概述

本策略基于布林带指标进行交易信号判断,使用止损止盈方式进行仓位管理。策略会监控布林带上轨和下轨的突破情况,在价格突破布林带上轨时做多,突破下轨时做空,并在反向突破时使用止损单平仓。

策略原理

该策略使用布林带指标中的中轨、上轨和下轨线。中轨线是计算一定周期内的价格中值,上轨线是中轨线加上标准差的两倍,下轨线是中轨线减去标准差的两倍。

代码首先计算布林带的中轨、上轨和下轨。然后,判断价格是否突破上轨或下轨,如果突破上轨则做多,如果突破下轨则做空。同时,如果价格反向突破上轨或下轨,则使用止损单平仓。

具体来说,策略逻辑如下:

- 计算布林带中轨、上轨、下轨

- 如果价格突破上轨,做多开仓

- 如果价格突破下轨,做空开仓

- 如果有做多仓位,价格突破下轨,使用止损单平仓

- 如果有做空仓位,价格突破上轨,使用止损单平仓

通过这种方式,可以在股价产生较大波动时捕捉趋势,同时也可以通过止损来限制亏损。

优势分析

- 使用布林带指标判断入场时机,可以有效捕捉价格突破后的趋势行情

- 做多做空信号明确,操作规则简单清晰

- 使用止损单策略,可以限制单笔交易的最大损失

- ParameterHandler可调整布林带参数,优化策略

风险分析

- 布林带交易容易产生多次小额止损单损失,造成整体盈亏受损

- 布林带参数设置不当可能导致交易频率过高或信号错失

- 仅考虑价格因素,没有结合其他指标来综合判断行情

- 没有考虑突破点附近的止损线调整,可能扩大损失

可以通过Combine指标组合,适当调整止损单位等方式来优化。

优化方向

- 可以考虑结合其他指标,如交易量、移动平均线等来确认突破信号

- 可以根据不同市场调整布林带参数,优化参数组合

- 可以根据突破点调整靠近的止损距离,避免过于敏感

- 可以考虑结合海龟交易法则,只在趋势形成后进行交易

- 可以结合机器学习算法自动优化布林带参数

总结

本策略基于布林带指标设计了一个较为简单的趋势跟踪策略。它可以在价格产生突破时快速形成仓位,同时利用止损来控制风险。但仅考虑价格因素可能导致误判,而过于灵敏的止损又可能增加交易频率。我们可以通过参数优化、指标组合、止损调整等方式进一步完善该策略。总体来说,本策略为我们提供了一个相对简单可靠的量化交易思路。

