概述

该策略通过计算ROC和SMA这两个指标的差值k,再对k进行一定长度的求和,根据求和值sum的正负作为做多做空的判断依据。该策略属于短线交易策略。

策略原理

该策略首先计算长度为l的SMA均线和ROC指标,然后计算当前收盘价与SMA的差值k。接着计算k的s日累加和sum。当sum>0时做多,当sum时做空。

具体来说,代码中:

计算长度为l的SMA均线a

计算长度为l的ROC指标r

计算当前收盘价与SMA均线的差值k = close - a

对k进行s日累加求和,得到sum

如果sum>0,则做多;如果sum,则做空

平仓条件:做多平仓时sum<0;做空平仓时sum>0

该策略的关键是计算k的累加和sum,通过sum的正负作为交易信号。当最近一段时间k>0,说明价格在上涨,这时做多;当最近一段时间k,说明价格在下跌,这时做空。

优势分析

这是一个较为简单实用的短线交易策略,具有以下优势:

使用的指标组合较为简单,容易理解和实现。

通过指标的差值进行滤波,可以发现更精确的交易机会。

对差值进行累加求和,可以更准确抓取短线趋势。

可根据市场调整参数l和s,适应不同周期。

策略思路清晰,程序简洁,容易修改和优化。

资金使用效率高,可实现频繁短线交易。

风险分析

该策略也存在一定的风险,主要包括:

短线交易风险较大,存在亏损的可能。

参数设置不当可能导致过于频繁交易或漏失机会。

无法有效应对趋势反转,跳过止损可能造成较大亏损。

需要频繁监控和调整参数,较为依赖交易者经验。

交易频繁容易增加交易成本和滑点,影响盈利。

对应风险的解决方法包括:

适当调整参数,降低交易频率。

结合趋势指标,识别趋势反转。

优化止损策略,控制单笔亏损。

加入自动化参数优化模块,降低依赖交易者经验。

优化下单模块,降低交易成本。

优化方向

该策略可以从以下几个方面进行进一步优化:

优化参数计算方法,使参数更具自适应性。可以考虑使用遗传算法、马尔科夫链等方法动态优化参数。

结合更多指标和过滤条件,提高交易信号的质量。例如结合趋势指标避免逆势交易等。

改进止损策略,例如引入移动止损、平均止损等,控制单笔亏损。

优化资金管理策略,例如风险点数管理、固定比例划分资金等,控制整体风险。

优化下单模块,使用趋势追踪、滑点控制等算法,降低交易成本。

增加自动化回测优化模块,快速评估不同参数对策略的影响。

增加量化指标评估模块,评估交易信号质量,提高策略稳定性。

通过以上优化,可以将该策略打造成一个更全面、智能、稳定、可控的短线交易体系。

总结

总体来说,该策略通过简单的指标计算产生交易信号,思路清晰易于实现,属于典型的短线交易策略。通过对参数、止损、资金管理等方面的进一步优化,可以降低风险、提高稳定性,使其成为值得运用的量化交易策略之一。但任何策略都无法完美,交易者还需要保持理性,并适当结合自己的风险偏好进行调整运用。

