概述

本策略融合了123反转和SMA弹力振荡器两个子策略,形成双轨道筛选信号的趋势追踪策略。123反转策略通过K线形态判断潜在转折点;SMA弹力振荡器则利用移动平均线判定趋势方向。两者互为验证,形成双重确认机制,可有效过滤掉错误信号,捕捉较强的趋势方向,实现趋势跟踪交易。

策略原理

- 123反转策略

该策略源自于Ulf Jensen的《我如何在期货市场上获得三倍回报》一书中P183的系统。属于反转类型策略。当收盘价连续2日高于前一日收盘价,且9日随机指标的慢线低于50时,做多;当收盘价连续2日低于前一日收盘价,且9日随机指标的快线高于50时,做空。

- SMA弹性振荡器

该指标类似William Blau开发的TSI指标,不同的是SMA振荡器包含一个信号线。SMA弹性指标使用价格减去前一日价格的双移动平均,再绘制SMA的指数移动平均线作为信号线,用于发出交易信号。可调节指标参数进行优化。

双重确认:只有当123反转和SMA弹性指标同向发出信号时,才开仓。当两者信号方向不一致时,保持空仓。

策略优势

融合多种指标,形成双重确认机制,可有效过滤错误信号。

123反转策略利用K线形态判定潜在反转点。SMA弹性振荡器通过趋势判断发出信号,两者互为验证,弥补单一指标的不足。

SMA弹性振荡器参数可调节,可以针对不同品种和周期进行优化,灵活性强。

整体作为趋势跟踪策略,可顺势而为,持续捕捉较强势头的方向。

策略风险

反转策略与趋势策略的整合与平衡需要不断优化,否则可能错过转折点或产生重大亏损。

反转策略本身存在一定的错误交易风险,需要调整参数以降低失败率。

纯跟踪策略无法判断趋势反转点,存在潜在亏损风险。需适时降低仓位规避风险。

不同品种和周期参数需要反复优化测试,不宜生搬硬套。

策略优化

调整123反转的参数,降低错误交易频率。

调整SMA弹性振荡器参数,优化指标的敏感度。

添加止损策略,降低单次亏损。

结合其它指标判断潜在反转,适时减仓。

测试不同品种参数优化,提升稳定性。

总结

本策略通过双重确认机制,整合反转与趋势策略的优势,形成较强的趋势跟踪效果。可有效滤除噪音,顺势而为,持续捕捉优质的趋势机会。同时也存在一定的回撤风险,需要不断优化参数,控制风险。关键在于反转与趋势的平衡,以及止损风控的搭配使用。如果用于长线追踪,效果可能更佳。总体来说,本策略具有一定的实战价值,可作为策略组合的一部分,也可单独使用。