策略源码

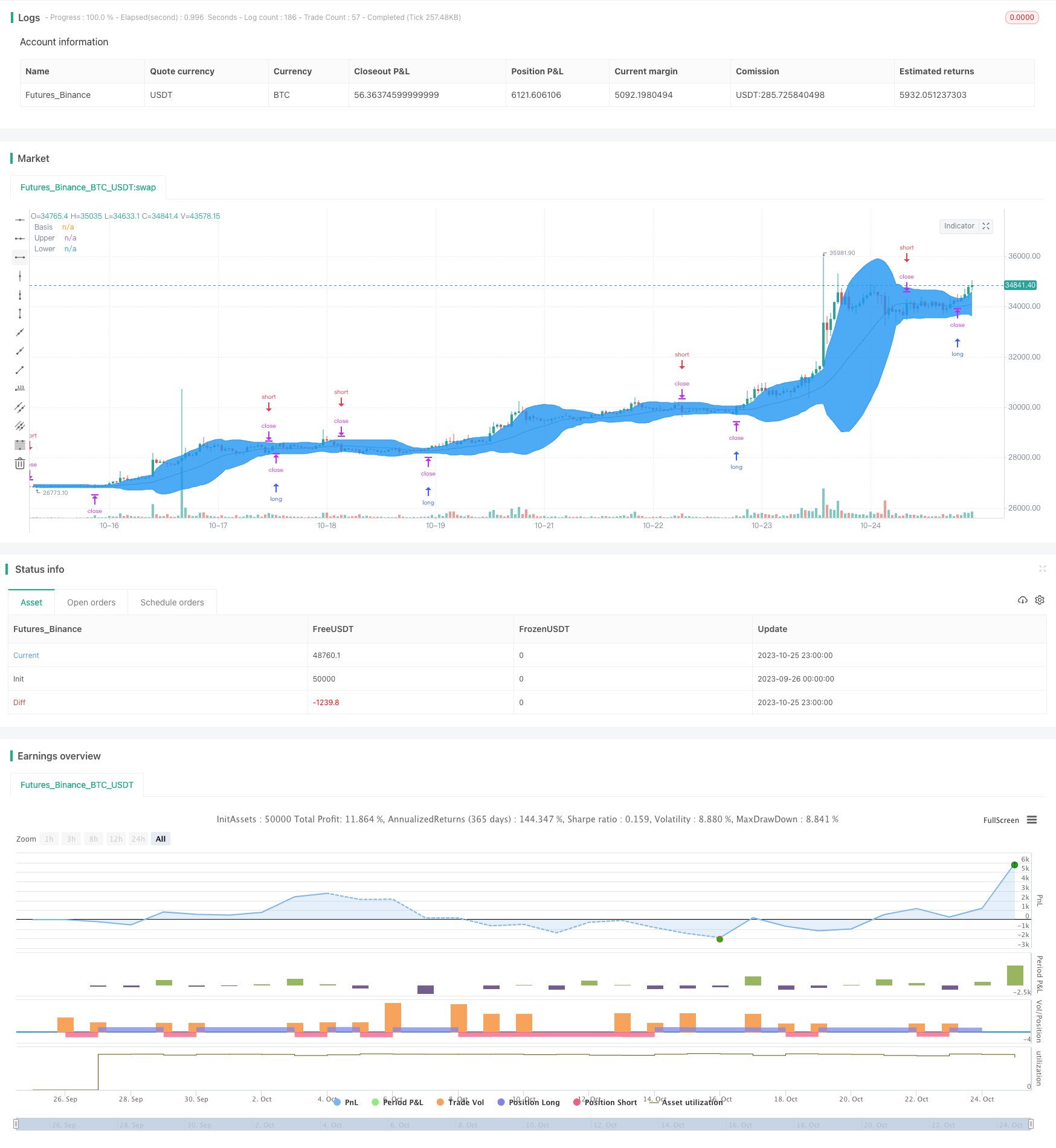

/*backtest

start: 2023-09-26 00:00:00

end: 2023-10-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ROBO_Trading

//@version=5

strategy(title = "Bollinger Stop Strategy", shorttitle = "BBStop", overlay = true, default_qty_type = strategy.percent_of_equity, initial_capital = 10000, default_qty_value = 100, commission_value = 0.1)

//Settings

long = input(true)

short = input(true)

length = input.int(20, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

source = input(close)

showbb = input(true, title = "Show Bollinger Bands")

showof = input(true, title = "Show Offset")

startTime = input(defval = timestamp("01 Jan 2000 00:00 +0000"), title = "Start Time", inline = "time1")

finalTime = input(defval = timestamp("31 Dec 2099 23:59 +0000"), title = "Final Time", inline = "time1")

//Bollinger Bands

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

//Show indicator

offset = showof ? 1 : 0

colorBasis = showbb ? color.gray : na

colorUpper = showbb ? color.blue : na

colorLower = showbb ? color.blue : na

colorBands = showbb ? color.blue : na

p0 = plot(basis, "Basis", color = colorBasis, offset = offset)

p1 = plot(upper, "Upper", color = colorUpper, offset = offset)

p2 = plot(lower, "Lower", color = colorLower, offset = offset)

fill(p1, p2, title = "Background", color = colorBands, transp = 90)

//Trading

truetime = true

if basis > 0 and truetime

if long

strategy.entry("Long", strategy.long, stop = upper, when = truetime)

if short

strategy.entry("Short", strategy.short, stop = lower, when = truetime)

if long == false

strategy.exit("Exit", "Short", stop = upper)

if short == false

strategy.exit("Exit", "Long", stop = lower)

if time > finalTime

strategy.close_all()