概述

本策略基于动量指标,结合移动平均线,实现追踪市场趋势的目的。当价格上涨势头较大时做多,当价格下跌势头较大时做空,属于趋势跟踪类策略。

策略原理

计算价格的动量值momentum,公式为:(当前价格-N周期前价格)/N周期前价格

计算价格的移动平均线mid,参数为N周期移动平均

将动量值归一化处理normalize,将其映射到0-1区间

当归一化后的动量值大于0.5且价格高于移动平均线时,做多

当归一化后的动量值小于0.5且价格低于移动平均线时,做空

采用移动止损机制,设定合理的止损位置

以上就是策略的基本交易逻辑。当市场处于趋势状态时,价格会连续涨跌,从而产生较大的动量值。策略会根据动量值的大小来判断趋势的力度,并结合移动平均线的方向来决定入市。此外,止损设置也非常重要,可以有效控制风险。

优势分析

这种策略具有以下几点优势:

追踪市场趋势,收益潜力较大

动量指标对价格变化敏感,可以快速响应趋势

移动平均线滤除随机波动,与动量指标组合使用效果好

采用止损策略,可以限制个别交易的损失

交易逻辑简单清晰,容易实现与回测

可灵活调整参数,适应不同周期和市场环境

总体来说,这是一个非常适合跟踪趋势市场的策略,在一些具有明显方向性行情中,其获利能力会非常强劲。

风险分析

尽管具有诸多优势,这种策略也存在一些风险需要注意:

多头行情中,存在突破上轨后再度回落的风险,移动止损可能被秒杀

空头行情中,存在跌破下轨后反弹的风险,移动止损同样存在被套的可能

当市场震荡环绕移动平均线时,会产生多次不必要的交易信号

参数设置不当时,动量值和移动平均线可能发出错误信号

本策略更依赖趋势,在震荡横盘市场中表现不佳

须严格控制止损比例和移动幅度,防止止损过小或过快被突破

针对这些风险,需要优化止损策略,宽松参数过滤不必要信号,调整参数配适不同周期,并控制仓位规模等。

优化方向

本策略还有以下几点可以进一步优化的方向:

可以测试不同参数对回测结果的影响,选择最佳参数组合

可以加入海龟交易法则,当亏损达到2N时清仓,获利达到1N时清仓

可以结合波动率指标优化止损位置,根据市场波动率调整止损幅度

可以添加仓位管理模块,根据回撤、时间等因素调整仓位大小

可以试验不同的动量计算方式,如指数平滑移动平均动量指标

可以加入candlestick图形筛选,过滤一些鲁棒的交易信号

可以尝试机器学习算法进行参数优化、特征选择等

可以引入一定的人工经验,在关键点辅助策略决策

通过以上办法,可以期望进一步增强策略的稳定性、适应性与SUFFIX性。但任何优化都需要严格统计验证,避免过度优化。

总结

动量追踪策略是一个简单实用的趋势策略。它能敏锐捕捉市场趋势,在追涨杀跌中获得丰厚收益。但也需要注意防范回测曲线过于美化,严格控制风险,保持策略稳健性。通过参数调优和功能扩展等优化,可以使策略在更多市场环境下获得稳定收益。

