概述

多空力量平衡策略是一种改进的趋势跟踪策略。它通过分析当前K线与前一根K线的关系,计算多空力量的平衡情况,从而判断目前的趋势方向。当多空力量失衡时,该策略会发出交易信号。其思路来源于传统的老阳线指标,但进行了改进,可以更准确地判断趋势。

策略原理

该策略的核心指标是nBBB,它反映当前K线与前一根K线的多空力量平衡情况。nBBB的计算公式如下:

nBBB = value2 - value

其中,value和value2分别计算当前K线和前一根K线的多空力量。它们的计算过程比较复杂,涉及对收盘价、开盘价、最高价、最低价的关系进行判断。但总的来说,value反映当前K线的多空力量,value2反映前一K线的多空力量。两者之差就反映了多空力量的变化情况。

当nBBB低于设置的门限SellLevel时,发出做空信号;当nBBB高于门限BuyLevel时,发出做多信号。门限可以通过参数调整。

策略优势

这种策略有以下几点优势:

基于K线反转的判断,能够识别较强的趋势转折点。

通过计算多空力量平衡,判断信号更准确可靠。

采用当前K线与前一K线比较的思路,可以过滤掉部分噪音,使信号更清晰。

可适用于不同时间周期,灵活性较强。

计算指标nBBB直观可视,形成的交易信号简单明确。

策略风险

该策略也存在一些风险需要注意:

多空力量指标nBBB可能会产生错误信号,需要结合价格实体方向、成交量等进行验证。

仅凭借nBBB指标决策存在一定盲区,最好辅助其他技术指标决策。

参数SellLevel和BuyLevel的设定会直接影响策略表现,需要谨慎测试优化。

行情剧烈波动时,指标发出的信号可能有滞后,需要注意判断风险。

该策略更适合中长线操作,短线操作可能会被套。

策略优化

该策略可以从以下几个方面进行优化:

优化SellLevel和BuyLevel参数,使信号更匹配实际行情。可以通过历史数据回测来确定最佳参数。

增加止损策略,如移动止损、震荡止损等,可以有效控制风险。

结合其他指标,如成交量, stochastic等进行辅助,可以提高决策准确性。

增加机器学习成分,利用AI技术自动优化参数,并辅助发出更准确的交易信号。

不同交易品种和时间周期的参数可以进行分别优化,使策略针对性更强。

总结

多空力量平衡策略通过计算多空力量变化,判断趋势转折点,是一个相对简单实用的趋势跟踪策略。它有一定的优势,但也存在风险。通过参数优化、止损策略、辅助指标等手段可以适当改进该策略,使其效果更好。总体来说,这是一个值得深入研究和运用的量化策略思路。

