概述

可扩展突破交易策略通过识别价格的关键支撑阻力区域,在价格突破这些区域时生成交易信号,是一个非常灵活可扩展的突破策略。该策略可以通过调整参数适用于不同时间周期,也可以轻松地集成各种额外的过滤条件和风险管理机制,从而针对特定资产进行优化。

策略原理

该策略首先利用swings()函数基于回看期计算出当前价格的波动高点和波动低点。回看期通过swingLookback参数设置,默认为20根K线。之后,当价格突破波动高点时,做多;当价格跌破波动低点时,做空。

做多信号的具体逻辑是,当收盘价大于等于波动高价时,做多。做空信号的具体逻辑是,当收盘价小于等于波动低价时,做空。

此外,策略还设置了止损位,通过stopTargetPercent参数来设定止损幅度。如做多止损价设置为最高价的5%以下,做空止损价设置为最低价的5%以上。

该策略的优势在于可以通过调整回看期来控制交易频率。回看期越短,对突破越敏感,交易频率越高。回看期过长则相反,交易频率下降但可能错过机会。所以找到最佳回看期对策略优化很关键。

策略优势

- 简单的突破思路,容易理解实现

- 可通过调节回看期优化参数,控制交易频率

- 可轻松集成止损、移动止损等风险管理机制

- 可扩展性强,可以加入各种过滤条件提高获利率

- 可应用在任何时间周期,适合日内和长线交易

风险及对策

- 回看期设置过短可能造成过度交易

- 回看期过长可能错过交易机会

- 止损设置过宽可能缩小盈利空间

- 止损过窄可能导致止损频繁被触发

对策:

- 测试不同的回看期,找到最佳参数组合

- 优化止损幅度,平衡获利空间和风险控制

- 可以加入移动止损或环形止损来锁定利润

- 增加过滤条件,提高获利交易的概率

优化方向

该策略可以从以下几个方面进行优化:

测试不同的回看期参数,找到最优参数组合;

测试不同的交易周期,如5分钟、15分钟、1小时等,选择最佳周期;

优化止损幅度,平衡获利空间和风险控制;

增加过滤条件,如交易量过滤,涨跌幅过滤等,减少不优质信号;

集成更多风险管理机制,如移动止损、锁定利润等;

参数优化,使用步进优化、随机搜索等找到最优参数;

集成机器学习技术,利用AI对参数进行自动优化。

总结

可扩展突破交易策略是一个非常实用的突破系统。它简单易用,可定制性强,可以通过调整回看期和集成各种过滤条件来针对不同资产进行优化。同时,可轻松集成各类风险管理机制来控制交易风险。通过参数优化和机器学习等技术的引入,该策略可以不断升级,适应市场的变化。总体来说,它是一个值得推荐的通用突破策略。

