概述

本策略利用移动平均线和相对强弱指标判断市场趋势方向,在下跌趋势中逐步建立短仓头寸,实现盈利。

策略原理

当收盘价低于100日简单移动平均线且RSI大于30时,做空入场。之后设置止损线和止盈线,止损线为入场价的3%以上,止盈线为入场价的2%以下。这样可以获得较大的止损空间来容忍行情波动。当价格大于止损线或小于止盈线时平仓。

在Coinrule平台上,可以设置多次顺序卖出订单来逐步建立头寸。当行情持续下跌时,逐步加大仓位。设置一定的下单时间间隔也有助于控制总仓位。

该策略为每个交易连接止损单和止盈单。止损比例和止盈比例针对中盘币进行了优化。你可以根据具体币种进行调整。由于策略符合趋势交易方向,止损和止盈比例可设为1:1.5。

止损价为入场价的3% 止盈价为入场价的2% 略大于止损比例可以容忍更大波动,避免不必要的止损。

优势分析

- 利用移动平均线判断市场趋势方向,可以及时捕捉到下跌行情

- 相对强弱指标过滤可以避免盲目做空

- 逐步加仓可以最大限度控制风险,获得较好的风险收益比

- 设置止损止盈确保每个交易有承受能力

风险分析

- 行情出现V型反转时,可能导致较大亏损

- 需要密切关注行情,及时调整止损止盈价格

- 需要合理控制仓位规模,不宜过度用杠杆

- 大盘震荡行情中可暂停该策略,避免无谓损失

优化方向

- 可以测试不同参数的移动平均线指标

- 可以测试不同参数的RSI指标组合

- 可以调整止损止盈比例,优化风险收益比

- 可以测试不同下单时间间隔,控制仓位规模

总结

本策略基于移动平均线判断趋势方向,RSI指标过滤确定具体入场时机,能够有效捕捉下跌行情。逐步加仓方式能控制风险,设置止损止盈确保单笔交易承受能力。优化止损止盈比例可以获得更好的风险收益比。在参数调整和风险控制方面还有优化空间,但总体来说是一个稳定可靠的短线做空策略。

策略源码

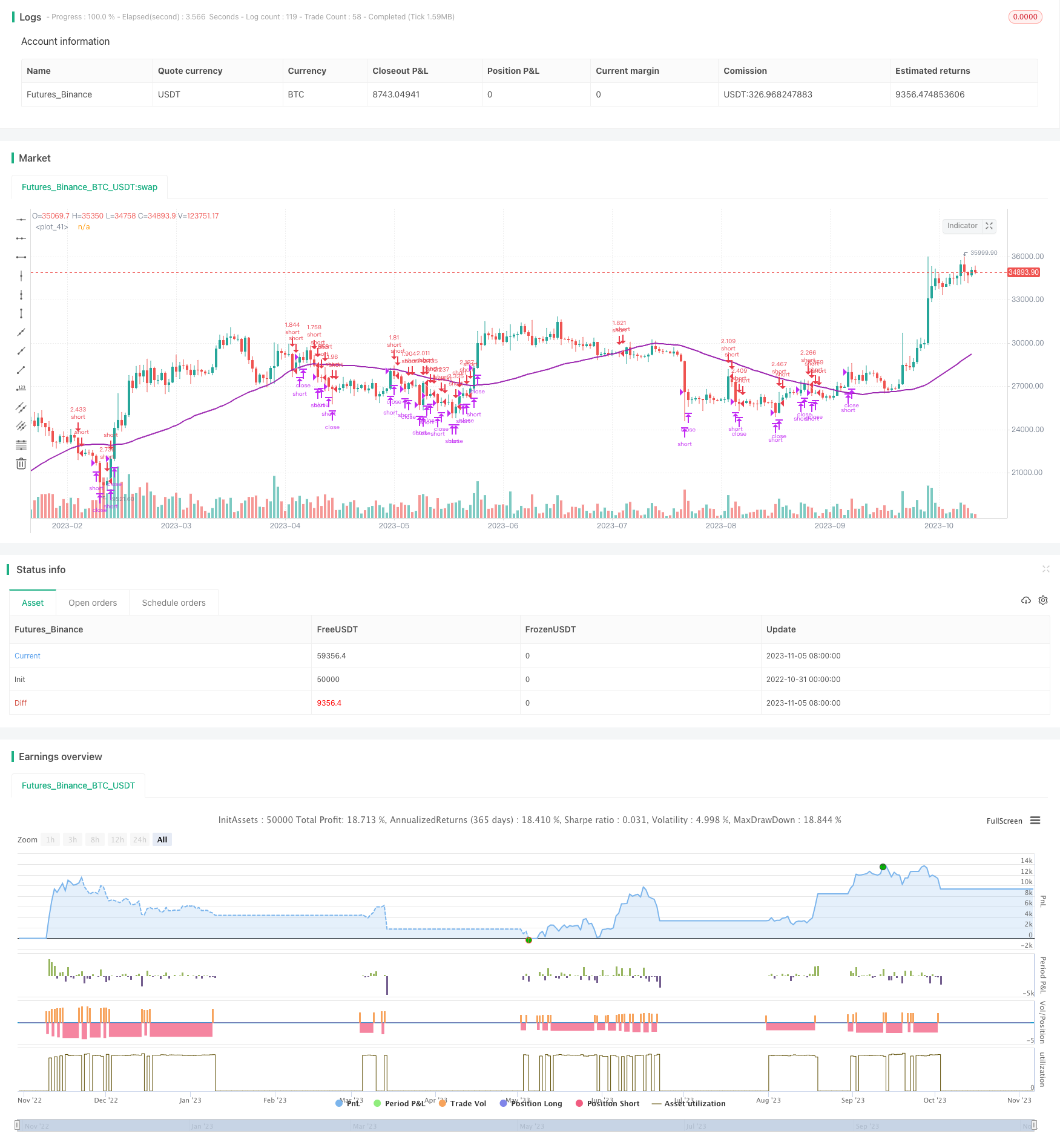

/*backtest

start: 2022-10-31 00:00:00

end: 2023-11-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=4

strategy(shorttitle='Short In Downtrend',title='Short In Downtrend Below MA100', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 10, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2019, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

//MA inputs and calculations

inSignal=input(50, title='MASignal')

MA= sma(close, inSignal)

// RSI inputs and calculations

lengthRSI = input(14, title = 'RSI period', minval=1)

RSI = rsi(close, lengthRSI)

//Entry

strategy.entry(id="short", long = false, when = close < MA and RSI > 30)

//Exit

shortStopPrice = strategy.position_avg_price * (1 + 0.03)

shortTakeProfit = strategy.position_avg_price * (1 - 0.02)

strategy.close("short", when = close > shortStopPrice or close < shortTakeProfit and window())

plot(MA, color=color.purple, linewidth=2)