该策略的核心思想是每月的第一个交易日开仓做多,最后一个交易日平仓。这是一个非常简单的策略,主要用于教学演示。

策略原理

该策略首先定义了每月的第一个交易日(星期一)作为开仓信号,最后一个交易日(星期五)作为平仓信号。

在开仓时,如果开启了仅做多设置,则直接做多;如果允许做空,则同时开仓做多做空。

在平仓时,如果允许做空,则平掉全部头寸;如果仅做多,则仅平掉做多头寸。

为了控制风险,策略还加入了一个简单的止损设置。当价格触及止损价时,强制平仓止损。

总体来说,该策略思路非常简单直白,属于最基础的月度交易策略,适合用来教学演示。实际运用中,可根据自己需要对入场出场信号、止损方式等进行优化。

策略优势

思路简单直白,非常适合初学者学习。

采用月度持仓,操作频率低,适合追求稳定的投资者。

做多做空可选,可满足不同风格的交易者。

加入止损功能,可以一定程度控制个股风险。

策略风险

入场出场时间固定,无法根据市场状态调整,存在被套利的可能。

没有加入量化指标判断,存在盲目跟踪的风险。

单一股票止损容易被突破,无法有效控制 Tail Risk。

仓位固定,无法根据市场情况调整仓位。

成交不确定性可能导致无法完全按策略执行。

简单的止损方式可能导致小止损,应采用 volatility stop 等动态止损。

策略优化方向

可以引入量化指标判断市场状态,动态调整开仓节奏。

考虑对标基准指数,判断个股相对强弱选择入场。

根据市场波动率等风险指标动态调整仓位。

采用动态止损,或许多层次止损。

加入算法交易模块,确保交易信号可以成交。

优化资金管理策略,不同市场环境调整股指期货仓位。

结合机器学习判断个股质量,选择入场个股。

总结

该策略是一个非常基础的月初买入月末平仓策略,逻辑简单,容易理解,适合初学者学习。但实际运用时,需要对入场出场时间、止损方式、仓位管理等进行优化,才能在复杂多变的市场中持续盈利。我们要深入理解策略的优劣势,不断完善策略系统,开发出适合自己的量化交易方案。

