概述

双均线交叉策略是一种基于移动平均线的趋势跟踪策略。该策略通过计算不同周期的均线,判断市场趋势方向,以发出买入和卖出信号。本策略采用快速均线和慢速均线交叉形成交易信号。当快线上穿慢线时,采取看涨立场买入;当快线下穿慢线时,采取看跌立场卖出。

策略原理

本策略主要依靠均线交叉形成交易信号。具体来说,策略包含以下几个步骤:

计算快速均线和慢速均线。快速均线周期为10,慢速均线周期为50。

判断均线关系。当快速均线上穿慢速均线时,产生买入信号;当快速均线下穿慢速均线时,产生卖出信号。

发出买入卖出信号。产生买入信号时,进入多头仓位;产生卖出信号时,进入空头仓位。

设置止损止盈。交易入场后,根据输入的止损百分比设置止损位和止盈位,实现风险控制。

该策略通过比较不同时间周期价格趋势的变化,来判断市场目前处于上升趋势还是下降趋势,属于典型的趋势跟踪策略。由于均线能过滤市场噪音,使得交易信号更加可靠。

策略优势

- 利用均线的趋势跟踪特性,能够有效捕捉中长线趋势。

- 均线交叉信号简单清晰,容易执行。

- 可自定义快线和慢线的周期,优化参数组合。

- 采用止损止盈方式,可以限制个别订单的损失。

策略风险

- 当市场处于震荡态势时,容易产生频繁的交易信号,造成过度交易。

- 均线具有滞后性,可能错过短线机会。

- 未考虑突发事件的影响,如重大利空消息。

- 没有设置资金管理机制,容易造成超出风险承受能力的损失。

风险控制措施:

- 优化均线周期,减少震荡市场下的虚假信号。

- 结合其他指标作为过滤条件,避免均线滞后问题。

- 增加消息面分析作为辅助。

- 设置止损与持仓规模控制,控制单笔损失。

策略优化

可考虑将均线系统与其他分析工具组合使用,如通道、形态等,提高交易信号质量。

优化快线和慢线的参数,寻找最佳组合。一般快线周期在10到30天之间,慢线周期在20到120天之间会较好。

增加仓位管理机制。如采用固定比例递增法,能够在趋势中获得较优利润。

增加对突发事件的判断。重大利空消息发布时可考虑暂停交易,避免异常大亏损。

进行回测与模拟交易,评估策略表现,不断改进策略系统。

总结

双均线交叉策略通过比较快速均线和慢速均线的交叉情况,判断市场目前的趋势方向,属于简单实用的趋势跟踪策略。该策略优点是交易信号清晰、易于实现,但也存在一些局限性。我们可以通过参数优化、增加过滤条件、组合其他工具等方法来改进该策略,在控制风险的前提下获得更好的回报。

