概述

本策略结合了动态支撑/阻力位和相对强弱指标RSI,设定RSI超买超卖范围,在突破动态支撑/阻力位时判断RSI是否进入超买超卖区域,从而产生买入和卖出信号。

原理

1. 动态支撑/阻力位

使用security函数获取收盘价作为动态支撑/阻力位,当价格突破此动态位时产生交易信号。

2. RSI指标

计算一定周期内的平均涨幅和平均跌幅,通过比较两者生成RSI值,判断是否进入超买超卖区域。

3. 交易信号

价格突破动态位时,如果RSI未进入超买超卖区域,产生买入/卖出信号。如果已进入,则忽略突破产生的信号。

4. 退出信号

价格回落到动态位时平仓,或RSI回到正常区域时平仓。

优势分析

利用动态支撑/阻力位判断趋势方向,提高获利概率。

RSI指标过滤假突破,避免乱入。

结合趋势和指标,适用于不同行情。

规则清晰易于实施。

风险及解决方案

动态位可能出现多次测试突破,造成错误信号,可适当放宽突破幅度过滤。

单一RSI指标可能产生误判,可引入其他指标进行组合过滤。

震荡行情中可能出现频繁开仓平仓,交易成本较高,可适当放宽RSI正常值范围,减少交易频率。

参数设置不当可能导致漏单或乱单,应根据不同品种合理选择参数。

优化方向

利用机器学习技术自动优化RSI参数。

增加止损止盈策略,以锁定利润和减少亏损。

结合更多指标进行组合过滤,提高策略稳定性。

增加波动率指标,在低波动时降低仓位。

优化仓位数算法,使仓位动态调整,适应不同市场环境。

总结

本策略结合趋势判断和指标过滤,能有效识别价格在关键水平附近的破坏,在控制风险的前提下获取较高盈利。通过进一步优化参数设置、增加止损止盈、引入更多指标等,可将策略的稳定性和适应性进一步提升,使其能够在更广泛的市场中获得稳定收益。

策略源码

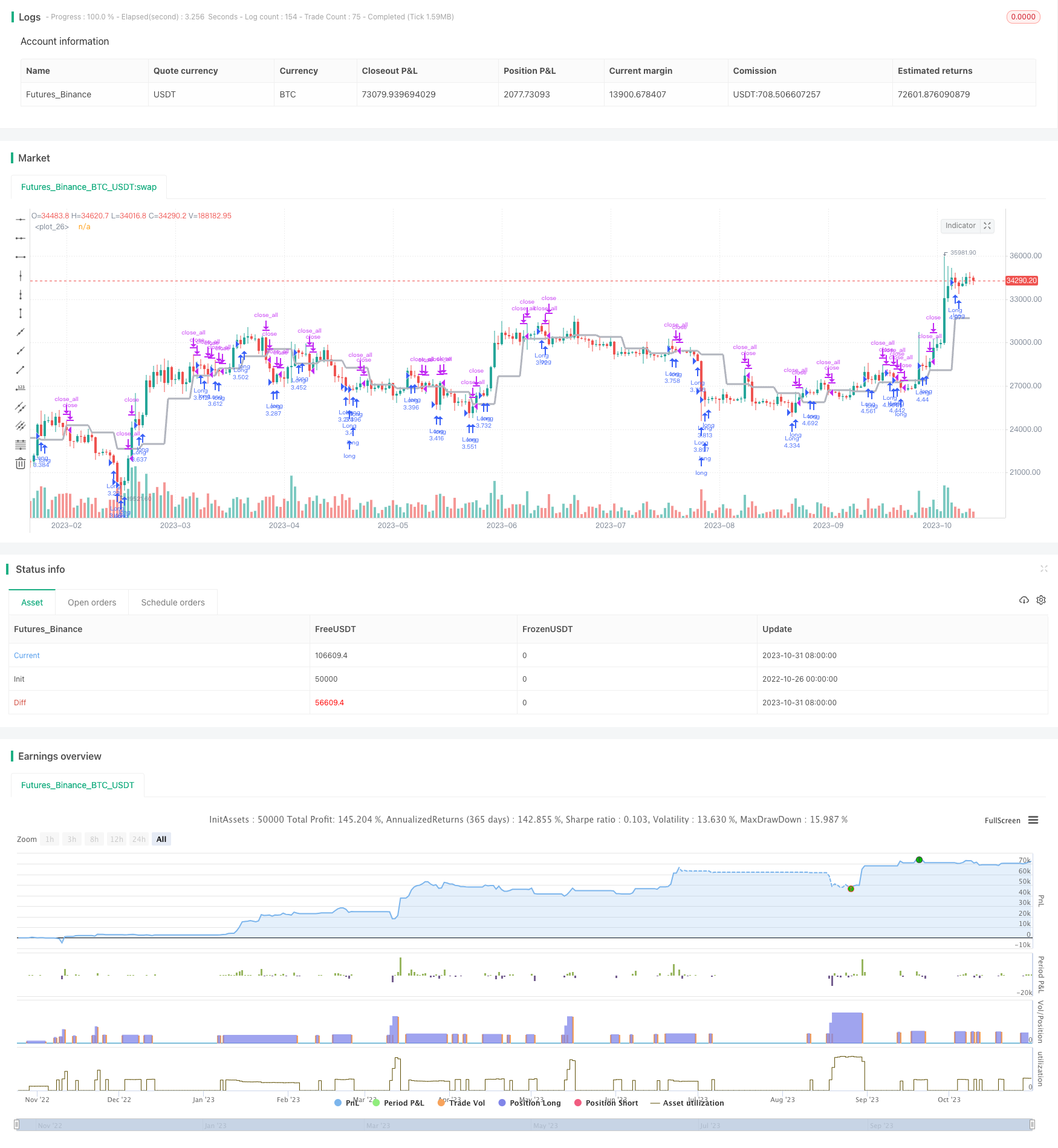

/*backtest

start: 2022-10-26 00:00:00

end: 2023-11-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Levels+RSI Strategy v1.0", shorttitle = "Levels+RSI str 1.0", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 3)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

tf = input('W', title = "timeframe 1")

src = input(ohlc4, "Source")

ap = input(true, defval = true, title = "antipila")

cf = input(true, defval = true, title = "color filter")

rsiperiod = input(7, defval = 7, minval = 2, maxval = 100, title = "RSI Period")

rsilimit = input(30, defval = 30, minval = 1, maxval = 50, title = "RSI Limit")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Level

level = request.security(syminfo.tickerid, tf, src[1])

plot(level, linewidth = 3, color = silver)

//RSI

uprsi = rma(max(change(close), 0), rsiperiod)

dnrsi = rma(-min(change(close), 0), rsiperiod)

rsi = dnrsi == 0 ? 100 : uprsi == 0 ? 0 : 100 - (100 / (1 + uprsi / dnrsi))

//Level Signals

ls = close > level and ap == false ? true : low > level ? true : false

up1 = strategy.position_size == 0 and ls and (close < open or cf == false)

exit1 = close < level and ap == false ? true : high < level ? true : false

//RSI Signal

up2 = rsi < rsilimit and (close < open or cf == false)

exit2 = rsi > rsilimit and ls == false

//Trading

lot = strategy.position_size != strategy.position_size[1] ? strategy.equity / close * capital / 100 : lot[1]

if up1 or up2

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot)

if (exit1 and rsi > rsilimit) or exit2

strategy.close_all()