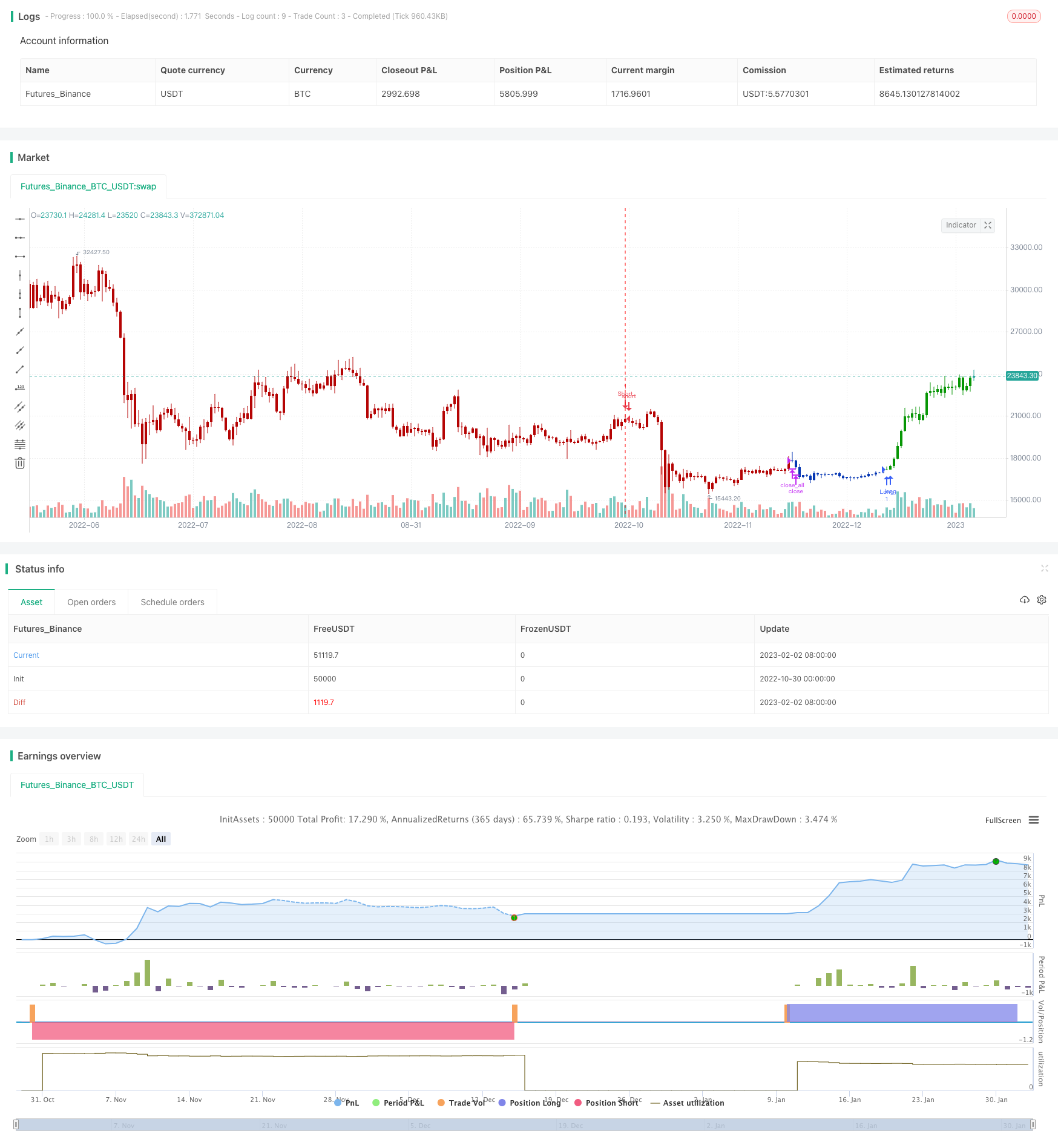

/*backtest

start: 2022-10-30 00:00:00

end: 2023-02-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 14/07/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The SMI Ergodic Indicator is the same as the True Strength Index (TSI) developed by

// William Blau, except the SMI includes a signal line. The SMI uses double moving averages

// of price minus previous price over 2 time frames. The signal line, which is an EMA of the

// SMI, is plotted to help trigger trading signals. Adjustable guides are also given to fine

// tune these signals. The user may change the input (close), method (EMA), period lengths

// and guide values.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

SMI_Erg(fastPeriod, slowPeriod,SmthLen, TopBand,LowBand) =>

pos = 0.0

xPrice = close

xPrice1 = xPrice - xPrice[1]

xPrice2 = abs(xPrice - xPrice[1])

xSMA_R = ema(ema(xPrice1,fastPeriod),slowPeriod)

xSMA_aR = ema(ema(xPrice2, fastPeriod),slowPeriod)

xSMI = xSMA_R / xSMA_aR

xEMA_SMI = ema(xSMI, SmthLen)

pos:= iff(xEMA_SMI < LowBand, -1,

iff(xEMA_SMI > TopBand, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & SMI Ergodic Oscillator", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- SMI Ergodic Oscillator ----")

fastPeriod = input(4, minval=1)

slowPeriod = input(8, minval=1)

SmthLen = input(3, minval=1)

TopBand = input(0.5, step=0.1)

LowBand = input(-0.5, step=0.1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posSMI_Erg = SMI_Erg(fastPeriod, slowPeriod,SmthLen, TopBand,LowBand )

pos = iff(posReversal123 == 1 and posSMI_Erg == 1 , 1,

iff(posReversal123 == -1 and posSMI_Erg == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )