概述

该策略运用快速EMA线和慢速EMA线的交叉作为买入和卖出信号,实现根据均线交叉进行自动交易。快速EMA线紧贴价格变动,慢速EMA线平滑价格变动。当快速EMA线从下方向上穿过慢速EMA线时,产生买入信号;当快速EMA线从上方向下跌破慢速EMA线时,产生卖出信号。该策略灵活可调,可以通过调整快慢EMA的参数,自定义买入和卖出的信号点。

策略原理

该策略主要通过计算快速EMA线和慢速EMA线,并比较两条均线的关系来产生交易信号。

首先,在输入参数中设置快速EMA的周期emaFast为1,这样快速EMA就能够紧贴价格变动。同时设置慢速EMA的周期,emaSlowBuy用于产生买入信号,emaSlowSell用于产生卖出信号。

然后,根据输入的周期,计算出快速EMA和慢速EMA。快速EMA固定周期为1,紧跟价格;慢速EMA为可调节的参数,平滑价格数据。

接下来,比较快速EMA和慢速EMA的大小关系,判断交叉情况。如果快速EMA从下方向上穿过慢速EMA,即产生金叉,满足买入条件;如果快速EMA从上方向下跌破慢速EMA,即产生死叉,满足卖出条件。

最后,在满足买入和卖出条件时,执行相应的开仓和平仓指令,完成交易。同时,检查当前时间是否在回测时间范围内,避免超出日期范围造成错误交易。

优势分析

- 使用均线交叉判断买卖点,是一种成熟可靠的技术指标

- 快慢EMA周期可调,可以根据市场调整参数,寻找最佳交易机会

- 采用金叉买入、死叉卖出的思路清晰易懂

- 可灵活设置买入和卖出使用不同EMA参数,完全自定义交易策略

- 可选择仅做多、仅做空或双向交易,灵活适应不同市场情况

- 可设置回测的时间范围,针对不同时间段进行优化测试

风险分析

- EMA均线交叉具有滞后性,可能错过价格变化的最佳时机

- 大幅波动市场中,EMA交叉产生的信号可能频繁,造成过度交易

- 需要反复测试参数,寻找最佳EMA组合,否则会出现大量错误信号

- 固定使用1周期的快速EMA,在市场突发事件时无法有效过滤噪音

- 不能有效处理价格震荡区间的市场,会产生许多不必要的交易信号

针对风险,可以考虑以下优化措施:

结合其他指标过滤EMA交叉信号,避免错误信号

根据市场波动程度调整EMA参数,降低交易频率

增加对止损和止盈的考虑,控制风险

优化快速EMA的周期,在特定市况下采用更合适的参数

增加对趋势的判断,避免陷入震荡市场的过度交易

优化方向

该策略可以从以下几个方向进行进一步优化:

- 优化EMA的参数设置,测试不同的周期组合,找出最优参数

可以通过遍历不同的emaFast和emaSlow参数,采用步进优化或随机优化的方法,找出在历史数据回测中表现最好的参数组合。

- 结合其他指标进行信号过滤验证

例如可以结合MACD、KDJ、布林带等指标,避免EMA交叉产生误信号。

- 增加对趋势的判断

计算平均真实波幅等指标,判断走势强弱,避免陷入震荡市场。

- 优化止损止盈策略

研究最佳的止损点位以控制亏损风险,以及确定合理的止盈点位最大化利润。

- 测试其他EMA组合

不仅测试快慢EMA组合,也可以测试双EMA、三EMA甚至多EMA组合,寻找更优参数。

- 进行参数调整以适应不同市场周期

对于趋势更强的市场可以适当加快EMA周期,而震荡市场则可以加慢EMA周期。

总结

该EMA交叉策略整体思路清晰易懂,使用成熟的技术指标判断买卖时机。策略可定制性强,可以通过调整EMA参数进行优化,从而针对不同市场环境制定交易策略。但EMA信号存在滞后性,需要反复测试找到最佳参数组合。此外,还需要针对风险进行优化,结合其他指标进行信号过滤验证,并优化止损止盈方式,从而降低回撤和提高盈利能力。如果持续优化测试,该策略有望获取良好的交易业绩。

