概述

1-3-1 红绿K线反转策略是一种根据K线形态进行买卖信号判断的策略。该策略通过观察1根红色K线是否被3根绿色K线反转来寻找买入机会。

原理

该策略的核心逻辑是:

- 判断当前K线是否为红色K线,即收盘价低于开盘价

- 判断之前3根K线是否都是绿色K线,即收盘价高于开盘价

- 判断最后1根绿色K线的收盘价是否高于前2根绿色K线

- 如果满足上述条件,则在红色K线收盘时以市价买入

- 止损价设为红色K线的最低价

- 止盈价设为入场价加上入场价到止损价的距离

通过这个策略,我们可以在红色K线被反转的情况下买入,因为之后的趋势很可能是上涨的。同时设置止损和止盈来控制风险和锁定盈利。

优势分析

1-3-1 红绿K线反转策略具有以下优势:

- 策略逻辑简单清晰,容易理解和实现

- 利用K线形态特征,不依赖任何指标,避免因过度优化产生的问题

- 有明确的入场和出场规则,可以客观执行

- 设置止损和止盈,可以控制每单交易的风险收益比

- 回测结果良好,具有较强的实盘调整可能性

风险分析

该策略也存在一些风险需要注意:

- K线形态无法百分百预测未来趋势,存在一定的不确定性

- 只买入一次,容易因个股特殊性导致胜率不高

- 没有考虑大盘走势,在大盘持续下跌时持有风险较大

- 没有设置交易费用和滑点,实盘效果可能会差一些

对策:

- 可以考虑结合均线等指标过滤信号,提高买入的成功率

- 调整仓位管理,分批建仓

- 根据大盘情况动态调整止损位置或暂停交易

- 测试不同的止损止盈比例设置

- 测试加入交易成本后的实盘效果

优化方向

该策略可以从以下几个方面进行优化:

基于大盘指数的过滤。可以根据大盘的短期和中期趋势来过滤交易信号,在大盘上涨时买入,大盘下跌时停止交易。

考虑成交量的确认。增加对绿色K线成交量的判断,仅在成交量有所放大时才买入。

优化止损止盈比例。可以测试不同的止损止盈比例,找到最优参数组合。也可以设置动态止损或移动止损。

仓位管理优化。可以分批建仓,后续在条件满足时加仓,降低单次交易的风险。

加入更多过滤条件。比如考虑均线、波动率等指标,确保在趋势更加明确时买入。

大数据训练寻找最优参数。收集大量历史数据,使用机器学习等技术训练最优的参数阈值。

总结

1-3-1 红绿K线反转策略整体来说是一个简单实用的短线交易策略。它有明确的入场退出规则,回测效果良好。我们可以通过一些优化措施来提高它的实盘效果,使之成为一个可靠的量化交易策略。同时也需要注意风险控制,妥善管理资金。

