概述

该策略基于EMA(指数移动平均线)和MAMA(MESA自适应移动平均线)两个指标,根据它们的交叉情况来判断行情趋势和产生交易信号。EMA常用于判断市场趋势方向,而MAMA可以更准确地捕捉市场转折点,两者配合使用可以提高策略的性能。

策略原理

- 计算快速EMA和慢速EMA,它们分别反映市场短期和长期趋势

- 计算MAMA和FAMA线,它们分别为自适应移动平均线

- 当快速EMA上穿慢速EMA时,产生买入信号

- 当快速EMA下穿慢速EMA时,产生卖出信号

- 当MAMA上穿FAMA时,产生买入信号

- 当MAMA下穿FAMA时,产生卖出信号

- MAMA和FAMA的交叉可用于验证EMA交叉信号或提前捕捉趋势转折

具体来说,策略首先计算快速EMA(fl)和慢速EMA(sl),分别反映短期和长期趋势。

然后根据John Ehlers的公式计算MAMA和FAMA: 1. 计算价格的 Hilbert Transform 并提取信号的相位信息 2. 根据相位信息计算信号的瞬时周期p 3. 根据p值计算α权重 4. 根据α权重计算MAMA和FAMA

最后,策略根据EMA和MAMA/FAMA的交叉情况来产生交易信号: - EMA金叉时做多 - EMA死叉时做空 - MAMA上穿FAMA时做多 - MAMA下穿FAMA时做空

优势分析

该策略结合EMA和MAMA指标的优势,可以提高交易信号的准确性。

EMA的优势: - 能够有效平滑价格数据,减少噪音 - 能跟踪市场趋势且有一定的滞后性 - 参数灵活,可调整对短期和长期趋势的敏感度

MAMA的优势: - 自适应参数,不需要人为指定周期 - 响应迅速,可提前捕捉趋势转折 - 准确识别支撑和阻力区域

两者配合使用的优势: - EMA判断主要趋势方向 - MAMA验证信号并提前捕捉转折 - 提高信号的准确性和胜率

风险分析

该策略主要存在以下风险:

- EMA和MAMA均为后期确认指标, Entry 点稍有滞后,可能带来滑点风险

- 大幅震荡行情中,EMA和MAMA交叉频繁,会产生多头套和空头套

- EMA和MAMA参数设置不当,可能错过趋势或产生假信号

对应措施:

- 采用止损来控制亏损

- 合理选择参数,避免过于灵敏

- 与其他指标组合使用,确认信号

优化方向

该策略可从以下方面进行优化:

- 优化EMA周期参数,使其更符合不同品种的特点

- 调整MAMA参数α的灵敏度,优化捕捉转折的速度

- 增加其他指标过滤,如MACD、RSI等,避免假信号

- 增加止损策略,以控制风险

- 进行回测优化,选择最佳的参数组合

- 增加自动止盈,让利润最大化

总结

该策略整合EMA和MAMA两个指标的优势,能够顺势而为,及时捕捉趋势转折,是一种可靠的跟踪趋势类策略。通过参数优化和风险控制,可以提高策略的胜率和盈利能力。但用户仍需根据自身风险偏好谨慎操作。