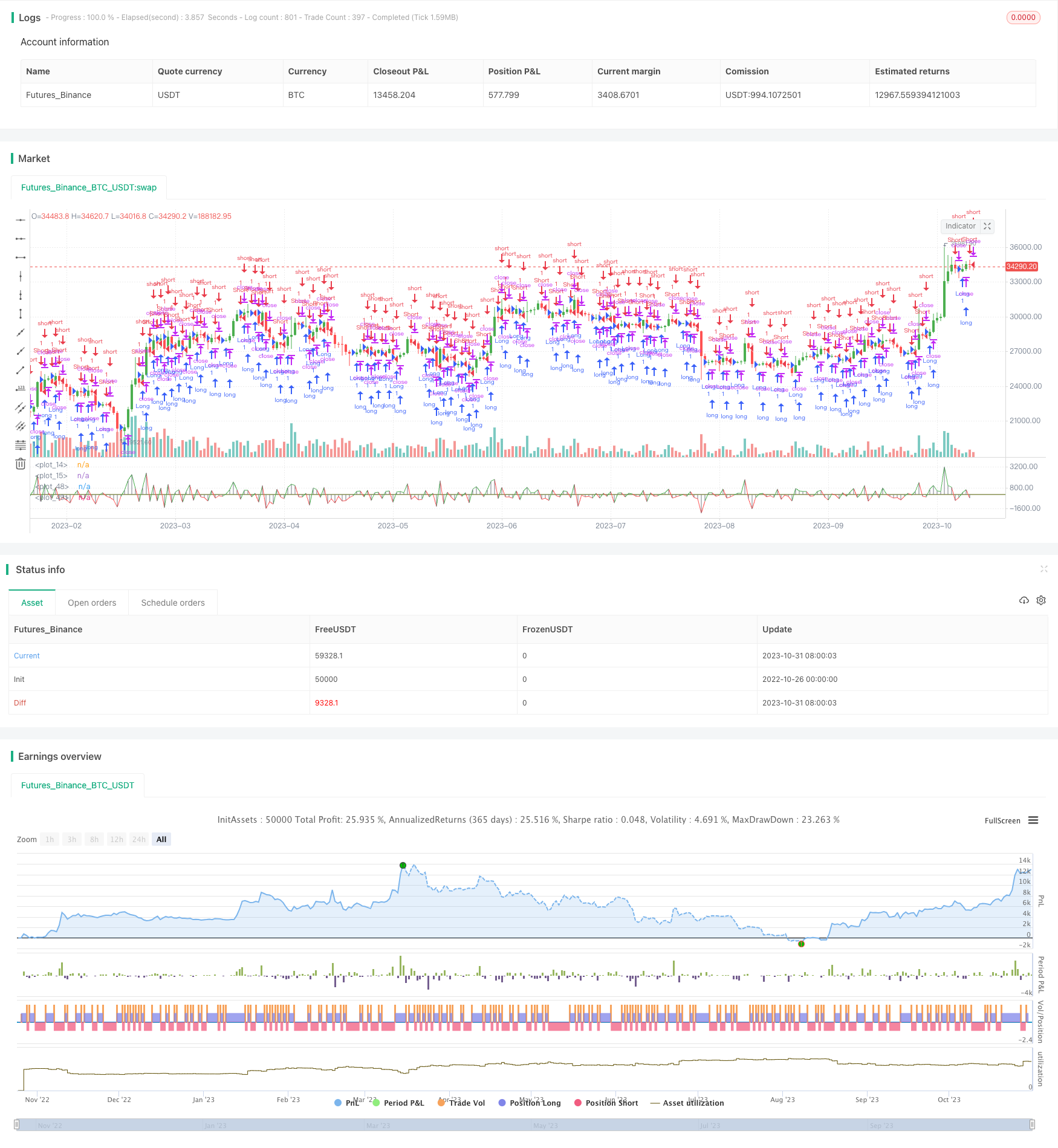

/*backtest

start: 2022-10-26 00:00:00

end: 2023-11-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 03/02/2017

// This new indicator analyzes the balance between bullish and

// bearish sentiment.

// One can cay that it is an improved analogue of Elder Ray indicator.

// To get more information please see "Bull And Bear Balance Indicator"

// by Vadim Gimelfarb.

////////////////////////////////////////////////////////////

strategy(title = "Bull And Bear Balance Strategy")

SellLevel = input(-15, step=0.01)

BuyLevel = input(15, step=0.01)

reverse = input(false, title="Trade reverse")

hline(SellLevel, color=red, linestyle=line)

hline(BuyLevel, color=green, linestyle=line)

value = iff (close < open ,

iff (close[1] > open , max(close - open, high - low), high - low),

iff (close > open,

iff(close[1] > open, max(close[1] - low, high - close), max(open - low, high - close)),

iff(high - close > close - low,

iff (close[1] > open, max(close[1] - open, high - low), high - low),

iff (high - close < close - low,

iff(close > open, max(close - low, high - close),open - low),

iff (close > open, max(close[1] - open, high - close),

iff(close[1] < open, max(open - low, high - close), high - low))))))

value2 = iff (close < open ,

iff (close[1] < open , max(high - close[1], close - low), max(high - open, close - low)),

iff (close > open,

iff(close[1] > open, high - low, max(open - close[1], high - low)),

iff(high - close > close - low,

iff (close[1] < open, max(high - close[1], close - low), high - open),

iff (high - close < close - low,

iff(close[1] > open, high - low, max(open - close, high - low)),

iff (close[1] > open, max(high - open, close - low),

iff(close[1] < open, max(open - close, high - low), high - low))))))

nBBB = value2 - value

nBBBc = nBBB < 0 ? red : green

pos = iff(nBBB < SellLevel, -1,

iff(nBBB >= BuyLevel, 1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(nBBB, style=line, linewidth=1, color=nBBBc)

plot(nBBB, style=histogram, linewidth=1, color=gray)