概述

该策略利用EMA指标识别股票价格趋势,并结合标准差计算买入卖出信号,实现追踪趋势的交易策略。主要思想是计算当前价格与EMA的差值,设定阈值买入。

策略原理

策略首先计算close价格与长度为ema_length的EMA的差值v。然后计算v的ema_length周期的标准差dev。再确定买入方向系数k,k为1表示买入看涨,k为-1表示买入看跌。然后计算买入信号阈值dev_limit,它是k乘以dev再乘以限制factor。当v越过dev_limit就产生买入信号。退出信号是v回穿0轴。

该策略提供两种模式:

买入看跌,当v下穿负的dev_limit就买入,即追踪下跌趋势。

买入看涨,当v上穿正的dev_limit就买入,即追踪上涨趋势。

综上,该策略通过动态计算价格与EMA差值的标准差,设定买入阈值实现追踪趋势。factor参数控制买入信号的灵敏度。ema_length控制EMA周期。买入模式控制买入方向。

策略优势分析

该策略具有以下优势:

使用EMA指标识别价格趋势方向,EMA指标平滑价格,识别趋势效果好。

结合标准差计算动态阈值,相比固定阈值更能适应市场变化。

两种买入模式可以选择追踪上涨趋势或下跌趋势。

factor参数提供调整买入灵敏度的空间。ema_length参数可调整EMA周期优化参数。

策略逻辑清晰简单,容易理解和修改。

可灵活设置仓位管理,实现追涨跌趋势的积极策略。

风险分析

该策略也存在以下风险:

EMA指标存在滞后,可能错过趋势转折点。

依赖参数优化,如果参数设置不当,可能过于灵敏或迟钝。

追逐趋势带来的风险,如果趋势反转可能造成较大损失。

多空转换频繁造成交易频繁。

大幅震荡行情中信号频繁,交易费用成本增加。

针对这些风险,可以考虑加入止损策略控制风险,优化参数组合测试寻找最佳参数,加入过滤条件避免过于频繁交易等。

优化方向

该策略可以从以下方面进行优化:

测试不同EMA周期的参数效果,寻找最优EMA周期长度。

测试factor的不同取值,寻找最佳阈值灵敏度。

优化开仓仓位管理策略,比如随趋势加仓方式。

添加其他指标过滤,避免在震荡行情下出错交易。

增加止损策略控制单笔损失。

针对两个买入模式分别优化参数,寻找最佳参数组合。

研究趋势反转信号,设置关闭趋势追踪。

总结

该策略基于EMA识别趋势方向,并动态计算阈值产生买入卖出信号,实现对趋势的追踪。策略逻辑简单清晰,可灵活配置仓位管理积极追踪趋势。同时策略也存在一定风险,需要对参数组合进行优化测试,并辅以StopIteration损策略控制风险。该策略可作为学习指标结合应用、优化参数设置的良好案例。

