概述

这是一个短周期(1-5分钟)的外汇黄金交易策略,主要利用潮位理论中的量价关系和多重 Stairstep EMA 来预测趋势反转点,进行短周期的趋势跟踪交易。该策略适用于高频交易。

原理

该策略的交易信号来源于两部分:

基于交易量平均价的量价关系判断。具体来说,策略通过计算不同周期(可配置)的交易量平均价EMA,来判断多空趋势的变化。如果短周期EMA上穿较长周期的EMA,认为是看涨信号;如果短周期EMA下穿较长周期的EMA,认为是看跌信号。

基于Stairstep EMA判断的反转信号。Stairstep EMA指的是设置不同参数的多重EMA均线,例如10日线、20日线、50日线等,根据它们的排列顺序来判断趋势反转。如果短周期EMA先于长周期EMA转折,说明趋势在反转。

策略会综合这两种信号来决定入场。具体来说,如果量价关系判断为看涨,并且Stairstep EMA显示多重EMA均已转折看涨,那么将入场做多;相反,如果量价关系判断为看跌,并且Stairstep EMA显示多重EMA均已转折看跌,那么将入场做空。

优势

这种策略结合了交易量平均价和多重EMA的优势,可以提高信号的准确性和稳定性:

基于交易量平均价判断量价关系,可以比单纯的价格EMA判断更准确,避免被增强的价格震荡误导。

Stairstep EMA可以通过不同参数EMA的排列顺序增加判断的维度,避免单一EMA带来的噪音。

两种信号的结合可以实现互相验证,减少假信号。

适用于高频短周期交易,可以快速抓取小范围的反转机会。

策略参数可以灵活配置,适应不同品种和周期的优化。

风险

该策略也存在一些风险:

过于依赖技术指标,存在被异动行情误导的可能。

短周期操作对交易成本比较敏感,需要控制好滑点和手续费。

短周期EMA参数需要经常优化,否则可能失效。

量价背离不一定产生反转,存在误判风险。

多重EMA排列顺序的判断并不完全可靠,也可能产生误判。

对应措施:

结合更多基本面因素进行判断。

调整仓位确保单笔止损不会过大。

定期重新测试和优化参数。

在关键支持阻力区域附近交易,提高成功率。

与其他指标结合使用,进行多维度验证。

优化方向

该策略还可以从以下方面进行优化:

测试不同的量价关系计算方式,寻找更稳定的参数。

增加更多层次的Stairstep EMA指标判断。

结合其他指标信号进行过滤,例如RSI,MACD等。

优化止损机制,例如移动止损、挂单止损等。

根据不同品种特点优化参数,制定适合该品种的参数集。

增加机器学习算法,利用大数据训练判断模型。

探索不同的exit策略,例如固定退出,趋势跟踪退出等。

引入自适应参数机制,根据市场变化自动调整参数。

总结

本策略综合利用交易量平均价和Stairstep EMA两种指标优势进行短周期趋势跟踪交易。该策略具有较高的稳定性和准确性,但也需要注意风险控制和参数优化。如果持续优化测试,配合其他技术指标使用,可以成为高效的短周期交易策略。

