概述

双EMA黄绿交易系统是一种基于双指数移动平均线的趋势跟踪交易系统。该系统使用两条不同周期的EMA均线,根据价格与EMA均线的关系来判断目前的趋势方向并作出交易决策。该系统逻辑简单,容易操作,能很好地捕捉市场趋势,适合中长线投资者使用。

策略原理

该策略主要依赖两条EMA均线,分别是一条较快周期的EMA均线和一条较慢周期的EMA均线。当快EMA在慢EMA之上时,视为bullish;当快EMA在慢EMA之下时,视为bearish。

根据价格与两条EMA均线的关系,可以将K线分为不同的交易区域:

当快EMA在慢EMA上方,而价格在快EMA之上时(G1),为强势买入区域,此时可以买入。

当快EMA在慢EMA下方,而价格在快EMA之下时(R1),为强势卖出区域,此时可以卖出。

当快慢EMA交叉时,根据价格与两EMA的关系,可划分黄色(预警)和橙色(观望)区域。这两个区域代表趋势转折的可能,需要结合其他区域和其他指标来决定交易。

根据价格在不同交易区域的变化,该策略会发出买入和卖出信号。在强势区域G1和R1,策略会直接产生信号;在预警和观望区域,则需要其他指标确认。

此外,该策略还引入了StochRSI来辅助判断买卖时机。StochRSI的超买超卖情况可作为额外的买入卖出信号。

策略优势

策略逻辑简单清晰,容易理解和实现;

基于趋势运行,能够有效捕捉中长线趋势;

区分强势区域和违背趋势的预警/观望区域,交易信号比较可靠;

结合StochRSI,可以更准确判定买卖时机。

策略风险

纯趋势系统,在没有明确趋势的市场中交易效果可能不佳;

EMA周期设置不当可能导致虚假信号;

预警和观望区域交易风险较大,需要审慎对待;

未考虑止损导致亏损扩大的风险。

可以采用以下方法来降低风险:

选择有明显趋势的品种,在趋势较弱时暂停交易;

优化EMA周期参数,降低虚假信号概率;

在预警和观望区域引入其他指标进行确认,减少交易风险;

设置止损点,以控制单笔亏损。

策略优化方向

该策略可以从以下几个方面进行优化:

引入更多指标进行确认,如MACD、KDJ等,提高信号质量;

在交易区域引入过滤条件,如交易量放大,提高trades的成功率;

根据市场情况动态调整EMA参数,优化参数设定;

增加止损策略,在亏损达到一定比例时止损;

优化资金管理,设定合理的仓位管理;

在不同的品种上测试优化,寻找最佳参数组合。

通过引入更多辅助判断指标、动态参数优化、止损策略等提高系统稳定性,从资金管理等角度降低风险,该策略可以得到更好的交易效果。

总结

双EMA黄绿交易系统是一个基于双EMA均线比较的趋势跟踪交易系统。它区分不同的交易区域,根据价格与EMA均线关系判断趋势方向并产生交易信号,是一个逻辑清晰、易于实现的趋势跟踪系统。该策略有效捕捉趋势、交易规则简单直观等优点,但也存在一定风险。通过引入辅助指标、動态优化参数、设置止损以及优化资金管理等方式,可以降低风险并进一步提高系统的稳定性和盈利能力。总体来说,双EMA黄绿交易系统是一个非常适合中长线投资者使用的趋势跟踪系统。