策略源码

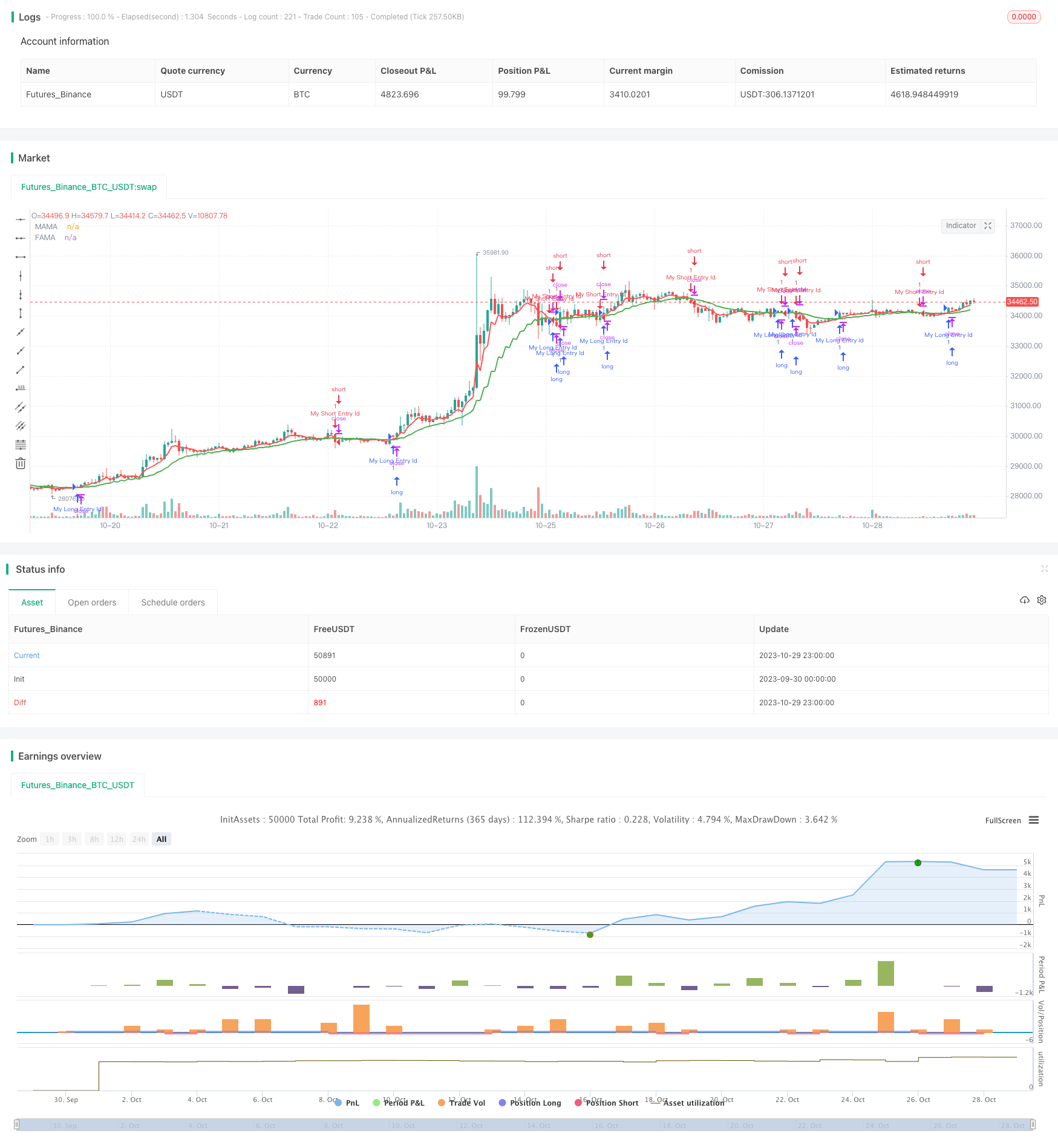

/*backtest

start: 2023-09-30 00:00:00

end: 2023-10-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("EMAMA strategy", overlay=true)

//This entire strategy is courtesy of LazyBear for programming the original EMAMA system, I simply added a strategy element to everything to round things out.

src=input(hl2, title="Source")

fl=input(.5, title="Fast Limit")

sl=input(.05, title="Slow Limit")

sp = (4*src + 3*src[1] + 2*src[2] + src[3]) / 10.0

dt = (.0962*sp + .5769*nz(sp[2]) - .5769*nz(sp[4])- .0962*nz(sp[6]))*(.075*nz(p[1]) + .54)

q1 = (.0962*dt + .5769*nz(dt[2]) - .5769*nz(dt[4])- .0962*nz(dt[6]))*(.075*nz(p[1]) + .54)

i1 = nz(dt[3])

jI = (.0962*i1 + .5769*nz(i1[2]) - .5769*nz(i1[4])- .0962*nz(i1[6]))*(.075*nz(p[1]) + .54)

jq = (.0962*q1 + .5769*nz(q1[2]) - .5769*nz(q1[4])- .0962*nz(q1[6]))*(.075*nz(p[1]) + .54)

i2_ = i1 - jq

q2_ = q1 + jI

i2 = .2*i2_ + .8*nz(i2[1])

q2 = .2*q2_ + .8*nz(q2[1])

re_ = i2*nz(i2[1]) + q2*nz(q2[1])

im_ = i2*nz(q2[1]) - q2*nz(i2[1])

re = .2*re_ + .8*nz(re[1])

im = .2*im_ + .8*nz(im[1])

p1 = iff(im!=0 and re!=0, 360/atan(im/re), nz(p[1]))

p2 = iff(p1 > 1.5*nz(p1[1]), 1.5*nz(p1[1]), iff(p1 < 0.67*nz(p1[1]), 0.67*nz(p1[1]), p1))

p3 = iff(p2<6, 6, iff (p2 > 50, 50, p2))

p = .2*p3 + .8*nz(p3[1])

spp = .33*p + .67*nz(spp[1])

phase = atan(q1 / i1)

dphase_ = nz(phase[1]) - phase

dphase = iff(dphase_< 1, 1, dphase_)

alpha_ = fl / dphase

alpha = iff(alpha_ < sl, sl, iff(alpha_ > fl, fl, alpha_))

mama = alpha*src + (1 - alpha)*nz(mama[1])

fama = .5*alpha*mama + (1 - .5*alpha)*nz(fama[1])

pa=input(false, title="Mark crossover points")

plotarrow(pa?(cross(mama, fama)?mama<fama?-1:1:na):na, title="Crossover Markers")

fr=input(false, title="Fill MAMA/FAMA Region")

duml=plot(fr?(mama>fama?mama:fama):na, style=circles, color=gray, linewidth=0, title="DummyL")

mamal=plot(mama, title="MAMA", color=red, linewidth=2)

famal=plot(fama, title="FAMA", color=green, linewidth=2)

fill(duml, mamal, red, transp=70, title="NegativeFill")

fill(duml, famal, green, transp=70, title="PositiveFill")

ebc=input(false, title="Enable Bar colors")

bc=mama>fama?lime:red

barcolor(ebc?bc:na)

longCondition = crossover(mama, fama)

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = crossunder(mama, fama)

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)