概述

本策略运用多种技术指标相结合,制定长短双向交易决策。主要包括布林线、RSI、ADX等指标,同时结合均线判断趋势方向。

策略原理

该策略主要是通过布林线来判断价格震荡态势,布林线收窄代表价格波动降低,可能发生突破;同时结合RSI来判断超买超卖现象,RSI高于70为超买区,低于30为超卖区。当布林线收窄,RSI指标接近超买超卖区时,进行反向交易。

此外,该策略还运用ADX判断价格走势强度。当ADX较高时,代表趋势较强,此时可选择顺势交易;当ADX较低时,代表无明显趋势,此时可考虑反转交易。最后,结合均线判断长期趋势方向,若价格在上涨趋势中,可以考虑买入;若价格处于下跌趋势中,可以考虑卖出。

具体来说,当布林带收窄,RSI指标接近超买超卖区,且价格跌破下轨时,认为行情可能反弹,此时考虑做多;当布林带收窄,RSI指标接近超卖区,且价格冲破上轨时,认为行情可能下跌,此时考虑做空。此外,若ADX较高,价格在上升趋势中,可以加仓做多;若ADX较低,价格在下跌趋势中,可以加仓做空。通过组合运用多种指标,可以提高交易系统的稳定性。

优势分析

这种多指标组合策略具有以下优势:

综合考虑多种技术指标,提高了交易信号的准确性和稳健性。单一指标易受假突破等误导,多指标组合可以验证信号,避免错误交易。

既考虑趋势,也考虑震荡,能够适应不同市场情况,灵活层变。趋势交易追求大趋势,震荡交易目标小幅获利。

同时做多做空,可以降低单边市场的仓位风险,防范极端行情。

设置止损止盈点,可以 some profits and limit losses when positions go wrong.

通过参数优化,可以不断提升策略效果,适应市场变化。

风险分析

该策略也存在一些风险需要注意:

多指标组合增加了策略复杂度,参数设置不当可能降低效果。需要充分测试优化。

过于依赖技术指标,忽略基本面信息,可能导致交易信号不准确。指标发出假信号时需要审慎对待。

指标产生信号时,行情可能已发生一定变化,存在追高杀跌的风险。需要适当等待回调。

多空双开会增加交易频率,提高手续费成本和资金压力。需要控制仓位规模。

存在一定的曲线拟合风险,最好在多种市场中测试策略健壮性。

可以通过严格的止损,谨慎加仓,合理控制仓位等方法来控制风险。整体来说,该策略具有较强的实用性。

优化方向

这种策略可以考虑从以下几个方面进行优化:

测试不同参数组合,寻找最优参数。可以用步进法、随机搜索、遗传算法等方法进行参数优化。

增加更多指标,如KDJ,威廉指标等,形成指标群,提高策略稳健性。

优化仓位管理,通过动态仓位调整来控制风险。

结合机器学习算法,利用量化模型来判断价格趋势及未来走势。

在不同品种、时间周期、市场中测试,提高策略的适应性。

优化入场 timing 和出场 timing,以 Capture trends at an early stage and exit before reversal.

采用止盈追踪、移动止损等方法来锁定利润、控制风险。

8.加入基本面因素、市场结构判断来过滤技术指标产生的信号。

总结

本策略通过运用多种指标判断价格趋势,实现自动化交易。策略具有指标群验证、双向交易、止损止盈等优点,可以提高交易效率。但也需注意过优化、假信号等问题。通过不断优化测试,该策略可以成为一个稳定、实用的量化交易系统。它代表了量化交易策略设计的发展方向。

