概述

本策略基于指标多空因子采取反转交易,同时设置了目标获利点。多空因子核心为基于交易量的扩展形态“广义支撑/阻力”,适用于具备高交易量和波动的标的。策略优势在于可捕捉到较大的中短期趋势反转机会,能快速获利;但也存在被套风险。

策略原理

基于交易量的“广义支撑/阻力”识别多空因子

使用K线形态识别经典支撑/阻力,以较大交易量过滤假突破

广义支撑/阻力比经典形态具有更好的包含性

突破广义支撑为多因子信号,突破广义阻力为空因子信号

反转交易

因子信号发出后,进行反向操作

若已持仓,则进行反向减仓或反向开仓

设置获利目标

根据ATR设定止损

设置1R/2R/3R等多个目标获利点

达到不同获利目标后分批减仓

优势分析

- 可捕捉中短期较大幅度反转

支撑阻力突破代表较强趋势反转信号,具有一定的可靠性,可捕捉中短期较大幅度反转。

- 快速获利,回撤小

通过止损和多档获利目标设定,可实现快速获利,并限制个股回撤。

- 适用于具有大量机构资金且波动较大的标的

该策略依赖交易量指标,需要有充足的机构资金流入支持趋势;同时需要一定的波动空间来实现盈利。

风险分析

- 被困于震荡行情的风险

行情震荡时,止损退出再反向入场的操作可能造成频繁被套。

- 支撑阻力失效风险

广义支撑阻力并不绝对可靠,存在失败测试反转的概率。

- 单边持仓风险

策略为纯反转,不考虑趋势跟踪,有可能错过较大方向性机会。

风控方面

可适当放宽反转交易的因子条件,不必每一次突破都反转

可结合其它指标过滤,如量价背离

可优化止损策略,降低被困概率

优化方向

- 优化口径参数

优化广义支撑阻力的参数,识别更可靠的因子

- 优化获利策略

可增加更多档位的获利目标,也可以采用非固定目标获利

- 优化止损策略

调整ATR参数或使用istics止损,减少不必要激烈止损造成的交易成本

- 结合趋势及其它因子

可引入均线等趋势判断,避免与趋势严重对抗;也可引入其它辅助因子

总结

本策略核心在于利用反转交易来捕捉中短期较大波动。策略思路简单直接,通过参数调整可获得不错的实盘效果。但反转策略较为激进,存在一定的回撤和被套风险,需要进一步优化止损和盈利策略,并适当结合趋势判断,以减少不必要的损失。

