概述

本策略采用RSI指标识别趋势和超买超卖情况,结合EMA均线判断当前趋势方向,在趋势方向与RSI信号一致时,进行反向开仓,实现短线反转交易。

策略原理

使用EMA指标判断当前趋势方向。当价格高于EMA均线时,定义为上升趋势;当价格低于EMA均线时,定义为下降趋势。

使用RSI指标判断超买超卖情况。RSI高于60为超买区,低于40为超卖区。

当上升趋势且RSI低于40时,发出买入信号;当下降趋势且RSI高于60时,发出卖出信号。

在发出买入和卖出信号时,分别设置止盈和止损价格。止盈价格按照开仓价格的一定比例计算;止损价格按照开仓价格的一定比例计算。

当仓位大于0时,设置止盈单;当仓位小于0时,设置止损单。

优势分析

策略合理运用EMA和RSI指标,识别趋势和超买超卖情况,避免逆势交易。

策略采用短线反转交易方式,能够抓住短线轮动获利机会。

策略设置止盈止损点,有助于锁定利润,控制风险。

策略交易逻辑清晰简洁,容易理解实现,适合新手学习。

策略可通过调整EMA周期、RSI参数等进行优化,适应不同品种和交易环境。

风险分析

反转失败风险。短线反转可能失败,从而造成亏损。

趋势不明显风险。在震荡行情下,EMA难以判断明确趋势方向,可能产生错误信号。

止损被触发风险。止损设置过于接近,可能会被意外触发。

过优化风险。针对历史数据过度优化,可能无法适应实盘环境。

交易频率过高风险。短线交易频率过高,会产生大量交易费用。

优化方向

优化EMA和RSI参数,寻找最佳参数组合。可以通过遍历回测获得最优参数。

增加过滤条件,避免在震荡行情中产生错误信号。例如增加成交量条件。

优化止盈止损比例,寻找最佳比例以锁定利润。止损比例不宜过大,可适当放宽。

增加仓位管理策略,例如固定仓位、马丁格尔等,控制单笔亏损。

结合其他指标,例如MACD、KD等,提高信号准确率。或优化为多因子模型。

针对实盘数据进行回测,不断优化参数,使策略适应最新行情。

总结

本策略基于EMA和RSI指标设计了一套短线反转交易策略,采用趋势判断和超买超卖识别的交易逻辑,在短线获利的同时设置止盈止损控制风险。该策略优势在于简单易用,逻辑清晰,通过参数优化可以获得较好回测结果。但实盘中仍需注意反转失败、震荡市等风险,需进行风险管理。整体来说,该策略为新手提供了一个简单实用的短线交易思路,值得学习借鉴。

