概述

多指标评分交易策略通过整合技术指标评分,识别趋势方向和力度,实现自动交易。该策略综合考虑一组指标,包括Ichimoku云,HMA,RSI,Stoch,CCI和MACD。根据每个指标的结果,为其评分,然后综合所有指标的评分,形成一个整体评分。当整体评分高于阈值时做多,低于阈值时做空。

策略原理

该策略由多个部分组成:

计算一组指标,包括Ichimoku云,Hull移动平均线,相对强弱指数,随机指标,商品通道指数和移动平均线敏感度。

对每个指标进行评分。当指标显示多头信号时给予正分,空头信号时给予负分。

将所有指标评分进行求和平均,得到一个综合评分。

将综合评分与事先设定的阈值进行比较,判断整体趋势方向。评分高于阈值时看多,低于阈值时看空。

根据判断结果进行开仓。当看多时做多,看空时做空。

止损停利通过ATR指标设定。

该策略充分利用了多种指标的优势,综合判断市场趋势方向。相比单一指标,能够过滤掉部分虚假信号,提高信号的可靠性。

优势分析

该策略具有以下优势:

多指标综合判断,提高信号准确率。单一指标容易产生误判,该策略通过评分求平均的方式,能有效过滤虚假信号。

利用指标优势,识别趋势和目前力度。例如Ichimoku云判断大趋势,Stoch判断超买超卖。

自动交易避免情绪影响,严格执行策略信号。

使用ATR设定止损停利点,有利于风险控制。

可以针对不同品种进行参数调优。指标参数和评分阈值都可以优化。

策略逻辑简单清晰,易于理解和修改。

风险分析

该策略也存在以下风险:

多指标组合不一定优于单一指标,需要反复测试找到最佳参数。

指标发出错误信号时,评分求平均也无法完全避免损失。

ATR止损可能过于接近或过于宽松,需要根据品种特点调整。

需要避免过度优化而导致的曲线拟合。应在不同品种和时间段测试策略稳健性。

交易频率可能过高,交易成本也会影响最终收益。

优化方向

该策略可以从以下几个方面进行优化:

测试更多指标的组合,找到对特定品种最优的指标选择。

调整每个指标的评分权重,优化评分算法。

动态调整ATR参数,使止损停利更贴合市场波动。

加入交易过滤条件,减少不必要的交易频率。例如趋势过滤,交易量过滤等。

进行步进优化找到参数优化区间,再随机/网格优化寻找最佳参数组合。

在多品种多时间框架测试策略稳健性,避免过度优化。

组合其他有效交易策略,形成策略组合。

总结

多指标评分交易策略通过评分求平均的思路,提高了信号判断的准确性和可靠性。该策略参数调优空间大,可针对不同品种进行优化得到较好效果。但是也需要注意过优化的风险,保持参数优化和策略测试的科学性。作为一种优化方向广阔的交易策略思路,值得进一步研究和应用。

