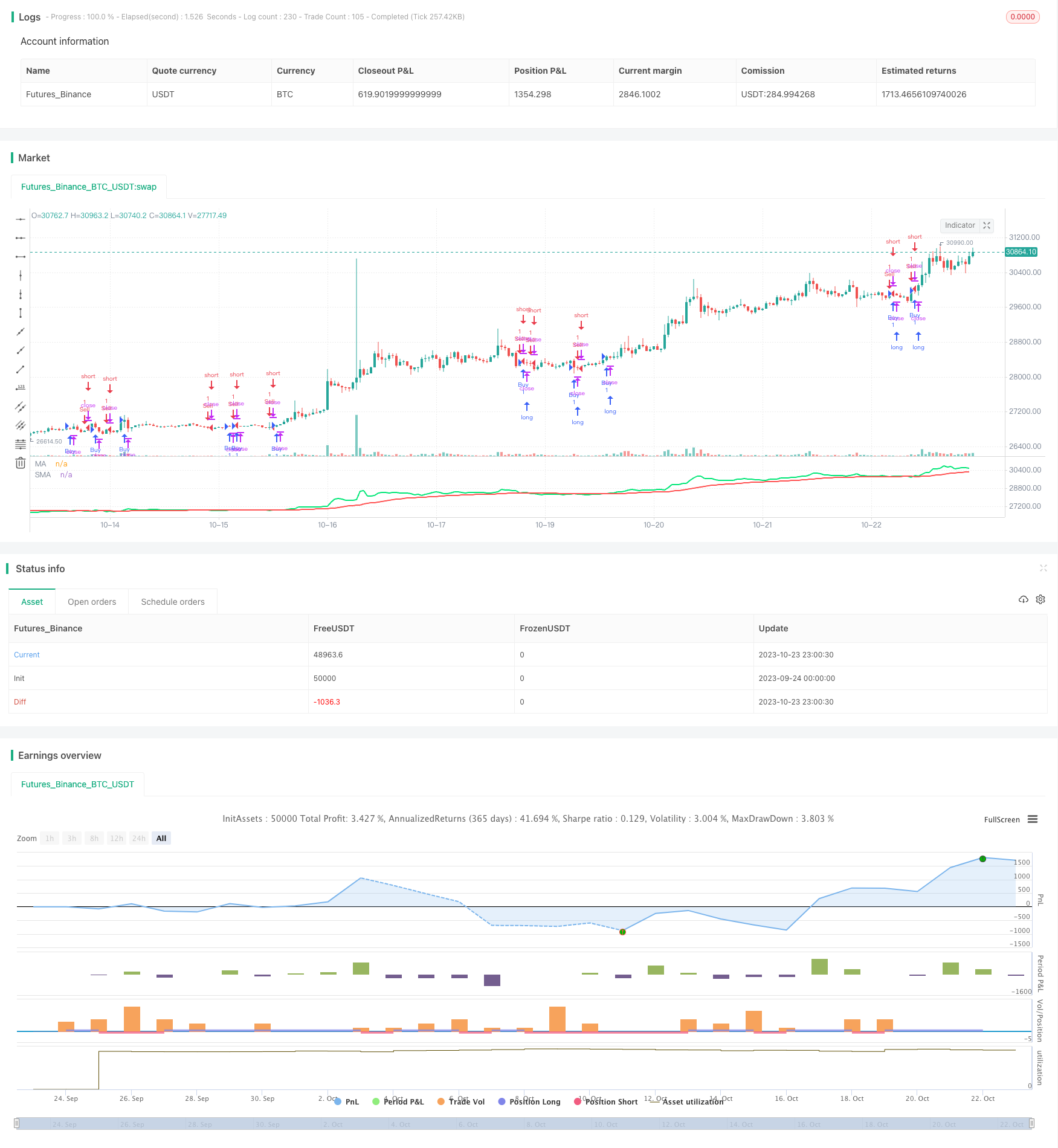

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Heiken-Ashi Strategy V3 by wziel

// strategy("Heiken-Ashi Strategy V3",shorttitle="WZIV3",overlay=true,default_qty_value=10000,initial_capital=10000,currency=currency.USD)

res = input(title="Heikin Ashi Candle Time Frame", defval="60")

hshift = input(1,title="Heikin Ashi Candle Time Frame Shift")

res1 = input(title="Heikin Ashi EMA Time Frame", defval="180")

mhshift = input(0,title="Heikin Ashi EMA Time Frame Shift")

fama = input(1,"Heikin Ashi EMA Period")

test = input(1,"Heikin Ashi EMA Shift")

sloma = input(30,"Slow EMA Period")

slomas = input(1,"Slow EMA Shift")

macdf = input(false,title="With MACD filter")

res2 = input(title="MACD Time Frame", defval="15")

macds = input(1,title="MACD Shift")

//Heikin Ashi Open/Close Price

ha_t = heikinashi(syminfo.tickerid)

ha_open = security(ha_t, res, open[hshift])

ha_close = security(ha_t, res, close[hshift])

mha_close = security(ha_t, res1, close[mhshift])

//macd

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9)

macdl = security(ha_t,res2,macdLine[macds])

macdsl= security(ha_t,res2,signalLine[macds])

//Moving Average

fma = ema(mha_close[test],fama)

sma = ema(ha_close[slomas],sloma)

plot(fma,title="MA",color=lime,linewidth=2,style=line)

plot(sma,title="SMA",color=red,linewidth=2,style=line)

//Strategy

golong = crossover(fma,sma) and (macdl > macdsl or macdf == false )

goshort = crossunder(fma,sma) and (macdl < macdsl or macdf == false )

strategy.entry("Buy",strategy.long,when = golong)

strategy.entry("Sell",strategy.short,when = goshort)