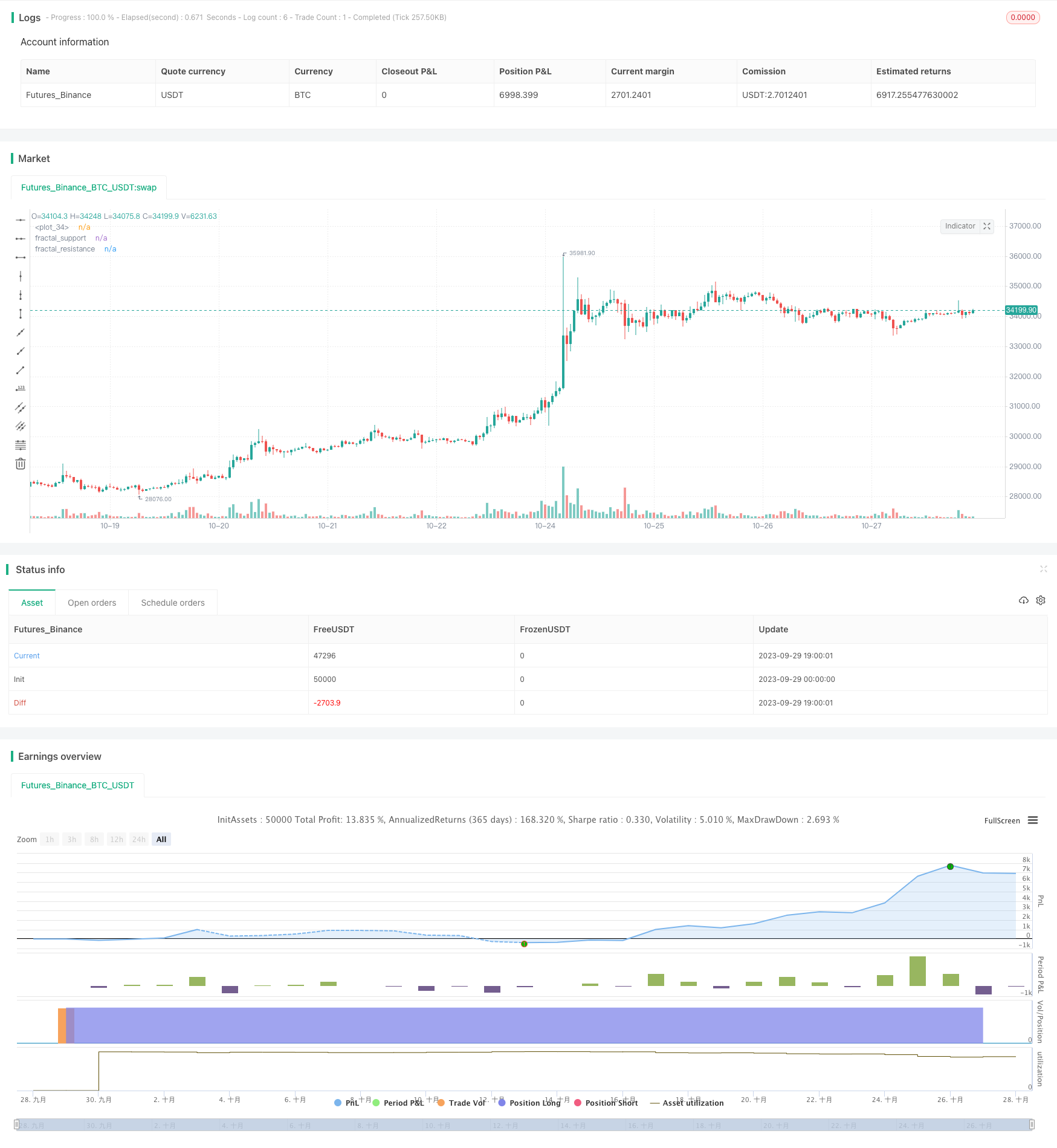

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DojiEmoji

//@version=5

strategy("Fractal Strat [KL] ", overlay=true, pyramiding=1, initial_capital=1000000000)

var string ENUM_LONG = "Long"

var string GROUP_ENTRY = "Entry"

var string GROUP_TSL = "Stop loss"

var string GROUP_TREND = "Trend prediction"

var string GROUP_ORDER = "Order size and Profit taking"

// backtest_timeframe_start = input.time(defval=timestamp("01 Apr 2000 13:30 +0000"), title="Backtest Start Time")

within_timeframe = true

// TSL: calculate the stop loss price. {

_multiple = input(2.0, title="ATR Multiplier for trailing stop loss", group=GROUP_TSL)

ATR_TSL = ta.atr(input(14, title="Length of ATR for trailing stop loss", group=GROUP_TSL, tooltip="Initial risk amount = atr(this length) x multiplier")) * _multiple

TSL_source = low

TSL_line_color = color.green

TSL_transp = 100

var stop_loss_price = float(0)

var float initial_entry_p = float(0)

var float risk_amt = float(0)

var float initial_order_size = float(0)

if strategy.position_size == 0 or not within_timeframe

TSL_line_color := color.black

stop_loss_price := TSL_source - ATR_TSL

else if strategy.position_size > 0

stop_loss_price := math.max(stop_loss_price, TSL_source - ATR_TSL)

TSL_transp := 0

plot(stop_loss_price, color=color.new(TSL_line_color, TSL_transp))

// } end of "TSL" block

// Order size and profit taking {

pcnt_alloc = input.int(5, title="Allocation (%) of portfolio into this security", tooltip="Size of positions is based on this % of undrawn capital. This is fixed throughout the backtest period.", minval=0, maxval=100, group=GROUP_ORDER) / 100

// Taking profits at user defined target levels relative to risked amount (i.e 1R, 2R, 3R)

var bool tp_mode = input(true, title="Take profit and different levels", group=GROUP_ORDER)

var float FIRST_LVL_PROFIT = input.float(1, title="First level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking first level profit at 1R means taking profits at $11", group=GROUP_ORDER)

var float SECOND_LVL_PROFIT = input.float(2, title="Second level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking second level profit at 2R means taking profits at $12", group=GROUP_ORDER)

var float THIRD_LVL_PROFIT = input.float(3, title="Third level profit", tooltip="Relative to risk. Example: entry at $10 and inital stop loss at $9. Taking third level profit at 3R means taking profits at $13", group=GROUP_ORDER)

// }

// Fractals {

// Modified from synapticEx's implementation: https://www.tradingview.com/script/cDCNneRP-Fractal-Support-Resistance-Fixed-Volume-2/

rel_vol_len = 6 // Relative volume is used; the middle candle has to have volume above the average (say sma over prior 6 bars)

rel_vol = ta.sma(volume, rel_vol_len)

_up = high[3]>high[4] and high[4]>high[5] and high[2]<high[3] and high[1]<high[2] and volume[3]>rel_vol[3]

