谱龄策略

概述

谱龄策略是一种基于价格通道的趋势跟踪策略。它使用快速和慢速的唐奇安通道来识别趋势方向,并在回调时进行逢低买入和逢高卖出。该策略优点是可以自动跟踪趋势,在趋势变化时及时止损和反向开仓。但也存在回撤和止损点过于接近的风险。

策略原理

该策略首先定义快速通道周期为20根K线,慢速通道周期为50根K线。快速通道用于设置止损价格,慢速通道用于判断趋势方向和入场时机。

策略首先计算快速通道的最高价和最低价,并取中线作为止损线。同时计算慢速通道的最高价和最低价,通道上沿和下沿作为入场线。

当价格突破慢速通道上沿时,做多;当价格突破慢速通道下沿时,做空。入场后,止损点设在快速通道中线。

这样,慢速通道判断大趋势方向,快速通道跟踪小范围内突破判断止损点。当大趋势反转时,价格会首先突破快速通道止损线,实现止损。

策略优势

自动跟踪趋势,及时止损。使用双通道结构,可以自动跟踪趋势,在趋势反转时快速止损。

回调开仓,具有一定的趋势过滤效果。只在价格突破通道边界时开仓,可以滤除部分非趋势性假突破。

风险可控。止损距离较近,可以控制单笔损失。

策略风险

回撤较大。趋势跟踪策略回撤可以较大,需要有心理准备。

止损点过于接近。快速通道周期较短,止损距离较近,容易被套。可以适当放宽快速通道周期。

容易产生过多交易。双通道结构导致买卖点较多,需要合理控制仓位。

优化方向

增加开仓过滤条件。可以在开仓条件中加入volatility等指标,过滤趋势性不强的突破。

优化通道周期参数。可以通过更系统的方法寻找最优通道参数组合。

结合多个时间周期决策。可以在更高时间周期确定大趋势,在较低周期进行具体交易。

动态调整止损距离。可以根据市场波动程度动态调整止损距离。

总结

谱龄策略整体是一个较为标准的趋势跟踪策略。它利用价格通道判断趋势方向,并设定止损来控制风险。该策略具有一定的优势,但也存在回撤和止损点过近的问题。通过优化通道参数、增加过滤条件等方法,可以获得更好的策略效果。但需要注意的是,趋势跟踪策略对交易者的心态要求较高,需要做好回撤的心理准备。

