概述

该策略基于质数震荡指标来判断市场趋势,并据此构建长短仓位。质数震荡指标计算价格附近的最近质数与价格的差值,正值表示多头趋势,负值表示空头趋势。该策略可以捕捉价格震荡时隐藏的趋势信息,对于突破交易有指导意义。

策略原理

该策略首先定义一个PrimeNumberOscillator函数,传入参数为价格和allowedPercent。该函数会在价格正负allowedPercent的范围内寻找最接近价格的质数,并返回两者的差值。差值大于0表示多头趋势,小于0表示空头趋势。

然后在策略中,调用PrimeNumberOscillator函数计算xPNO值。根据xPNO正负判断仓位方向,乘以reverseFactor来确定最终的交易方向。根据交易方向开仓做多做空。

该策略主要依赖质数震荡指标判断趋势方向。指标本身比较粗糙,需要结合其他因素来验证交易信号。但它基于数学原理,可以提供一定的客观指引。

优势分析

- 基于数学原理,相对客观

- 可以识别隐藏在震荡中的趋势

- 参数调整灵活,可以自由设定敏感度

- 实现简单,容易理解和优化

风险分析

- 质数震荡指标本身比较粗糙,存在多次错判的可能

- 需要结合其他技术指标验证,不能单独使用

- 需谨慎选择参数,过大或过小都会失效

- 交易频率可能过高,需要控制仓位规模

优化方向

- 可以结合移动平均,超买超卖等指标过滤信号

- 可以添加止损策略,降低单笔损失

- 可以根据市场情况动态调整allowedPercent参数

- 可以优化仓位管理,通过波动率等指标控制仓位大小

总结

该策略基于质数震荡原理判断趋势方向,实现简单,逻辑清晰。但质数震荡本身存在一定局限,需谨慎使用。可以通过組合其他技术指标来验证信号,控制交易风险。该策略为数学交易策略的典型代表,对于学习和研究具有一定参考价值。

策略源码

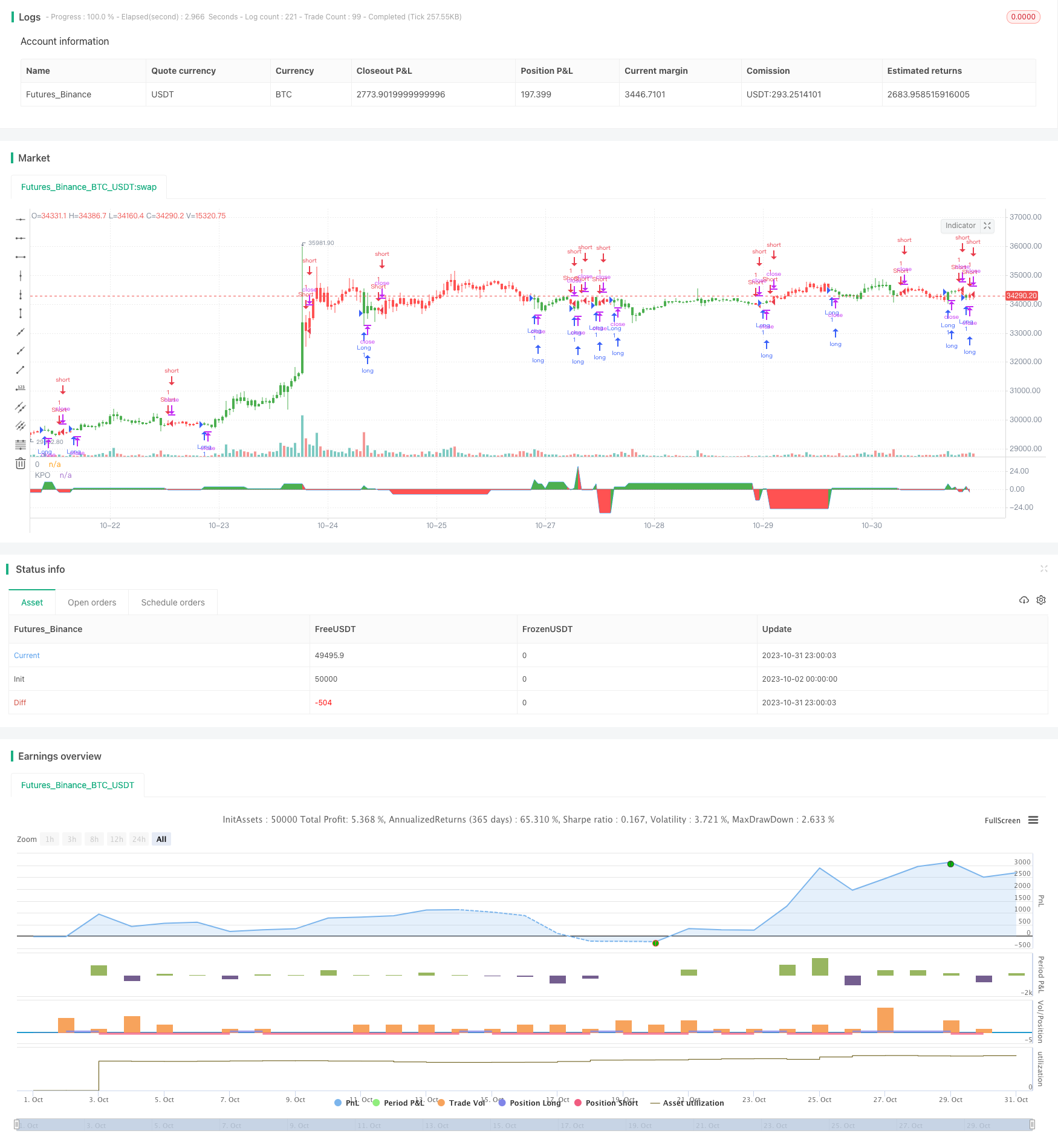

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 29/03/2018

// Determining market trends has become a science even though a high number or people

// still believe it’s a gambling game. Mathematicians, technicians, brokers and investors

// have worked together in developing quite several indicators to help them better understand

// and forecast market movements.

//

// Developed by Modulus Financial Engineering Inc., the prime number oscillator indicates the

// nearest prime number, be it at the top or the bottom of the series, and outlines the

// difference between that prime number and the respective series.

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

PrimeNumberOscillator(price, percent) =>

res = 0

res1 = 0

res2 = 0

for j = price to price + (price * percent / 100)

res1 := j

for i = 2 to sqrt(price)

res1 := iff(j % i == 0 , 0, j)

if res1 == 0

break

if res1 > 0

break

for j = price to price - (price * percent / 100)

res2 := j

for i = 2 to sqrt(price)

res2 := iff(j % i == 0 , 0, j)

if res2 == 0

break

if res2 > 0

break

res := iff(res1 - price < price - res2, res1 - price, res2 - price)

res := iff(res == 0, res[1], res)

res

strategy(title="Prime Number Oscillator Backtest")

percent = input(5, minval=0.01, step = 0.01, title="Tolerance Percentage")

reverse = input(false, title="Trade reverse")

xPNO = PrimeNumberOscillator(close, percent)

pos = iff(xPNO > 0, 1,

iff(xPNO < 0, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

clr = iff(xPNO > 0, green, red)

p1 = plot(xPNO, color=blue, title="KPO")

p2 = plot(0, color=black, title="0")

fill(p1,p2,color=clr)