概述

震荡突破策略运用布林带和随机指标,识别资产价格达到超买超卖区域时的潜在反转点,适合日内交易者利用小幅价格波动获利。该策略主要思想是在特定资产价格突破布林带上下轨,且随机指标显示超买超卖信号时,寻找交易机会。

策略原理

该策略同时使用布林带和随机指标作为主要技术指标。布林带通过计算指定周期(如20天)的均线及标准差,得到上轨和下轨。价格到达上轨时被认为超买,到达下轨时被认为超卖。随机指标RSI则判断价格是否过度超买或超卖。RSI低于20时为超卖,高于80时为超买。

具体交易策略是:当价格突破布林带下轨,同时随机指标RSI低于20时,做多;当价格突破布林带上轨,同时随机指标RSI高于80时,做空。做多时的止损价格设在当前K线低点之下若干点,做空止损价格设在当前K线高点之上若干点。目标利润设在最近几根K线平均波动点数之外。

代码通过交叉函数实现布林带轨道突破判断,RSI高低位判断,并绘制形状标记突破信号。进场后设置止损和止盈,跟踪价格变动退出。

优势分析

该策略结合布林带判定支撑压力区域,和RSI判断超买超卖区域,可以提高交易信号质量。相比单一指标,可以减少错误信号。

利用K线突破布林带上下轨道,配合RSI过滤,可以捕捉反转机会。这类反转交易潜在获利空间较大。

止损距离较小,有利于控制单笔损失。止盈根据平均波动设定,可以较好平衡获利大小。

该策略交易频次较高,适合日内短线交易,可以充分利用小范围市场波动获利。

风险分析

布林带轨道突破假设价格会发生回归均线的反转,但部分突破可能是假突破,无法形成趋势反转。这会导致亏损。

RSI具有滞后性,可能出现提前触发超买超卖信号,从而错过部分交易机会的情况。

止损距离较小,追求控制单笔损失,但也限制了单笔盈利空间。

高频交易需要较强心理质量,过于频繁止损可能影响总体盈利。

优化方向

可以测试调整布林带参数,如增大周期长度,来提高突破信号质量。

可以尝试以K线收盘价突破布林带作为信号,而不是直接突破判定,减少假突破。

可以结合其他指标如MACD、KD等与RSI形成组合,提升超买超卖判定的准确性。

可以根据不同品种特点设定动态止损距离,而不是固定点数止损。

总结

该策略整合布林带判定支撑压力区域,和RSI指标判断超买超卖区域,在理论上可以较好发现反转机会。实际操作中,关键是找到合适的参数配置,控制风险,持续优化。

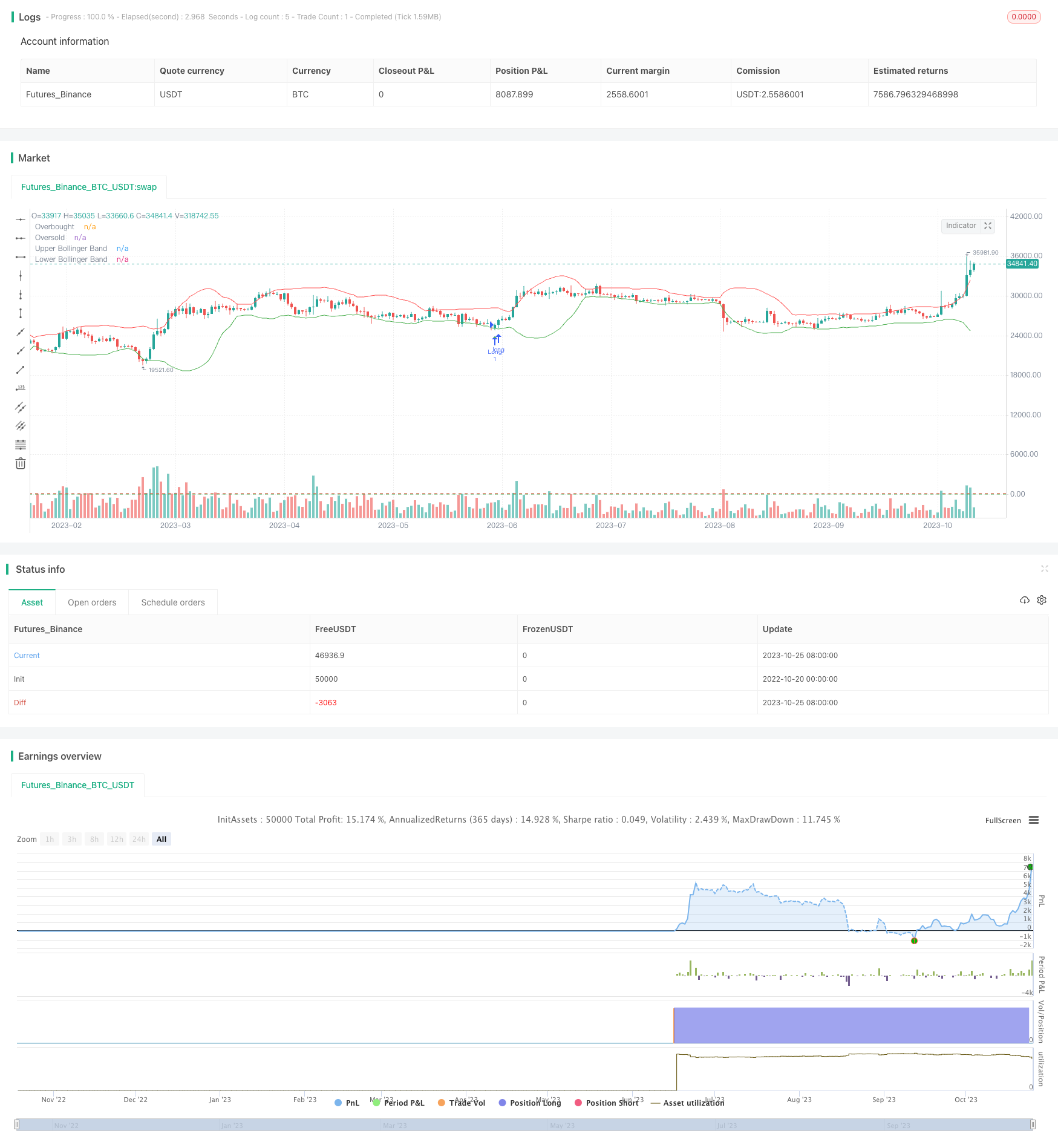

/*backtest

start: 2022-10-20 00:00:00

end: 2023-10-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger Bands & Stochastic Scalping Strategy", shorttitle="BB & Stoch Scalp", overlay=true)

// Bollinger Bands

length = input(20, title="Bollinger Bands Length")

src = input(close, title="Source")

mult = input(2, title="Multiplier")

