概述

渐变追踪止损策略通过动态调整止损线,实现风险控制和止盈截取的有机结合。它使用平均真实波动范围计算止损线,可有效跟踪股价趋势,在保护利润的同时减少不必要的止损。该策略适用于趋势较强的股票,可获得稳定收益。

原理

该策略使用计算平均真实波动范围(ATR)作为动态止损的基础。ATR可以有效反映股票的波动性。策略先输入ATR周期参数,典型为10天。然后计算出ATR值。股价上涨时,止损线也会随之上移,是动态追踪的;当股价下跌时,止损线保持不变,可锁定利润。同时,策略允许通过“因子”参数微调止损线与股价的距离。

具体来说,策略计算当前K线的ATR值,然后乘以“因子”参数,得到止损距离。如果股价高于止损价格,则开多仓;如果股价低于止损价格,则开空仓。这样,止损线就会紧貼股价运行,实现止损线的渐变追踪效果。

优势

- 动态追踪止损,可根据市场情况调整止损距离,灵活性强

- 采用ATR计算止损距离,可有效跟踪市场波动

- 策略简单易用,容易实现自动化交易

- 可自定义ATR周期和止损距离因子,适应不同交易品种

- 可平衡止损和止盈,降低不必要止损的概率

风险

- ATR作为动态止损依据,选择合适的参数很关键

- 止损距离过近可能增加不必要的止损概率

- 止损距离过远则无法及时止损,无法控制风险

- 策略本身无法判断市场趋势,需要人工确认买卖信号

- 需要关注ATR的计算周期是否合理,以及“因子”参数的调整

优化

- 可以考虑结合移动均线等指标过滤信号,降低错误交易概率

- 可以通过机器学习方法自动优化ATR周期和止损距离参数

- 可以引入自动止盈策略,结合止损来锁定利润

- 可以考虑与其它指标组合使用,验证买卖信号的可靠性

- 可以尝试改进ATR计算方法或动态调整ATR周期参数

- 可以研究不同的动态追踪止损算法,进一步优化止损效果

总结

渐变追踪止损策略通过动态调整止损距离,实现了风险控制与止盈截取的有效平衡。该策略操作简单,可自定义度高,适用于机器人自动交易。当然,合理的参数选择和指标组合仍需人工经验。通过进一步优化,该策略可望获取更加稳定的投资回报。

策略源码

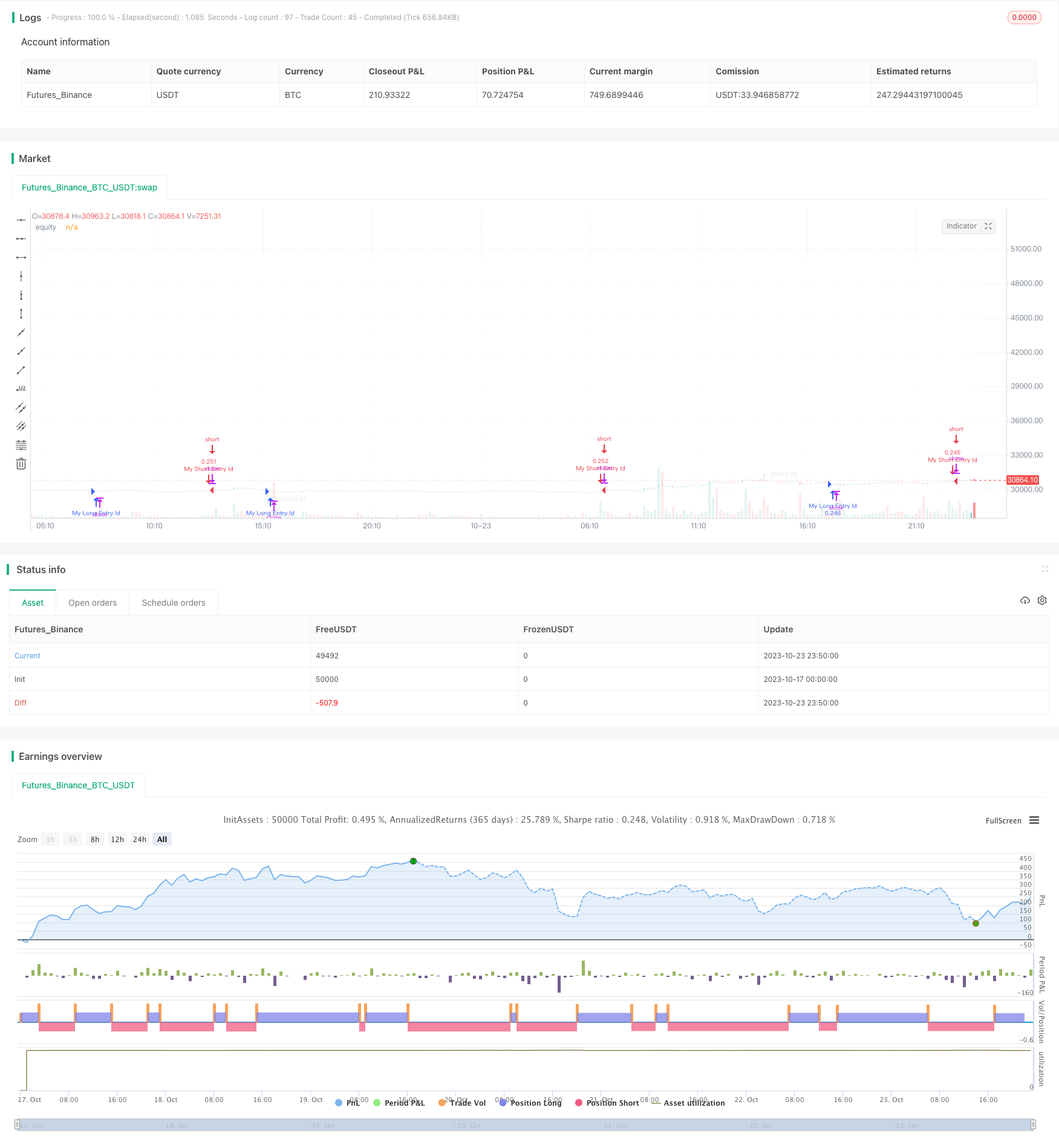

/*backtest

start: 2023-10-17 00:00:00

end: 2023-10-24 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Supertrend Strategy, by Ho.J.", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=15)

// 백테스팅 시작일과 종료일 입력

startYear = input(2020, title="Start Year")

startMonth = input(1, title="Start Month")

startDay = input(1, title="Start Day")

endYear = input(9999, title="End Year")

endMonth = input(12, title="End Month")

endDay = input(31, title="End Day")

// 백테스팅 시간 범위 확인

backtestingTimeBool = (year >= startYear and month >= startMonth and dayofmonth >= startDay) and (year <= endYear and month <= endMonth and dayofmonth <= endDay)

atrPeriod = input(10, "ATR Length")

factor = input.float(3.0, "Factor", step = 0.01)

[_, direction] = ta.supertrend(factor, atrPeriod)

var bool longCondition = false

var bool shortCondition = false

if backtestingTimeBool

prevDirection = direction[1]

if direction < 0

longCondition := false

shortCondition := true

else if direction > 0

longCondition := true

shortCondition := false

if longCondition

strategy.entry("My Long Entry Id", strategy.long)

if shortCondition

strategy.entry("My Short Entry Id", strategy.short)

plot(strategy.equity, title="equity", color=color.rgb(255, 255, 255), linewidth=2, style=plot.style_area)