概述

RSI双轨震荡线长短双向交易策略是一个利用RSI指标进行双向交易的策略。该策略通过RSI指标的超买超卖原理,结合双轨道设定和均线交易信号,实现高效的双向开仓与平仓。

策略原理

该策略主要基于RSI指标的超买超卖原理进行交易决策。策略首先计算RSI指标的值vrsi,以及双轨道的上轨sn和下轨ln。当RSI值下穿下轨ln时产生做多信号,当RSI值上穿上轨sn时产生做空信号。

策略还检测K线的涨跌变化,进一步产生做多做空信号。具体来说,当K线从下往上突破时产生做多信号longLocic,当K线从上往下突破时产生做空信号shortLogic。此外,策略提供参数开关,可以只做多、只做空,或翻转信号。

在产生做多做空信号后,策略会统计信号次数,控制开仓次数。通过参数可以设置不同的加仓规则。平仓条件包括止盈、止损、移动止损等方式,可设置不同的止盈止损百分比。

总之,该策略综合运用RSI指标、均线交叉、统计加仓、止盈止损等多种技术手段,实现自动的长短双向交易。

策略优势

- 利用RSI指标的超买超卖原理,在合理位置建立做多做空仓位。

- 双轨道设定避免错误信号。上轨阻止多头仓位过早平仓,下轨阻止空头仓位过早平仓。

- 均线交易信号过滤假突破。股价突破均线才产生信号,避免虚假信号。

- 统计信号次数和加仓次数,控制风险。

- 可自定义止盈止损百分比,收益风险可控。

- 移动止损跟踪止损,进一步锁定盈利。

- 可仅做多、仅做空或翻转信号,适应不同市场环境。

- 自动化交易系统,降低人工操作成本。

策略风险

- RSI指标存在反转失败风险。RSI进入超买超卖区域不一定反转。

- 固定止盈止损点存在被套风险。止盈止损设置不当可能造成过早止损或止盈。

- 依赖技术指标,存在参数优化风险。指标参数设置不当,会影响策略效果。

- 多种条件同时触发,存在漏单风险。

- 自动交易系统存在异常错误风险。

针对以上风险,可以优化参数设置,调整止盈止损策略,增加流动性筛选,优化信号生成逻辑,增加异常错误监控等进行改进。

策略优化方向

- 测试不同周期参数优化RSI指标参数。

- 测试不同的止盈止损百分比设置。

- 增加交易量或收益率筛选,避免流动性不足。

- 优化信号生成逻辑,改进均线交叉方式。

- 增加多时间段回测,验证稳定性。

- 考虑加入其他指标,优化信号效果。

- 加入仓位管理策略。

- 增加异常错误监控。

- 优化自动止损跟踪算法。

- 考虑加入机器学习提升策略。

总结

RSI双轨震荡线长短双向交易策略通过综合运用RSI指标、统计开仓与止损原理等多种技术手段,实现了自动化的双向交易。该策略有较强的可定制性,用户可以根据需求调整参数,适应不同市场环境。同时,策略也存在一定改进空间,可从优化参数设置、风控策略、信号生成逻辑等方面进行优化,使策略更稳定可靠。总体来说,该策略为用户提供了一种相对高效的量化交易方案。