_down = low[3]<low[4] and low[4]<low[5] and low[2]>low[3] and low[1]>low[2] and volume[3]>rel_vol[3]

fractal_resistance = high[3], fractal_support = low[3] // initialize

fractal_resistance := _up ? high[3] : fractal_resistance[1]

fractal_support := _down ? low[3] : fractal_support[1]

plot(fractal_resistance, "fractal_resistance", color=color.new(color.red,50), linewidth=2, style=plot.style_cross, offset =-3, join=false)

plot(fractal_support, "fractal_support", color=color.new(color.lime,50), linewidth=2, style=plot.style_cross, offset=-3, join=false)

// }

// ATR diversion test {

// Hypothesis testing (2-tailed):

//

// Null hypothesis (H0) and Alternative hypothesis (Ha):

// H0 : atr_fast equals atr_slow

// Ha : atr_fast not equals to atr_slow; implies atr_fast is either too low or too high

len_fast = input(5,title="Length of ATR (fast) for diversion test", group=GROUP_ENTRY)

atr_fast = ta.atr(len_fast)

atr_slow = ta.atr(input(50,title="Length of ATR (slow) for diversion test", group=GROUP_ENTRY, tooltip="This needs to be larger than Fast"))

// Calculate test statistic (test_stat)

std_error = ta.stdev(ta.tr, len_fast) / math.pow(len_fast, 0.5)

test_stat = (atr_fast - atr_slow) / std_error

// Compare test_stat against critical value defined by user in settings

//critical_value = input.float(1.645,title="Critical value", tooltip="Strategy uses 2-tailed test to compare atr_fast vs atr_slow. Null hypothesis (H0) is that both should equal. Based on the computed test statistic value, if absolute value of it is +/- this critical value, then H0 will be rejected.", group=GROUP_ENTRY)

conf_interval = input.string(title="Confidence Interval", defval="95%", options=["90%","95%","99%"], tooltip="Critical values of 1.645, 1.96, 2.58, for CI=90%/95%/99%, respectively; Under 2-tailed test to compare atr_fast vs atr_slow. Null hypothesis (H0) is that both should equal. Based on the computed test statistic value, if absolute value of it is +/- critical value, then H0 will be rejected.")

critical_value = conf_interval == "90%" ? 1.645 : conf_interval == "95%" ? 1.96 : 2.58

reject_H0_lefttail = test_stat < -critical_value

reject_H0_righttail = test_stat > critical_value

// } end of "ATR diversion test" block

// Entry Signals

entry_signal_long = close >= fractal_support and reject_H0_lefttail

// MAIN {

// Update the stop limit if strategy holds a position.

if strategy.position_size > 0

strategy.exit(ENUM_LONG, comment="SL", stop=stop_loss_price)

// Entry

if within_timeframe and entry_signal_long and strategy.position_size == 0

initial_entry_p := close

risk_amt := ATR_TSL

initial_order_size := math.floor(pcnt_alloc * strategy.equity / close)

strategy.entry(ENUM_LONG, strategy.long, qty=initial_order_size)

var int TP_taken_count = 0

if tp_mode and close > strategy.position_avg_price

if close >= initial_entry_p + THIRD_LVL_PROFIT * risk_amt and TP_taken_count == 2

strategy.close(ENUM_LONG, comment="TP Lvl3", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

else if close >= initial_entry_p + SECOND_LVL_PROFIT * risk_amt and TP_taken_count == 1

strategy.close(ENUM_LONG, comment="TP Lvl2", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

else if close >= initial_entry_p + FIRST_LVL_PROFIT * risk_amt and TP_taken_count == 0

strategy.close(ENUM_LONG, comment="TP Lvl1", qty=math.floor(initial_order_size / 3))

TP_taken_count := TP_taken_count + 1

// Alerts

_atr = ta.atr(14)

alert_helper(msg) =>

prefix = "[" + syminfo.root + "] "

suffix = "(P=" + str.tostring(close, "#.##") + "; atr=" + str.tostring(_atr, "#.##") + ")"

alert(str.tostring(prefix) + str.tostring(msg) + str.tostring(suffix), alert.freq_once_per_bar)

if strategy.position_size > 0 and ta.change(strategy.position_size)

if strategy.position_size > strategy.position_size[1]

alert_helper("BUY")

else if strategy.position_size < strategy.position_size[1]

alert_helper("SELL")

// Clean up - set the variables back to default values once no longer in use

if ta.change(strategy.position_size) and strategy.position_size == 0

TP_taken_count := 0

initial_entry_p := float(0)

risk_amt := float(0)

initial_order_size := float(0)

stop_loss_price := float(0)

// } end of MAIN block