概述

本策略基于枢轴指标,通过枢轴指标判断当前趋势方向,并结合RSI指标进行反向操纵,以达到追踪趋势的目的。

策略原理

本策略利用SMA移动平均线和RSI相对强弱指标构建枢轴指标。具体计算方法如下:

- 计算N日SMA移动平均线

- 计算M日RSI指标

- 当收盘价高于SMA时,枢轴指标=(RSI-35) / (85-35)

- 当收盘价低于SMA时,枢轴指标=(RSI-20) / (70-20)

- 根据枢轴指标值判断趋势方向

- 枢轴指标>50为看涨

- 枢轴指标<50为看跌

根据枢轴指标信号,进行反向操纵,即看涨时做空,看跌时做多,以追踪趋势方向。

本策略的关键在于运用枢轴指标判断趋势方向,并进行反向操纵,从而追踪市场趋势。

优势分析

本策略主要具有以下优势:

运用枢轴指标判断趋势方向准确。枢轴指标综合考虑了移动平均线和RSI指标,能较准确判断趋势转折点。

采用反向操纵策略,可有效追踪趋势。当出现趋势反转时,及时进行反向操作,追踪趋势走势。

RSI参数设置可调节策略灵敏度。RSI参数越小,对市场变化越敏感,可针对不同市场调整参数。

可灵活调整SMA周期,适应不同周期的趋势分析。

可切换做多做空方向,适应不同行情方向。

资金利用效率高,不需要大量资金即可获得较好收益。

风险分析

本策略也存在一定的风险:

枢轴指标存在误判风险,可能出现背离导致判断失误。

反向操纵策略亏损风险较大,需要严格控制止损。

趋势较强时,无法及时反转操作,可能错过趋势。

参数设置不当可能导致过于灵敏或迟钝。

交易频繁,交易费用是一大负担。

对应风险管理措施:

合理设置移动平均线周期,避免误判。

严格止损,控制单笔亏损。

采用分批建仓,降低风险。

参数优化测试,选择适合本策略的参数组合。

优化止损策略,降低损失。

优化方向

本策略可从以下几个方面进行优化:

优化指标参数,选择最优参数组合。可以通过遍历回测确定最佳参数。

优化止损策略。可以设置余弦波动止损、跟踪止损等动态止损方案。

结合其他指标过滤信号。可以加入MACD、KDJ等指标,避免误信号。

采用机器学习方法自动优化。使用进化算法、强化学习等方法自动寻找最优参数。

结合量价关系选时。如成交量突增时才考虑进场。

采用基于模型的止损。建立股价波动模型,进行动态止损。

利用高频数据进行止损优化。

总结

本策略基于枢轴指标判断趋势方向,采用反向操纵模式追踪趋势,可有效跟踪市场趋势走向。优点是判断准确、灵活、资金利用效率高,但也存在一定的误判风险和亏损风险。通过参数优化、止损优化等手段,可以进一步提高策略盈利能力和稳定性。本策略为一种较为典型的定量交易策略,整体思路清晰,值得深入研究。