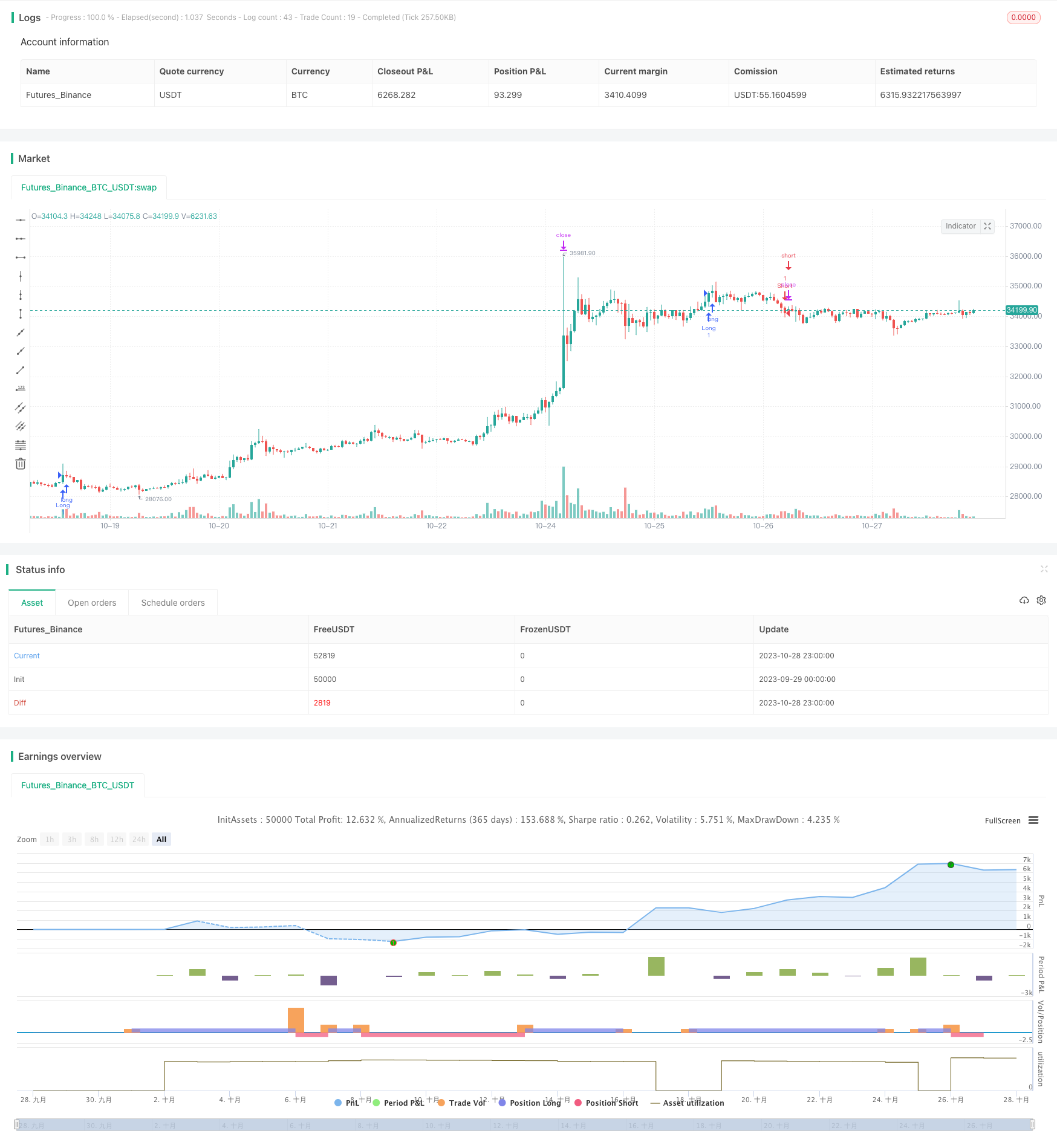

/*backtest

start: 2023-09-29 00:00:00

end: 2023-10-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © deperp

//@version=5

// strategy("Range Breaker", overlay=true, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, commission_type=strategy.commission.percent, commission_value=0.07, pyramiding=0)

// Backtest Time Period

useDateFilter = input.bool(true, title="Begin Backtest at Start Date",

group="Backtest Time Period")

backtestStartDate = input(timestamp("1 Jan 2020"),

title="Start Date", group="Backtest Time Period",

tooltip="This start date is in the time zone of the exchange " +

"where the chart's instrument trades. It doesn't use the time " +

"zone of the chart or of your computer.")

inTradeWindow = true

swingLookback = input.int(20, title="Swing Lookback", minval=3)

stopTargetPercent = input.float(5, title="Stop Target Percentage", step=0.1)

// Calculate lockback swings

swings(len) =>

var highIndex = bar_index

var lowIndex = bar_index

var swingHigh = float(na)

var swingLow = float(na)

upper = ta.highest(len)

lower = ta.lowest(len)

if high[len] > upper

highIndex := bar_index[len]

swingHigh := high[len]

if low[len] < lower

lowIndex := bar_index[len]

swingLow := low[len]

[swingHigh, swingLow, highIndex, lowIndex]

// Strategy logic

[swingHigh, swingLow, highIndex, lowIndex] = swings(swingLookback)

longCondition = inTradeWindow and (ta.crossover(close, swingHigh))

shortCondition = inTradeWindow and (ta.crossunder(close, swingLow))

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

longStopTarget = close * (1 + stopTargetPercent / 100)

shortStopTarget = close * (1 - stopTargetPercent / 100)

strategy.exit("Long Stop Target", "Long", limit=longStopTarget)

strategy.exit("Short Stop Target", "Short", limit=shortStopTarget)

// Plot break lines

// line.new(x1=highIndex, y1=swingHigh, x2=bar_index, y2=swingHigh, color=color.rgb(255, 82, 82, 48), width=3, xloc=xloc.bar_index, extend=extend.right)

// line.new(x1=lowIndex, y1=swingLow, x2=bar_index, y2=swingLow, color=color.rgb(76, 175, 79, 47), width=3, xloc=xloc.bar_index, extend=extend.right)

// Alert conditions for entry and exit

longEntryCondition = inTradeWindow and (ta.crossover(close, swingHigh))

shortEntryCondition = inTradeWindow and (ta.crossunder(close, swingLow))

longExitCondition = close >= longStopTarget

shortExitCondition = close <= shortStopTarget

alertcondition(longEntryCondition, title="Long Entry Alert", message="Enter Long Position")

alertcondition(shortEntryCondition, title="Short Entry Alert", message="Enter Short Position")

alertcondition(longExitCondition, title="Long Exit Alert", message="Exit Long Position")

alertcondition(shortExitCondition, title="Short Exit Alert", message="Exit Short Position")