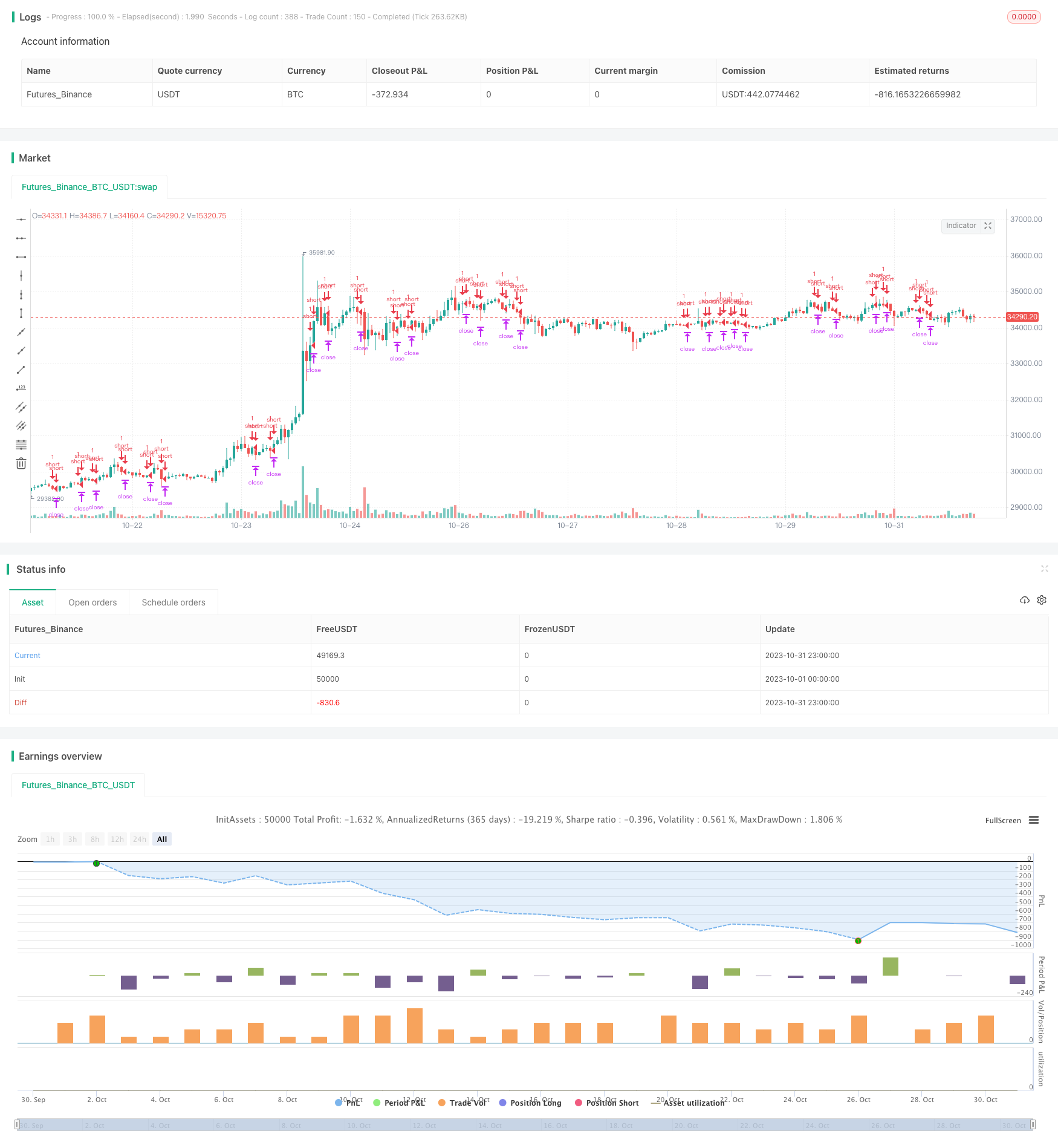

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=5

strategy("Forex Fractal EMA Scalper", overlay=true)

// Define "n" as the number of periods and keep a minimum value of 2 for error handling.

n = input.int(title="Period Fractals", defval=2, minval=2, group="Optimization Parameters")

src = input(hl2, title="Source for EMA's", group="Optimization Parameters")

len1 = input.int(10, minval=1, title="Length EMA 1", group="Optimization Parameters")

out1 = ta.ema(src, len1)

len2 = input.int(20, minval=1, title="Length EMA 2", group="Optimization Parameters")

out2 = ta.ema(src, len2)

len3 = input.int(100, minval=1, title="Length EMA 3", group="Optimization Parameters")

out3 = ta.ema(src, len3)

// UpFractal

bool upflagDownFrontier = true

bool upflagUpFrontier0 = true

bool upflagUpFrontier1 = true

bool upflagUpFrontier2 = true

bool upflagUpFrontier3 = true

bool upflagUpFrontier4 = true

for i = 1 to n

upflagDownFrontier := upflagDownFrontier and (high[n-i] < high[n])

upflagUpFrontier0 := upflagUpFrontier0 and (high[n+i] < high[n])

upflagUpFrontier1 := upflagUpFrontier1 and (high[n+1] <= high[n] and high[n+i + 1] < high[n])

upflagUpFrontier2 := upflagUpFrontier2 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+i + 2] < high[n])

upflagUpFrontier3 := upflagUpFrontier3 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+3] <= high[n] and high[n+i + 3] < high[n])

upflagUpFrontier4 := upflagUpFrontier4 and (high[n+1] <= high[n] and high[n+2] <= high[n] and high[n+3] <= high[n] and high[n+4] <= high[n] and high[n+i + 4] < high[n])

flagUpFrontier = upflagUpFrontier0 or upflagUpFrontier1 or upflagUpFrontier2 or upflagUpFrontier3 or upflagUpFrontier4

upFractal = (upflagDownFrontier and flagUpFrontier)

// downFractal

bool downflagDownFrontier = true

bool downflagUpFrontier0 = true

bool downflagUpFrontier1 = true

bool downflagUpFrontier2 = true

bool downflagUpFrontier3 = true

bool downflagUpFrontier4 = true

for i = 1 to n

downflagDownFrontier := downflagDownFrontier and (low[n-i] > low[n])

downflagUpFrontier0 := downflagUpFrontier0 and (low[n+i] > low[n])

downflagUpFrontier1 := downflagUpFrontier1 and (low[n+1] >= low[n] and low[n+i + 1] > low[n])

downflagUpFrontier2 := downflagUpFrontier2 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+i + 2] > low[n])

downflagUpFrontier3 := downflagUpFrontier3 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+3] >= low[n] and low[n+i + 3] > low[n])

downflagUpFrontier4 := downflagUpFrontier4 and (low[n+1] >= low[n] and low[n+2] >= low[n] and low[n+3] >= low[n] and low[n+4] >= low[n] and low[n+i + 4] > low[n])

flagDownFrontier = downflagUpFrontier0 or downflagUpFrontier1 or downflagUpFrontier2 or downflagUpFrontier3 or downflagUpFrontier4

downFractal = (downflagDownFrontier and flagDownFrontier)

// plotshape(downFractal, style=shape.triangledown, location=location.belowbar, offset=-n, color=#F44336, size = size.small)

// plotshape(upFractal, style=shape.triangleup, location=location.abovebar, offset=-n, color=#009688, size = size.small)

long= out1 > out2 and out2>out3 and upFractal

short= out1 < out2 and out2<out3 and downFractal

strategy.entry("long",strategy.long,when= short)

strategy.entry("short",strategy.short,when=long)

tp=input(25, title="TP in PIPS", group="Risk Management")*10

sl=input(25, title="SL in PIPS", group="Risk Management")*10

strategy.exit("X_long", "long", profit=tp, loss=sl )

strategy.exit("x_short", "short",profit=tp, loss=sl )