概述

该策略运用平均向导(ADX)、顺势指标(DMI)以及商品路径指数(CCI)等动量指标,判断趋势方向,进行趋势追踪。当ADX和趋向指标确认趋势形成时,在CCI过冲的时候建立头寸。

策略原理

计算ADX,DMI和CCI指标。

- ADX用于判断趋势力度,当ADX高于设定阈值时,认为趋势足够强劲。

- DMI包括DI+和DI-,分别表示上升趋势和下降趋势的力度。当DI+高于DI-,认为处于上升趋势,反之则为下降趋势。

- CCI用于判断超买超卖情况。当CCI低于-100时为超卖,高于100时为超买。

判断趋势方向。

- 当DI+上穿DI-,判定为上升趋势。

- 当DI-下穿DI+,判定为下降趋势。

进入场内。

- 当上升趋势形成,ADX高于阈值,且CCI低于-100时,做多入场。

- 当下降趋势形成,ADX高于阈值,且CCI高于100时,做空入场。

出场止损。

- 做多时,当DI-下穿DI+时清仓。

- 做空时,当DI+上穿DI-时清仓。

策略优势分析

使用ADX判断趋势强弱,避免在无明显趋势时无谓交易。

使用DMI确定趋势方向,减少错误判断的概率。

在CCI过冲时入场,可以及时捕捉趋势转折点,降低入场风险。

动量指标组合使用,可以提高判断准确率。

有止损机制,可以限制每单损失。

风险与对冲

ADX回落时,会有多次焦虑交易导致亏损。可以适当调高ADX入场阈值,确保趋势足够明显。

DMI指标存在滞后,可能错过趋势早期机会。可以配合其他指标或图形技术分析确定入场时机。

CCI容易产生频繁交易。可以适当放宽CCI阈值幅度,过滤掉部分噪音。

做多做空同时持有头寸时,可考虑采用股票市场中性策略,制定套期保值规则,降低整体仓位风险。

策略优化方向

优化ADX参数,找到最佳平衡点 between filtering noise and catching trend in time.

优化DMI参数,平衡滞后性和灵敏度。

优化CCI参数,平衡交易频率和捕捉反转的能力。

测试增加或修改其他指标,寻找更好的组合效果。例如MACD,KDJ等。

对交易品种进行测试,找到最佳适配的品种。

优化仓位管理策略,在保持跟踪趋势能力的前提下,控制风险。

总结

该策略利用ADX判断趋势,DMI确定方向,CCI定位反转点的思路进行趋势跟踪交易,具有较强的逻辑性。但仍需针对参数进行优化,并配合仓位管理来控制风险。如果各参数调整到恰当水平,在趋势明显的品种上应用,该策略有望获取稳定收益。但交易者需要密切关注市场环境变化,动态调整参数。