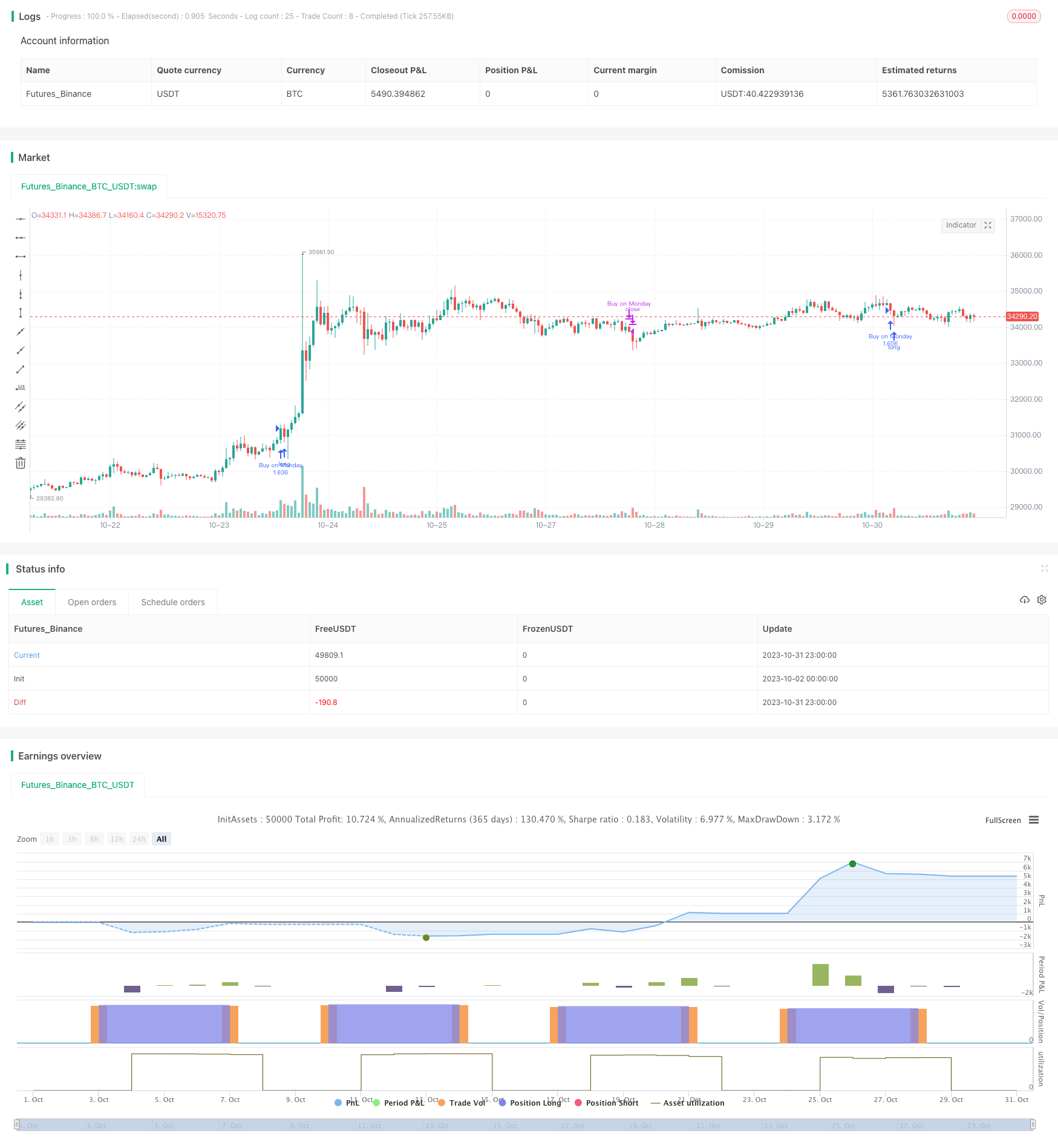

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © Je_Buurman September 1st 2020

//@version=4

strategy("Buurmans Tutorial", overlay=true, initial_capital=1000, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_value=0.2)

// Some initial inputs, these are needed in case the strategy returns an error of "too many trades, > 3000"

Year = input(defval = 2020, title = "From Year", minval = 2010) //

Month = input(defval = 1, title = "From Month", minval = 1, maxval=12)

LongOnly=input(true, title="Only go Long?")

// Phase I - the initial "Strategy" - buy Monday, sell Friday

longCondition = dayofweek==dayofweek.monday and (time > timestamp(Year, Month, 01, 00, 00, 00))

shortCondition = dayofweek==dayofweek.friday and (time > timestamp(Year, Month, 01, 23, 59, 59))

// Phase II - some rudimentary "risk-management" e.g. stoploss

Use_stoploss=input(false, title="Use stoploss ?")

stoploss_input=input(150, title="Stoploss in $")

Stoploss = Use_stoploss ? strategy.position_size>0 ? iff(strategy.position_size>0,strategy.position_avg_price - stoploss_input, na) : strategy.position_size<0 ? iff(strategy.position_size<0,strategy.position_avg_price + stoploss_input, na) : na : na

plot(Use_stoploss and strategy.position_size!=0 ? Stoploss : na, color=iff(Stoploss!=na,color.silver, color.red),style=plot.style_linebr)

// Phase III - make it more profitable by trying to filter conditions

// only buy on odd Mondays ? only buy on full moon Mondays ? something else entirely ?

// The actual trades, going Long, close Long, going Short and Stoploss

if (longCondition)

strategy.entry("Buy on Monday", strategy.long)

if (shortCondition and LongOnly==false)

strategy.entry("Short on Friday", strategy.short)

if (shortCondition and LongOnly)

strategy.close("Buy on Monday", comment="Sell on Friday")

if (low < Stoploss)

strategy.close("Buy on Monday", comment="Long Stopped on Someday")

if (high > Stoploss)

strategy.close("Short on Friday", comment="Short Stopped on Someday")