策略源码

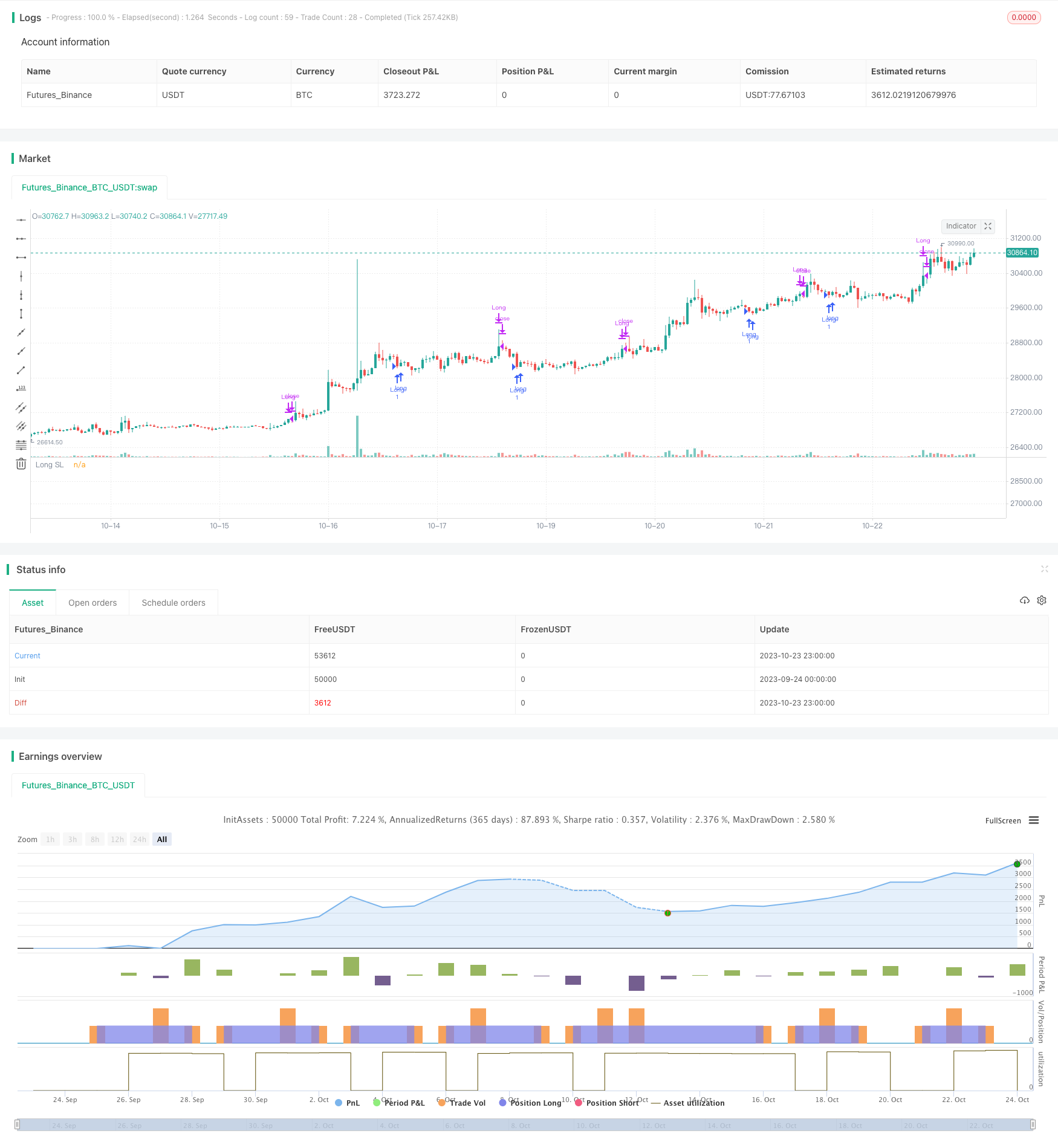

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// Learn more about Autoview and how you can automate strategies like this one here: https://autoview.with.pink/

// strategy("Autoview Build-a-bot - 5m chart", "Strategy", overlay=true, pyramiding=2000, default_qty_value=10000)

// study("Autoview Build-a-bot", "Alerts")

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made *//

testStartYear = input(1, "Backtest Start Year")

testStartMonth = input(11, "Backtest Start Month")

testStartDay = input(10, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(77777777, "Backtest Stop Year")

testStopMonth = input(11, "Backtest Stop Month")

testStopDay = input(15, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

RSIlength = input(1,title="RSI Period Length")

price = close

vrsi = (rsi(price, RSIlength))

src = close

len = input(2, minval=1, title="Length")

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsin = input(12)

sn = 100 - rsin

ln = 0 + rsin

// Put your long and short rules here

longLocic = crossunder(rsi, ln)

shortLogic = crossover(rsi, sn)

//////////////////////////

//* Strategy Component *//

//////////////////////////

isLong = input(true, "Longs Only")

isShort = input(false, "Shorts Only")

isFlip = input(false, "Flip the Opens")

long = longLocic

short = shortLogic

if isFlip

long := shortLogic

short := longLocic

else

long := longLocic

short := shortLogic

if isLong

long := long

short := na

if isShort

long := na

short := short

////////////////////////////////

//======[ Signal Count ]======//

////////////////////////////////

sectionLongs = 0

sectionLongs := nz(sectionLongs[1])

sectionShorts = 0

sectionShorts := nz(sectionShorts[1])

if long

sectionLongs := sectionLongs + 1

sectionShorts := 0

if short

sectionLongs := 0

sectionShorts := sectionShorts + 1

//////////////////////////////

//======[ Pyramiding ]======//

//////////////////////////////

pyrl = input(2, "Pyramiding less than") // If your count is less than this number

pyre = input(1, "Pyramiding equal to") // If your count is equal to this number

pyrg = input(1000000, "Pyramiding greater than") // If your count is greater than this number

longCondition = long and sectionLongs <= pyrl or long and sectionLongs >= pyrg or long and sectionLongs == pyre ? 1 : 0 and vrsi < 20

shortCondition = short and sectionShorts <= pyrl or short and sectionShorts >= pyrg or short and sectionShorts == pyre ? 1 : 0

////////////////////////////////

//======[ Entry Prices ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

////////////////////////////////////

//======[ Open Order Count ]======//

////////////////////////////////////

sectionLongConditions = 0

sectionLongConditions := nz(sectionLongConditions[1])

sectionShortConditions = 0

sectionShortConditions := nz(sectionShortConditions[1])

if longCondition

sectionLongConditions := sectionLongConditions + 1

sectionShortConditions := 0

if shortCondition

sectionLongConditions := 0

sectionShortConditions := sectionShortConditions + 1

///////////////////////////////////////////////

//======[ Position Check (long/short) ]======//

///////////////////////////////////////////////

last_longCondition = na

last_shortCondition = na

last_longCondition := longCondition ? time : nz(last_longCondition[1])