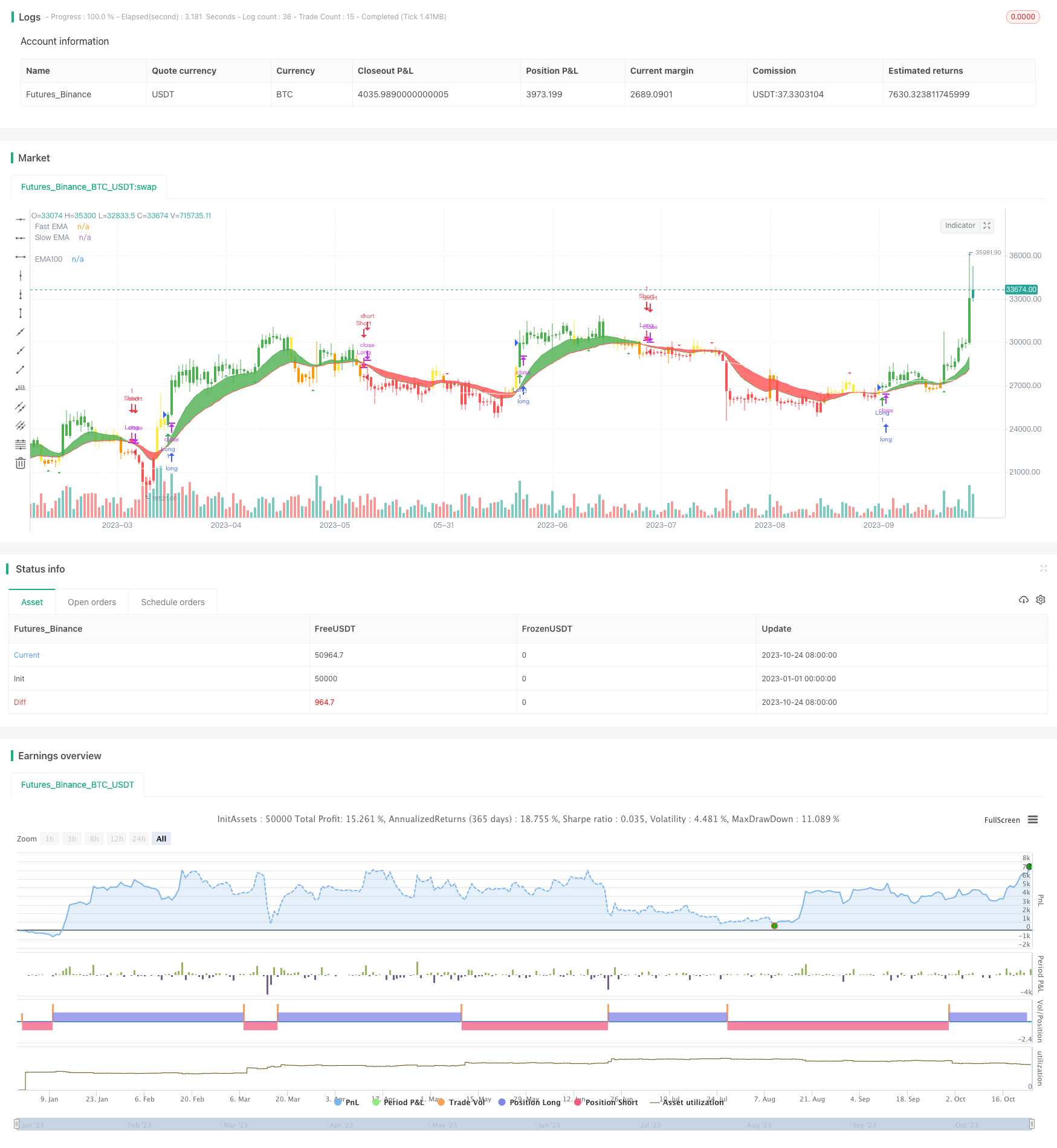

/*backtest

start: 2023-01-01 00:00:00

end: 2023-10-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Vvaz_

//base-on CDC ActionZone By Piriya a simple 2EMA and is most suitable for use with medium volatility market

//@version=4

strategy(title="Vin's Playzone" ,shorttitle="VPz", overlay=true, margin_long=4, margin_short=2)

//variable

srcf = input(title="Source",type=input.source,defval=close)

tffix = input(title="Fixed Timeframe",type=input.bool,defval=true)

tfn = input(title="Timeframe in",type=input.resolution,defval="D")

ema1 = input(title="Fast EMA",type=input.integer,defval=12)

ema2 = input(title="Slow EMA",type=input.integer,defval=26)

ema3 = input(title="EMA 100",type=input.bool,defval=true)

smooter =input(title="Smoothing period (1 = no smoothing)",type=input.integer,defval=2)

fillbar =input(title="Fill Bar Color",type=input.bool,defval=true)

emasw = input(title="Show EMA",type=input.bool,defval=true)

bssw = input(title="Show Buy-Sell signal",type=input.bool,defval=true)

plotmm = input(title="Show Buy-Sell Momentum",type=input.bool,defval=true)

plotmmsm = input(title="RSI Smoothing",type=input.integer,defval=0,minval=0,maxval=2)

