概述

该策略的主要思想是利用高级别均线的突破来实现趋势交易。在高级别时间范围内,当价格突破上升或下破均线时,可以判断出趋势的开始,这时可以选择适当的方向进行跟踪。

策略原理

该策略通过Pine Script语言开发,主要分为以下几个部分:

输入参数

定义了均线周期参数period,默认值为200;定义了K线时间周期参数timeframe,默认值为日线”D”。

均线计算

使用ta.ema函数计算Exponential Moving Average均线。

突破判断

使用ta.crossover和ta.crossunder函数来判断价格是否突破或下破均线。

信号绘制

当发生突破时,在K线上绘制向上或向下的箭头。

交易开平仓

发生突破时选择方向开仓,双倍止损距离达到之后平仓。

该策略主要依靠高级别均线的趋势判断能力,通过简单的突破操作来实现趋势跟踪,属于较为传统的突破策略。

优势分析

该策略具有以下几点优势:

概念简单,容易理解和掌握。

仅依靠一个均线指标,参数调节简单。

突破操作容易形成趋势,不会频繁交易。

高级别周期清晰显示大趋势,不容易被短期波动影响。

可配置不同的时间周期组合,适应不同品种。

可轻松实现多品种跟踪,难以同时被套牢。

风险分析

该策略也存在一些风险:

突破信号可能发生假突破,无法有效过滤市场震荡。

无法有效利用短线机会获利。

大方向判断错误时,亏损可能比较严重。

均线周期和交易周期不匹配时,会出现过度交易或漏损情况。

无法实时止损,亏损扩大的可能性较大。

对应风险的解决方案包括:结合趋势指标、增加过滤条件、适当缩短持仓周期、动态调整止损位置等。

优化方向

该策略可以考虑从以下几个方面进行优化:

增加趋势指标的组合,如MACD、KD等,提高突破的可靠性。

增加交易量或布林线通道等过滤条件,避免假突破。

优化参数周期的匹配,使得持仓周期与趋势周期更加匹配。

增加实时止损策略,通过跟踪止损来控制单笔亏损。

考虑结合机器学习技术,实现参数的动态优化。

尝试多种资产配置组合,提高整体的稳定性。

总结

该策略总体来说较为简单实用,通过简单的均线突破来实现趋势跟踪,易于掌握,可以作为量化交易的入门策略之一。但也存在一些问题,需要通过组合指标、优化参数、动态止损等方式进行改进,使得策略更稳定高效。具有很大的优化空间和扩展性。