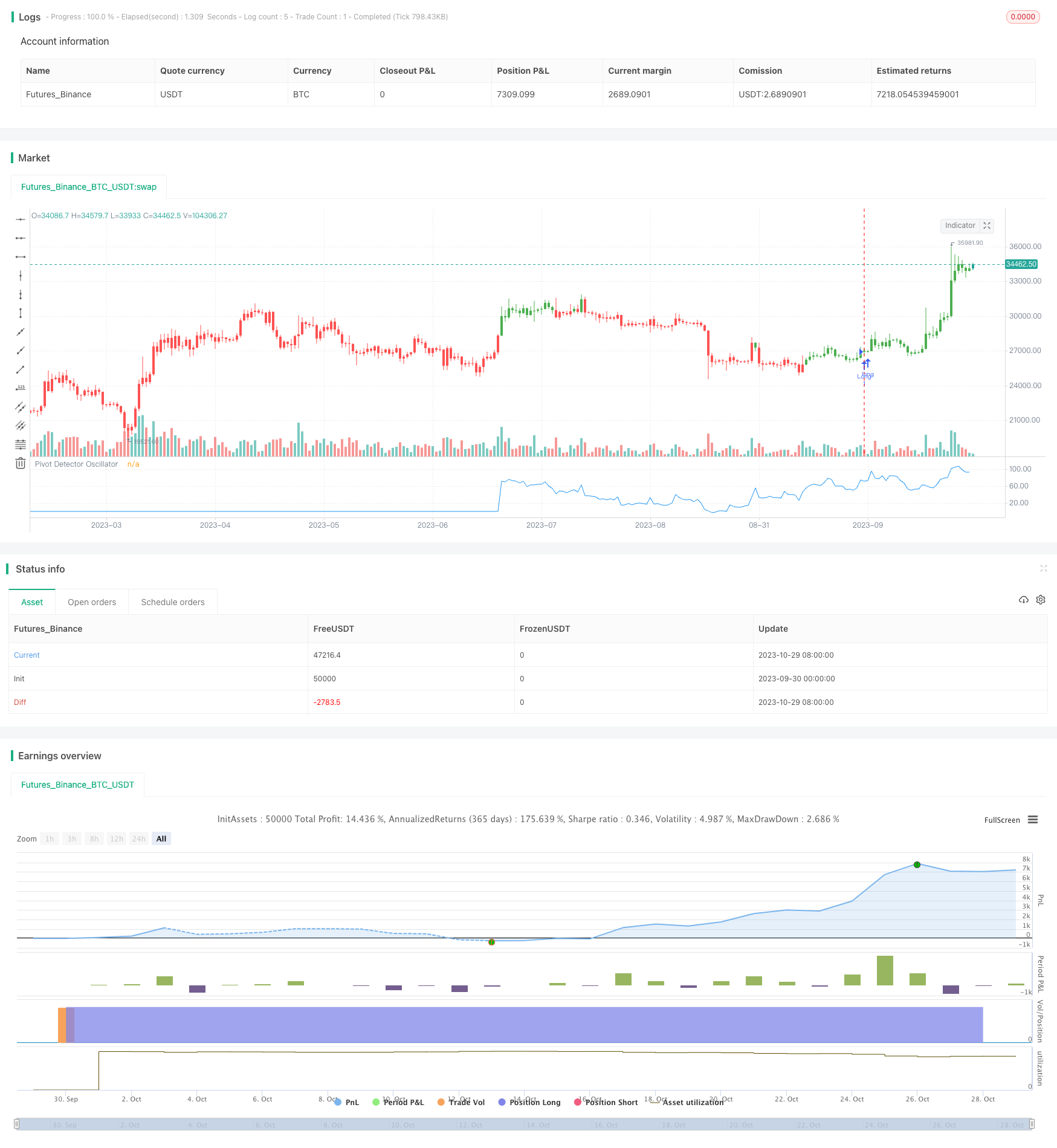

/*backtest

start: 2023-09-30 00:00:00

end: 2023-10-30 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 03/10/2017

// The Pivot Detector Oscillator, by Giorgos E. Siligardos

// The related article is copyrighted material from Stocks & Commodities 2009 Sep

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="The Pivot Detector Oscillator, by Giorgos E. Siligardos")

Length_MA = input(200, minval=1)

Length_RSI = input(14, minval=1)

UpBand = input(100, minval=1)

DownBand = input(0)

MidlleBand = input(50)

reverse = input(false, title="Trade reverse")

// hline(MidlleBand, color=black, linestyle=dashed)

// hline(UpBand, color=red, linestyle=line)

// hline(DownBand, color=green, linestyle=line)

xMA = sma(close, Length_MA)

xRSI = rsi(close, Length_RSI)

nRes = iff(close > xMA, (xRSI - 35) / (85-35),

iff(close <= xMA, (xRSI - 20) / (70 - 20), 0))

pos = iff(nRes * 100 > 50, 1,

iff(nRes * 100 < 50, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(nRes * 100, color=blue, title="Pivot Detector Oscillator")