策略源码

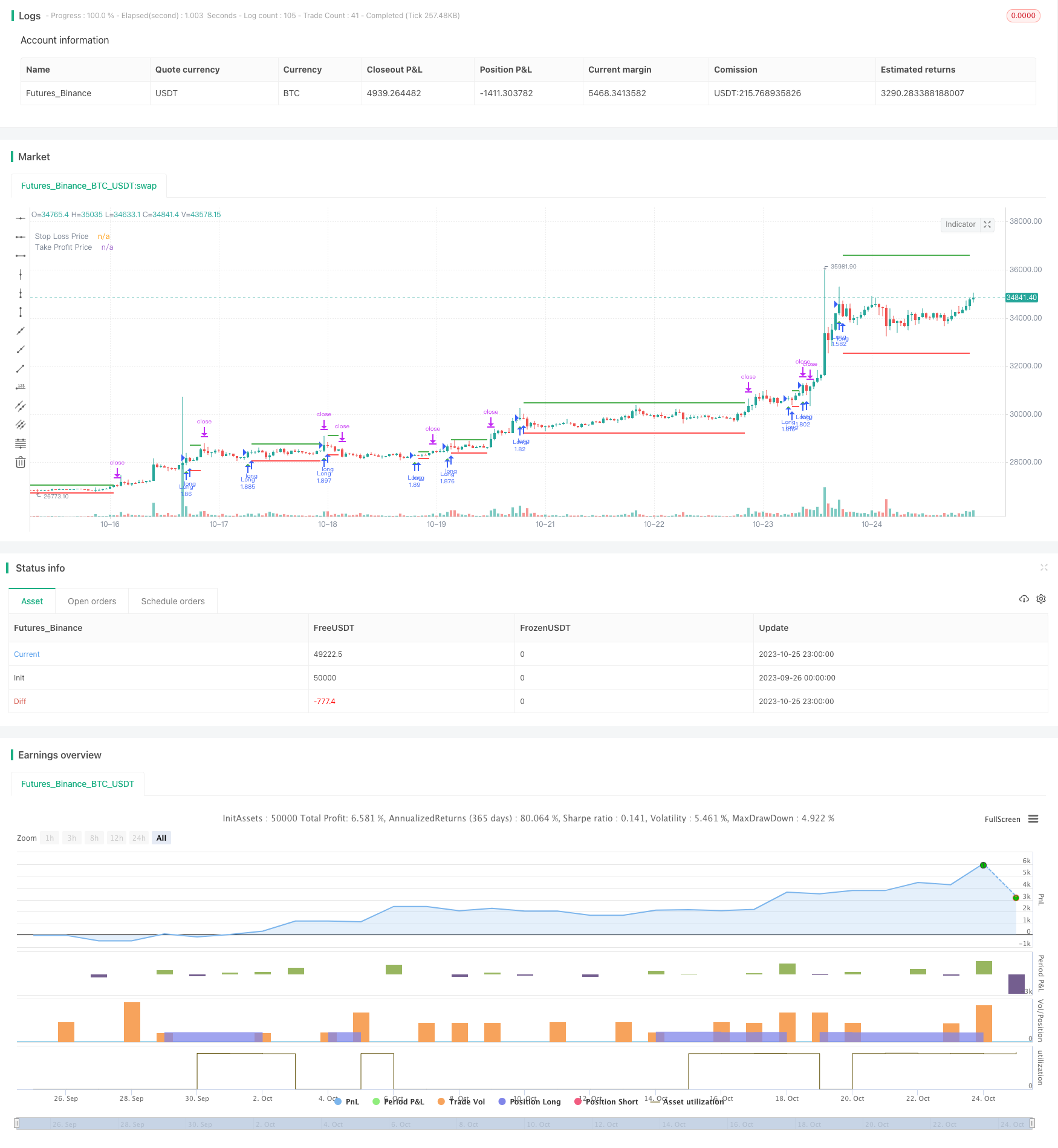

/*backtest

start: 2023-09-26 00:00:00

end: 2023-10-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//by Genma01

strategy("Stratégie tradosaure 1 Bougie Rouge suivi de 3 Bougies Vertes", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

// Définir les paramètres

var float stopLossPrice = na

var float takeProfitPrice = na

var float stopLossPriceD = na

var float takeProfitPriceD = na

// Vérifier les conditions

redCandle = close[3] < open[3] and low[3] < low[2] and low[3] < low[1] and low[3] < low[0]

greenCandles = close > open and close[1] > open[1] and close[2] > open[2]

higherClose = close > close[1] and close[1] > close[2]

// Calcul du stop-loss

if (redCandle and greenCandles and higherClose) and strategy.position_size == 0

stopLossPrice := low[3]

// Calcul du take-profit

if (not na(stopLossPrice)) and strategy.position_size == 0

takeProfitPrice := close + (close - stopLossPrice)

// Entrée en position long

if (redCandle and greenCandles and higherClose) and strategy.position_size == 0

strategy.entry("Long", strategy.long)

// Sortie de la position

if (not na(stopLossPrice)) and strategy.position_size > 0

strategy.exit("Take Profit/Stop Loss", stop=stopLossPrice, limit=takeProfitPrice)

if strategy.position_size == 0

stopLossPriceD := na

takeProfitPriceD := na

else

stopLossPriceD := stopLossPrice

takeProfitPriceD := takeProfitPrice

// Tracer le stop-loss et le take-profit sur le graphique

plotshape(series=redCandle and greenCandles and higherClose and strategy.position_size == 0, title="Conditions Remplies", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=redCandle and greenCandles and higherClose and strategy.position_size == 0, title="Conditions Remplies", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

// Afficher les prix du stop-loss et du take-profit

plot(stopLossPriceD, color=color.red, title="Stop Loss Price", linewidth=2, style = plot.style_linebr)

plot(takeProfitPriceD, color=color.green, title="Take Profit Price", linewidth=2, style = plot.style_linebr)