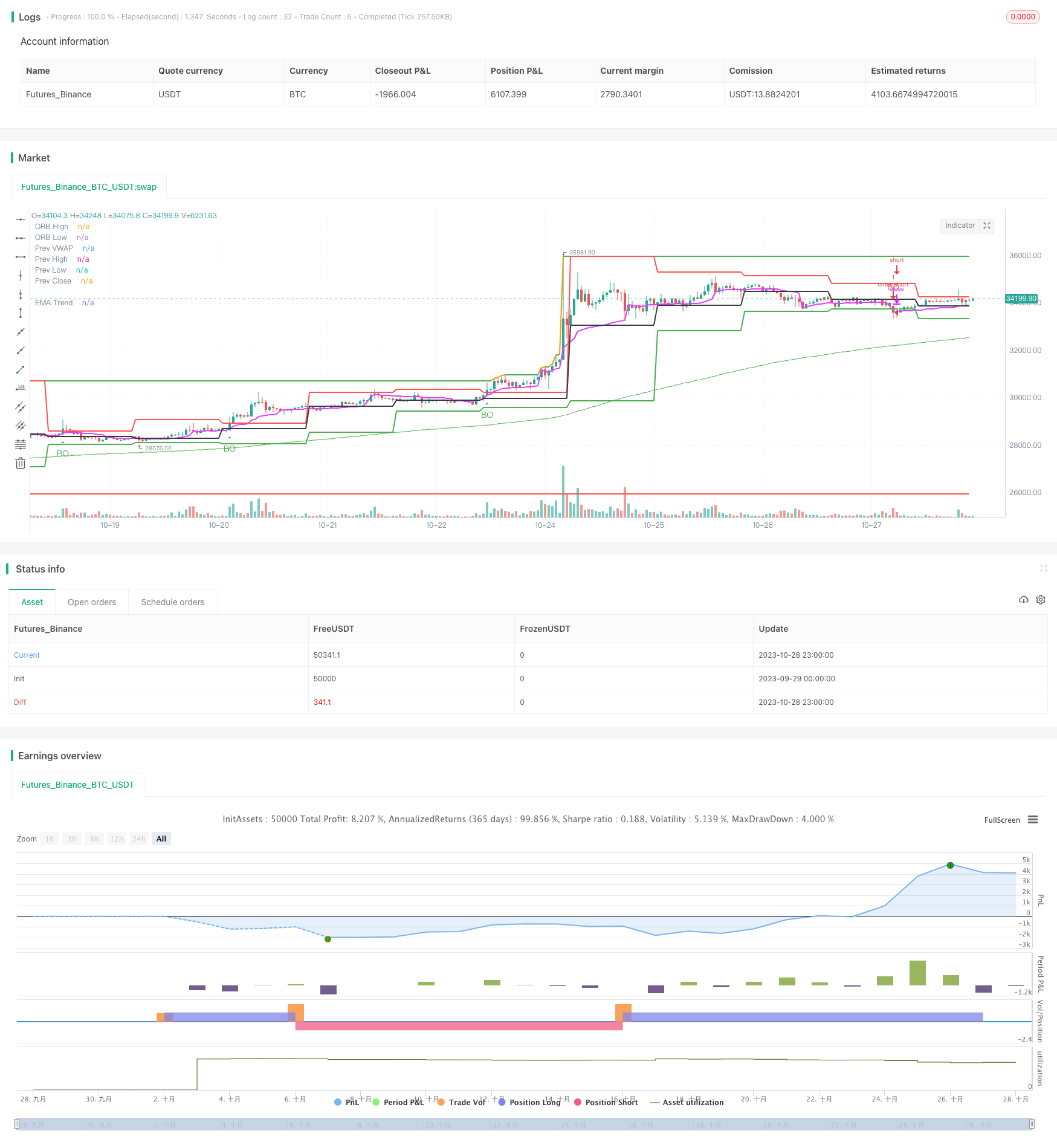

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=5

// Open-Range-Breakout strategy

// No license. Free and Open Source.

strategy('Strategy: ORB', shorttitle="ORB", overlay=true , currency=currency.NONE, initial_capital=100000)

// Inputs

period = input.int(defval=15, title="TimeRange", tooltip="The range in minutes (default: 15m)")

sessionInput = input(defval="0915-0930", title="Time Range", group="ORB settings", tooltip='What is the timeperiod (default 9:15AM to 9:30AM, exchange timezone')

hide = input.bool(defval = false, title="Hide ORB Range", group="ORB setting", tooltip = 'Hide the ORB range drawing')

// SL Related

slAtrLen = input.int(defval=14, title="ATR Period for placing SL", group="StopLoss settings")

showSLLines = input.bool(defval=false, title="Show SL lines in chart", tooltip="Show SL lines also as dotted lines in chart. Note: chart may look untidy.", group="StopLoss settings")

// Further Filtering

ignoreMementumVolume = input.bool(defval=false, title="Ignore Momentum & Volume", tooltip="Ignore Momentum & Volume to find out trades", group="Strengh Settings")

rsiLen = input.int(defval=14, title="Momentum Period", group="Strengh Settings", tooltip = 'To determine the momentum, RSI period is set default to 100')

rsiBullish = input.int(defval=50, step=1, title="Bullish Momentum", group="Strengh Settings", tooltip = 'Bullish Momentum, default set to RSI as 50')

rsiBearish = input.int(defval=50, step=1, title="Bearish Momentum", group="Strengh Settings", tooltip = 'Bearish Momentum, default set to RSI as 50')

volAvg = input.int(defval=20, step=1, title="Volume Average Period", group="Strengh Settings", tooltip = 'To calculate average volume, how many historical bars are considered. Default: 20.')

volThreshold = input.float(defval=1, step=0.1, title="Volume Strengh", group="Strengh Settings", tooltip = 'Multiplier: How big the current bar volume compared to average of last 20')

trendPeriod = input.int(defval=200, step=1, title="Trend Period", group="Trend Settings", tooltip = 'To calculate trend, what period is considered. Default: 200.')

hideTrend = input.bool(defval = false, title="Hide the trend line", group="Trend Settings", tooltip = 'Hide the trend')

hidePDHCL = input.bool(defval = false, title="Hide the PDHCL (prev day High Close Low range)", tooltip = 'Hide the Previous Day High, Close, Low lines')

hideTable = input.bool(defval = false, title="Hide the Summary Table", tooltip = 'Hide the summary table.')

// Trade related

rrRatio = input.float(title='Risk:Reward', step=0.1, defval=2.0, group="Trade settings")

endOfDay = input.int(defval=1500, title="Close all trades, default is 3:00 PM, 1500 hours (integer)", group="Trade settings")

mktAlwaysOn = input.bool(defval=true, title="Markets that never closed (Crypto, Forex, Commodity)", tooltip="Some markers never closes. For those cases, make this checked.", group="Trade settings")

lotSize = input.int(title='Lot Size', step=1, defval=1, group="Trade settings")

// Util method

is_newbar(res) =>

timeframe.change(time(res)) != 0

// print table

printTable(txt) =>

var table t = table.new(position.bottom_right, 1, 1)

table.cell(t, 0, 0, txt, text_halign = text.align_left, bgcolor = color.lime)

