概述

本策略基于相对强弱指数(RSI)指标进行超买超卖的判断,在RSI达到超买超卖区域时建立反向头寸,实现低买高卖的目的。策略简单高效,通过捕捉市场短期的超买超卖现象来获取利润。

策略原理

该策略仅使用RSI指标作为建仓信号。当RSI下穿设定的低点(默认20)时做多,当RSI上穿设定的高点(默认80)时做空。每次交易固定资金(默认100美元),无论行情如何只追求获利1%后止盈。如果亏损达到3%则止损。为控制交易频率,策略还设置了在亏损后会暂停24根K线不进行交易。

具体来说,策略的核心逻辑是:

- 使用RSI指标判断超买超卖

- RSI下穿20时做多

- RSI上穿80时做空

- 每次开仓100美元

- 止盈或止损后平仓

- 若亏损则在下一根K线暂停24根K线不交易

可见该策略非常简单 mechanical,几乎不存在参数优化的空间。它纯粹利用RSI指标的数学特征,在超买超卖区域反向建仓获得反转利润。

优势分析

该策略最大的优势在于简单和高效。

- 使用单一指标RSI,无需复杂技术分析。

- 完全的机械交易系统,不受个人情绪影响。

- 利用市场短期偏离的数学特征获利,不需要预测市场走势。

- 资金管理规范,止盈止损机制控制风险。

此外,策略还设置了止盈止损比例以锁定利润和控制风险,以及暂停交易机制来降低交易频率。这使得策略以最小的风险获得稳定利润。

风险分析

该策略的主要风险来自:

趋势行情下无法获利。当趋势非常强劲时,RSI可能长期处于超买或超卖区域,反转机会不多,该策略将难以获利。

止损设置过大可能导致亏损扩大。目前止损为3%,可能需要调整至1-2%更为合理。

交易频率过高容易获利后继续建仓,应适当控制开仓频率。

固定每次开仓资金100美元可能风险过度集中,需要优化为资金百分比。

优化方向

根据上述分析,该策略可以从以下几个方面进行优化:

增加趋势判断指标,如MA,在趋势不明朗时暂停交易。

优化止损止盈比例,将止损调整为1-2%更合理,止盈可以设置为浮动止盈。

增加开仓频率限制,如一定时间内只允许开仓1-2次。

将固定资金100美元修改为资金百分比,如1%。

优化参数组合,如RSI周期、超买超卖区域等参数的组合优化。

增加仓位控制, initial capital增加时不提高单笔交易资金。

通过以上几点优化,可以有效降低交易风险,提高策略稳定性和可靠性。

总结

本策略总体来说非常简单直接,通过RSI指标判断超买超卖获得短期反转利润。优点是简单高效,无需预测,交易逻辑清晰,容易回测和验证。但可能难以对付趋势行情,存在一定亏损风险。通过引入趋势判断、优化参数设置、控制仓位等方法可以进一步增强策略的稳定性和盈利能力。该策略思路新颖,具有实际交易价值,如果合理应用可以获得较好效果。