策略源码

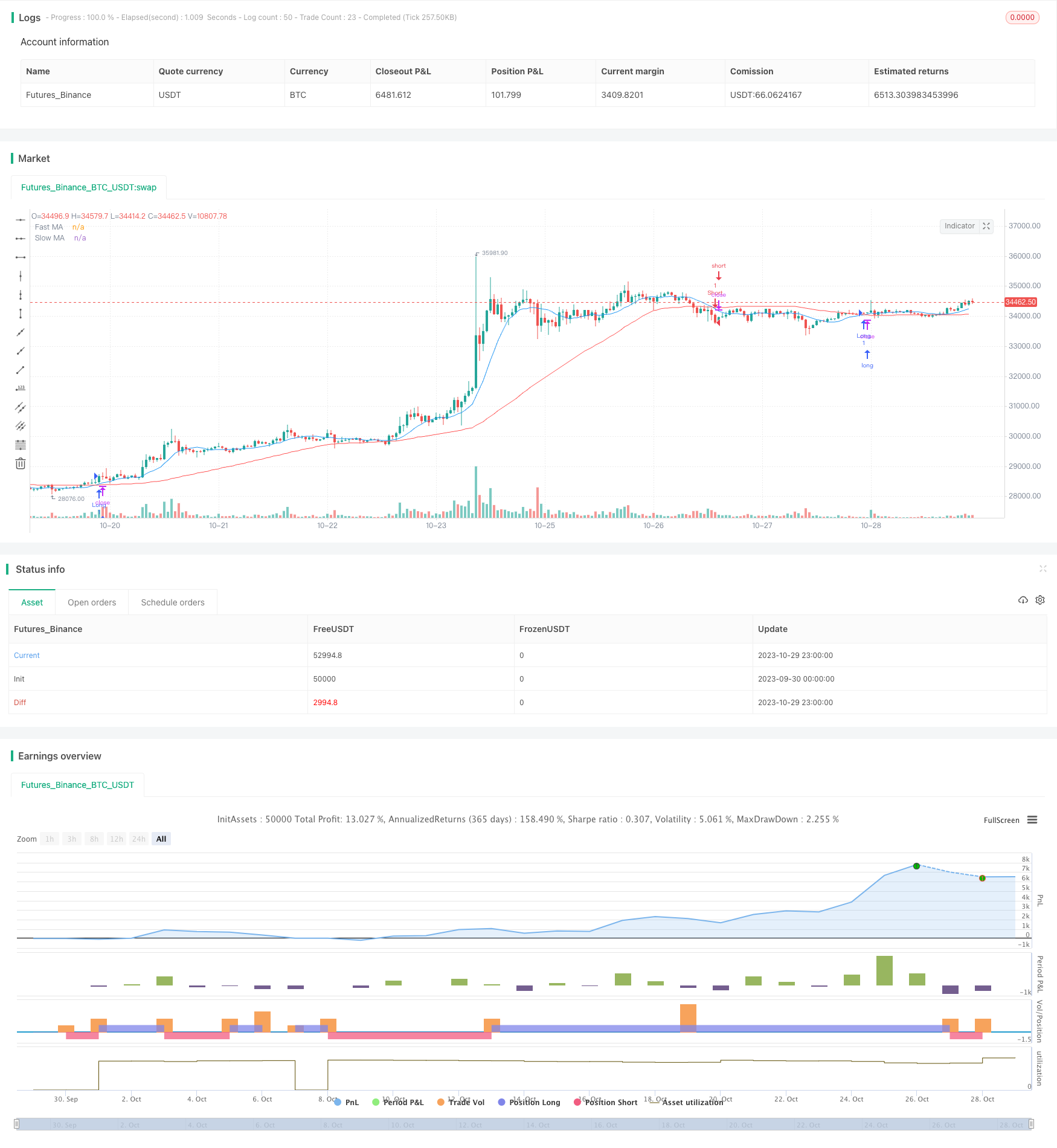

/*backtest

start: 2023-09-30 00:00:00

end: 2023-10-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Simple Moving Average Crossover", overlay=true)

// Input parameters

fast_length = input(10, title="Fast MA Length")

slow_length = input(50, title="Slow MA Length")

stop_loss_pct = input(1, title="Stop Loss Percentage", minval=0, maxval=5) / 100

// Calculate moving averages

fast_ma = sma(close, fast_length)

slow_ma = sma(close, slow_length)

// Plot moving averages

plot(fast_ma, color=color.blue, title="Fast MA")

plot(slow_ma, color=color.red, title="Slow MA")

// Strategy logic

long_condition = crossover(fast_ma, slow_ma)

short_condition = crossunder(fast_ma, slow_ma)

// Execute trades

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

// Set stop loss

long_stop_price = close * (1 - stop_loss_pct)

short_stop_price = close * (1 + stop_loss_pct)

strategy.exit("Stop Loss/Profit", from_entry="Long", stop=long_stop_price)

strategy.exit("Stop Loss/Profit", from_entry="Short", stop=short_stop_price)