// globals

t = time(timeframe.period, sessionInput + ":1234567") // everyday

in_session = not na(t)

is_first = in_session and not in_session[1]

is_end_session = in_session[1] and not in_session

green(open, close) => close > open ? true : false

red(open, close) => close < open ? true : false

var float orb_high = na

var float orb_low = na

if is_first

orb_high := high

orb_low := low

else

orb_high := orb_high[1]

orb_low := orb_low[1]

if high > orb_high and in_session

orb_high := high

if low < orb_low and in_session

orb_low := low

plot(hide ? na : orb_high, style=plot.style_line, color=orb_high[1] != orb_high ? na : color.green, title="ORB High", linewidth=2)

plot(hide ? na : orb_low, style=plot.style_line, color=orb_low[1] != orb_low ? na : color.red, title="ORB Low", linewidth=2)

// PDHCL (Previous Day High Close Low)

[dh,dl,dc] = request.security(syminfo.ticker, "D", [high[1],low[1], close[1]], lookahead=barmerge.lookahead_on)

plot(hidePDHCL ? na : dh, title="Prev High", color=color.red, linewidth=2, trackprice=true, show_last = 1)

plot(hidePDHCL ? na : dl, title="Prev Low", color=color.green, linewidth=2, trackprice=true, show_last = 1)

plot(hidePDHCL ? na : dc, title="Prev Close", color=color.black, linewidth=2, trackprice=true, show_last = 1)

plot(hidePDHCL ? na : ta.vwap(close), title="Prev VWAP", color=color.fuchsia, linewidth=2, trackprice=true, show_last = 1)

var l1 = label.new(bar_index, hidePDHCL ? na : dh, 'PDH', style=label.style_label_right)

// Previous Day WWAP

// For SL calculation

atr = ta.atr(slAtrLen)

highestHigh = ta.highest(high, 7)

lowestLow = ta.lowest(low, 7)

longStop = showSLLines ? lowestLow - (atr * 1) : na

shortStop = showSLLines ? highestHigh + (atr * 1) : na

plot(longStop, title="Buy SL", color=color.green, style=plot.style_cross)

plot(shortStop, title="Sell SL", color=color.red, style=plot.style_cross)

// Momentum: rsi

rsi = ta.rsi(close, rsiLen)

// trend: EMA200

ema = ta.ema(close, trendPeriod)

plot(hideTrend ? na : ema, "EMA Trend", color=close > ema ? color.green : color.red, linewidth = 1)

// Volume-Weighed Moving Average calculation

vwmaAvg = ta.vwma(close, volAvg)

vwma_latest = volume

// plotshape((barstate.isconfirmed and (vwma_latest > (vwmaAvg * volThreshold))), title='VolumeData', text='', location=location.abovebar, style=shape.diamond, color=color.gray, textcolor=color.gray, size=size.tiny)

// Trade signals

longCond = barstate.isconfirmed and (ta.crossover(close, orb_high) or ta.crossover(close, dh)) and green(open, close) and (ignoreMementumVolume ? true : rsi > rsiBullish and (vwma_latest > (vwmaAvg * volThreshold)))

shortCond = barstate.isconfirmed and (ta.crossunder(close, orb_low) or ta.crossunder(close, dl)) and red(open, close) and (ignoreMementumVolume ? true : rsi < rsiBearish and (vwma_latest > (vwmaAvg * volThreshold)))

plotshape(longCond, title='Breakout', text='BO', location=location.belowbar, style=shape.triangleup, color=color.green, textcolor=color.green)

plotshape(shortCond, title='Breakout', text='BD', location=location.abovebar, style=shape.triangledown, color=color.red, textcolor=color.red)

// Trade execute

h = hour(time('1'), syminfo.timezone)

m = minute(time('1'), syminfo.timezone)

hourVal = h * 100 + m

totalTrades = strategy.opentrades + strategy.closedtrades

if (mktAlwaysOn or (hourVal < endOfDay))

// Entry

var float sl = na

var float target = na

if (longCond)

strategy.entry("enter long", strategy.long, lotSize, limit=na, stop=na, comment="Enter Long")

sl := longStop

target := close + ((close - longStop) * rrRatio)

alert('Buy:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

if (shortCond)

strategy.entry("enter short", strategy.short, lotSize, limit=na, stop=na, comment="Enter Short")

sl := shortStop

target := close - ((shortStop - close) * rrRatio)

alert('Sell:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

// Exit: target or SL

if ((close >= target) or (close <= sl))

strategy.close("enter long", comment=close < sl ? "Long SL hit" : "Long target hit")

if ((close <= target) or (close >= sl))

strategy.close("enter short", comment=close > sl ? "Short SL hit" : "Short target hit")

else if (not mktAlwaysOn)

// Close all open position at the end if Day

strategy.close_all(comment = "Close all entries at end of day.")

// Plotting table

if (not hideTable and is_end_session)

message = syminfo.ticker + " :\n\nORB Upper: " + str.tostring(math.round(orb_high)) + "\nORB Lower: " + str.tostring(math.round(orb_low)) + "\nPDH: " + str.tostring(math.round(dh)) + "\nPDC: " + str.tostring(math.round(dc)) + "\nPDL: " + str.tostring(math.round(dl)) + "\nVWAP: " + str.tostring(math.round(ta.vwap(close)))

printTable(message)

alert(message, alert.freq_once_per_bar_close)