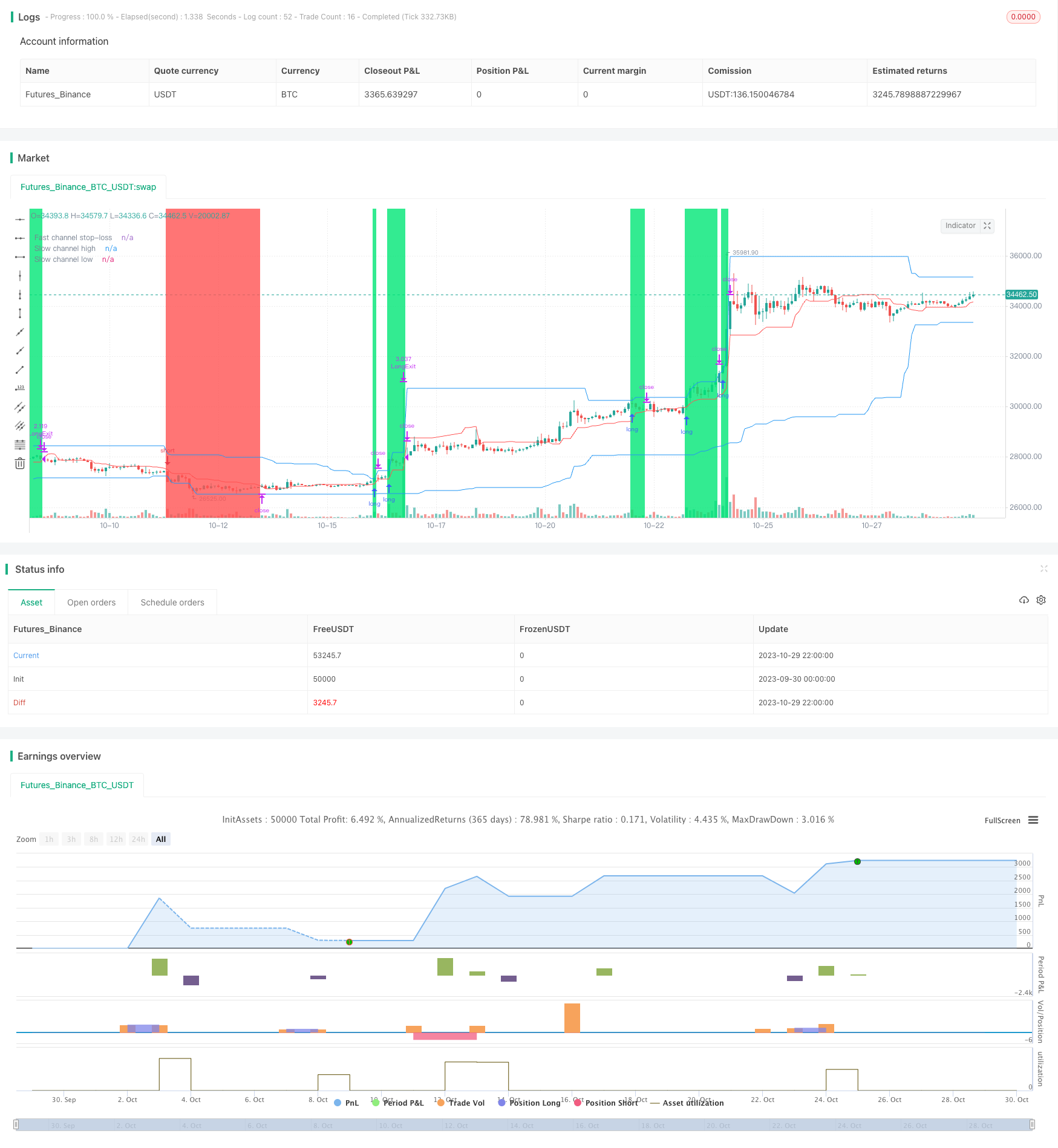

/*backtest

start: 2023-09-30 00:00:00

end: 2023-10-30 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2020

//@version=4

strategy("Noro's RiskTurtle Strategy", shorttitle = "RiskTurtle str", overlay = true, default_qty_type = strategy.percent_of_equity, initial_capital = 100, default_qty_value = 100, commission_value = 0.1)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

risk = input(2, minval = 0.1, maxval = 99, title = "Risk size, %")

fast = input(20, minval = 1, title = "Fast channel (for stop-loss)")

slow = input(50, minval = 1, title = "Slow channel (for entries)")

showof = input(true, defval = true, title = "Show offset")

showll = input(true, defval = true, title = "Show lines")

showdd = input(true, defval = true, title = "Show label (drawdown)")

showbg = input(true, defval = true, title = "Show background")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Donchian price channel fast

hf = highest(high, fast)

lf = lowest(low, fast)

center = (hf + lf) / 2

//Donchian price chennal slow

hs = highest(high, slow)

ls = lowest(low, slow)

//Lines

colorpc = showll ? color.blue : na

colorsl = showll ? color.red : na

offset = showof ? 1 : 0

plot(hs, offset = offset, color = colorpc, title = "Slow channel high")

plot(ls, offset = offset, color = colorpc, title = "Slow channel low")

plot(center, offset = offset, color = colorsl, title = "Fast channel stop-loss")

//Background

size = strategy.position_size

colorbg = showbg == false ? na : size > 0 ? color.lime : size < 0 ? color.red : na

bgcolor(colorbg, transp = 70)

//Var

loss = 0.0

maxloss = 0.0

equity = 0.0

truetime = true

//Lot size

risksize = -1 * risk

risklong = ((center / hs) - 1) * 100

coeflong = abs(risksize / risklong)

lotlong = (strategy.equity / close) * coeflong

riskshort = ((center / ls) - 1) * 100

coefshort = abs(risksize / riskshort)

lotshort = (strategy.equity / close) * coefshort

//Orders

strategy.entry("Long", strategy.long, lotlong, stop = hs, when = needlong and strategy.position_size == 0 and hs > 0 and truetime)

strategy.entry("Short", strategy.short, lotshort, stop = ls, when = needshort and strategy.position_size == 0 and ls > 0 and truetime)

strategy.exit("LongExit", "Long", stop = center, when = needlong and strategy.position_size > 0)

strategy.exit("Short", stop = center, when = needshort and strategy.position_size < 0)

if time > timestamp(toyear, tomonth, today, 23, 59)

strategy.close_all()

strategy.cancel("Long")

strategy.cancel("Short")

if showdd

//Drawdown

max = 0.0

max := max(strategy.equity, nz(max[1]))

dd = (strategy.equity / max - 1) * 100

min = 100.0

min := min(dd, nz(min[1]))

//Max loss size

equity := strategy.position_size == 0 ? strategy.equity : equity[1]

loss := equity < equity[1] ? ((equity / equity[1]) - 1) * 100 : 0

maxloss := min(nz(maxloss[1]), loss)

//Label

min := round(min * 100) / 100

maxloss := round(maxloss * 100) / 100

labeltext = "Drawdown: " + tostring(min) + "%" + "\nMax.loss " + tostring(maxloss) + "%"

var label la = na

label.delete(la)

tc = min > -100 ? color.white : color.red

osx = timenow + round(change(time)*10)

osy = highest(100)

// la := label.new(x = osx, y = osy, text = labeltext, xloc = xloc.bar_time, yloc = yloc.price, color = color.black, style = label.style_labelup, textcolor = tc)