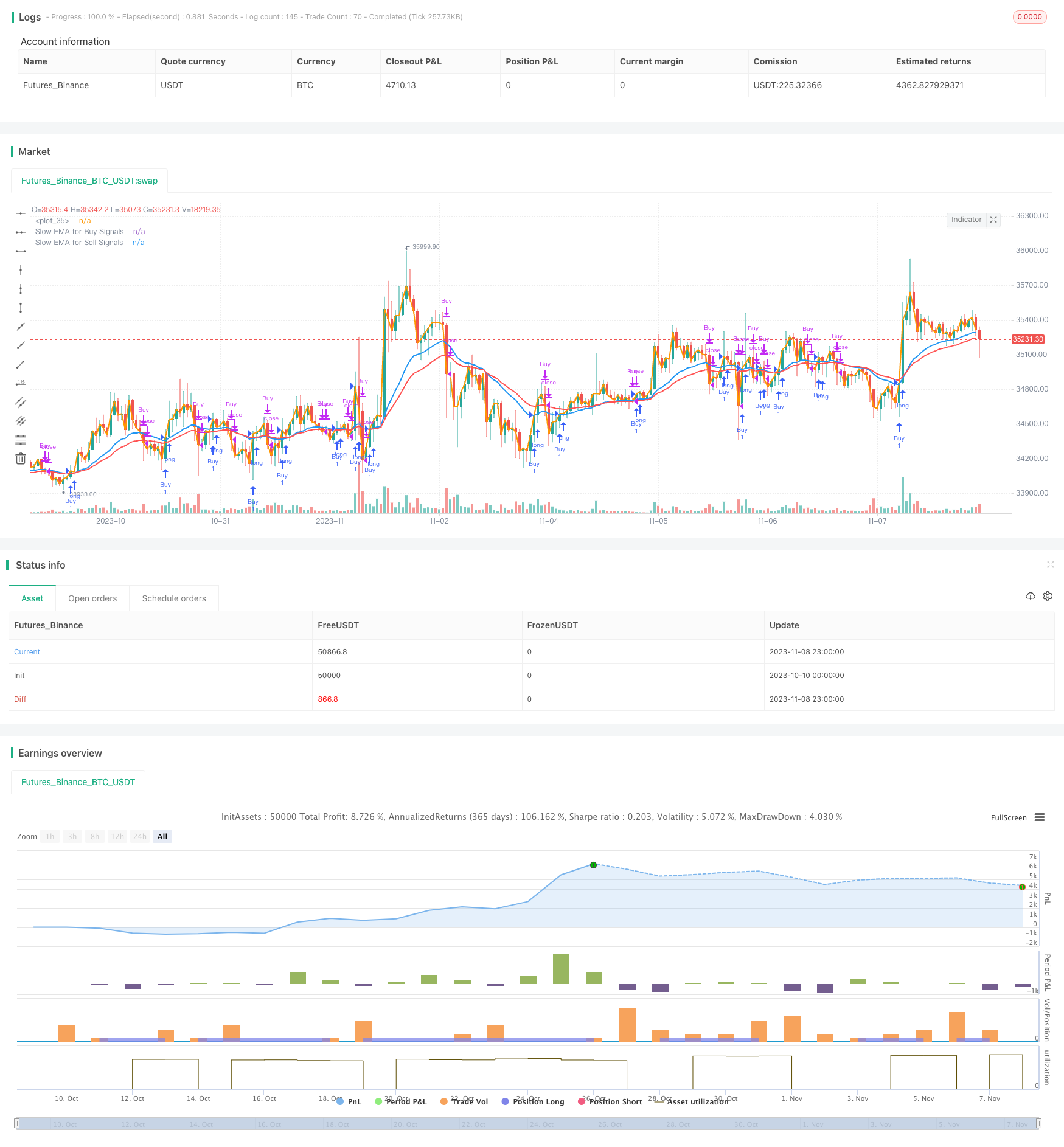

/*backtest

start: 2023-10-10 00:00:00

end: 2023-11-09 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(

"EMA Cross Strategy with Custom Buy/Sell Conditions",

overlay=true

)

// INPUT:

// Options to enter fast Exponential Moving Average (EMA) value

emaFast = 1

// Options to enter slow EMAs for buy and sell signals

slowEMABuy = input(title="Slow EMA for Buy Signals", defval=20, minval=1, maxval=9999)

slowEMASell = input(title="Slow EMA for Sell Signals", defval=30, minval=1, maxval=9999)

// Option to select trade directions

tradeDirection = input(title="Trade Direction", options=["Long", "Short", "Both"], defval="Both")

// Options that configure the backtest date range

startDate = input(title="Start Date", type=input.time, defval=timestamp("01 Jan 2018 00:00"))

endDate = input(title="End Date", type=input.time, defval=timestamp("31 Dec 2025 23:59"))

// CALCULATIONS:

// Use a fixed fast EMA of 1 and calculate slow EMAs for buy and sell signals

fastEMA = ema(close, emaFast)

slowEMABuyValue = ema(close, slowEMABuy)

slowEMASellValue = ema(close, slowEMASell)

// PLOT:

// Draw the EMA lines on the chart

plot(series=fastEMA, color=color.orange, linewidth=2)

plot(series=slowEMABuyValue, color=color.blue, linewidth=2, title="Slow EMA for Buy Signals")

plot(series=slowEMASellValue, color=color.red, linewidth=2, title="Slow EMA for Sell Signals")

// CONDITIONS:

// Check if the close time of the current bar falls inside the date range

inDateRange = true

// Translate input into trading conditions for buy and sell signals

buyCondition = crossunder(slowEMABuyValue, fastEMA)

sellCondition = crossover(slowEMASellValue, fastEMA)

// Translate input into overall trading conditions

longOK = (tradeDirection == "Long") or (tradeDirection == "Both")

shortOK = (tradeDirection == "Short") or (tradeDirection == "Both")

// ORDERS:

// Submit entry (or reverse) orders based on buy and sell conditions

if (buyCondition and inDateRange)

strategy.entry("Buy", strategy.long)

if (sellCondition and inDateRange)

strategy.close("Buy")

// Submit exit orders based on opposite trade conditions

if (strategy.position_size > 0 and sellCondition)

strategy.close("Sell")

if (strategy.position_size < 0 and buyCondition)

strategy.close("Sell")