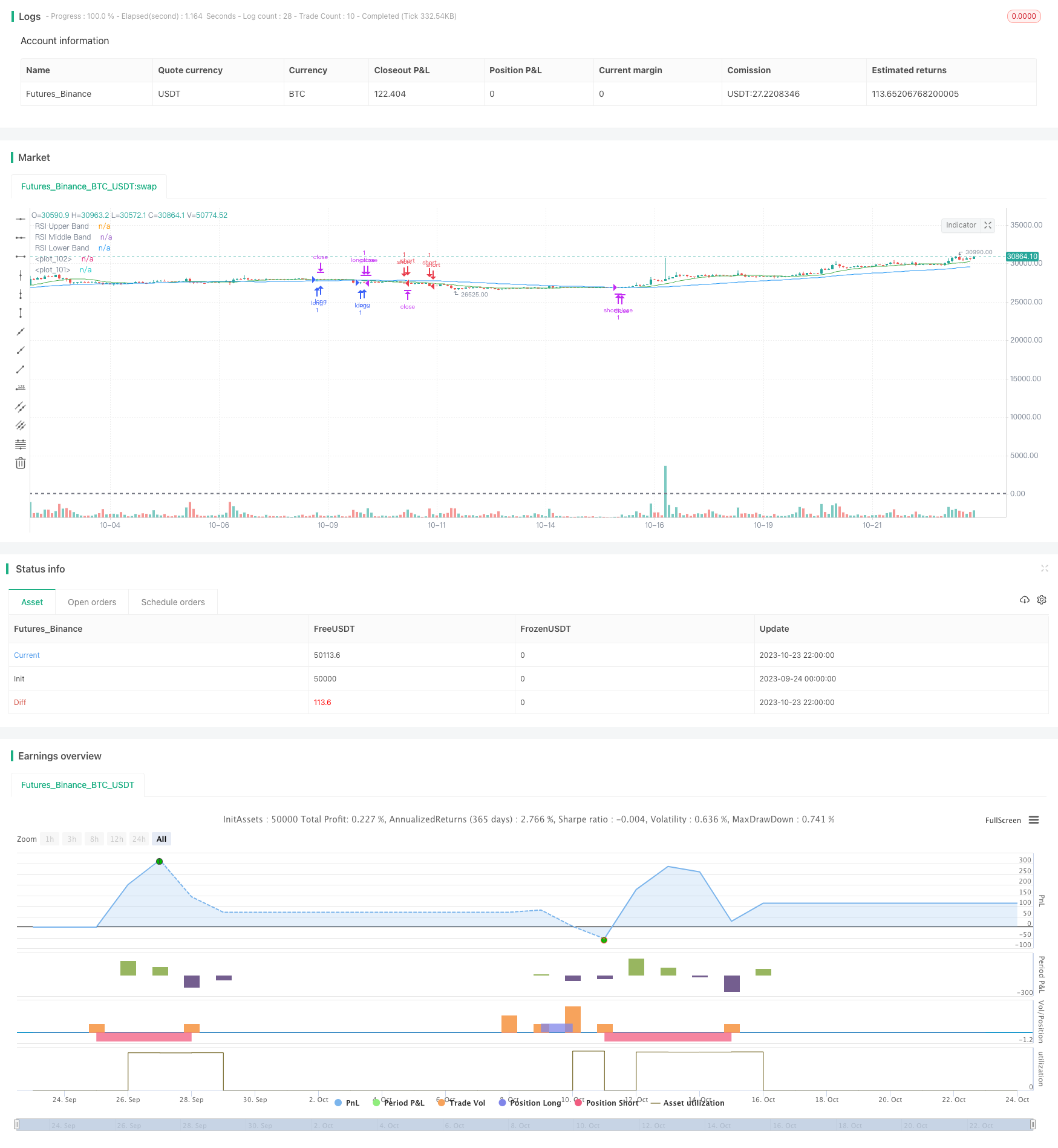

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © The_Bigger_Bull

//@version=5

strategy("Best TradingView Strategy", overlay=true, margin_long=0, margin_short=0)

//Bollinger Bands

source1 = close

length1 = input.int(15, minval=1)

mult1 = input.float(2.0, minval=0.001, maxval=50)

basis1 = ta.sma(source1, length1)

dev1 = mult1 * ta.stdev(source1, length1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

//buyEntry = ta.crossover(source1, lower1)

//sellEntry = ta.crossunder(source1, upper1)

//RSI

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

//plot(rsi, "RSI", color=#7E57C2)

//plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

fill(rsiUpperBand, rsiLowerBand, color=color.rgb(126, 87, 194, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

//ADX

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up1 = ta.change(high)

down1 = -ta.change(low)

plusDM = na(up1) ? na : (up1 > down1 and up1 > 0 ? up1 : 0)

minusDM = na(down1) ? na : (down1 > up1 and down1 > 0 ? down1 : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

out = ta.sma(close, 14)

sma1=ta.sma(close,55)

ema200=ta.ema(close,200)

longCondition = (out>sma1) and ta.crossover(source1, lower1)

if (longCondition )

strategy.entry("long", strategy.long)

shortCondition = (out<sma1) and ta.crossunder(source1, lower1)

if (shortCondition )

strategy.entry("short", strategy.short)

stopl=strategy.position_avg_price-50

tptgt=strategy.position_avg_price+100

stopshort=strategy.position_avg_price+50

tptgtshort=strategy.position_avg_price-100

strategy.exit("longclose","long",trail_offset=5,trail_points=45,when=ta.crossover(sma1,out))

strategy.exit("shortclose","short",trail_offset=5,trail_points=45,when=ta.crossover(out,sma1))

//if strategy.position_avg_price<0

plot(sma1 , color=color.blue)

plot(out, color=color.green)

//plot(ema200,color=color.red)