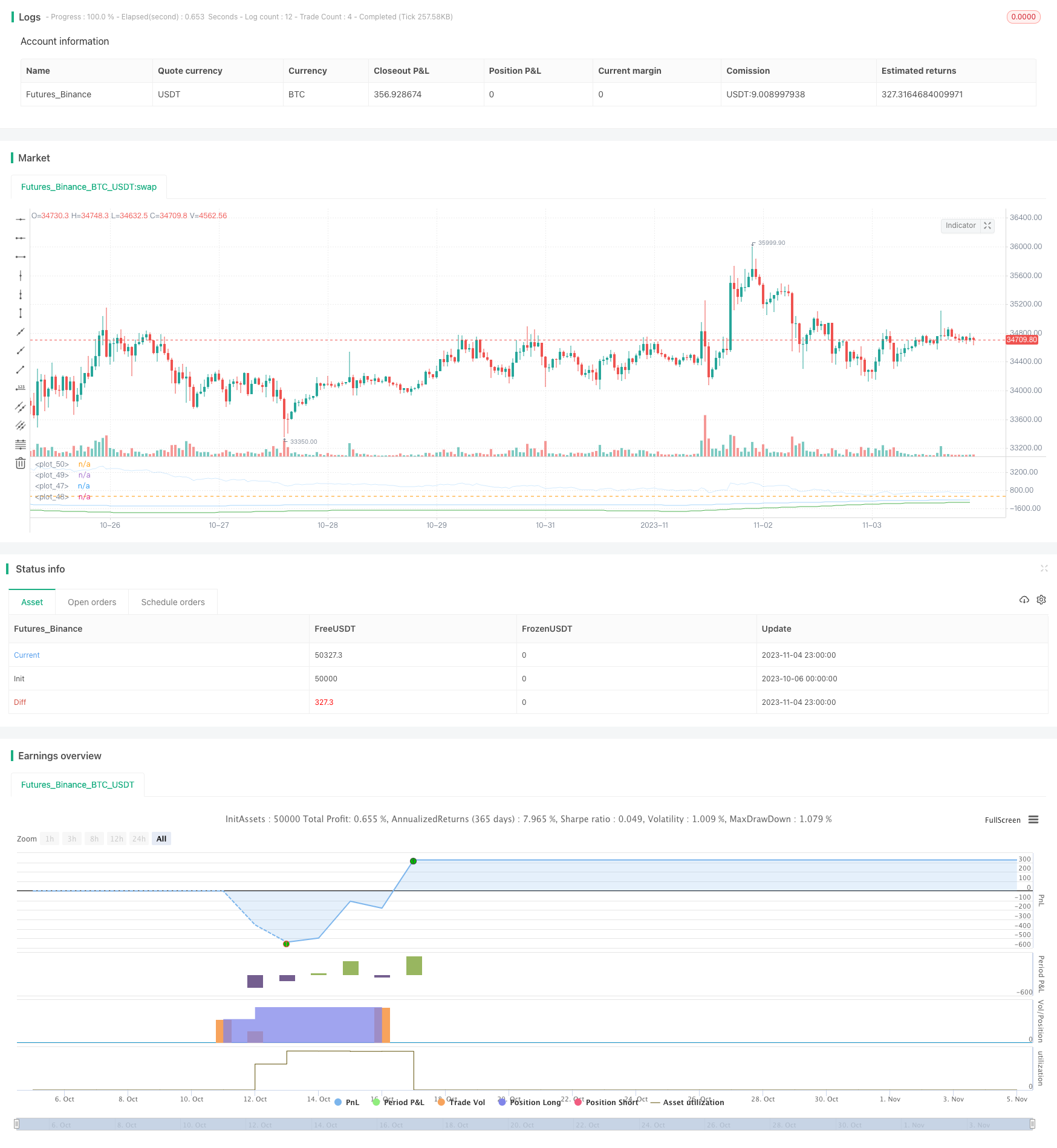

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Azzrael

// Based on EMA and EMA Oscilator https://www.tradingview.com/script/qM9wm0PW-EMA-Oscilator-Azzrael/

// (EMA - close) + Std Dev + Factor = detecting oversell/overbuy

// Long only!

// Pyramiding - sometimes, depends on ...

// There 2 enter strategies in one script

// 1 - Classic, buy on entering to OverSell zone (more profitable ~> 70%)

// 2 - Crazy, buy on entering to OverBuy zone (catching trend and pyramiding, more net profit)

// Exit - crossing zero of (EMA - close)

//@version=5

strategy("STR:EMA Oscilator [Azzrael]", overlay=false,

margin_long=100,

margin_short=100,

currency=currency.USD,

default_qty_type=strategy.percent_of_equity,

default_qty_value=30,

pyramiding=3)

entry_name="Buy"

ema_length = input.int(200, "Period", minval=2, step=10)

limit = input.float(1.7, "Factor", minval=1, step=0.1, maxval=10)

dno = input.string(defval="Buy on enter to OverSell", title="Model", options=["Buy on enter to OverSell", "Buy on enter to OverBuy"]) == "Buy on enter to OverSell"

v = close - ta.ema(close, ema_length)

dev = ta.stdev(v, ema_length)

k = dno ? -1 : 1

dev_limit = k*dev*limit

cond_long = dno ? ta.crossunder(v, dev_limit) : ta.crossover(v, dev_limit)

cond_close = ta.cross(v, 0)

// dev visualization

sig_col = (dno and v <= dev_limit) or (not dno and v >= dev_limit) ? color.green : color.new(color.blue, 80)

plot(dev_limit, color=color.green)

plot(k*dev, color=color.new(color.blue, 60))

plot(v, color=sig_col )

hline(0)

// Make love not war

strategy.entry(entry_name, strategy.long, when=cond_long)

strategy.close(entry_name, when=cond_close)