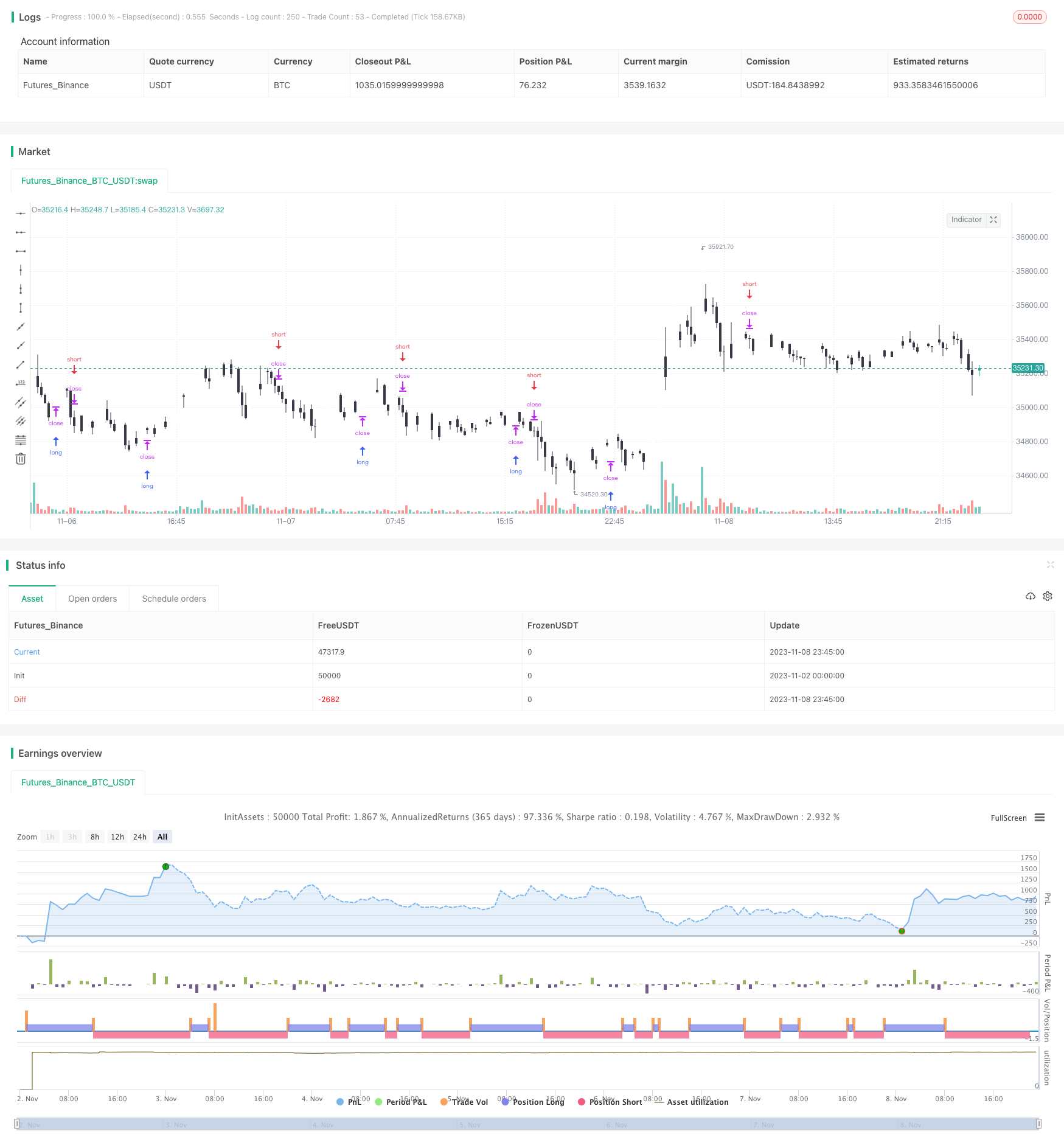

/*backtest

start: 2023-11-02 00:00:00

end: 2023-11-09 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Momentum Strategy, rev.2", overlay=true)

//

// Data

//

src = input(close)

lookback = input(20)

cscheme=input(1, title="Bar color scheme", options=[1,2])

//

// Functions

//

momentum(ts, p) => (ts - ts[p]) / ts[p]

normalize(src, len) =>

hi = highest(src, len)

lo = lowest(src, len)

res = (src - lo)/(hi - lo)

//

// Main

//

price = close

mid = sma(src, lookback)

mom = normalize(momentum(price, lookback),100)

//

// Bar Colors

//

clr1 = cscheme==1?black: red

clr2 = cscheme==1?white: green

barcolor(close < open ? clr1 : clr2)

//

// Strategy

//

if (mom > .5 and price > mid )

strategy.entry("MomLE", strategy.long, stop=high+syminfo.mintick, comment="MomLE")

else

strategy.cancel("MomLE")

if (mom < .5 and price < mid )

strategy.entry("MomSE", strategy.short, stop=low-syminfo.mintick, comment="MomSE")

else

strategy.cancel("MomSE")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)