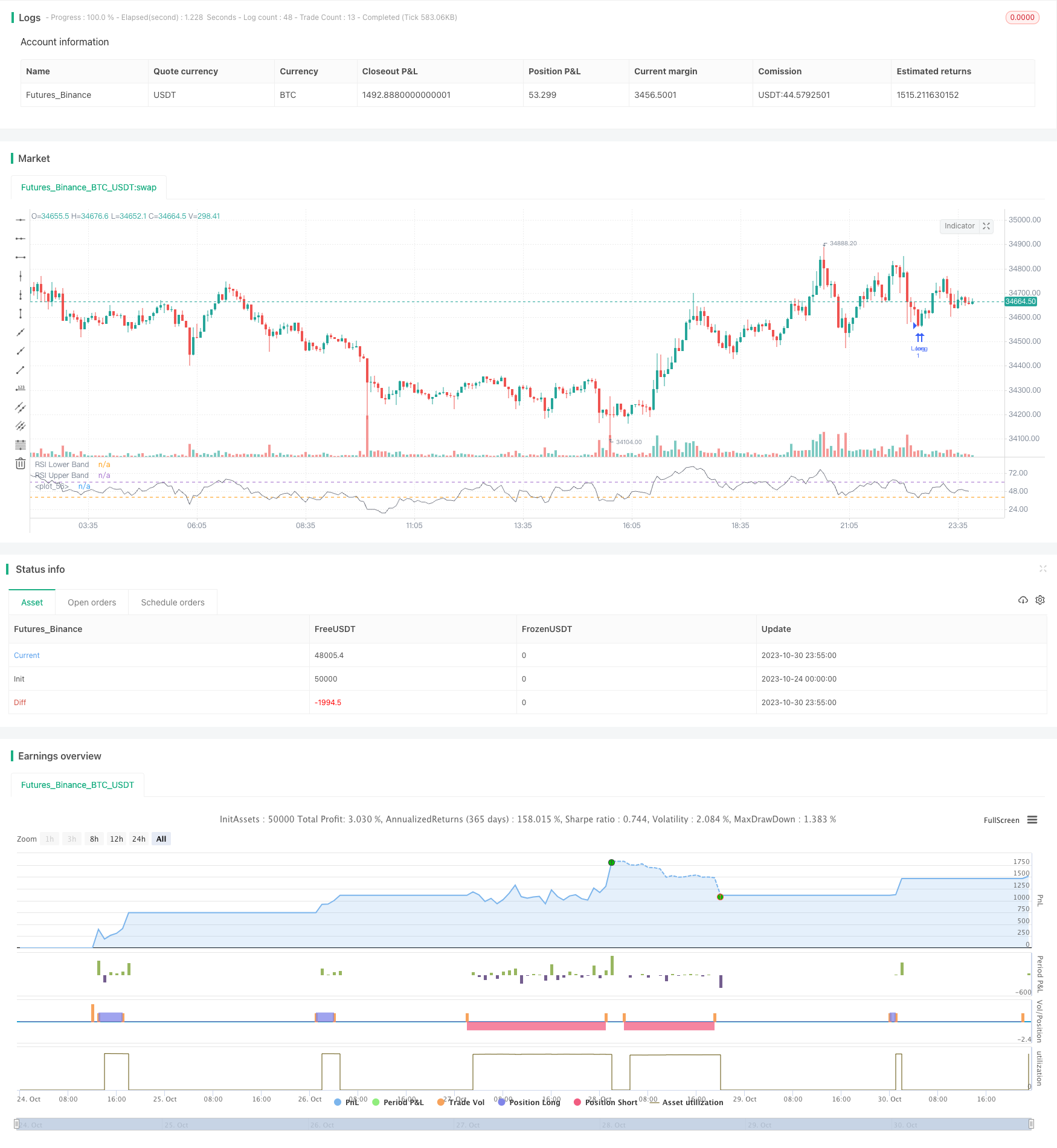

/*backtest

start: 2023-10-24 00:00:00

end: 2023-10-31 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Sarahann999

//@version=5

strategy("RSI Strategy", shorttitle="RSI", overlay= false)

//Inputs

long_entry = input(true, title='Long Entry')

short_entry = input(true, title='Short Entry')

emaSettings = input(100, 'EMA Length')

ema = ta.ema(close,emaSettings)

rsi = ta.rsi(close,14)

//Conditions

uptrend = close > ema

downtrend = close < ema

OB = rsi > 60

OS = rsi < 40

buySignal = uptrend and OS and strategy.position_size == 0

sellSignal = downtrend and OB and strategy.position_size == 0

//Calculate Take Profit Percentage

longProfitPerc = input.float(title="Long Take Profit", group='Take Profit Percentage',

minval=0.0, step=0.1, defval=1) / 100

shortProfitPerc = input.float(title="Short Take Profit",

minval=0.0, step=0.1, defval=1) / 100

// Figure out take profit price 1

longExitPrice = strategy.position_avg_price * (1 + longProfitPerc)

shortExitPrice = strategy.position_avg_price * (1 - shortProfitPerc)

// Make inputs that set the stop % 1

longStopPerc = input.float(title="Long Stop Loss", group='Stop Percentage',

minval=0.0, step=0.1, defval=1.5) / 100

shortStopPerc = input.float(title="Short Stop Loss",

minval=0.0, step=0.1, defval=1.5) / 100

// Figure Out Stop Price

longStopPrice = strategy.position_avg_price * (1 - longStopPerc)

shortStopPrice = strategy.position_avg_price * (1 + shortStopPerc)

// Submit entry orders

if buySignal and long_entry

strategy.entry(id="Long", direction=strategy.long, alert_message="Enter Long")

if sellSignal and short_entry

strategy.entry(id="Short", direction=strategy.short, alert_message="Enter Short")

//Submit exit orders based on take profit price

if (strategy.position_size > 0)

strategy.exit(id="Long TP/SL", limit=longExitPrice, stop=longStopPrice, alert_message="Long Exit 1 at {{close}}")

if (strategy.position_size < 0)

strategy.exit(id="Short TP/SL", limit=shortExitPrice, stop=shortStopPrice, alert_message="Short Exit 1 at {{close}}")

//note: for custom alert messages to read, "{{strategy.order.alert_message}}" must be placed into the alert dialogue box when the alert is set.

plot(rsi, color= color.gray)

hline(40, "RSI Lower Band")

hline(60, "RSI Upper Band")