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1])

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

/////////////////////////////////////

//======[ Position Averages ]======//

/////////////////////////////////////

totalLongs = 0.0

totalLongs := nz(totalLongs[1])

totalShorts = 0.0

totalShorts := nz(totalShorts[1])

averageLongs = 0.0

averageLongs := nz(averageLongs[1])

averageShorts = 0.0

averageShorts := nz(averageShorts[1])

if longCondition

totalLongs := totalLongs + last_open_longCondition

totalShorts := 0.0

if shortCondition

totalLongs := 0.0

totalShorts := totalShorts + last_open_shortCondition

averageLongs := totalLongs / sectionLongConditions

averageShorts := totalShorts / sectionShortConditions

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

isTS = input(false, "Trailing Stop")

tsi = input(100, "Activate Trailing Stop Price (%). Divided by 100 (1 = 0.01%)") / 100

ts = input(100, "Trailing Stop (%). Divided by 100 (1 = 0.01%)") / 100

last_high = na

last_low = na

last_high_short = na

last_low_short = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

last_low_short := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = isTS and not na(last_high) and low <= last_high - last_high / 100 * ts and longCondition == 0 and last_high >= averageLongs + averageLongs / 100 * tsi

short_ts = isTS and not na(last_low) and high >= last_low + last_low / 100 * ts and shortCondition == 0 and last_low <= averageShorts - averageShorts/ 100 * tsi

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(125, "Take Profit (%). Divided by 100 (1 = 0.01%)") / 100

long_tp = isTP and close > averageLongs + averageLongs / 100 * tp and not longCondition

short_tp = isTP and close < averageShorts - averageShorts / 100 * tp and not shortCondition

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(true, "Stop Loss")

sl = input(140, "Stop Loss (%). Divided by 100 (1 = 0.01%)") / 100

long_sl = isSL and close < averageLongs - averageLongs / 100 * sl and longCondition == 0

short_sl = isSL and close > averageShorts + averageShorts / 100 * sl and shortCondition == 0

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

longClose = long_tp or long_sl or long_ts ? 1 : 0

shortClose = short_tp or short_sl or short_ts ? 1: 0

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? purple : long_sl ? maroon : long_ts ? blue : longCloseCol[1]

shortCloseCol := short_tp ? purple : short_sl ? maroon : short_ts ? blue : shortCloseCol[1]

tpColor = isTP and in_longCondition ? purple : isTP and in_shortCondition ? purple : white

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : white

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

plot(isTS and in_longCondition ? averageLongs + averageLongs / 100 * tsi : na, "Long Trailing Activate", blue, style=3, linewidth=2)

plot(isTS and in_longCondition and last_high >= averageLongs + averageLongs / 100 * tsi ? last_high - last_high / 100 * ts : na, "Long Trailing", fuchsia, style=2, linewidth=3)

plot(isTS and in_shortCondition ? averageShorts - averageShorts/ 100 * tsi : na, "Short Trailing Activate", blue, style=3, linewidth=2)

plot(isTS and in_shortCondition and last_low <= averageShorts - averageShorts/ 100 * tsi ? last_low + last_low / 100 * ts : na, "Short Trailing", fuchsia, style=2, linewidth=3)

plot(isTP and in_longCondition and last_high < averageLongs + averageLongs / 100 * tp ? averageLongs + averageLongs / 100 * tp : na, "Long TP", tpColor, style=3, linewidth=2)

plot(isTP and in_shortCondition and last_low > averageShorts - averageShorts / 100 * tp ? averageShorts - averageShorts / 100 * tp : na, "Short TP", tpColor, style=3, linewidth=2)

plot(isSL and in_longCondition and last_low_short > averageLongs - averageLongs / 100 * sl ? averageLongs - averageLongs / 100 * sl : na, "Long SL", slColor, style=3, linewidth=2)

plot(isSL and in_shortCondition and last_high_short < averageShorts + averageShorts / 100 * sl ? averageShorts + averageShorts / 100 * sl : na, "Short SL", slColor, style=3, linewidth=2)

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

// plot(longCondition, "Long", green)

// plot(shortCondition, "Short", red)

// plot(longClose, "Long Close", longCloseCol)

// plot(shortClose, "Short Close", shortCloseCol)

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or not in_longCondition

averageLongs := 0

totalLongs := 0.0

sectionLongs := 0

sectionLongConditions := 0

if shortClose or not in_shortCondition

averageShorts := 0

totalShorts := 0.0

sectionShorts := 0

sectionShortConditions := 0

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod()

strategy.entry("Long", 1, when=longCondition)

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Long", when=longClose)

strategy.close("Short", when=shortClose)