概述

三EMA趋势追踪策略通过计算不同周期的EMA均线,判断价格趋势方向,实现趋势追踪。该策略简单易于实现,在趋势明显的品种中效果显著。

策略原理

该策略通过计算三条不同周期的EMA均线,具体为10周期、20周期和30周期的EMA。代码中通过ema函数计算出三条均线。

策略主要判断三条均线的方向。如果三条均线同时上涨,则产生做多信号;如果三条均线同时下跌,则产生做空信号。

做多和做空信号的具体判定逻辑是,如果ema1、ema2和ema3在过去一根K线上同时上涨,则enter_long为真,产生做多信号。如果ema1、ema2和ema3在过去一根K线上同时下跌,则enter_short为真,产生做空信号。

根据做多和做空信号,策略会建立对应的做多和做空仓位。平仓逻辑与入场信号相反,如果ema1、ema2和ema3当前K线没有同时上涨,则exit_long为真,平掉做多仓位。如果ema1、ema2和ema3当前K线没有同时下跌,则exit_short为真,平掉做空仓位。

这样,通过判断三条EMA均线的方向一致性,可以判断价格总体趋势,实现趋势追踪。

策略优势

使用三条EMA均线,可以比较准确地判断趋势方向。相比单一均线,三条均线判断趋势更可靠,出现错误信号的概率更小。

EMA对价格变化更为敏感,可以及时反映趋势转折。相比SMA等其他均线,EMA更适合判断趋势方向。

不同周期EMA结合使用,可以兼顾短期和中长期趋势。10周期EMA判断短期趋势,20周期和30周期EMA判断中长期趋势。

策略实现简单,容易理解,适合初学者学习。且参数优化空间大,可以针对不同品种调整参数。

策略仅基于EMA均线运作,资源占用少,适合大批量并发运行。

策略风险

三条EMA均线方向一致是判断趋势的必要但不充分条件。EMA均线方向假突破时,会产生错误信号。

趋势转折时,EMA均线交叉滞后,无法及时反映趋势转折点,可能导致损失。

EMA对价格变化敏感,多头和空头转换频繁时,会频繁开仓平仓,增加交易费用。

大幅震荡市场中,EMA均线产生多次方向转变,无法准确判断趋势,该策略效果不佳。

可适当扩大三条EMA均线周期差距,降低错误信号概率。或加入其他指标过滤假突破。

可结合量能指标等确认趋势,识别趋势转折点,减少损失。也可以适当放宽止损点位。

可适当增加EMA参数,降低开平仓频率。或采用其他均线指标替代。

识别震荡市场后,可以暂停策略,避免无效交易。

优化方向

周期优化:调整三条EMA的周期参数,适应不同品种特性。

过滤条件:加入MA、BOLL等指标,避免EMA假突破。

止损策略: trailing stop逐步追踪止损,保护利润。

资金管理:优化仓位管理,降低单笔损失对总体的影响。

市场态势判断:根据波动率等指标判断市场震荡程度,控制策略参与度。

参数自适应:使EMA周期参数可根据市场变化自动优化,提高策略鲁棒性。

总结

三EMA趋势追踪策略通过EMA均线方向判断价格趋势,实现自动跟踪趋势进行交易。该策略简单实用,参数调整空间大,可针对品种特点进行优化。同时也存在一定风险,需要注意防范EMA假突破,以及震荡市场的影响。通过持续优化,该策略可以成为稳定可靠的趋势跟踪策略。