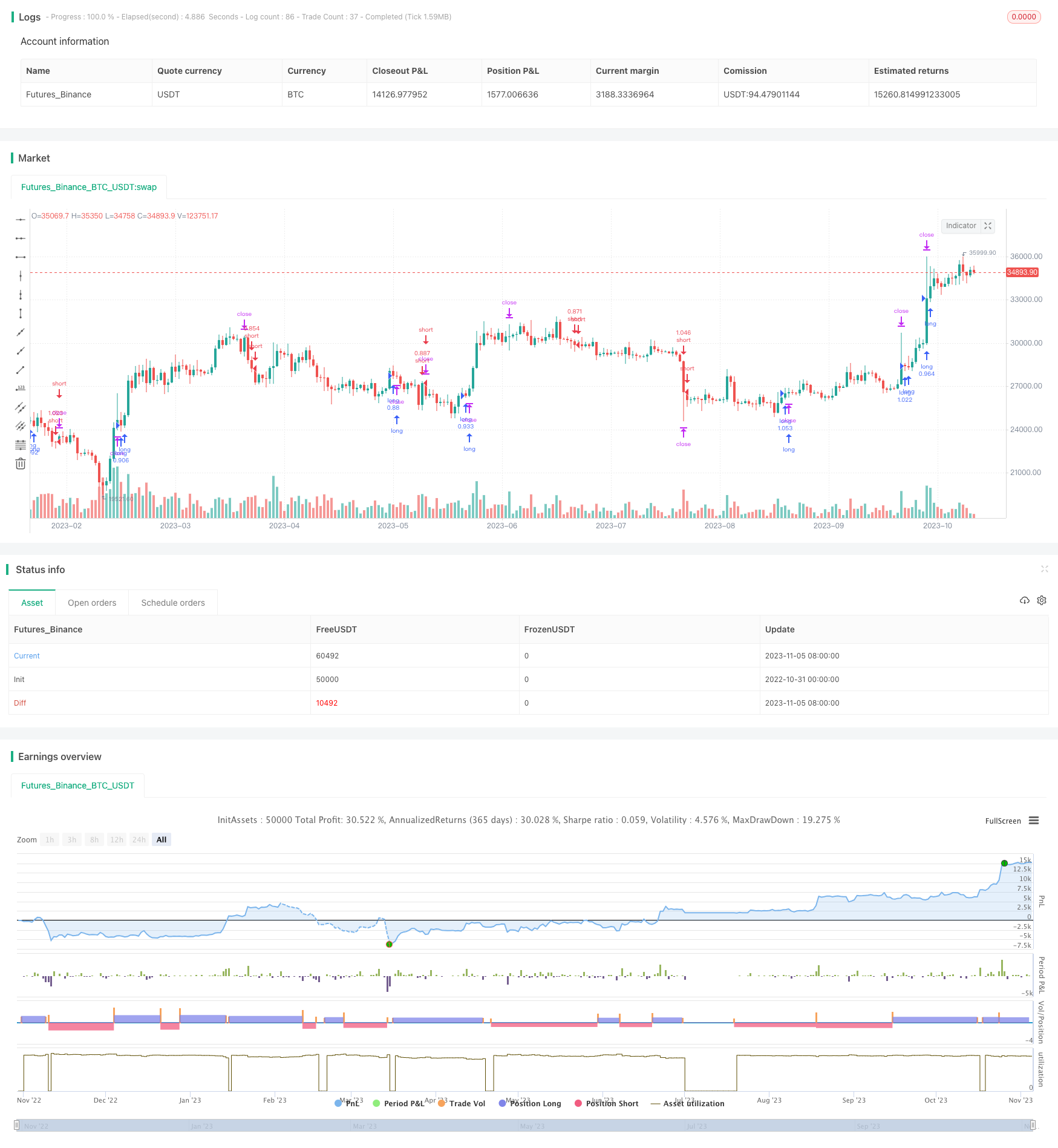

/*backtest

start: 2022-10-31 00:00:00

end: 2023-11-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Ichi HMA RSI Stoch CCI MACD Technicals Rating Strategy",shorttitle="TRSv420",overlay=true,default_qty_type=strategy.percent_of_equity,default_qty_value=50,commission_type=strategy.commission.percent,commission_value=0.05)

res = input("", title="Indicator Timeframe", type=input.resolution)

Period = input(defval = 14, title = "Period Length", minval = 2)

MinSignalStrength= input(title="Minimum Signal Strength", type=input.float, defval=1.1, minval=0.00, maxval=2.00, step=0.1)

Price = input(defval=open, title="Price Source", type=input.source)

Use_Only_Buy= input(false, title = "Use ONLY BUY mode",type=input.bool)

Use_Only_Sell= input(false, title = "Use ONLY SELL mode",type=input.bool)

Use_ATR_SL_TP= input(true, title = "Use ATR for TP & SL",type=input.bool)

Use_Ichimoku= input(true, title = "Use Ichimoku",type=input.bool)

Use_HMA= input(true, title = "Use Hull MA",type=input.bool)

Use_RSI= input(true, title = "Use RSI",type=input.bool)

Use_Stoch= input(true, title = "Use Stoch",type=input.bool)

Use_CCI= input(true, title = "Use CCI",type=input.bool)

Use_MACD= input(true, title = "Use MacD",type=input.bool)

// Ichimoku Cloud

donchian(len) => avg(lowest(len), highest(len))

ichimoku_cloud() =>

conversionLine = donchian(9)

baseLine = donchian(26)

leadLine1 = avg(conversionLine, baseLine)

leadLine2 = donchian(52)

[conversionLine, baseLine, leadLine1, leadLine2]

[IC_CLine, IC_BLine, IC_Lead1, IC_Lead2] = ichimoku_cloud()

calcRatingMA(ma, src) => na(ma) or na(src) ? na : (ma == src ? 0 : ( ma < src ? 1 : -1 ))

calcRating(buy, sell) => buy ? 1 : ( sell ? -1 : 0 )

calcRatingAll() =>

//============== HMA =================

HMA10 = hma(Price, Period)

HMA20 = hma(Price, 20)

HMA30 = hma(Price, 30)

HMA50 = hma(Price, 50)

HMA100 = hma(Price, 100)

HMA200 = hma(Price, 200)

// Relative Strength Index, RSI

RSI = rsi(Price,14)

// Stochastic

lengthStoch = 14

smoothKStoch = 3

smoothDStoch = 3

kStoch = sma(stoch(Price, high, low, lengthStoch), smoothKStoch)

dStoch = sma(kStoch, smoothDStoch)