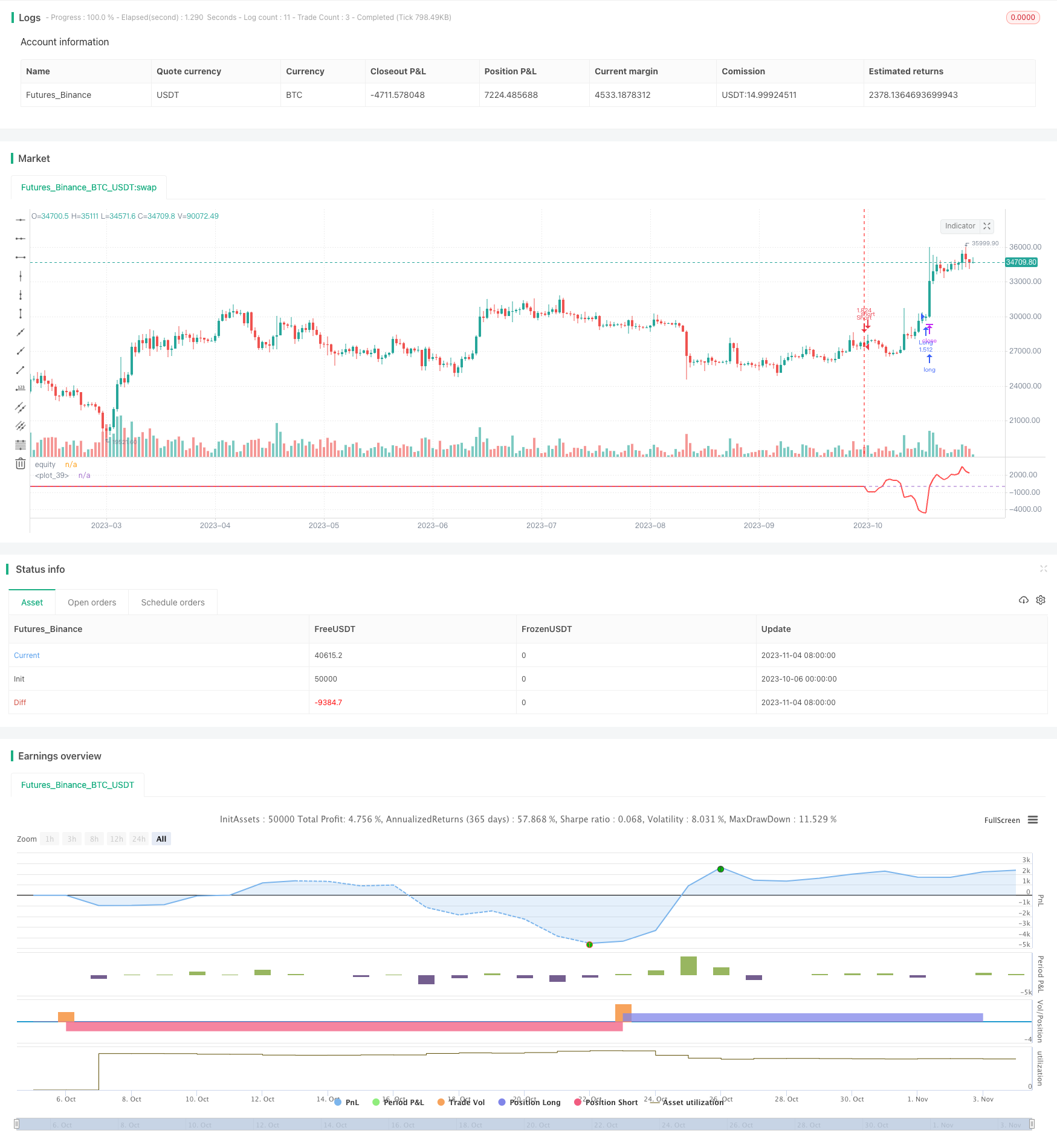

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Indicator Integrator Strat",default_qty_type = strategy.percent_of_equity, default_qty_value = 100,currency="USD",initial_capital=662, overlay=false)

l = input(defval=170,title="Length for indicator")

s = input(title="Length of summation",defval=18)

a= sma(close,l)

r=roc(close,l)

k=close-a

sum = 0

for i = 0 to s

sum := sum + k[i]

//plot(a,color=yellow,linewidth=2,transp=0)

//bc = iff( sum > 0, white, teal)

//plot(sum,color=bc, transp=20, linewidth=3,style=columns)

//plot(sma(sum,3),color=white)

//hline(0)

inpTakeProfit = input(defval = 0, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 0, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

////buyEntry = crossover(source, lower)

////sellEntry = crossunder(source, upper)

if sum>0

strategy.entry("Long", strategy.long, oca_name="Long", comment="Long")

else

strategy.cancel(id="Long")

if sum<0

strategy.entry("Short", strategy.short, oca_name="Short", comment="Short")

else

strategy.cancel(id="Short")

strategy.initial_capital = 50000

plot(strategy.equity-strategy.initial_capital-strategy.closedtrades*.25/2, title="equity", color=red, linewidth=2)

hline(0)

//longCondition = sum>0

//exitlong = sum<0

//shortCondition = sum<0

//exitshort = sum>0

//strategy.entry(id = "Long", long=true, when = longCondition)

//strategy.close(id = "Long", when = exitlong)

//strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=exitlong)

//strategy.entry(id = "Short", long=false, when = shortCondition)

//strategy.close(id = "Short", when = exitshort)

//strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset, when=exitshort)