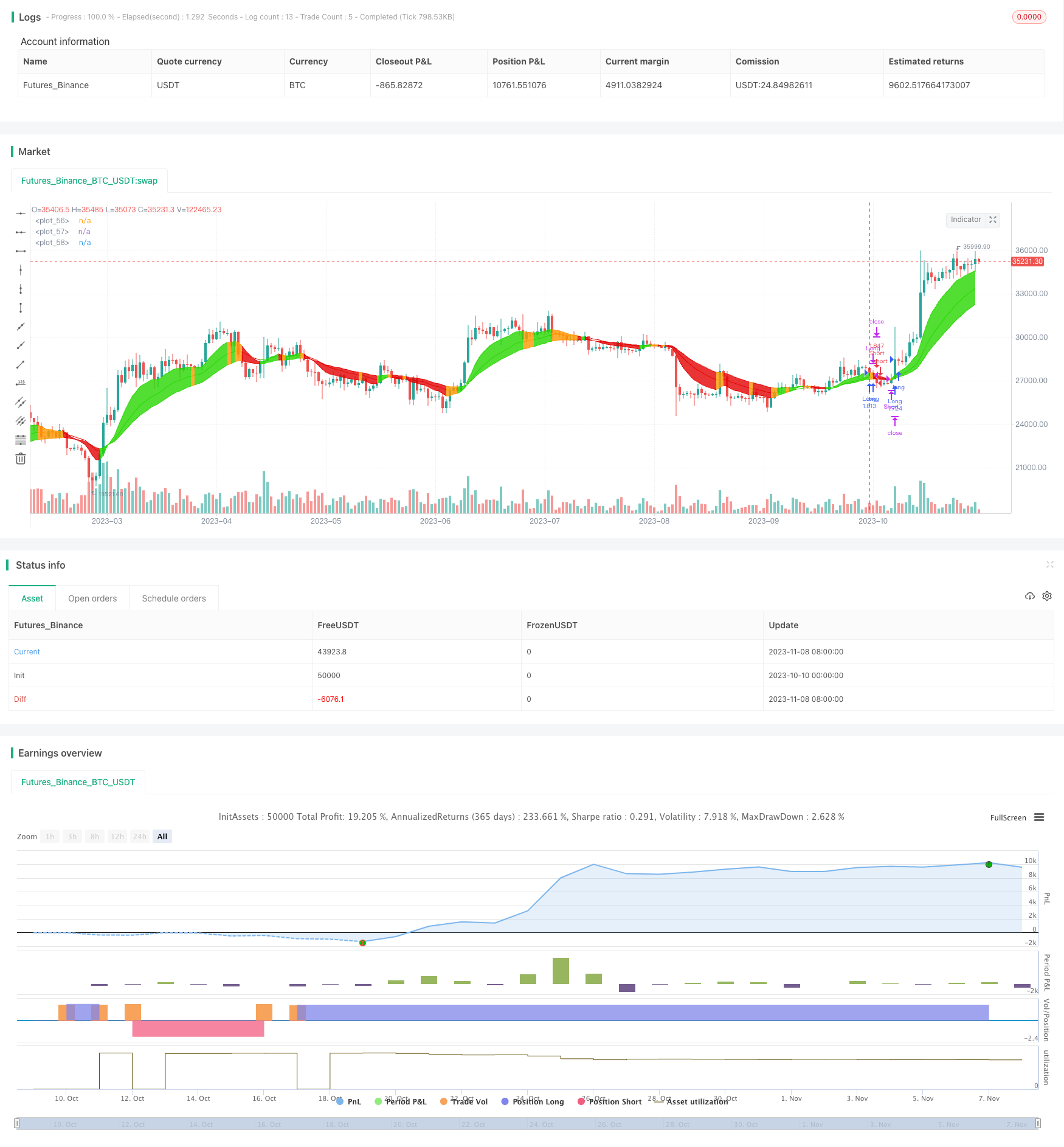

/*backtest

start: 2023-10-10 00:00:00

end: 2023-11-09 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © QuantCT

//@version=4

strategy("PMA Strategy Idea",

shorttitle="PMA",

overlay=true,

pyramiding=0,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100,

initial_capital=1000,

commission_type=strategy.commission.percent,

commission_value=0.075)

// ____ Inputs

ema1_period = input(title="EMA1 Period", defval=10)

ema2_period = input(title="EMA2 Period", defval=20)

ema3_period = input(title="EMA3 Period", defval=30)

long_only = input(title="Long Only", defval=false)

slp = input(title="Stop-loss (%)", minval=1.0, maxval=25.0, defval=5.0)

use_sl = input(title="Use Stop-Loss", defval=false)

// ____ Logic

ema1 = ema(hlc3, ema1_period)

ema2 = ema(hlc3, ema2_period)

ema3 = ema(hlc3, ema3_period)

enter_long = (rising(ema1, 1) and rising(ema2, 1) and rising(ema3, 1))

exit_long = not enter_long

enter_short = (falling(ema1, 1) and falling(ema2, 1) and falling(ema3, 1))

exit_short = not enter_short

strategy.entry("Long", strategy.long, when=enter_long)

strategy.close("Long", when=exit_long)

if (not long_only)

strategy.entry("Short", strategy.short, when=enter_short)

strategy.close("Short", when=exit_short)

// ____ SL

sl_long = strategy.position_avg_price * (1- (slp/100))

sl_short = strategy.position_avg_price * (1 + (slp/100))

if (use_sl)

strategy.exit(id="SL", from_entry="Long", stop=sl_long)

strategy.exit(id="SL", from_entry="Short", stop=sl_short)

// ____ Plots

colors =

enter_long ? #27D600 :

enter_short ? #E30202 :

color.orange

ema1_plot = plot(ema1, color=colors)

ema2_plot = plot(ema2, color=colors)

ema3_plot = plot(ema3, color=colors)

fill(ema1_plot, ema3_plot, color=colors, transp=50)