// Commodity Channel Index, CCI

CCI = cci(Price, 20)

// Moving Average Convergence/Divergence, MACD

[macdMACD, signalMACD, _] = macd(Price, 12, 26, 9)

// -------------------------------------------

PriceAvg = hma(Price, Period)

DownTrend = Price < PriceAvg

UpTrend = Price > PriceAvg

float ratingMA = 0

float ratingMAC = 0

if(Use_HMA)

if not na(HMA10)

ratingMA := ratingMA + calcRatingMA(HMA10, Price)

ratingMAC := ratingMAC + 1

if not na(HMA20)

ratingMA := ratingMA + calcRatingMA(HMA20, Price)

ratingMAC := ratingMAC + 1

if not na(HMA30)

ratingMA := ratingMA + calcRatingMA(HMA30, Price)

ratingMAC := ratingMAC + 1

if not na(HMA50)

ratingMA := ratingMA + calcRatingMA(HMA50, Price)

ratingMAC := ratingMAC + 1

if not na(HMA100)

ratingMA := ratingMA + calcRatingMA(HMA100, Price)

ratingMAC := ratingMAC + 1

if not na(HMA200)

ratingMA := ratingMA + calcRatingMA(HMA200, Price)

ratingMAC := ratingMAC + 1

if(Use_Ichimoku)

float ratingIC = na

if not (na(IC_Lead1) or na(IC_Lead2) or na(Price) or na(Price[1]) or na(IC_BLine) or na(IC_CLine))

ratingIC := calcRating(

IC_Lead1 > IC_Lead2 and Price > IC_Lead1 and Price < IC_BLine and Price[1] < IC_CLine and Price > IC_CLine,

IC_Lead2 > IC_Lead1 and Price < IC_Lead2 and Price > IC_BLine and Price[1] > IC_CLine and Price < IC_CLine)

if not na(ratingIC)

ratingMA := ratingMA + ratingIC

ratingMAC := ratingMAC + 1

ratingMA := ratingMAC > 0 ? ratingMA / ratingMAC : na

float ratingOther = 0

float ratingOtherC = 0

if(Use_RSI)

ratingRSI = RSI

if not(na(ratingRSI) or na(ratingRSI[1]))

ratingOtherC := ratingOtherC + 1

ratingOther := ratingOther + calcRating(ratingRSI < 30 and ratingRSI[1] < ratingRSI, ratingRSI > 70 and ratingRSI[1] > ratingRSI)

if(Use_Stoch)

if not(na(kStoch) or na(dStoch) or na(kStoch[1]) or na(dStoch[1]))

ratingOtherC := ratingOtherC + 1

ratingOther := ratingOther + calcRating(kStoch < 20 and dStoch < 20 and kStoch > dStoch and kStoch[1] < dStoch[1], kStoch > 80 and dStoch > 80 and kStoch < dStoch and kStoch[1] > dStoch[1])

if(Use_CCI)

ratingCCI = CCI

if not(na(ratingCCI) or na(ratingCCI[1]))

ratingOtherC := ratingOtherC + 1

ratingOther := ratingOther + calcRating(ratingCCI < -100 and ratingCCI > ratingCCI[1], ratingCCI > 100 and ratingCCI < ratingCCI[1])

if(Use_MACD)

if not(na(macdMACD) or na(signalMACD))

ratingOtherC := ratingOtherC + 1

ratingOther := ratingOther + calcRating(macdMACD > signalMACD, macdMACD < signalMACD)

ratingOther := ratingOtherC > 0 ? ratingOther / ratingOtherC : na

float ratingTotal = 0

float ratingTotalC = 0

if not na(ratingMA)

ratingTotal := ratingTotal + ratingMA

ratingTotalC := ratingTotalC + 1

ratingTotal := ratingTotal + ratingOther

ratingTotalC := ratingTotalC + 1

ratingTotal := ratingTotalC > 0 ? ratingTotal / ratingTotalC : na

[ratingTotal, ratingOther, ratingMA, ratingOtherC, ratingMAC]

[ratingTotal, ratingOther, ratingMA, ratingOtherC, ratingMAC] = security(syminfo.tickerid, res, calcRatingAll(), lookahead=false)

tradeSignal = ratingTotal+ratingOther+ratingMA

dynSLpoints(factor) => factor * atr(14) / syminfo.mintick

if not (Use_Only_Sell)

strategy.entry("long", strategy.long, when = tradeSignal > MinSignalStrength)

if not (Use_Only_Buy)

strategy.entry("short", strategy.short, when = tradeSignal < -MinSignalStrength)

if(Use_ATR_SL_TP)

strategy.exit("sl/tp", loss = dynSLpoints(3), trail_points = dynSLpoints(5), trail_offset = dynSLpoints(2))