basis = sma(src, length)

dev = mult * stdev(src, length)

upperBB = basis + dev

lowerBB = basis - dev

// Stochastic

stochLength = input(14, title="Stochastic Length")

smoothK = input(5, title="Stochastic %K Smoothing")

smoothD = input(3, title="Stochastic %D Smoothing")

k = sma(stoch(close, high, low, stochLength), smoothK)

d = sma(k, smoothD)

// Entry Conditions

longCondition = crossover(close, lowerBB) and crossover(k, 20)

shortCondition = crossunder(close, upperBB) and crossunder(k, 80)

// Exit Conditions

takeProfit = input(50, title="Take Profit (pips)")

plotshape(series=longCondition, title="Long Entry Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortCondition, title="Short Entry Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Stop Loss

stopLossPips = input(3, title="Stop Loss (pips)")

stopLossLong = close - stopLossPips * syminfo.mintick

stopLossShort = close + stopLossPips * syminfo.mintick

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.exit("Take Profit/Stop Loss", from_entry="Long", profit=takeProfit, stop=stopLossLong)

strategy.exit("Take Profit/Stop Loss", from_entry="Short", profit=takeProfit, stop=stopLossShort)

plot(upperBB, title="Upper Bollinger Band", color=color.red)

plot(lowerBB, title="Lower Bollinger Band", color=color.green)

hline(80, "Overbought", color=color.red)

hline(20, "Oversold", color=color.green)