策略源码

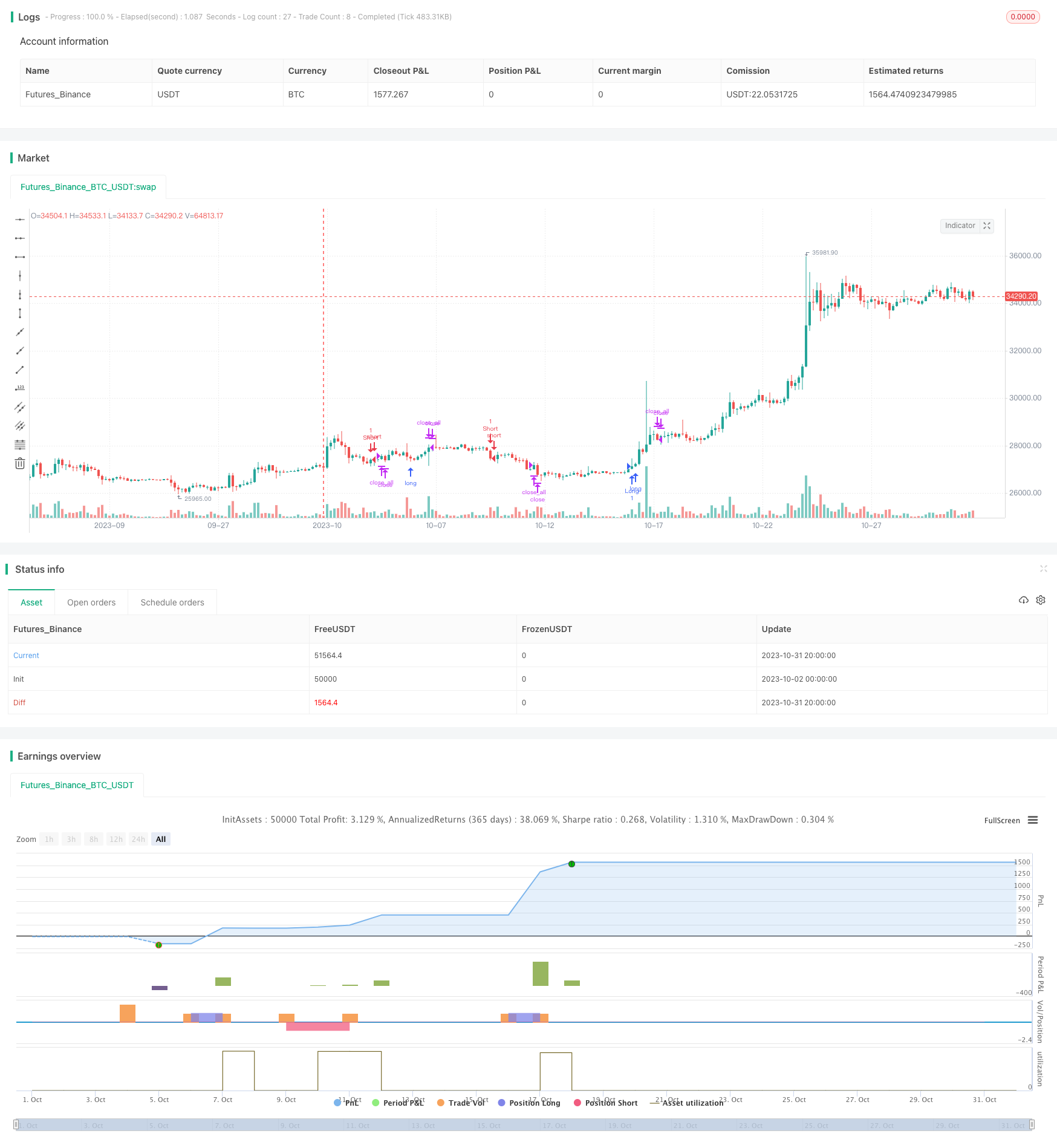

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("ADX Strategy", currency = "USD", initial_capital = 1000, overlay=true)

adxlen = input(9, title="ADX Smoothing")

dilen = input(14, title="DI Length")

ADX_Entry = input(25, title="ADX Entry")

dirmov(len) =>

up = change(high)

down = -change(low)

truerange = rma(tr, len)

plus = fixnan(100 * rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * rma(abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

[adx, plus, minus]

[sig, up, down] = adx(dilen, adxlen)

cci_length = input(20, minval=1, title="CCI Length")

cci_ma = sma(close, cci_length)

cci = (close - cci_ma) / (0.015 * dev(close, cci_length))

stop_loss = syminfo.mintick * 100

open_longs = strategy.position_size > 0

open_shorts = strategy.position_size < 0

possible_bull = false

possible_bull := not open_longs ? (possible_bull[1] and not crossunder(up,down) ? true : false) : false

possible_bear = false

possible_bear := not open_shorts ? (possible_bear[1] and not crossunder(down,up) ? true : false) : false

bool bull_entry = crossover(up,down)

if(bull_entry and up < ADX_Entry and cci < 0)

possible_bull := true

bull_entry := false

if(possible_bull and up > ADX_Entry and cci > -100)

bull_entry := true

bool bear_entry = crossover(down,up)

if(bear_entry and down < ADX_Entry and cci > 0)

possible_bear := true

bear_entry := false

if(possible_bear and down >= ADX_Entry and cci < 100)

bear_entry := true

strategy.entry("Short", strategy.short, qty = 1,comment="Short", stop=high[1] - stop_loss, when = bear_entry)

strategy.entry("Long", strategy.long, qty = 1, comment="Long", stop=low[1] - stop_loss, when = bull_entry )

strategy.close_all(when = (open_shorts and (crossover(up,down) or crossover(sig,down))) or (open_longs and ( crossover(down,up) or crossover(sig, up))))