//math

xcross =ema(srcf,smooter)

efast = tffix ? ema(security(syminfo.tickerid,tfn,ema(srcf,ema1), gaps = barmerge.gaps_off,lookahead = barmerge.lookahead_on),smooter) :ema(xcross,ema1)

eslow = tffix ? ema(security(syminfo.tickerid,tfn,ema(srcf,ema2), gaps = barmerge.gaps_off,lookahead = barmerge.lookahead_on),smooter) :ema(xcross,ema2)

ema3x = ema(xcross,100)

//Zone

Bull = efast > eslow

Bear = efast < eslow

G1 = Bull and xcross > efast //buy

G2 = Bear and xcross > efast and xcross > eslow //pre-buy1

G3 = Bear and xcross > efast and xcross < eslow //pre-buy2

R1 = Bear and xcross < efast //sell

R2 = Bull and xcross < efast and xcross < eslow //pre-sell1

R3 = Bull and xcross < efast and xcross > eslow //pre-sell2

//color

bcl = G1 ? color.green : G2 ? color.yellow : G3 ? color.orange :R1 ? color.red :R2 ? color.orange : R3 ? color.yellow : color.black

barcolor(color=fillbar ? bcl : na )

//plots

line1 = plot(ema3 ? ema3x : na ,"EMA100",color=color.white)

line2 = plot(emasw ? efast : na ,"Fast EMA",color=color.green)

line3 = plot(emasw ? eslow : na ,"Slow EMA",color=color.red)

fillcl = Bull ? color.green : Bear ? color.red : color.black

fill(line2,line3,fillcl)

//actions

buywhen = G1 and G1[1]==0

sellwhen = R1 and R1[1]==0

bullish = barssince(buywhen) < barssince(sellwhen)

bearish = barssince(sellwhen) < barssince(buywhen)

buy = bearish[1] and buywhen

sell = bullish[1] and sellwhen

bullbearcl = bullish ? color.green : bearish ? color.red : color.black

//plot trend

plotshape(bssw ? buy : na ,style=shape.arrowup,title="BUY",location=location.belowbar,color=color.green)

plotshape( bssw ? sell : na ,style=shape.arrowdown ,title="Sell",location=location.abovebar,color=color.red)

// Momentum Signal using StochRSI

smoothK = input(5,"StochRSI smooth K",type=input.integer,minval=1)

smoothD = input(4,"StochRSI smooth D",type=input.integer,minval=1)

RSIlen = input(14,"RSI length",type=input.integer,minval=1)

STOlen = input(14,"Stochastic length",type=input.integer,minval=1)

SRsrc = input(close,"Source for StochasticRSI",type=input.source)

OSlel = input(20,"Oversold Threshold",type=input.float,minval=0.00)

OBlel = input(80,"Oversold Threshold",type=input.float,minval=0.00)

rsil = rsi(SRsrc,RSIlen)

K = sma(stoch(rsil,rsil,rsil,STOlen),smoothK)

D = sma(K,smoothD)

buymore = iff( bullish ,iff(D < OSlel and crossover(K,D), 2, iff(D > OSlel and crossover(K,D), 1,0)),0)

sellmore = iff( bearish,iff(D > OBlel and crossunder(K,D), 2, iff(D < OBlel and crossunder(K,D), 1,0)),0)

//plot momentum

plotshape(plotmm ? buymore > plotmmsm ? buymore : na : na ,"Buy More!" ,style=shape.triangleup,location=location.belowbar,color=color.green)

plotshape(plotmm ? sellmore > plotmmsm ? sellmore : na : na ,"Sell More!" ,style=shape.triangledown,location=location.abovebar,color=color.red)

// === INPUT BACKTEST RANGE ===

FromYear = input(defval = 2009, title = "From Year", minval = 2009)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2009)

ToMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

//stratgy excuter

strategy.entry("Long",true,when=window() and buy or buymore)

strategy.close("Long",when=window() and sell or sellmore,comment="TP Long")

strategy.entry("Short",false,when=window() and sell or sellmore)

strategy.close("Short",when=window() and buy or buymore,comment="TP Short")