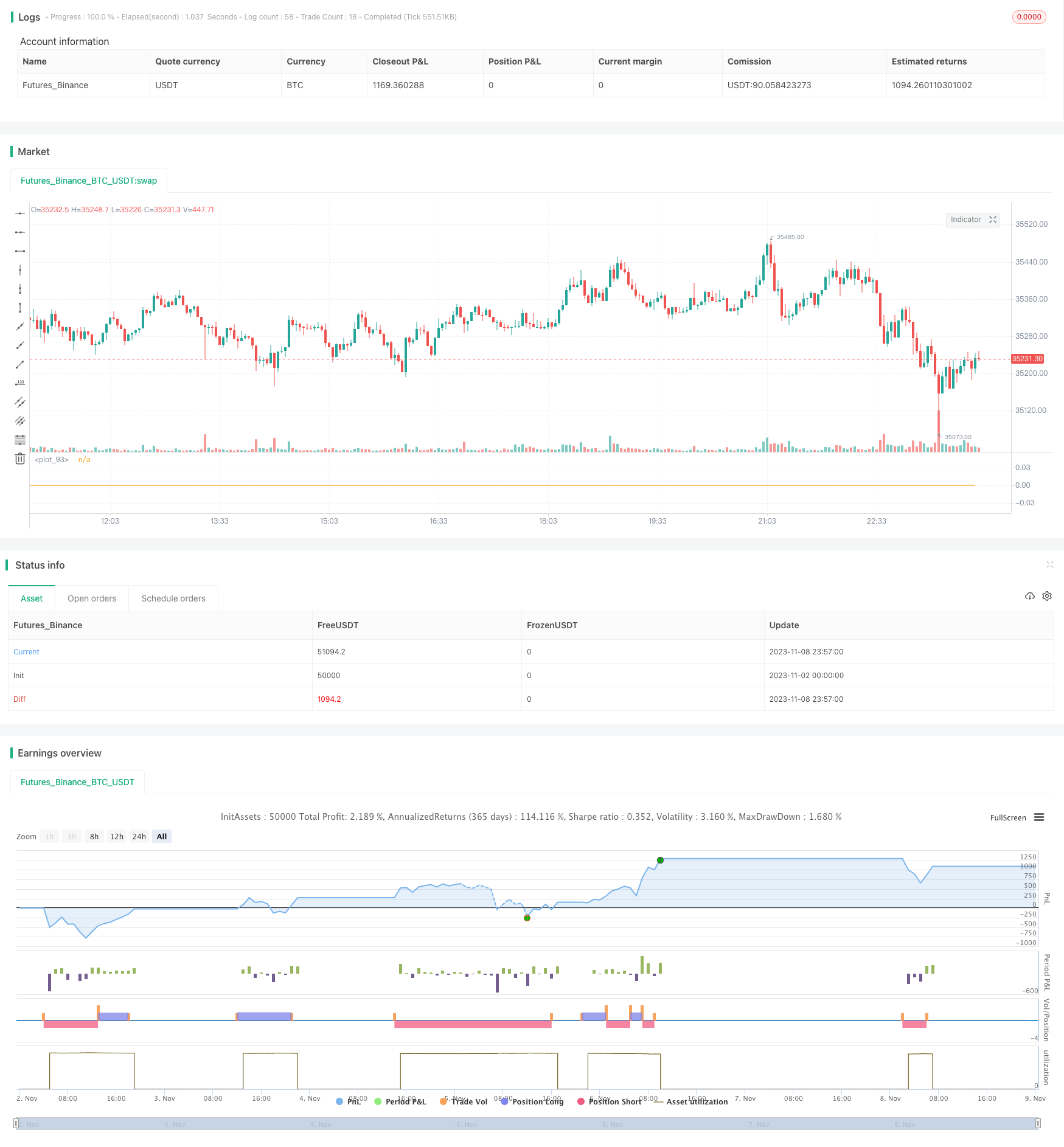

/*backtest

start: 2023-11-02 00:00:00

end: 2023-11-09 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("rsi超买超卖_回测用", overlay=false, initial_capital=50000, currency=currency.USD, default_qty_type=strategy.cash)

open_pos = input.int(50000, title = "每次开单资金(usdt)")

rsi_period = input.int(14, title = "rsi周期")

rsi_line = input.float(20.0, title='RSI触发线', step=0.05)

stop_rsi_top_line = input.float(70, title = "顶部rsi止损线")

stop_rsi_bottom_line = input.float(30, title = "底部rsi止损线")

stop_loss_perc = input.float(0.03, title = "止损线")

stop_profit = input.float(0.01, title = "止盈")

loss_stop_trade_k = input.int(24, title = "亏损后x根K线不做交易")

rsiParam = ta.rsi(close, rsi_period)

var int failedTimes = 0

var bool stopTrade = false

// plot(rsiParam)

if stopTrade

failedTimes += 1

if failedTimes == loss_stop_trade_k

failedTimes := 0

stopTrade := false

// 获取当前持仓方向

checkCurrentPosition() =>

strategy.position_size > 0 ? 1 : strategy.position_size < 0 ? -1 : 0

curPosition = checkCurrentPosition()

// 当前持仓成本价

position_avg_price = strategy.position_avg_price

// 当前持单, 触达反向的rsi线,清仓

if curPosition > 0 and rsiParam >= stop_rsi_top_line

strategy.close_all(comment = "closebuy")

if curPosition < 0 and rsiParam <= stop_rsi_bottom_line

strategy.close_all(comment = "closesell")

// 止盈止损清仓

if curPosition > 0

// if (position_avg_price - close) / close >= stop_loss_perc

// // 止损

// strategy.close_all(comment = "closebuy")

// stopTrade := true

if (close - position_avg_price) / position_avg_price >= stop_profit

// 止盈

strategy.close_all(comment = "closebuy")

if curPosition < 0

// if (close - position_avg_price) / position_avg_price >= stop_loss_perc

// // 止损

// strategy.close_all(comment = "closesell")

// stopTrade := true

if (position_avg_price - close) / close >= stop_profit

// 止盈

strategy.close_all(comment = "closesell")

a = strategy.closedtrades.exit_bar_index(strategy.closedtrades - 1)

if bar_index == a and strategy.closedtrades.profit(strategy.closedtrades - 1) < 0

stopTrade := true

var float openPrice = 0.0

if rsiParam <= rsi_line and stopTrade == false

strategy.entry("long", strategy.long, open_pos / close, comment = "long")

if curPosition == 0

openPrice := close

strategy.exit("long_stop", "long", limit = openPrice * (1+stop_profit), stop=openPrice * (1-stop_loss_perc), comment = "closebuy")

if rsiParam >= 100 - rsi_line and stopTrade == false

strategy.entry("short", strategy.short, open_pos / close, comment = "short")

if curPosition == 0

openPrice := close

strategy.exit("short_stop", "short", limit = openPrice * (1-stop_profit), stop=openPrice * (1+stop_loss_perc), comment = "closesell")

plot(failedTimes)